Ten things to remember when preparing 30 June 2021 annual and half-year financial statements

After a busy few years implementing the new revenue, financial instruments, leasing, and not-for-profit income standards, the good news for most preparers is that there are only minor changes to accounting standards to consider for 30 June 2021 reporting. However, entities that have acquired businesses during the reporting period, and public sector entities that are grantors in service concession arrangements, may have some work to do, and COVID-19 continues to throw up many accounting issues that also need to be considered. This article summarises ten things to remember when preparing 30 June 2021 financial reports.

- Extension of reporting deadlines by one month for listed and unlisted entities

- New standards

- New IFRIC agenda decisions - SAAS implementation costs & accounting for supply chain financing arrangements

- Rent concessions

- Treatment of leased assets for NTA calculations by AFS licensees

- COVID-19 government stimulus measures

- Other COVID-19 impacts on 30 June 2021 financial statements

- Employee benefits (underpayments and double dipping on casual entitlements)

- Climate-related matters

- Listed entities – new Corporate Governance disclosures.

Please contact BDO’s IFRS Advisory team if you require assistance on any of these issues. You can also access our recent webinar, Accounting Standards Update: Getting Ready for 30 June 2021 for more information.

ASIC focus areas

Preparers should also take note of ASIC’s focus areas for its surveillance of 30 June 2021 financial reports that include:

- Asset values

- Provisions

- Solvency and going concern assessments

- Subsequent events, and

- Disclosures in the financial report and the Operating and Financial Review (OFR).

These areas are similar to focus areas at 31 December 2020. Refer to Media Release 21-129 ASIC highlights focus areas for 30 June 2021 financial reports under COVID-19 conditions.

One last thing – Transitioning to Simplified Disclosures (Tier 2 general purpose financial reporting)

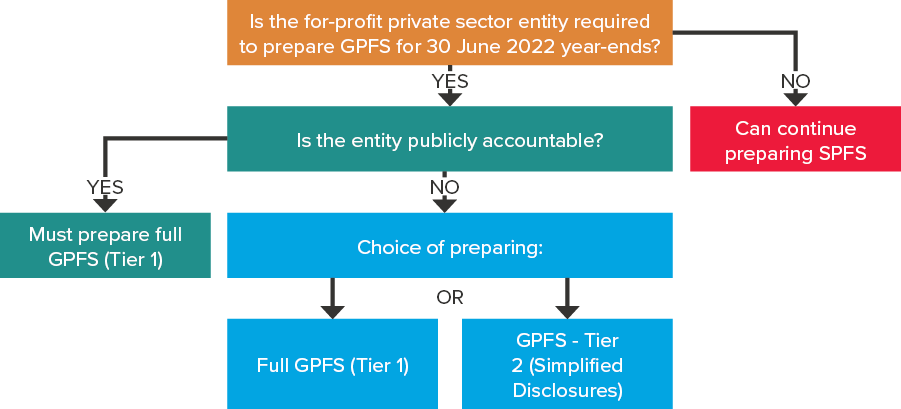

While not mandatory for 30 June 2021, some for-profit private sector entities that previously prepared special purpose financial statements will have to prepare general purpose financial statements (GPFS) for 30 June 2022 (refer to February 2021 Accounting News article for more information on which for-profit private sector entities must prepare GPFS from 2022). If the entity is not a ‘publicly accountable entity’, these GPFS can be prepared according to the new Tier 2 regime for general purpose financial reporting called ‘Simplified Disclosures’.

‘Publicly accountable’ entities are defined in AASB 1053 Application of Tiers of Australian Accounting Standards to include those:

- With equity or debt instruments traded in a public market, or those in the process of issuing such instruments for trading in a public market (e.g. listed entities and unlisted disclosing entities), and

- Holding assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (e.g. banks, credit unions, insurance companies, securities dealers/brokers, mutual funds and investments banks).

Co-operatives that issue debentures, registered managed investment schemes and superannuation funds registered with APRA are also considered to be publicly accountable, and therefore full GPFS (Tier 1) would be required.

While transitioning to Simplified Disclosures may simply be a ‘disclosure exercise’ for entities current applying all recognition and measurement requirements of Australian Accounting Standards (including presenting consolidated financial statements if applicable), it is a complex process for other entities. Decisions need to be made regarding the best method of transition (i.e. applying IAS 8 or IFRS 1) and there are also various transition exemptions to consider.

If you require assistance, refer to our Five steps to successful GPFS transition. Following these five simple steps can help to ensure you avoid unnecessary speed bumps in your GPFS transition journey. Our team of IFRS specialists across Australia can help you take the wheel, and guide your entity to its destination.

For more information, please refer to our recent webinar, Applying IFRS 1 to transition to general purpose financial statements and our February 2021 Accounting News article, Key questions to ask when getting ready for general purpose financial statements.

Extension of reporting deadlines by one month for listed and unlisted entities

Due to ongoing impacts of COVID-19, the Australian Securities and Investments Commission (ASIC) announced that it would again extend reporting deadlines by one month for entities with reporting dates from 23 June 2021 to 7 July 2021 (inclusive).

This follows previous extensions granted for 30 June 2020 and 31 December 2020 annual reporting periods.

The one-month extension only covers entities reporting to ASIC under:

- Chapter 2M of the Corporations Act 2001 (i.e. disclosing entities, public companies, large proprietary companies, certain small proprietary companies and registered schemes), and

- Chapter 7 (AFS licensees).

There is no extension for foreign registered companies because they do not fall into either Chapter 2M or Chapter 7 of the Corporations Act 2001. This means that foreign entities listed on the ASX will not be able to lodge late and the usual deadlines will apply.

Refer to May 2021 Accounting News article for more information on revised deadlines for various types of entities.

Extensions for ASX listed entities

The ASX issued a Class Waiver on 3 May 2021 to align with ASIC’s extended deadlines, and therefore permit late lodgements. Listed entities intending to lodge information with the ASX in line with the extended deadlines must ensure that:

- They lodge unreviewed, or unaudited information within the usual lodgement deadlines specified in the ASX Listing Rules, and

- Make an announcement to the market of its intention to rely on the extension relief.

Half-years ending 30 June 2021

The table below shows the time frames within which listed entities must give half-year documents to the ASX:

| Type of entity | When to lodge? | What to lodge? |

| Non-miners and non-explorers | Within two months (31 August 2021) | Appendix 4D Unreviewed half-year accounts1 |

| Within 106 days (14 October 2021) | Reviewed half-year financial statements in accordance with AASB 134 Interim Financial Reporting

| |

| Mining exploration entity or oil & gas exploration entity | Within 75 days (13 September 2021) | Unreviewed half-year accounts1 |

| Within 106 days (14 October 2021) | Reviewed half-year financial statements in accordance with AASB 134 Interim Financial Reporting

|

Note 1: The unreviewed half-year accounts should comprise similar information to what is required in Appendix 4E, i.e. the four primary financial statements together with a selection of explanatory notes. A full set of half-year financial statements as required by AASB 134 is not required.

Annual periods ending 30 June 2021

If using the extended reporting deadline, annual documents must be provided to the ASX as follows:

| Type of entity | When to lodge? | What to lodge? |

| Non-miners and non-explorers | Within two months (31 August 2021) | Appendix 4E |

| Within four months (31 October 2021) | Audited annual financial statements in accordance with all Australian Accounting Standards

| |

| Mining exploration entity or oil & gas exploration entity | Within three months (30 September 2021) | Unaudited annual accounts2 |

| Within four months (31 October 2021) | Audited annual financial statements in accordance with all Australian Accounting Standards

|

Note 2: The unaudited annual accounts should comprise similar information to what is required in Appendix 4E, i.e. the four primary financial statements together with a selection of explanatory notes. A full set of annual financial statements applying all Australian Accounting Standards is not required.

New standards

Annual periods

The table below highlights new and amending standards that apply to annual reporting periods ending 30 June 2021 for the first time. Note: These standards would have already applied for the first time in an entity’s 30 June 2020 half-year financial statements.

While many of these changes are unlikely to have a major impact on the majority of entities, businesses that have acquired other businesses or assets during the period will need to work through the new principles for determining whether you have acquired a ‘business’ under IFRS 3 Business Combinations, or individual assets under applicable Accounting Standards. If a grantor in a service concession arrangement, public sector entities will also need to contend with the new standard, AASB 1059.

Standard number | Standard name | References to BDO Accounting News articles |

All entities | ||

AASB 2018-6 | Amendments to Australian Accounting Standards - Definition of a Business | How the optional concentration test could save you time assessing whether you have acquired a business (September 2020) IASB amends definition of a 'business' in IFRS 3 (November 2018) |

AASB 2018-7 | Amendments to Australian Accounting Standards - Definition of Material | IASB amends definition of 'material' (November 2018) |

AASB 2019-3 | Amendments to Australian Accounting Standards – Interest Rate Benchmark Reform |

|

AASB 2019-1 | Amendments to Australian Accounting Standards – References to Conceptual Framework |

|

AASB 2019-5 | Amendments to Australian Accounting Standards – Disclosure of the Effect of New IFRS Standards Not Yet Issued in Australia | Disclosure of the effect of new IFRS standards not yet issued in Australia (December 2019) |

AASB 2020-4 | Amendments to Australian Accounting Standards – Covid-19-Related Rent Concessions | Refer rent concessions below |

Public sector entities | ||

AASB 1059 | Service Concession Arrangements: Grantors | More infrastructure projects (service concession arrangements) of public sector entities to be capitalised on balance sheet (August 2017) Application date of AASB 1059 Service Concession Arrangements: Grantors delayed until 2020 (November 2018) |

AASB 2019-2 | Amendments to Australian Accounting Standards – Implementation of AASB 1059 |

|

AASB 2019-7 | Amendments to Australian Accounting Standards – Disclosure of GFS Measures of Key Fiscal Aggregates and GAAP/GFS Reconciliations - December 2019 |

|

Half-year periods

Listed and disclosing entities preparing 30 June 2021 half-year financial statements need only consider the following new or amending standards:

- AASB 2020-8 Amendments to Australian Accounting Standards – Interest Rate Benchmark Reform – Phase 2

- AASB 2020-4 Amendments to Australian Accounting Standards – Covid-19-Related Rent Concessions (if not already early adopted in 30 June 2020 half-year financial statements).

New IFRIC agenda decisions - SAAS implementation costs & accounting for supply chain-financing arrangements

Entities should not overlook two important recent agenda decisions by the IFRS Interpretations Committee that could have a material impact on your 30 June 2021 financial statements (annual or half-year). These are:

- Configuration or customisation costs in a cloud computing arrangement (April 2021)

- Supply chain financing (reverse factoring) arrangements (December 2020).

Configuration or customisation costs in a cloud computing arrangement

Entities using cloud-based software in a Software as a Service (SaaS) arrangement may incur significant costs in relation to configuration and customisation of the supplier’s application software to which they receives access.

SaaS arrangements are usually accounted for as service contracts and not as intangible assets (refer IFRIC agenda decision – March 2019). Even though no intangible asset has been recognised in the balance sheet for the SaaS arrangement, in the past, some companies have nevertheless capitalised configuration and customisation costs relating to these arrangements as ‘intangible assets’.

For 30 June 2021, many companies may need to remove these capitalised costs from their balance sheets (i.e. expense the costs), and retrospective adjustments will be required to prior year comparative information.

ASIC has noted in its FAQ 9D that there should be a sufficient amount of time for entities to identify past costs that need to be expensed in 30 June 2021 financial statements. This is because entities would typically only finalise their financial statements a few months after year-end.

These retrospective adjustments are treated as a change in accounting policy because the IFRIC decision is merely clarifying the accounting treatment for a transaction that was previously contentious, i.e. it is not accounted for as an error. However, ASIC’s FAQ 9D also notes that:

- If past amounts to be expensed may be material but cannot be identified for 30 June 2021 financial reporting, this fact should be prominently disclosed in 30 June 2021 financial statements, and

- Where only some amounts are identified and expensed at 30 June 2021 as a change in accounting policy, any further amounts identified and expensed at 31 December 2021 would be treated as errors (i.e. you can only have a change in accounting policy once).

Refer to our May 2021 Accounting News article for an explanation of the April 2021 IFRIC agenda decision regarding configuration and customisation costs in a SaaS arrangement.

Supply chain financing (reverse factoring) arrangements

This December 2020 IFRIC agenda decision outlines how IFRS standards already provide guidance on the appropriate accounting classification and disclosures for reverse factoring arrangements and considers the following questions:

- Should the reverse factoring arrangements be classified as trade payables or as borrowings in the balance sheet?

- How should these arrangements be presented in the cash flow statement?

- What additional disclosures are required about reverse factoring arrangements?

Refer to our April 2021 Accounting News article for more information.

Rent concessions

Many lessors have granted rent concessions to lessees during this COVID-19 pandemic period, resulting in either the waiver or deferral of lease payments (or both).

Implications for lessees

COVID-19 rent concessions have posed particular problems for lessees accounting for leases under IFRS 16 Leases where it is not clear whether the rent concession is a modification to the original lease contract (i.e. not part of the original terms and conditions of the lease contract). The IASB therefore amended IFRS 16 by introducing a time-limited practical expedient (IFRS 16, paragraph 46A) so that lessees can assume there is no lease modification, which will save time because revised discount rates will not need to be determined. The original time limit for COVID-19-related rent concessions were those that affected lease rentals prior to 30 June 2021.

The following Accounting News articles provide useful information about the accounting for rent concessions, including:

| Topic | Title | Source – Accounting News |

| Eligible criteria for applying the practical expedient | IASB provides accounting relief for lessees who receive rent concessions | May 2020 |

Worked examples of how the practical expedient works for:

| Accounting relief for COVID-19-related rent concessions approved by the IASB | June 2020 |

Worked examples of how the practical expedient works for:

| More examples on accounting for COVID-19-related rent concessions by lessees | July 2020 |

| IASB extends practical expedient for COVID-19 rent concessions until 30 June 2022 | IASB extends practical expedient for COVID-19 rent concessions until 30 June 2022 | April 2021 |

Implications for lessors

COVID-19 rent concessions are also causing headaches for landlords trying to grapple with the appropriate accounting under IFRS 16. The following Accounting News articles summarise FAQs to assist in accounting for rent concessions within the context of existing IFRS 16 requirements and ASIC’s comments noted in its FAQ 9B.

| Topic | Title | Source – Accounting News |

FAQs to assist in accounting for rent concessions | Implications of COVID-19 for lessors - Your questions answered | July 2020 |

Amendment to FAQ 1.2 in above article | February 2021 |

Treatment of leased assets for NTA calculations by AFS licensees

Because of ASIC’s view that right-of-use leased assets are considered to be intangible assets, many AFS licensees could fail to meet their financial conditions with the introduction of AASB 16 Leases. This is because lease liabilities reduce net tangible assets (NTA) with no corresponding increase in ROU assets. NTA (or adjusted assets minus adjusted liabilities) then serves as a starting point for surplus liquid funds (SLF) and adjusted surplus liquid funds (ASLF) calculations.

To solve this problem, ASIC, in its recent Media Release MR 21-088, noted that it has amended the financial requirements of some types of AFS licensees so that they will be able to count right-of-use (ROU) leased assets towards determining ‘net asset value’ (NTA), ‘adjusted surplus liquid funds’ (ASLF) and ‘surplus liquid funds’ (SLF).

More information

Please refer to our May 2021 Accounting News article for more information.

COVID-19 government stimulus measures

A number of government stimulus measures have been on offer for businesses during the COVID-19 pandemic and these may present accounting challenges. Please refer to past Accounting News articles for more information on how to account for these different types of stimulus measures in your 30 June 2021 financial statements:

Other COVID-19 impacts on 30 June 2021 financial statements

Although written at the height of the ‘first wave’ of the COVID-19 pandemic in Australia, entities should be aware that many of the issues raised in news articles highlighted below could once again affect recognition and measurement in various areas of your 30 June 2021 financial statements, particularly for businesses impact by the recent Melbourne lock down.

Implications of COVID-19 for recognition and measurement

In addition to rent concessions and government stimulus measures discussed above, COVID-19 is also likely to affect the recognition and measurement of many items in the financial statements. BDO’s IFRB 2020/03 provides a snapshot of some of the areas affected. In addition, we have expanded on some of these concepts in Accounting News articles highlighted below.

| Topic | Title | Source – Accounting News |

COVID-19 impacts on:

| Impairment is not the only accounting consequence of COVID-19 – Pay attention to revenue recognition, share-based payments and termination benefits | June 2020 |

COVID-19 impacts on:

| COVID-19 impacts on financial reporting – Impairment of non-financial assets, provisions and insurance proceeds | May 2020 |

COVID-19 impacts on:

| Coronavirus impacts on the accounting for financial instruments under IFRS 9 and contract assets under IFRS 15 | April 2020 |

Disclosing impact of COVID-19

Regardless of whether entities have been unfavourably (or favourably) affected by COVID-19, ASIC expects disclosures in the Operating and Financial Review (OFR) to explain how business has been affected (refer ASIC FAQ 4).

ASIC has also indicated in FAQ 5 that entities should not present profit measures that attempt to remove the impact of COVID-19 (i.e. create hypothetical profit measures) as they may be misleading, nor should they split profit or loss into a ‘pre-COVID-19’ and ‘post-COVID-19’ period. Refer to June 2020 Accounting News article for more information.

COVID-19 may also have an impact on other disclosures in the financial statements, and also affect the classification of assets and liabilities as current or non-current, and whether non-current assets should, or should not, be classified as held for sale. Refer to July 2020 Accounting News article for more information.

Employee benefits (underpayments and double dipping on casual entitlements)

Remuneration underpayments

We have seen several instances in the press of widespread underpayment of employee wages. Businesses operating in industries where this problem has been prevalent need to ensure that they have adequately accounted for all employee wages in the appropriate period, including at the appropriate award, and for the appropriate number of hours worked. In some cases, retrospective restatement may be required if the reason for the underpayment was a prior period error. Our August 2020 Accounting News article provides more detail on the AASB Staff FAQ that answers three questions:

- In what year should the payments be recorded?

- How do I determine whether any prior year payments are material and require a restatement of the financial statements?

- What disclosures are required?

Double dipping on casual entitlements – you may need to adjust provisions for entitlements for casual employees

In our August 2020 Accounting News article, we noted the May 2020 Federal Court decision in WorkPac Pty Ltd v Rossato (Rossato decision) and how entities employing casual workers in similar circumstances to this case (i.e. on a regular, systematic and predictable basis with a predictable work schedule) might be affected by it. The decision required employers of casual workers to consider whether a provision was required in 30 June 2020 or 31 December 2020 financial statements for any unpaid, or unused entitlements for annual leave, personal and carer’s leave, compassionate leave, public holiday pay and redundancy payments.

Recent changes have been made to the Fair Work Act 2009 by the Fair Work Amendments (Supporting Australia’s Jobs and Economic Recovery) Act 2021. These changes are operative from 27 March 2021 and operate retrospectively in certain respects. The legislation introduces a definition of ‘casual employee’ and businesses have a six-month transition period to assess whether an employee is a ‘casual employee’ or not. Casual employees will not be entitled to certain entitlements if they receive loading on their pay rate. Entities may need to seek legal advice as to whether an employee is a ‘casual employee’ and other advice to ascertain whether provisions for casual entitlements raised as a result of the Rossato decision are still required under IAS 37 Provisions, Contingent Liabilities and Contingent Assets in 30 June 2021 financial statements.

Note: This comment is not legal advice and must not be relied on as such.

Climate-related matters

Even though IFRS standards do not refer explicitly to climate-related matters, there is increasing awareness that such issues may have an impact on financial reporting. With this in mind, the IASB recently released educational materials summarising how companies must consider climate-related matters when applying IFRS standards. Businesses should consider the educational materials when preparing 30 June 2021 financial statements because these matters may have a material impact, including when determining values for assets, liabilities and provisions, and well as when making disclosures regarding estimates and judgements.

Please refer to BDO's IFRB 2020/14 for a summary of these materials.

Listed entities – new Corporate Governance disclosures

Listed entities should be mindful that the Fourth Edition of the Corporate Governance Principles and Recommendations (Fourth Edition) applies for the first time to 30 June 2021 year-ends. Disclosures in the Corporate Governance Statement should therefore conform to the Fourth Edition. Refer to October 2020 Accounting News article for more information.