NFPs – Disclosures about revenue and income – more than you bargained for (Part 2)?

30 June 2020 was the first year that not-for-profit entities (NFPs) were required to adopt the new revenue and income standards, AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities. As is typical when a new standard is first adopted, preparers tend to focus on recognition and measurement issues, and not a lot of attention is given to the required disclosures.

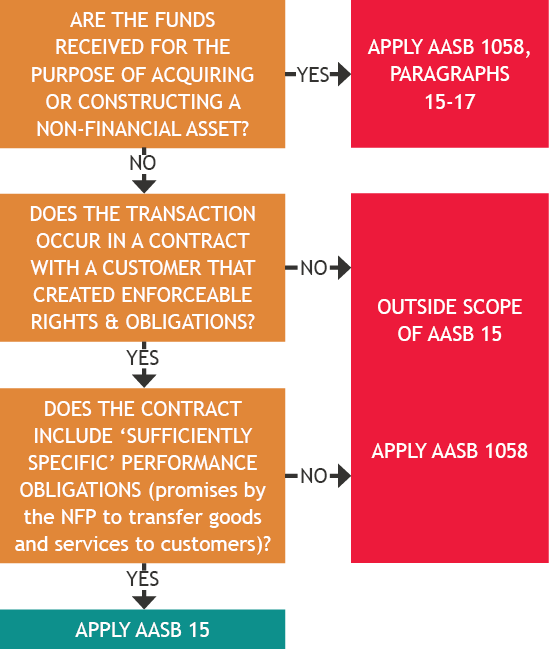

When does a NFP recognise revenue from contracts with customers under AASB 15?

NFPs only recognise revenue from contracts with customers under AASB 15 where funds received are not for the purpose of acquiring or constructing a non-financial asset, and the contract for the receipt of funds creates enforceable rights and obligations, as well as ‘sufficiently specific’ performance obligations.

All revenue from contracts with customers recognised by NFPs must be measured in accordance with all the requirements in AASB 15. Tier 1 NFPs must also comply with all the disclosure requirements in AASB 15. However, where Tier 2 NFPs are currently applying the Reduced Disclosures (RDR) or the Simplified Disclosures (required for years ending 30 June 2022), those disclosures are provided instead of the AASB 15 disclosures.

AASB 15 contains extensive disclosures relating to:

- Disaggregation of revenue

- Contract balances

- Performance obligations

- Transaction price allocated to remaining performance obligations

- Significant judgements

- Assets recognised from the costs to obtain or fulfil a contract with a customer

- Practical expedients (relating to significant financing components and incremental costs of obtaining a contract).

Disaggregation of revenue

AASB 15, RDR and Simplified Disclosures all require disaggregation of revenues from contracts with customers into categories that depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. Examples of categories that may be appropriate include, but are not limited to:

- Type of good or service

- Geographic region

- Market or type of customer

- Type of contract

- Contract duration

- Timing of transfer of goods and services (e.g. over time vs. point in time)

- Sales channels.

Disaggregation applies equally to for-profit and not-for-profit entities and the importance of disclosing disaggregated revenues has been emphasised by the Australian Charities and Not-for-Profits Commission (ACNC) in their Best Practice Guide. While the Best Practice Guide recommends detailing sources of government revenue, AASB 15 may require information disaggregated in other ways.

Example

Crisis Charity receives $200,000 on 1 July 2020 from Government and has a sufficiently specific performance obligation to provide 5,000 nights of crisis accommodation during the period 1 July 2020 to 30 June 2021.

Crisis Charity also has various corporate sponsors who in aggregate donated $100,000 for the 30 June 2021 financial year to provide another 2,500 nights of crisis accommodation.

There is no charge to recipients for crisis accommodation. Crisis Charity operates in NSW, NT, SA and QLD.

Crisis Charity also provides a ‘Meals on Wheels’ service for the elderly that are unable to cook nutritious meals for themselves. Revenue for this service is charged to recipients at $5 per meal, and total revenue for the year from this service is $50,000. This service only operates in NSW.

Complying with the ACNC Best Practice recommendations, as well as the AASB 15 disaggregation requirements, it may be appropriate to disclose disaggregated revenues for Crisis Charity in more than one way. Below is an example of how this could be achieved in practice:

| Revenue from contracts with customers by type of good or service | 2021 |

Provision of crisis accommodation |

|

| 200,000 |

| 100,000 |

| 300,000 |

|

|

Meals on Wheels – paid by customers | 50,000 |

Total revenue from contracts with customers | 350,000 |

|

|

Contract balances

If NFPs have receivables, contract assets, or contract liabilities (also referred to as ‘revenue received in advance’) from contracts with customers, they need to disclose the opening and closing balances of these items (requirement in AASB 15, RDR and Simplified Disclosures).

Additional requirements for Tier 1 NFPs

In addition, AASB 15 requires that the following amounts of revenue recognised during the reporting period be separately disclosed for Tier 1 NFPs:

- Revenue recognised that was included in the contract liability balance at the beginning of the period, and

- Revenue recognised from performance obligations that were satisfied (or partially satisfied) during the prior year (e.g. adjustments to transaction price).

NFPs must also explain when performance obligations are satisfied and how this relates to the timing of payments from customers.

While a formal reconciliation is not strictly required, NFPs must explain significant changes to contract assets and contract liabilities during the period using qualitative and quantitative information.

Performance obligations

AASB 15, RDR and Simplified Disclosures also require disclosure of the following about performance obligations:

- When the entity typically satisfies the performance obligations

- Significant payments terms such as when payment is due, whether there is a significant financing component, whether consideration is variable and whether the estimate of variable consideration is typically constrained

- Nature of goods or services that the NFP has promised to transfer, including if there are performance obligations for the NFP to arrange for another party to deliver the goods and services (this may be common in NFP arrangements)

- Obligations for returns and refunds (may not be common for NFPs), and

- Types of warranties and related obligations.

Transaction price allocated to remaining performance obligations

At the end of the reporting period, AASB 15 requires Tier 1 NFPs to disclose the aggregate amount of the transaction price allocated to performance conditions that will be satisfied in future years, indicating either qualitatively or quantitatively (in appropriate time bands) when the NFP expects to recognise this revenue.

This disclosure is not required for Tier 2 NFPs applying either RDR or Simplified Disclosures.

Significant judgements

AASB 15 requires that Tier 1 NFPs must disclose significant judgements made when determining timing of satisfaction of performance obligations, including:

- For performance obligations satisfied over time - the method used to recognise revenue such as the input or output method, and why that method provides a faithful depiction of how goods and services are transferred to customers

- For performance obligations satisfied at a point in time – significant judgements made in evaluating when the customer obtains control of the promised goods and services.

Tier 2 NFPs, regardless of whether RDR or Simplified Disclosures is applied, do not need to provide the disclosures shaded in grey above.

Tier 2 entities applying Simplified Disclosures also do not need to include ‘point in time’ disclosures shaded in red above.

Additional requirements for Tier 1 NFPs

AASB 15 also requires that Tier 1 NFPs disclose information about the methods, inputs and assumptions used to:

- Determine the transaction price (e.g. estimating variable consideration)

- Assess whether an estimate of variable consideration is constrained

- Allocate the transaction price, including estimating stand-alone selling prices and allocating discounts and variable consideration to specific parts of the contract

- Measuring obligations for returns and refunds.

Costs to obtain or fulfil a contract with a customer

If an NFP has recognised costs to obtain or fulfil a contract as an asset, it must disclose:

- The judgements made in determining the amount of the costs incurred to obtain or fulfil a contract with a customer

- The method it uses to determine the amortisation for each reporting period

- The closing balances of assets recognised by main category of asset (e.g. costs to obtain contracts with customers, pre-contract costs and setup costs), and

- Amount of amortisation and any impairment losses recognised in the reporting period.

The above disclosures also apply to Tier 2 NFPs applying RDR (except for disclosures shaded in grey). They are not required for Simplified Disclosures.

Need assistance?

Please contact one of our NFP Advisory Partners if you requires assistance with any NFP matters, including preparation of your 30 June 2021 revenue disclosures.