Four key focus areas for NFPs at June 2020

When preparing financial statements for 30 June 2020 year-ends, not-for-profit entities (NFPs) have a big task ahead, with the ‘triple threat’ accounting standards all applying for the first time this year, as well as having to deal with various accounting implications arising as a result of COVID-19, including accounting for government stimulus payments such as ‘job keeper’.

AASB 1058 Income of Not-for-Profit Entities, AASB 15 Revenue from Contracts with Customers and AASB 16 Leases all apply for the first time to annual periods beginning on or after 1 January 2019 (i.e. for 30 June 2020 year-ends).

AASB 1058 and AASB 15

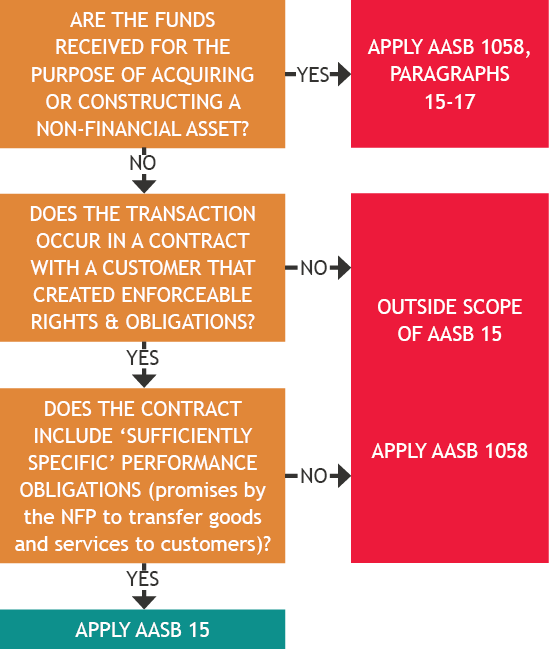

The first two focus areas relate to income and revenue recognition under AASB 1058 and AASB 15. NFPs should take note that the timing of recognition of income from many types of grants may change when AASB 1058 and AASB 15 are applied for the first time. This is because income deferral is only possible if:

- The grant contract is enforceable and contains sufficiently specific performance obligations under AASB 15, otherwise grant income is recognised immediately in profit or loss, or

- The grant is a transfer to enable the NFP to acquire or construct a non-financial asset that the NFP will control after acquisition or construction. In such cases, income is deferred and recognised over the period of construction.

Refund obligations

Previously, NFPs may have simply deferred grant income because they had a refund obligation if all funds were not spent in accordance with the grant. AASB 1058, paragraph B14 does not permit income deferral in these circumstances. Instead, income is recognised immediately because the NFP typically has the ability, through its own actions, to avoid circumstances that would give rise to a breach of conditions which necessitate a return of funds received. In such cases, liabilities for refund obligations are only recognised when a breach occurs.

Subjectivity in determining ‘sufficiently specific’ performance obligations

Although AASB 15, Appendix F contains extensive guidance for NFPs to assist with determining whether there is an enforceable contract with a customer, and sufficiently specific performance obligations, there are no ‘bright line’ rules to apply, and NFPs will need to consider the exact facts and circumstances of their grant contracts, and then apply judgement. Our October 2019 Accounting News demonstrates a practical way to analyse grant contracts in order to extract information needed for making these ‘sufficiently specific’ decisions. Please contact our IFRS Advisory Team if you require assistance in this regard.

Transition

AASB 1058 and AASB 15 are applied either:

- Retrospectively with adjustments to comparatives in accordance with AASB 108 Accounting Polices, Changes in Accounting Estimates and Errors (full retrospective restatement), or

- Retrospectively applying the ‘cumulative catch-up’ approach, with the cumulative effect of initial adjustments recognised in opening balances of retained earnings on the ‘date of initial application’ (1 July 2019), and no restatement of comparatives.

eLearning materials

Please refer to our online eLearning materials for a detailed discussion on accounting for income and revenue by NFPs.

AASB 16

The third focus area is lease accounting. NFPs leasing operating assets such as office equipment, motor vehicles, office premises and retail stores that were previously accounted for under IAS 17 Leases,and expensed on a straight-line basis over the lease term, will now capitalise these right-of-use (ROU) assets on the balance sheet. However, NFPs can continue to expense on a straight-line basis:

- Short-term leases (where the total lease term, including extension options, is for a period of 12 months or less), and

- Low value leases (where the value of the ROU asset, as new, is less than approximately US $5,000).

Transition

Transition options on first-time adoption of AASB 16 are complicated to apply in practice, and NFPs need to assess which option is best for them. Please contact our IFRS Advisory Team if you require assistance in this regard.

Peppercorn leases

Australian Accounting Standards require assets acquired by NFPs to be measured on initial recognition at fair value in accordance with AASB 13 Fair Value Measurement if the consideration paid is significantly less than fair value principally to enable the NFP to further its objectives. However, given difficulties in determining the fair value for ROU assets subject to ‘peppercorn leases’, recognition at fair value on a class-by-class basis is OPTIONAL (AASB 16, paragraph Aus 25.1) and we expect most NFPs would choose the ‘cost’ option for ‘peppercorn leases’.

COVID-19

The last, but by no means the least, focus area for NFPs is dealing with the financial reporting impacts of COVID-19. NFPs could be impacted by some or all of the following:

- Going concern issues because many NFPs are experiencing reductions in fund raising efforts during the COVID-19 pandemic. You will need to ensure adequate disclosure regarding going concern in the financial statements

- Accounting for various government stimulus measures, including job keeper (refer to article above on Accounting for COVID-19 government stimulus – Job keeper payments) and PAYG subsidies via the initial and additional cash flow boost, and

- Changes to the measurement of financial liabilities due to modification of borrowing terms (e.g. deferral of payments, etc.).

Once again, our IFRS Advisory Team is able to assist NFPs in accounting for these issues in 30 June 2020 financial reports.