NFPs – Time to start reviewing grant contracts to determine if there are any ‘sufficiently specific’ performance obligations

Most not-for-profit entities (NFPs) should be aware of the imminent significant changes to accounting for income and revenue from contracts with customers.

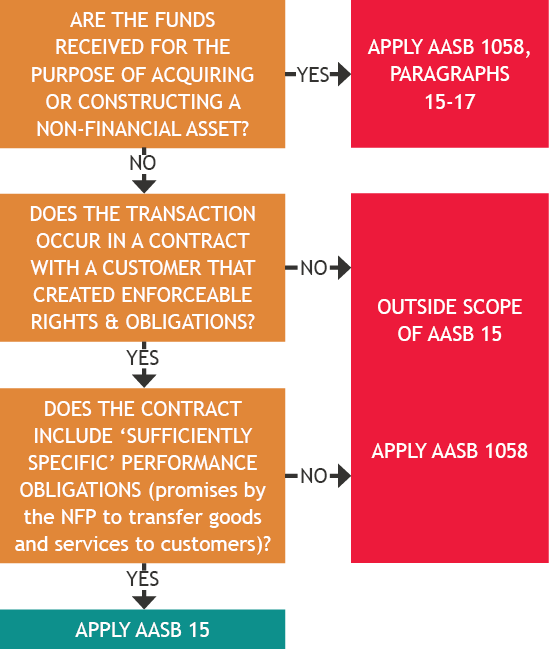

If the funds are granted for the purpose of constructing a non-financial asset, the transaction is accounted for under the specific requirements in AASB 1058, paragraphs 15-17. The receipt is initially recognised as a liability and transferred to income when (or as) the NFP satisfies its obligation to build the non-financial asset.

However, if the funds are granted for a purpose other than to acquire or construct a non-financial asset, using the above decision tree, NFPs will need to determine whether these are accounted for under:

- AASB 15 as revenue from contracts with customers (i.e. there is an enforceable contract with a customer, and the contract includes ‘sufficiently specific’ performance obligations), or

- AASB 1058 (as income).

Over the past few months, our Accounting News articles have considered, in-depth, the theory in both AASB 1058, and AASB 15 Appendix F, to demonstrate how NFPs can determine whether grant contracts include ‘sufficiently specific’ performance obligations (refer table below).

| Topic | Accounting News… |

Is there an enforceable contract with a customer? | |

How to identify ‘sufficiently specific’ performance obligations when assessing whether AASB 15 or AASB 1058 applies – overview | |

Grants to NFPs to deliver IP to a customer | |

Grants to NFPs to transfer a licence to a customer | |

Grants to NFPs to transfer research findings to a customer | |

Grants to NFPs to transfer research findings to a customer | |

Allocating the transaction price to performance obligations under AASB 15 | |

Refund obligations are not automatically ‘sufficiently specific’ performance obligations under AASB 15 |

A practical solution

A high level of judgement is often required in order to conclude whether conditions associated with the grant are ‘sufficiently specific’, and therefore accounted for as revenue under AASB 15.

Grant contracts are often written to include:

- Inputs

- Outputs, and

- Outcomes.

Inputs

Grant agreements tend to include long lists of ‘inputs’, which are basically all types of activities that are necessary to support the satisfaction of the ‘sufficiently specific’ performance obligations, but which themselves do not result in a transfer of a good or service to a customer.

Outcomes

These are often worded in grant contracts as the ‘outcome’, ‘objectives’, ‘aim’ or reason for providing the grant.

It is important to note that outcomes are usually too vague to be ‘sufficiently specific’ performance obligations. However, sometimes outcomes include implied outputs (see further discussion under Outputs below).

Outputs

Outputs are the deliverables in grant contracts that are ‘sufficiently specific’ performance obligations because they meet the requirements in AASB 15, Appendix F, paragraphs F20-F27, and it can be determined when these performance obligations have been satisfied.

As noted under Outcomes above, sometimes ‘outcomes’ include implied outputs. This can be illustrated in the Outcome for Example 3 below, where the objective is to improve water safety for beach goers and to reduce the instances of drowning by 50%. Provided there is a benchmark which quantifies the number of drownings at the start of the grant contract, there is potentially also an output that can be measured and may result in a sufficiently specific performance obligation.

Example 1 – Literacy NFP

Literacy NFP is given a three-year grant by the State Government to improve literacy in a community. Literacy NFP receives $1 million on 31 December 2019 in cash to cover the three-year contract. Any unspent monies need to be refunded to State Government at the end of the three-year period.

The contract stipulates that the money must be used as follows:

- Employ 2 specialist teachers for the first year (FY20) to develop specialised reading programs for Years K-2 (cost of $200,000)

- Purchase special reading books and workbooks to use during lessons ($50,000 budgeted to be spent during FY20, $70,000 during FY21 and $80,000 during FY22)

- Employ 3 specialist teachers to be available three afternoons per week during school terms in FY21 and FY22 to run face-to-face teaching sessions at the XYZ Primary School for all children from public schools in Suburb XYZ (cost of $100,000 per teacher per year, total of $600,000).

Activities (Inputs) | Outputs | Outcomes |

The above internal activities do not result in the transfer of goods or services to a customer. |

The above internal activities do result in the transfer of goods or services to a customer. |

The above is not on its own sufficiently specific. However, the existence of clear outcomes enables the entity to meet the sufficiently specific performance obligation hurdle. |

Example 2 – Crisis counselling

Mr Rich donates $3 million to Crisis Charity to be used over the next three years to provide crisis counselling services to those experiencing domestic violence. Any unspent monies need to be refunded to Mr Rich at the end of the three-year period.

The contract stipulates that the money must be used as follows:

- Rent premises out of which crisis counselling services can be provided

- Hire social workers and psychologists

- Administration – initial case assessments and appointment bookings

- Employ one full-time psychologist and one full-time social worker (8 hours per day) at the premises of Crisis Charity for three years on a stand ready basis should victims of domestic violence require these services.

Activities (Inputs) | Outputs | Outcomes |

The above internal activities do not result in the transfer of goods or services to a customer. |

The above internal activities do result in the transfer of goods or services to a customer. |

The above is not on its own sufficiently specific. However, the existence of clear outcomes enables the entity to meet the sufficiently specific performance obligation hurdle. |

Example 3 – Local Surf Club

State Government provides a three-year, $1 million grant to Local Surf Club to improve water safety for beach goers and to reduce the instances of drowning by 50%.

Any unspent monies need to be refunded to State Government at the end of the three-year period.

The contract stipulates that the money must be used as follows:

- Rent building for the surf club

- Train volunteers

- Purchase rescue equipment

- Provide surf club patrols during daylight hours, with a minimum of 5 lifesavers on duty in summer months and 2 life savers on duty during winter months.

Activities (Inputs) | Outputs | Outcomes |

The above internal activities do not result in the transfer. of goods or services to a customer. |

The above internal activities do result in the transfer of goods or services to a customer. |

The above on its own might constitute sufficiently specific performance obligations due to the implied nature. |

Concluding thoughts

From 1 January 2019, NFPs will need to undergo a detailed review of all grant contracts to assess whether recognition under AASB 1058 or AASB 15 is appropriate. The first reporting date, 31 December 2019 is not far away. Reviewing grant contracts is a difficult and time-consuming process and involves judgement. We encourage NFPs who have not commenced reviewing grant agreements to do so as a matter of urgency.