Grants to NFPs to transfer research findings to a customer – Does AASB 15 or AASB 1058 apply? Part II

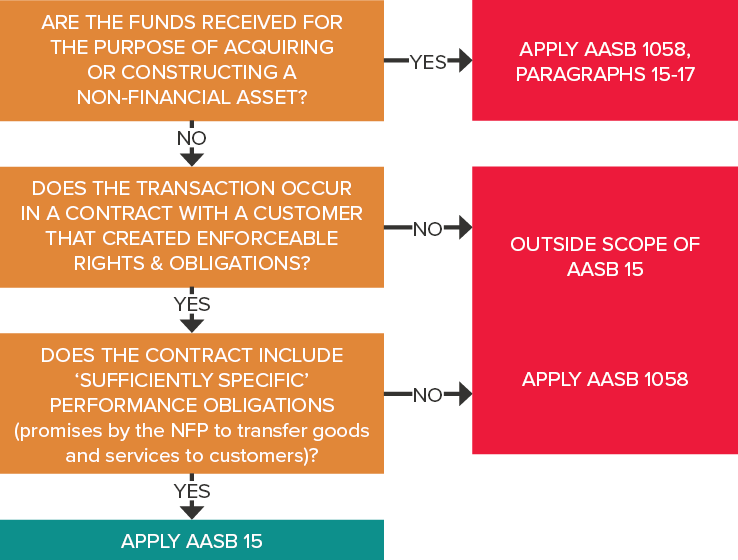

Grants and other donations received by not-for-profit entities (NFPs) can only be recognised as revenue under AASB 15 Revenue from Contracts with Customers if there is an enforceable contract with a customer, and that contract contains ‘sufficiently specific’ performance obligations. Otherwise, income is recognised under paragraph 9 of AASB 1058 Income of Not-for-Profit Entities.

Please refer to previous Accounting News articles for more background information on how to assess whether:

- The transaction occurs in a contract with a customer that creates enforceable rights and obligations (November 2018), and

- The contract includes ‘sufficiently specific’ performance obligations (February 2019).

Grants to perform research activities

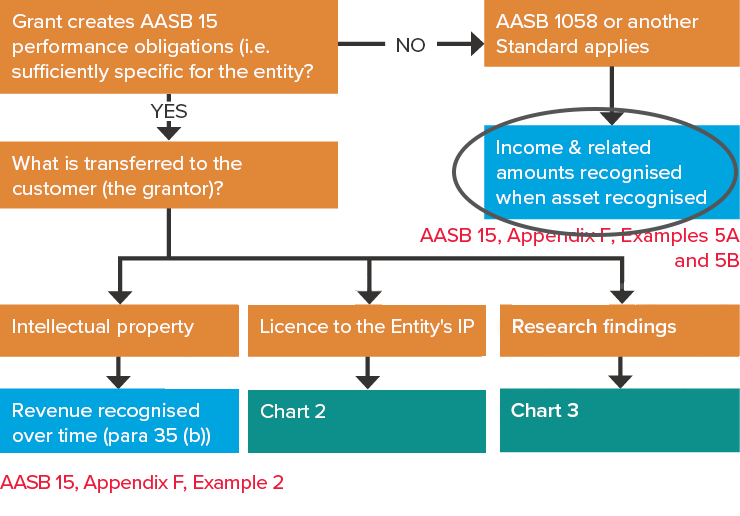

One of the areas where we encounter practical difficulties in applying the above requirements is where grants are received by NFPs to conduct research activities. The assessment of whether the contract includes ‘sufficiently specific’ performance obligations very much depends on what is being transferred to the customer (grantor).

AASB FAQ No. 5

The flow chart below is extracted from FAQs issued by the Australian Accounting Standards Board (AASB) in August 2018. Chart 1 of FAQ No. 5 summarises the required thought process for determining the appropriate recognition of income from grant contracts for different types of research activities, based upon what is being transferred to the customer (sufficiently specific performance obligations), i.e.:

- Intellectual property (IP)

- Licence to use the NFPs’ IP, or

- Research findings.

In April, May and June 2019 Accounting News, we considered these above three aspects. This month, we look at examples from AASB 15, Appendix 15, where it is determined that there are no ‘sufficiently specific’ performance obligations.

Chart 1 extracted from AASB FAQ No. 5

AASB 15 – Examples 5A and 5B

Below is an extract of the relevant Fact Pattern from Example 5A contained in AASB 15, Appendix F.

| Facts common to both examples |

University G receives a cash grant from a donor, Medical Research Trust Z, of $2 million to undertake research that aims to identify and validate biomarkers to distinguish malignant cancers from benign tumours. Terms of the grant that are common to both examples are as follows:

|

| Additional Facts – Example 5B |

|

Is there an enforceable contract/agreement with a customer?

In both of the above fact patterns, the arrangement is enforceable because the grant is refundable if the research is not undertaken.

Does the contract/agreement contain ‘sufficiently specific’ performance obligations?

University G concludes in both fact patterns that there are no ‘sufficiently specific’ performance obligations because:

- Publicising the research results when appropriate is not sufficiently specific to enable University G to identify when it satisfies its obligations because there is no requirement to produce a specified number of publications or deliver a specified number of presentations, and

- The budget reports merely provide the grantor an indication of University G’s spending of funds and do not represent a transfer of a benefit to the grantor.

Which standard does the contract/arrangement fall under?

It should be noted that while both examples result in an enforceable agreement but no sufficiently specific performance obligations, each is accounted for under different Accounting Standards because of the additional facts provided in Example 5B.

Example 5A

The arrangement described in Example 5A falls outside the scope of AASB 15 and is accounted for as income under AASB 1058 because University G acquired cash (grant funds) for consideration that is significantly less than fair value (i.e. there are no performance obligations to recognise) principally to enable it to further its objectives (research).

Example 5B

On the other hand, in Example 5B, University G merely administers the grant funds on behalf of the researcher, and therefore considers the arrangement under the requirements of AASB 9 Financial Instruments because:

- It receives cash that it administers in accordance with the grant agreement (to which it is a party)

- It may invest the funds it holds as it considers appropriate, benefiting from any interest received and obliged to reimburse any losses incurred, and

- Agrees to expend the funds at the direction of the researcher.

Accounting treatment – Initial recognition

Example 5A

As AASB 1058 applies, University G recognises the $2 million grant on initial recognition (receipt of cash) as income because it has no further sufficiently specific performance obligations.

| Dr ($) | Cr ($) | |

| Cash | 2,000,000 | |

| Income | 2,000,000 |

Example 5B

As AASB 9 applies, University G recognises a financial asset of $2 million for the funds received. It then considers whether it has transferred the financial asset to the researcher, but notes that because it may invest the funds as it considers appropriate, it retains substantially all the risks and rewards of ownership of the funds.

University G therefore recognises a financial asset for the $2 million grant funds on initial recognition, as well as an equal amount for a financial liability to expend the grant funds at the researcher’s direction (AASB 9, paragraph 3.2.15).

| Dr ($) | Cr ($) | |

| Cash | 2,000,000 | |

| Financial liability | 2,000,000 |

Accounting treatment – After initial recognition

In Example 5A, as all income is recognised on receipt of the grant, there are no further journal entries subsequent to initial recognition.

However, for Example 5B, because grant funds are spent by the researcher on the research project, the following journal entry (cumulative over the life of the project) will be processed by University G:

| Dr ($) | Cr ($) | |

| Financial liability | 2,000,000 | |

| Cash | 2,000,000 |

Concluding thoughts

Many NFPs defer recognition of a variety of income streams because there is a lack of clarity in the current accounting requirements for income of NFPs. However, from 1 January 2019, this situation is about to change. NFPs will need to undergo a formal assessment of all income streams to assess whether recognition under AASB 1058 or AASB 15 is appropriate. Importantly, revenue can only be recognised if there is an enforceable contract with a customer, and ‘sufficiently specific’ performance obligations. Disclosure will be required in the financial statements about key judgements made in arriving at the conclusion that performance obligations are/are not ‘sufficiently specific’. Management should therefore already be undertaking a detailed review of all contracts and agreements to determine the appropriate accounting standard for accounting for grant income.