How do we determine if a charity is small, medium or large for financial reporting purposes?

Reporting thresholds for charities are based on ‘revenue’, and these are likely to change soon (refer October Accounting News). Some charities that were previously required to prepare financial statements and either have them audited or reviewed, may in future not be required to do so at all, and others may have less onerous reporting obligations (for example they may require a review rather than an audit of their financial statements) as they move to lower level tiers.

| Size of charity | Current revenue thresholds for the 2021 AIS* | Revenue thresholds from 1 July 2022 for the 2022 AIS* | Audit/review requirement? |

| Small | Less than $250,000 | Less than $500,000 | None |

| Medium | $250,000 - $1 million | $500,000 - $3 million | Review or audit |

| Large | Greater than $1 million | Greater than $3 million | Audit |

| *AIS = Annual Information Statement | |||

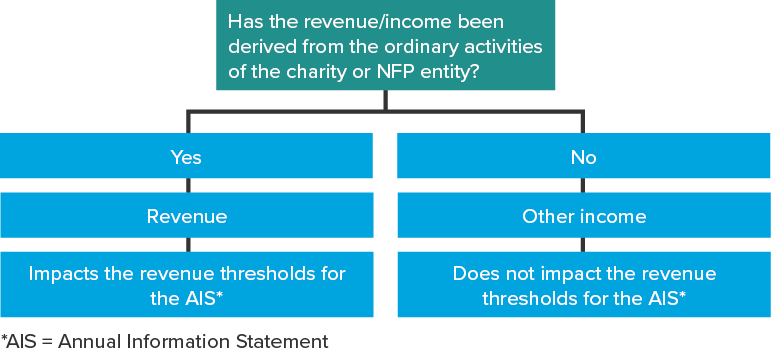

The above table clearly illustrates the importance of correctly determining revenue. This article looks at how a charity determines its revenue for the purpose of deciding whether it is a large, medium or small charity.

ACNC Act requirements

The Australian Charities and Not-for-profits Commission Act 2012 (ACNC Act), section 205-25(4) requires revenue to be calculated in accordance with accounting standards in force at the relevant time. For reporting periods beginning before 1 January 2019, the old revenue standard, AASB 118 Revenue clearly articulated that revenue is income that arises from ordinary activities.

Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.

Extract of Objective of AASB 118

While AASB 118 only prescribed the accounting treatment for revenue from the sale of goods, provision of services, interest, royalties and dividends, the objective of AASB 118 made it clear that revenue can go by a variety of different names. Indeed, this was reinforced by paragraph 6 which scoped out revenue arising from:

- Lease agreements

- Dividends from investments accounted for using the equity method

- Insurance contracts

- Changes in fair value of financial assets or their disposal

- Changes in the value of other current assets

- Changes in the fair value of biological assets, and

- The extraction of mineral ores.

By scoping out ‘revenue arising’ from the above transactions, we can conclude that these items were all considered to be ‘revenue’ for the purposes of determining the size of a charity if they were derived from ordinary activities.

AASB 15

The new revenue standard, AASB 15, defines ‘revenue’ as ‘income arising in the course of an entity’s ordinary activities’ and only applies to revenue from contracts with customers.

A customer is a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration.

Extract of AASB 15, paragraph 6

‘Ordinary activities’ is not defined in AASB 15.

In particular, AASB 1058, paragraph BC36 acknowledges that depending on the facts and circumstances, income recognised under AASB 1058 can also be revenue of a not-for-profit entity (i.e. income arising in the course of the entity’s ordinary activities).

Accordingly, the Board based its proposals in ED 260 on the concept of income of an not-for-profit entity arising from inflows of resources because, in its view, revenue of not-for-profit entities did not capture all transactions that the Board intended AASB 1058 to provide requirements for. The Board observed that this does not mean that income recognised in accordance with this Standard is not also revenue of a not-forprofit entity; the extent to which amounts recognised in accordance with this Standard meets the definition of revenue to the entity (that is, income arising the course of an entity’s ordinary activities) is a matter of facts and circumstances.

ACNC guidance

Given the lack of clarity on what is revenue, the ACNC web site contains guidance on how to determine revenue when applying the charity size test.

Revenue is realised from the sale of goods or services, through the use of capital or assets, or revenue arising from the contribution of an asset to a charity when certain conditions have been met during the ordinary activities of your charity.

Examples of revenue for a typical charity include:

- grants from government, foundations, private or any other sources

- donations, tithes, bequests or legacies

- fees for provision of services

- sale of goods

- inflows from fundraising activities or sponsorship

- interest earned on investments, dividends

- royalties and license fees

- in-kind donations (for example, volunteer time or goods).

Extract of ACNC guidance on ‘revenue’

The above guidance clarifies that revenue encompasses more than just revenue from contracts with customers recognised under AASB 15. It also includes income items recognised under AASB 1058 if those are also derived during ordinary activities of the charity.

Other income that is not derived from ordinary activities is not included as revenue for the purpose of the charity size test. For example, realised gains on sales of property, plant and equipment, real estate and other investments, etc. are usually ‘one-off’ transactions and therefore not derived from the entity’s ordinary activities.

What are ‘ordinary activities’?

We can see from the ACNC guidance above that revenue and income derived from ordinary activities will be counted towards the revenue size test. So how do we ascertain if they arose from ordinary activities?

‘Ordinary activities’ are not defined in either AASB 15 or the Framework for the Preparation and Presentation of Financial Statements (Framework), which is the current Framework applicable to not-for-profit entities. However, the Framework, paragraph 72 explains that the distinction between income and expenses arising from ‘ordinary activities’ and those that do not arise from ordinary activities “is made on the basis that the source of an item is relevant in evaluating the ability of the entity to generate cash and cash equivalents in the future.”.

Income and expenses may be presented in the income statement in different ways in order to provide information that is relevant for economic decision-making. For example, it is common practice to distinguish between those items of income and expenses that arise in the course of the ordinary activities of the entity and those that do not. This distinction is made on the basis that the source of an item is relevant in evaluating the ability of the entity to generate cash and cash equivalents in the future. For example, incidental activities such as the disposal of a long-term investment are unlikely to recur on a regular basis. When distinguishing between items in this way, consideration needs to be given to the nature of the entity and its operations. Items that arise from the ordinary activities of one entity may be unusual in respect of another.

Framework, paragraph 72

This suggests that:

- Ordinary activities are based on how the charity generates its revenue and income, not on how it spends its money for charitable purposes, and

- One-off, non-recurring items are unlikely to be considered part of revenue from ordinary activities.

However, judgement is always required based on facts and circumstances specific to the charity.

Note that the approach to ‘ordinary activities’ for for-profit entities and not-for-profit entities is different:

- For-profit entities - ordinary activities refers to goods and services provided to customers to generate cash inflows

- Not-for-profit entities - goods and services provided to customers do not always result in cash inflows. Instead, not for profit entities may generate cash inflows from government grants, bequests, etc. to enable them to provide goods and services to customers.

Example 1

NFP provides crisis counselling to sufferers of domestic violence. It has recurring contracts with government to receive $100 for each counselling session provided, and also raises fund from donations and bequests in the form of cash or other non-financial assets such as properties that it can use to provide its services. From time to time the entity has excess cash and it may invest this in term deposits for a short period of time.

Revenue from ordinary activities for the purposes of the size test is likely to include:

- $100 for each counselling session provided (AASB 15)

- Cash donations (AASB 1058)

- Bequests of properties (AASB 1058).

The interest income on surplus funds is not likely to result from ordinary activities and would not be included in the revenue test.

Example 2

Charitable Foundation was established 10 years ago with a $10 million bequest to manage a portfolio of investments, with income each year distributed as scholarships. During the current reporting period, Charitable Foundation sold a motor vehicle that the CEO was driving and made a gain of $5,000.

Revenue from ordinary activities for the purposes of the size test is likely to include:

- Interest income on cash invested

- Investment income from the investment portfolio

- Fair value movements recognised in profit or loss on the investments.

The gain on disposal of the motor vehicle is not likely to result from ordinary activities and would not be included in the revenue test because it is a ‘one-off’ other income item.

How to deal with a charity’s reporting status that changes from year to year?

As noted above, bequests are part of a NFP’s ordinary activities and therefore included as part of revenue for the size test. However, they tend to be large in size, happen less frequently, and be less predictable than donations. This could result in a charity being large in one period and small in another, resulting in different financial reporting responsibilities from one year to another. To resolve this problem, section 205-25(5) of the ACNC Act allows the Commissioner to continue to treat a charity as small, medium or large if the Commissioner is of the opinion that the entity is likely to return to that size in the next financial year.

The Commissioner may continue to treat a registered entity as either a small, medium or large registered entity for a financial year if the Commissioner is of the opinion that:

- the entity was a registered entity of that size for the previous financial year; and

- the entity, while not being of that size for the current financial year, is likely to return to that size during the next financial year.

Example 3

Lucky NFP is a small charity registered with the ACNC. In 2021 it received a bequest of $10 million when one of its directors passed away with no next of kin. It is unlikely to receive a bequest of this size in future. It relies on income from sausage sizzles to be able to perform its mission.

The Commissioner may decide in this instance that Lucky NFP is still a small charity for the 2021 financial year, and therefore it would not have to prepare financial statements and have them audited.

How to apply to keep your charity’s size?

Form 4D: Apply to keep charity size can be found on the ‘Forms’ page of the ACNC web site should be used to ask the Commissioner to classify your charity as its usual size. The form must be submitted:

- During the reporting period in which the unusual event occurred, or

- Within six months of the end of the reporting period in which the unusual event occurred, and

- In any event, before you submit the Annual Information Statement.

The ACNC will provide written confirmation of its decision.

Refer to the ACNC web site for more information about keeping your charity’s size.

Principal vs agent implications on the size test

If a charity receives revenue for its own benefit, it will be counted towards the revenue size test. However, if it receives revenue (e.g. a grant) on behalf of another charity, which it then forwards onto the second charity, both the accounting, as well as whether it gets counted towards the size test, will depend on whether the charity is acting as agent or principal as follows:

- Principal – the revenue is recognised on a gross basis and included in the revenue size test

- Agent – only the fee or commission is recognised as revenue.

AASB 15, paragraphs B34-B37 contain guidance to help a charity to determine if it is acting as principal or agent.

More information

There are many complex issues surrounding accounting for income and revenue by NFPs which can have a flow on effect to the size of a charity, and its resulting financial reporting obligations. Please contact one of our NFP Partners or our IFRS & Corporate Reporting team if you require assistance.