Step Five – Recognising revenue under IFRS 15 – Simultaneous use and consumption can be complex

In the April 2018 edition of Accounting News, we discussed the five-step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers:

| Step 1 | Identify the contract(s) with the customer | |

| Step 2 | Identify the performance obligations in the contract | |

| Step 3 | Determine the transaction price | |

| Step 4 | Allocate the transaction price to the performance obligations | |

| Step 5 | Recognise revenue when a performance obligation is satisfied |

Since then we have included a number of articles on IFRS 15 in Accounting News that cover various issues from the five-step process in greater depth:

| Step | Accounting News edition… | |

| Step 1 | Identify the contract(s) with the customer | May and June 2018 |

| Step 2 | Identify the performance obligations in the contract | July and September 2018 |

| Step 3 | Determine the transaction price | November 2018, February 2019, March 2019 and May 2019 |

| Step 4 | Allocate the transaction price to the performance obligations | June and July 2019 |

| Step 5 | Recognise revenue when a performance obligation is satisfied | August 2019 |

In this edition we continue our examination of the final step in the five step process – recognising revenue when a performance obligation is satisfied.

Recognising revenue

In the August 2019 edition of Accounting News we outlined how, under IFRS 15, revenue is recognised when (or as) a performance obligation is satisfied by transferring a promised good or service (i.e. an asset) to a customer (with transfer occurring when, or as, the customer obtains control of the good or service). A performance obligation may be satisfied:

- At a point in time, or

- Over time.

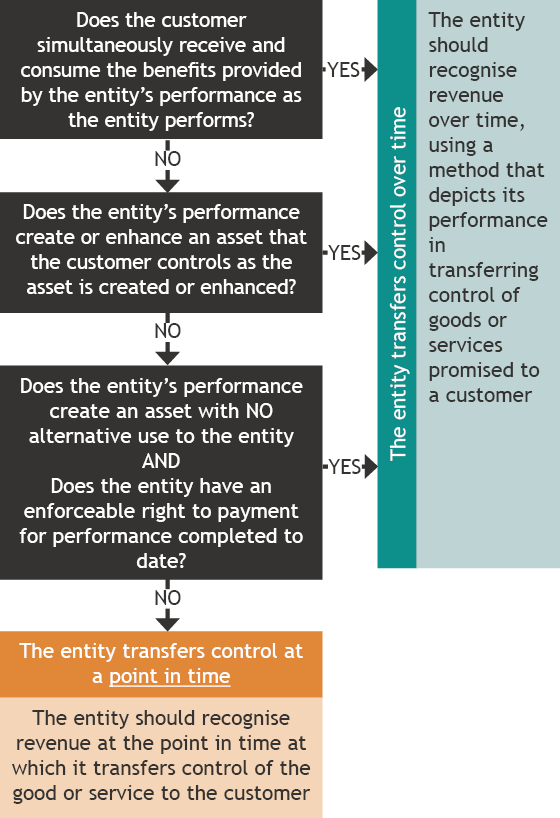

We also noted that an entity transfers control of a good or service over time and, therefore, satisfies a performance obligation and recognises revenue over time, provided that at least one of the following criteria is met:

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (this would occur, for example, in relation to the provision of nightly office cleaning services)

- The entity’s performance creates or enhances an asset (for example, work in progress) that the customer controls as the asset is created or enhanced, or

- The entity’s performance does not create an asset with an alternative use to the entity (due to a contractual restriction, or practical limitation, on directing the asset to another use) and the entity has an enforceable right to payment for performance completed to date.

The requirements for the recognition of revenue are illustrated in the decision tree below:

In the August 2019 edition of Accounting News, we examined the third of the three criteria for recognition of revenue over time (i.e. the entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date). In this edition we examine the first instance where revenue is recognised over time, i.e. where the customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (IFRS 15, paragraph 35(a)).

The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (IFRS 15, paragraph 35(a))

This criterion applies to certain contracts for services. The concept of control of an asset applies, because services are viewed as being an asset (if only momentarily) when they are received and used.

In some cases, it will be straightforward to identify whether a customer simultaneously receives and consumes the benefits provided by the entity’s performance, but in other circumstances it will be more complex. In these cases, a key test is whether, in order to complete the remaining performance obligations, another vendor would need to substantially re-perform the work the vendor has completed to date.

In determining whether another entity would need to substantially re-perform the work completed to date, the vendor is required to:

- Disregard any contractual or practical barriers to the transfer of the remaining performance obligations to another entity, and

- Presume that any replacement vendor would not have the benefit of any asset that the entity currently controls, and would continue to control (such as a partially completed service or item of property, plant and equipment), were the remainder of the contract to be fulfilled by the entity.

Example 1

Payroll Co enters into a contract to provide monthly payroll processing services to a customer for one year. Most of the payroll processing work is conducted on the 14th day of each month as staff are paid on the 15th day of each month.

If the entity ceased providing services to the customer, another entity would not need to re-perform the payroll processing services performed prior to the date that Payroll Co ceases its service provision.

In this case it is clear that the customer simultaneously receives and consumes the benefits of Payroll Co’s performance in processing each payroll transaction as and when each transaction is processed.

Note that, in determining whether a customer simultaneously receives and consumes the benefits of the entity’s performance as the entity performs, the entity must disregard any practical limitations on transferring the remaining performance obligation, including setup activities that would need to be undertaken by another entity.

Payroll Co therefore concludes that revenue from providing the payroll services meet the criteria in paragraph 35(a) for recognising revenue ‘over time’.

In addition, Payroll Co is essentially providing a series of distinct services (i.e. 12 monthly payroll services) that are substantially the same, and that have the same pattern of transfer to the customer (i.e. all 12 services are performed on the 14th day of each month). IFRS 15 treats such a series of distinct services as one performance obligation. Revenue is recognised over time for this one performance obligation using a method that measures Payroll Co’s progress towards complete satisfaction of this performance obligation to transfer each of the 12 month’s payroll services to the customer. Because the payroll services are processed on the 14th day of each month, strictly speaking, using a straight-line method to recognise revenue over time would not be appropriate. Revenue should instead be recognised as and when each payroll process is complete, i.e. on 14th of each month. However, in practice, because revenue is recognised every month, using a straight-line basis would achieve a similar outcome.

Example 2

Shipping Co enters into a contract to transport a customer’s goods from Sydney to Los Angeles. When Shipping Co enters into the contract, the ship to be used to transport the customer’s goods is docked in Hobart. On Shipping Co’s reporting date (30 June 2019), the goods had been collected from Sydney and the ship is half way across the Pacific Ocean.

In this scenario, we can conclude that another shipping company would not need to substantially re-perform the work completed to date by Shipping Co (being the transport of goods from Sydney to a point half way across the Pacific Ocean).

Shipping Co can therefore recognise revenue over time to reflect its partial performance at the reporting date, 30 June 2019. Note that, in determining how to recognise revenue, the shipping company disregards the practical limitations associated with a hypothetical transfer of the goods from its ship to another shipping company’s ship in the middle of the Pacific Ocean.

Note: The ’series’ provisions noted in Example 1 above do not apply in this case because the shipping services do not comprise a series of distinct and repetitive services. Revenue is merely recognised over time using a method that depicts Shipping Co’s performance in transferring control of the shipping services to the customer (e.g. kilometres shipped).

More complex examples – timing of revenue recognition

However, things are not always as straightforward as in the payroll processing contract (Example 1) and shipping contract (Example 2) examined above. For example, consider the following two cleaning contracts, each running for one year, commencing 1 April 2019, with a 30 June year-end and half-yearly reporting obligations:

| Details of services provided | Revenue recognised… |

Contract one | Provision of after-hours office cleaning services five evenings a week, with each clean to include the same services (emptying of bins, cleaning of kitchens and bathrooms, dusting and vacuuming) | The customer simultaneously receives and consumes the benefits of the cleaning services provided ‘over time’ (IFRS 15, paragraph 35(a)). Cleaning services are routine and recurring. Each cleaning service forms part of a ‘series’ of distinct services that are substantially the same and have the same pattern of transfer. Cleaning contract is treated as one performance obligation recognised over time using a straight-line method to measure the entity’s progress towards satisfying the whole performance obligation. Note: Straight-line method is appropriate because cleaning services are provided each day of the working week. |

Contract two |

| Performance obligations #1 As for Contract one above. |

| Performance obligations #2 The customer simultaneously receives and consumes the benefits of the carpet cleaning services provided ‘over time’ (IFRS 15, paragraph 35(a)). Carpet cleaning services are recurring. Each carpet cleaning service forms part of a ‘series’ of distinct services that are substantially the same and have the same pattern of transfer. Carpet cleaning contract is treated as one performance obligation recognised over time using a method to measure the entity’s progress towards satisfying the whole performance obligation. Note: At 30 June 2019 year-end, no carpet clean service had been provided to the customer. Therefore it would not be appropriate to recognise revenue over time using a straight-line basis as no carpet cleaning service had been provided to customer at 30 June 2019. Instead, an output method for recognising revenue over time may be appropriate. | |

| Performance obligations #3 The customer simultaneously receives and consumes the benefits of the window cleaning services provided ‘over time’ (IFRS 15, paragraph 35(a)). Window cleaning services do not meet the ‘series’ requirement as there is only one window cleaning service provided in the contract (i.e. there is no repetitive service). There is simply one performance obligation to be recognised over time using a method to measure the entity’s progress towards satisfying the whole performance obligation (e.g. as each day completed). Note: At 30 June 2019 year-end and 31 December 2019 half-year end, no window cleaning service had been provided to the customer. Therefore it would not be appropriate to recognise revenue over time using a straight-line basis as no window cleaning service had been provided to customer at 30 June 2019 or 31 December 2019. Instead, an output method for recognising revenue over time for the five-day cleaning period may be appropriate. |

Concluding thoughts

Under IAS 18 Revenue, revenue recognition was comparatively straightforward – when services were being sold, revenue was recognised on a percentage of completion basis.

Under IFRS 15, revenue can only be recognised over time if strict criteria are met. A determination of whether those criteria have been met will often involve an in-depth examination of the terms of contracts that have been entered into with customers. As we have seen with all of the five steps in the IFRS 15 revenue recognition model, this will require finance teams to work with sales (and in some instances legal) teams to ensure that they have a sufficiently in-depth understanding of contractual terms to correctly identify when revenue should be recognised.