Agenda decisions on tuition revenue, intangibles for climate-related expenditure, and guarantee contracts

IFRS Interpretations Committee (the Committee) agenda decisions are those issues the Committee decided not to include on its agenda. Although not authoritative guidance, these decisions are regarded as being highly persuasive in practice. All entities reporting under IFRS® Accounting Standards should be aware of these decisions, as they could impact how particular transactions and balances are accounted for. Entities are generally expected to implement any resulting changes in accounting policies in the first set of financial statements following an agenda decision, although this timeframe may be extended where detailed systems and process changes are required.

Preparers should consider the impact of three IFRS Interpretations Committee agenda decisions published by the Committee in April 2025:

- Recognising revenue from tuition fees

- Recognising intangible assets from climate-related expenditure

- Accounting for guarantees issued for obligations of other entities.

The questions put to the Committee and the Committee’s observations and conclusions are summarised below.

Revenue from tuition fees

Question: Over what period should an educational institution recognise revenue from tuition fees?

The fact pattern put to the Committee was as follows:

- Students attend University ABC for approximately ten months of the year (academic year) and have a summer break of approximately two months

- During the summer break, University ABC’s academic staff take a four-week holiday and use the rest of the time to:

- Wrap up the previous academic year (for example, by marking exams and assignments and issuing certificates), and

- Prepare for the next academic year (for example, administering re-sit exams for students who failed in the previous academic year and developing schedules and teaching materials)

- During the four-week period in which the academic staff is on holiday:

- Academic staff continue to be employed by, and receive a salary from, University ABC, but they provide no teaching services and do not carry out other activities related to providing educational services

- Non-academic staff provide some administrative support (for example, responding to email enquiries and requests for past records), and

- University ABC continues to receive and pay for services such as IT services and cleaning.

University ABC applies IFRS 15 Revenue from Contracts with Customers and recognises revenue from tuition fees over time. However, University ABC is unsure as to whether it should recognise revenue:

- Evenly over the academic year (ten months)

- Evenly over the annual reporting period (twelve months), or

- Over a different period (and if so, what is that period)?

Committee observations

The agenda decision notes the Committee’s key observations, including that:

- There is no diversity in how educational institutions account for revenue from tuition fees

- Educational institutions recognising revenue over different periods is due to different facts and circumstances, rather than diversity in accounting practice.

Conclusions

The Committee concluded that this issue does not have a widespread effect and, therefore, decided not to add a standard-setting project to its work plan.

Recognition of intangible assets from climate-related expenditure

Question: Can an entity capitalise costs for acquiring carbon credits and expenditure on climate-related research activities and development activities?

The question put to the Committee related to the following fact pattern:

- In 2020 and 2021, Good Citizen Limited made commitments to other parties that it would reduce a percentage of its carbon emissions by 2030 (its ‘2030 commitment’).

- It has taken ‘affirmative actions’ regarding its 2030 commitment. In its view, it has created an established pattern of practice to achieve its 2030 commitment, including:

- Creating a transition plan

- Engaging with ‘net zero focused investors’

- Publishing its commitment and plans on its website

- Joining coalitions with a mission to collaborate to achieve emissions reductions

- Stating its emission reduction targets in its financial statements and in presentations to investors and others, and

- Allocating capital to buying carbon credits and investing in ‘innovation programs’, purposed to find solutions to reduce emissions to meet its 2030 commitment.

- Its innovation programs engage teams of people with know-how, expertise and other intellectual property to create and develop solutions for reducing its own emissions and sector-specific emissions, creating intellectual capital.

- Its investors, insurers and bankers have made their own transition commitments, which rely on Good Citizen Limited actioning its 2030 commitments.

- Good Citizen Limited has concluded that its 2030 commitment and subsequent affirmative actions, create a constructive or legal obligation when applying IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

The April 2024 agenda decision confirms that climate-related commitments are only recognised as provisions in the financial statements if the entity has a constructive or legal obligation, and meets all the recognition criteria in paragraph 14 of IAS 37. The entity then separately assesses whether the related costs are recognised as an asset or expensed.

The question put to the Committee was whether Good Citizen Limited can capitalise the following types of expenditure it incurred during its 2024 annual reporting period:

- Acquisition of carbon credits

- Research activities

- Development activities.

That is, do the costs incurred on innovation programs result in intellectual capital that meets the requirements to be recognised as an intangible asset in IAS 38 Intangible Assets?

Committee observations

The Committee only considered the question about the accounting for expenditure on research activities and development activities.

It did not comment on the accounting for the acquisition of carbon credits because the International Accounting Standards Board (IASB) has been researching and engaging with stakeholders about the prevalence and significance of pollutant pricing mechanisms (PPMs), some of which include the use of carbon credits. The IASB expects to decide during its next agenda consultation whether to add a project on the accounting for PPMs to its work plan.

Conclusions

On the question of accounting for expenditures on research and development activities, the Committee concluded that there is no material diversity in practice, and that the matter described in the request does not have a widespread effect. The Committee, therefore, decided not to add a standard-setting project to the work plan.

Guarantees issued on the obligations of other entities

The issue discussed here was which IFRS Accounting Standard applies when an entity guarantees to make payments to a bank, a customer or another third party in the event its joint venture fails to meet its contractual obligations. While the question related to the accounting treatment in separate financial statements, the Committee also considered the impact on consolidated financial statements.

Committee observations

The Committee noted in its observations that:

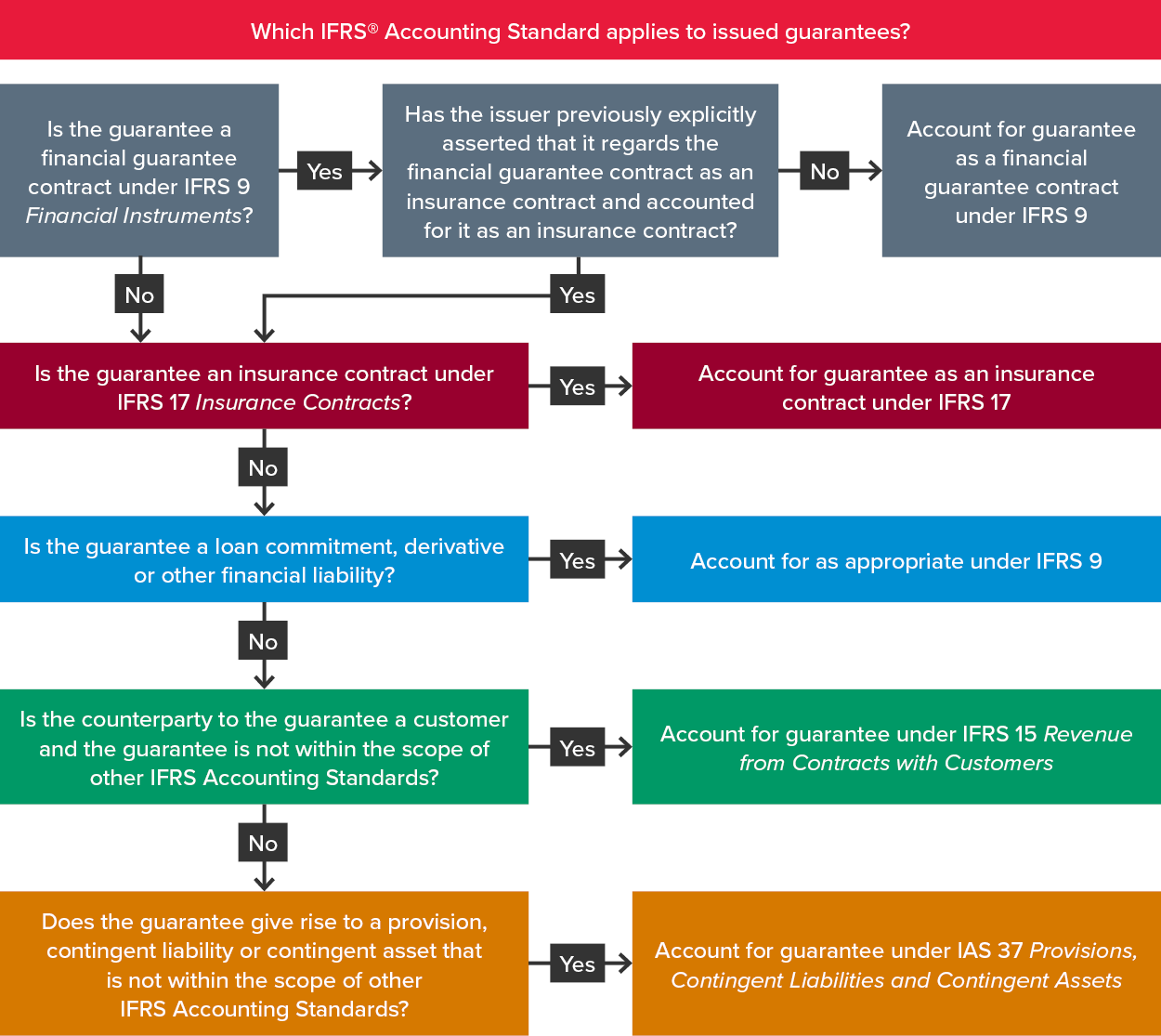

- IFRS Accounting Standards do not define ‘guarantees’, and no single standard applies to all guarantees

- Entities must look to the scoping requirements in each standard to determine the appropriate standard that deals with the particular type of guarantee; accounting is not based on the nature of the entity’s business activities

- Entities must apply judgement to determine which standard is most appropriate, and in doing so, must analyse all the terms and conditions – whether explicit or implicit – of the guarantee, unless those terms and conditions have no substance.

The following decision tree summarises the Committee’s process outlined in the agenda decision for determining the appropriate standard for accounting for guarantees:

Conclusions

Regarding scoping, the Committee concluded that the principles and requirements in IFRS Accounting Standards provide an adequate basis for an entity to determine the appropriate accounting for guarantee contracts.

The Committee also noted that the term ‘debt instrument’ is not defined in IFRS Accounting Standards and that there is diversity in practice in how the term ‘debt instrument’ is interpreted in the definition of a financial guarantee contract.

A contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument.

Definition of ‘financial guarantee contract’ in IFRS 9, Appendix A (emphasis added)

In practice, entities must, therefore, apply judgement when determining whether a guarantee should be accounted for as a financial guarantee contract. The International Accounting Standards Board will consider broader application questions related to financial guarantee contracts during its next agenda consultation.

More information

You can find more information by reading the full text of each agenda decision:

- Recognising revenue from tuition fees

- Recognising intangible assets from climate-related expenditure

- Accounting for guarantees issued for obligations of other entities

Need help?

Agenda decisions result from difficult accounting questions that entities grapple with in practice. If you require assistance with issues discussed in this article or any other complex accounting matters, our IFRS & Corporate Reporting experts are here to help. Contact us now.