Common errors in financial reporting and audit quality: Applying scope and definition criteria

Common errors in financial reporting and audit quality: Applying scope and definition criteria

In our April 2025 article, we explored why entities sometimes misapply IFRS® Accounting Standards and Australian Accounting Standards (AAS). We found that many errors stem from failing to properly assess the context of transactions or events. In this article, we highlight common examples of such mistakes and explain the accounting consequences of misapplying scope and definition criteria.

Context is (almost) everything

There are three key missteps that often lead to incorrect application of IFRS Accounting Standards and AAS:

- Applying the wrong accounting standard from the outset, which typically results in incorrect accounting treatment.

- Overlooking other potentially relevant standards and focusing only on the one that appears to apply.

- Failing to fully explore and evaluate the specific context of the transaction or event, the nature and objectives of the entity, and the purpose and consequences of the transaction.

To show how context is critical for determining the appropriate accounting standard for a particular transaction or event, we present three examples of transactions that could fall under multiple standards, depending on the circumstances.

Example 1: Options to acquire or dispose of assets

Entities frequently use options and similar arrangements to secure future purchases or sales of assets at predetermined prices. Common examples include land purchase options and share options. Options are also sometimes issued as part of share-based staff remuneration arrangements.

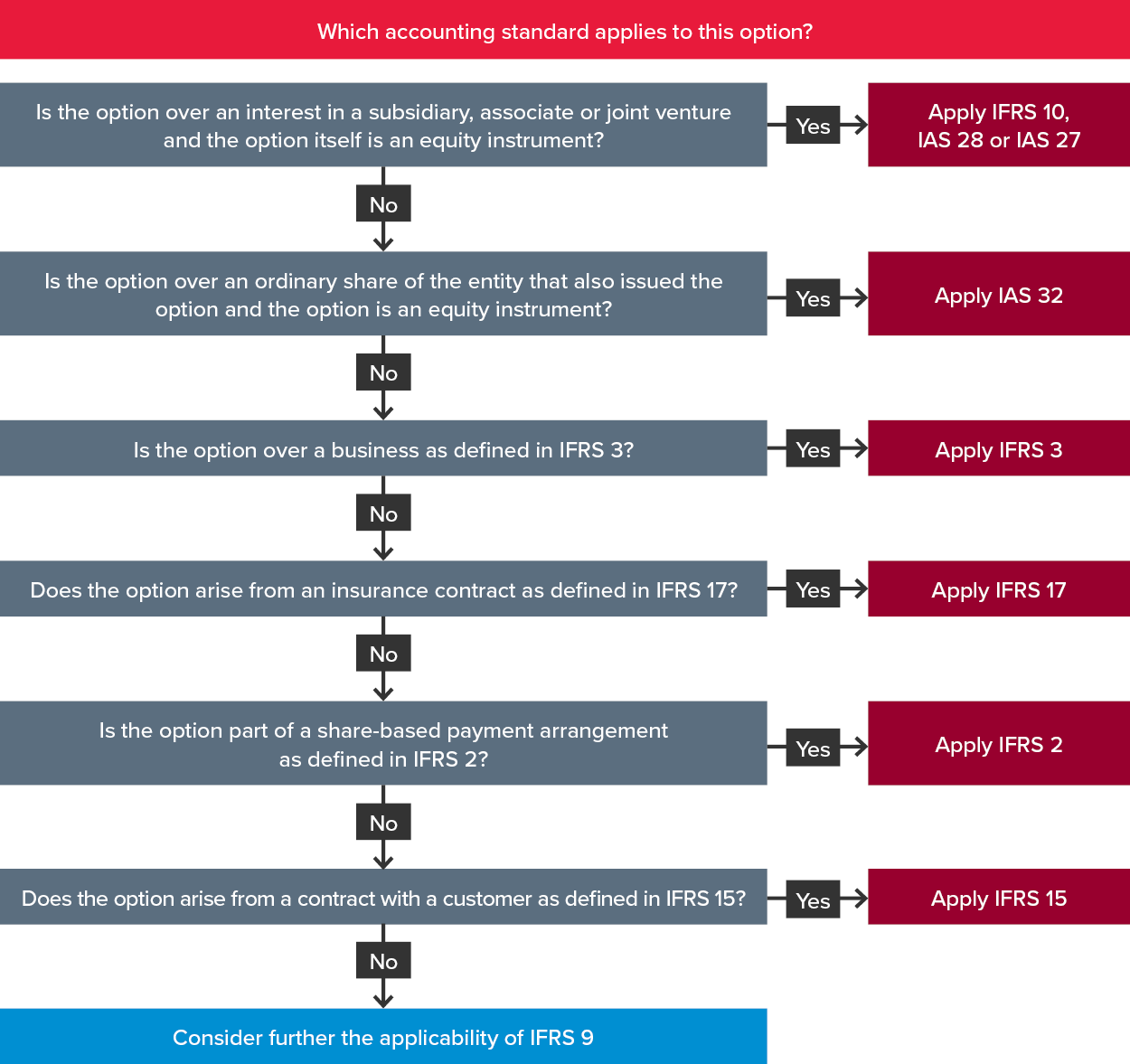

While these options all share common features, their accounting treatment can vary significantly. For instance, the following types of options fall outside IFRS 9 Financial Instruments and are accounted for using different accounting standards:

- Options over equity in subsidiaries, associates, or joint ventures (where the option itself is an equity instrument)

- Options issued by an entity over its own ordinary shares (where the option itself is an equity instrument)

- Options to acquire a business (IFRS 3 Business Combinations)

- Options embedded in insurance contracts (IFRS 17 Insurance Contracts)

- Share-based payment options (IFRS 2 Share-based Payment)

- Options embedded in revenue contracts (IFRS 15 Revenue from Contracts with Customers).

For example, if an entity issues a put option over its own ordinary shares, obligating it to repurchase them at a fixed price, IAS 32 Financial Instruments: Presentation applies. In such circumstances, the option issuer must add any consideration received to equity and ignore subsequent changes in the option’s fair value.

In contrast, IFRS 9 requires entities to recognise derivatives (including options) as financial assets or liabilities and measure them at fair value through profit or loss at each reporting date—unless the ‘own use’ exemption applies.

What is the own use exemption?

This Standard shall be applied to those contracts to buy or sell a non-financial item that can be settled net in cash or another financial instrument, or by exchanging financial instruments, as if the contracts were financial instruments, with the exception of contracts that were entered into and continue to be held for the purpose of the receipt or delivery of a non-financial item in accordance with the entity’s expected purchase, sale or usage requirements. However, this Standard shall be applied to those contracts that an entity designates as measured at fair value through profit or loss in accordance with paragraph 2.5.

IFRS 9, paragraph 2.4

Our previous article on nature-dependent power purchase agreements clarifies that paragraph 2.4 of IFRS 9 applies to contracts to buy or sell a non-financial item that can be settled net in cash. However, it does not apply to contracts held for the purpose of receiving or delivering a non-financial item according to the entity’s expected purchase, sale or usage requirements.

For example:

- A supply contract for the delivery of a specified amount of bananas to a retail grocery chain with no cash settlement option falls outside IFRS 9

- A crude oil contract for delivering a specified amount of crude oil to a broker with a net cash settlement option based on market prices is accounted for as a derivative under IFRS 9.

In short, not all options receive the same accounting treatment. The following diagram provides a visual summary of this discussion:

Example 2: Classifying sales of plant and equipment

The sale of a motor vehicle may fall under IFRS 15 or IAS 16, depending on whether the sale forms part of the entity’s ordinary activities. This assessment significantly affects the accounting treatment.

Although IFRS 15 and other accounting standards don’t define ‘ordinary activities’, the superseded Conceptual Framework described revenue as arising during the ordinary activities of an entity, including sales, fees, interest, dividends, royalties and rent. However, the updated Conceptual Framework for Financial Reporting did not retain this guidance, leaving preparers and auditors to rely on the common meaning of ‘ordinary activities’ to determine whether a sale falls within the scope of IFRS 15.

To assess whether a sale of plant and equipment qualifies as a sale under IFRS 15, preparers should consider:

- Has the entity previously engaged in similar profit-driven transactions?

- Does the entity have the necessary resources and processes to continue such profit-driven transactions in the future?

Accounting implications

Let’s look at the accounting implications if the sale of a motor vehicle is incorrectly classified.

|

Requirements |

IFRS 15 Revenue from Contracts with Customers |

IAS 16 Property, Plant and Equipment |

|

Derecognition |

Recognise revenue when the entity satisfies the performance obligation by transferring the promised good or service to the customer. An asset is transferred when (or as) the customer obtains control of that asset (paragraph 31). IFRS 15 does not include any specific guidance on when to derecognise an asset that is sold to a customer. Entities must refer to the applicable accounting standard for the relevant requirements (e.g., IAS 2 Inventories). |

Derecognise the carrying amount of an item of property, plant and equipment on disposal, or when no further economic benefits are expected (paragraph 67). Disposal may occur in various ways (e.g. sale, finance lease, donation). The date of disposal is when the recipient obtains control of the item in accordance with the requirements for determining when a performance obligation is satisfied in IFRS 15. IFRS 16 Leases applies to disposals via a sale and leaseback (paragraph 69). |

|

Measurement |

When (or as) a performance obligation is satisfied, an entity shall recognise as revenue the amount of the transaction price (which excludes estimates of variable consideration that are constrained in accordance with paragraphs 56–58) that is allocated to that performance obligation. (paragraph 46). IFRS 15 does not include any specific guidance on the amount to derecognise in respect of an asset that is sold to a customer. Entities must refer to the applicable accounting standard for the relevant requirements (e.g., IAS 2). |

The gain or loss from derecognition is the difference between the net disposal proceeds and the carrying amount (paragraph 71). |

|

Presentation |

The profit or loss section or the statement of profit or loss must include a line item presenting revenue amounts for the period (IAS 1, paragraph 82). |

The gain or loss is recognised in profit or loss when the item is derecognised (unless IFRS 16 requires otherwise for a sale and leaseback). Gains are not classified as revenue (paragraph 68). |

|

Disclosure |

Extensive disclosures under IFRS 15, including:

|

No specific disclosures for individual disposals, except for assets held for sale or part of a disposal group under IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. |

As outlined in the table above, misclassification of a vehicle sale can significantly impact:

- The reported results from the sale – IFRS 15 requires the revenue to be based on the transaction price allocated to the performance obligation, which may differ from proceeds arising from the sale if, for instance, the sale proceeds reflect other performance obligations

- Presentation of the results from the sale – IFRS 15 and IAS 1 require proceeds to be presented as revenue on a gross basis, whereas IAS 16 requires the proceeds to be presented as income and recognised net of the asset’s carrying amount and costs of disposal, and

- The disclosures provided in respect to the transaction.

Example 3: Electricity supply contracts

Electricity supply contracts that allow buyers to fix prices for future electricity tranches are also prone to misapplication of standards. Much of the foregoing discussion on accounting for options and the own use exemption is also applicable to electricity supply contracts that contain features of a contract for difference (CFD). A CFD is a derivative contract that will be settled net in cash based on the market value of the underlying item rather than physical delivery. For example, a CFD for electricity purchases might settle based on the difference between the contracted and spot price per megawatt hour (MWh).

As we discussed last month, the IASB recently amended the accounting treatment for such contracts. We’ll explore these changes in more detail next month.

Looking ahead

Next month, we’ll examine the types of accounting transactions that should be documented in accounting position papers—and the risks of failing to do so.

Need help?

BDO provides expert support for entities preparing for audits or drafting accounting position papers. Contact BDO’s IFRS & Corporate Reporting team for assistance.