Entities may have to reclassify their borrowings at 31 December 2024

Entities may have to reclassify their borrowings at 31 December 2024

New rules for classifying liabilities as current or non-current commence for annual periods beginning on or after 1 January 2024. One of the most complex areas of the new rules relates to entities classifying loan arrangements with loan covenants.

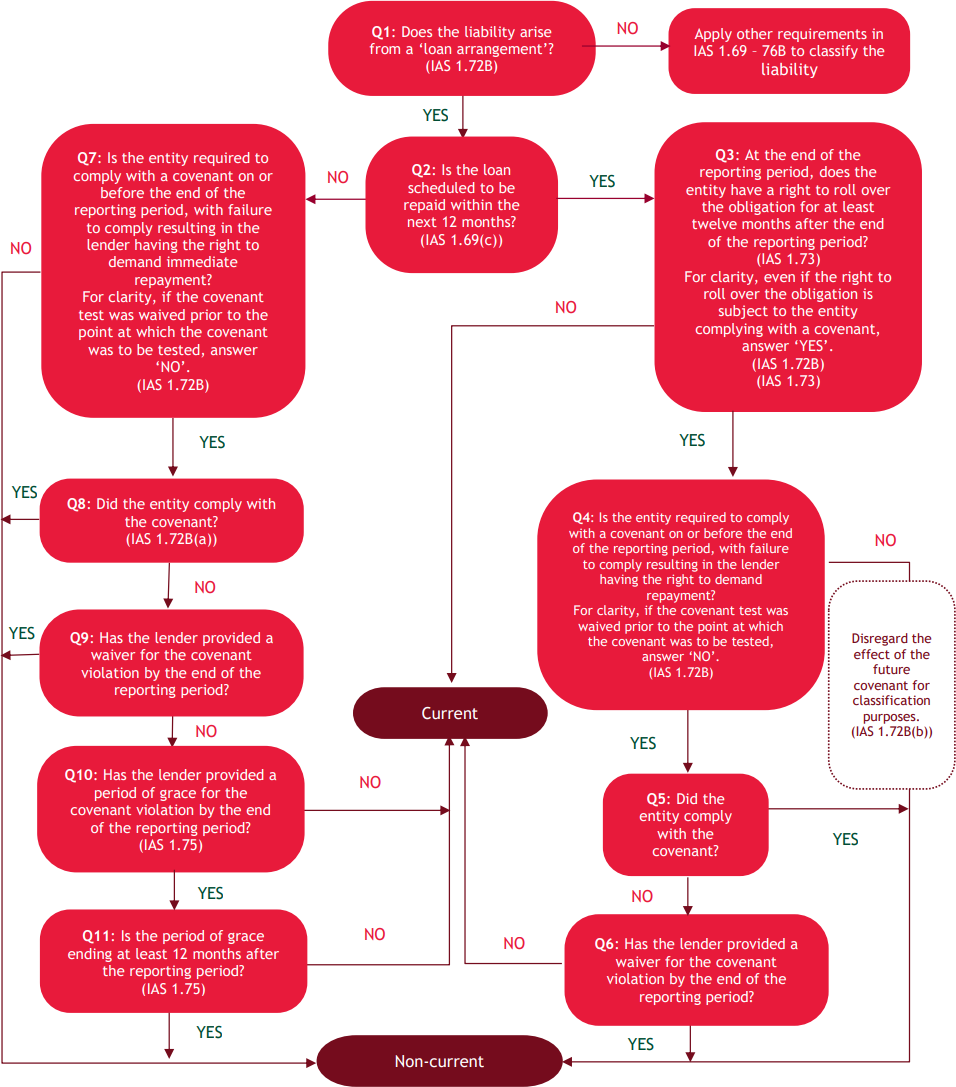

BDO’s recent publication, IFRS Accounting Standards in Practice - Classification of loans as current or non-current, includes a flow chart and numerous examples to help you determine the correct classification of your loan arrangements. This article highlights some examples from our publication where compliance with loan covenants is required at the end of, or after, the reporting date and how that impacts the classification of the loan arrangement. Follow our articles over the next few months to learn how to classify loans where compliance with a covenant is required before the end of the reporting period, or quarterly, and more.

You can also listen to our webinar for more information about the new classification requirements.

When is a loan classified as non-current?

A loan is classified as a non-current liability if none of the criteria in IAS 1 Presentation of Financial Statements (IAS 1), paragraph 69, are met. This means:

- The entity does not expect to settle the liability in its normal operating cycle

- The entity does not hold the liability primarily for the purpose of trading

- The liability is not due to be settled within twelve months after the reporting period, and

- The entity has the right at the end of the reporting period to defer settlement of the liability for at least twelve months after the reporting period.

IAS 1, paragraphs 69(a) and (b) do not apply to the classification of long-term loan arrangements and paragraph 69(c) is only relevant if the loan is due to be settled within twelve months of the reporting date.

IAS 1, paragraph 69(d), is key to assessing whether a loan subject to loan covenants is classified as a current or a non-current liability. The entity’s right in paragraph 69(d) must exist at the end of the reporting period and have substance. Whether an entity’s right to defer settlement has substance is discussed further in IAS 1, paragraphs 72B to 75.

Does the entity’s right to defer settlement have substance?

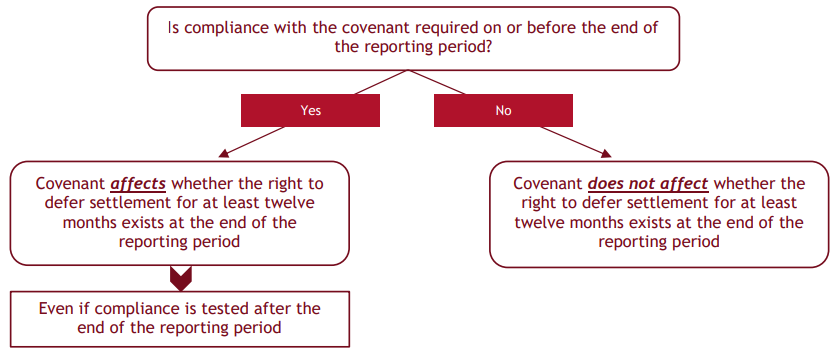

IAS 1, paragraph 72B summarises how the timing of covenants affects an entity’s right to defer settlement of its loans at the reporting date and whether such right has substance. This is illustrated in the diagram below.

To classify a loan as a non-current liability at the reporting date, it must meet any loan covenant test required on or before the end of the reporting period.

If the entity breaches a loan covenant before the reporting date such that the loan becomes repayable on demand, the loan is classified as a current liability because the borrower does not have a right to defer settlement.

If there is a breach of a loan covenant before the reporting date, a waiver or period of grace obtained from the lender after the reporting date, but before the financial statements are authorised for issue is a subsequent event and results in the loan still being classified as a current liability (refer IAS 1, paragraph 74).

However, if the entity obtains, before the end of the reporting period, a waiver for the breach, or a period of grace whereby the borrower agrees not to demand repayment for at least twelve months after the end of the reporting period, the loan is classified as a non-current liability. We explain waivers and periods of grace in more detail below.

Periods of grace

If there has been a loan covenant breach before the reporting date, the loan could be classified as a non-current liability if the lender provides a ‘period of grace’ during which the entity can rectify the breach and the lender cannot demand immediate repayment. This ‘period of grace’ must be for at least twelve months after the end of the reporting period (refer to IAS 1, paragraph 75).

IAS 1 does not define a ‘period of grace’. However, in our view, it would refer to a period provided by the lender during which the lender agrees not to demand immediate repayment of the loan due to the breach. At the end of the ‘period of grace’, the lender regains the right to demand immediate repayment resulting from the breach.

Waivers

In some cases, the lender provides a ‘waiver’ for a breach of a covenant rather than a ‘period of grace’. The term ‘waiver’ is not used nor defined in IAS 1, however, in our view, a ‘waiver’:

- Refers to the lender surrendering its rights related to the breach of covenant - for example - the lender surrenders its right to demand immediate repayment, which arises from a breach

- Would be a complete surrender of the rights, whereas a period of grace is a suspension of the rights for a specified period

- Is permanent and not for a specified period

- Effectively modifies the terms of the loan arrangement, removing the covenant that is waived from the contractual terms of the liability.

Assessing whether there has been a waiver may require a legal interpretation to understand the nature of the rights surrendered or retained by the lender.

How do ‘periods of grace’ and ‘waivers’ affect loan classification?

Our publication includes a flow chart, the left-hand side of which illustrates how a loan’s classification can change depending on whether the entity obtains a ‘period of grace’ or ‘waiver’ from its lender.

Examples

Our publication illustrates seven examples where Entity A must comply with a loan covenant at or after the end of the reporting period (examples A1 to A7) and identifies how this impacts the loan classification at the reporting date. For each example, the publication uses the above flow chart and walks you through step-by-step to arrive at the correct loan classification. For all these examples, the answer to Question 1 (Does the liability arise from a loan arrangement?) is ‘Yes’, and Question 2 (is the loan scheduled to be repaid within the next 12 months?) is ‘No’. Therefore, Questions 7 to 11 need to be considered.

Base fact pattern

Entity A obtains a loan from Bank B on 1 January 20X0. The loan is repayable in full after five years. Entity A's annual reporting period ends on 31 December. The loan arrangement requires Entity A to have a working capital ratio above 1.1 at the end of every annual period, i.e. 31 December. If the covenant test of the working capital ratio is not met, Bank B retains the right to demand immediate repayment of the loan. Classification of the loan is assessed at 31 December 20X1.

Examples A1 to A5

|

|

Example A1 – Covenant met at the end of the reporting period |

Example A2 – Covenant not met at the end of the reporting period |

Example A3 – Waiver of breach received after the end of the reporting period |

Example A4 – Waiver of an expected breach received before the end of the reporting period |

Example A5 – Anticipated breach is waived, and lender inserts a new covenant test at 31 March 20X2 |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? |

Yes |

Yes

|

Yes

|

No

|

No

|

|

Note: If the covenant test was waived prior to the point at which the covenant was to be tested, answer ‘NO’. |

|

The covenant test was not waived prior to the covenant being tested. |

The covenant test was not waived prior to the covenant being tested. |

The covenant test was waived prior to the covenant being tested. |

The covenant test was waived prior to the covenant being tested. IAS 1.72B(b) applies to the new covenant. |

|

Question 8: Did the entity comply with the covenant? |

Yes |

No |

No |

N/A |

N/A |

|

Question 9: Has the lender provided a waiver for the covenant violation by the end of the reporting period? |

N/A |

No |

No |

N/A |

N/A |

|

Question 10: Has the lender provided a period of grace for the covenant violation by the end of the reporting period? |

N/A |

No |

No |

N/A |

N/A |

|

Classification |

Non-current |

Current |

Current |

Non-current |

Non-current |

Example A6 – Period of grace provided for expected covenant violation

This example is similar to Example A4 (waiver of the anticipated breach is received before the reporting date), except Entity A receives a period of grace rather than a waiver.

Terms of period of grace

Bank B agrees it will not exercise its right to demand the loan until 30 June 20X2. As part of this agreement to not demand repayment, Bank B introduces a working capital ratio covenant test as on 30 June 20X2.

As expected, the working capital ratio as of 31 December 20X1 was 0.9.

After 30 June 20X2, Bank B will reconsider the loan based on the new working capital ratio covenant. From 1 July 20X2, Bank B has the right to demand repayment of the loan with respect to the 31 December 20X1 covenant violation. Bank B has this right irrespective of whether Entity A meets the new covenant on 30 June 20X2.

|

|

Example A6 – Period of grace for expected covenant violation before reporting date - lender inserts a new covenant test on 30 June 20X2 |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? |

Yes

|

|

Note: If the covenant test was waived prior to the point at which the covenant was to be tested, answer ‘NO’. |

The covenant test was not waived prior to the covenant being tested on 31 December 20X1. |

|

Question 8: Did the entity comply with the covenant? |

No |

|

Question 9: Has the lender provided a waiver for the covenant violation by the end of the reporting period? |

No |

|

Question 10: Has the lender provided a period of grace for the covenant violation by the end of the reporting period? |

Yes |

|

Question 11: Is the period of grace ending at least 12 months after the reporting period? |

No |

|

Classification |

Current |

The fact patterns in Example A5 and A6 appear similar but are not.

In Example A5, the lender provided a complete waiver from the breach of covenant, whereby the lender surrendered all its rights related to the covenant violation.

In Example A6, the lender has provided a period of grace regarding the covenant to be tested as at 31 December 20X1. Effectively, the lender has retained the rights related to the breach of covenant that was expected to (and did) occur as of 31 December 20X1.

In both examples, a covenant will be tested within twelve months of the end of the reporting period. However:

- In Example A5, if the covenant is met in March 20X2, the lender does not obtain a right to demand immediate repayment. If the covenant is not met, the lender obtains the right to demand immediate repayment. This right arises from the breach of the future covenant that will be tested in March 20X2 and not the original breach that was expected to occur on 31 December 20X1 (IAS 1, paragraph 72B(b))

- In Example A6, although the lender has added a new covenant to be tested in June 20X2, the lender regains the right to demand immediate repayment, irrespective of the outcome of the covenant test in June 20X2. This right arises from the original breach of covenant that was expected to (and did) occur as of 31 December 20X1 and is not a violation of the new covenant. Therefore, the requirements of IAS 1, paragraph 75 apply in this case. As the period of grace is less than twelve months from the end of the reporting period, the loan is classified as a current liability.

Example A7 – Covenant required to be met after the end of the reporting period

In this example, the covenant test is after the reporting period, i.e. 31 January 20X1 instead of 31 December 20X1.

At the end of the reporting period, i.e. 31 December 20X1, Entity A expects the working capital ratio to be 0.9 on 31 January 20X2. Thus, the covenant is expected to be breached after the end of the reporting period.

|

|

Example A7 – Covenant required to be met after the end of the reporting period |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? |

No |

|

Note: If the covenant test was waived prior to the point at which the covenant was to be tested, answer ‘NO’. |

The covenant must only be complied with after the reporting date, i.e. 31 January 20X2. |

|

Classification |

Non-current |

Disclosure about standards issued not yet effective

Paragraph 30 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, requires disclosing known or reasonably estimable information about the possible impact a new standard will have when it becomes effective.

Entities with loan arrangements subject to loan covenants will have to assess the impacts of these IAS 1 changes on their borrowings, and disclose the effect on the comparative and opening balance sheets for reporting periods starting before 1 January 2024.

|

Year-ends |

First-time application |

Comparative restatement |

Opening balance sheet |

|

31 December |

31 December 2024 |

31 December 2023 |

1 January 2023 |

|

31 March |

31 March 2025 |

31 March 2024 |

1 April 2023 |

|

30 June |

30 June 2025 |

30 June 2024 |

1 July 2023 |

|

30 September |

30 September 2025 |

30 September 2024 |

1 October 2023 |

More information

For more information on this topic, please look at our new publication or listen to our recent webinar for further explanation and examples.

Need help?

Classifying loan arrangements and other liabilities as current or non-current may be complex. Deciding whether the bank has provided a waiver or a period of grace for a covenant breach can also be tricky, and the hurdle for a waiver is high. Please contact our IFRS & Corporate Reporting team for help.