How to amend impairment models for right-of-use assets under IFRS 16

How to amend impairment models for right-of-use assets under IFRS 16

The leases standard, IFRS 16 Leases, has been effective for five years. For entities that have not already done so, now is the time to update value in use (VIU) impairment models to reflect that lease payments are cash flows from financing activities and, therefore, excluded from discounted cash flow (DCF) calculations.

When reviewing VIU models, many auditors, corporate advisory firms and ASIC are no longer accepting the old ‘IAS 17 approach’, which treats lease payments as cash outflows, and excludes right-of-use assets from the carrying amount of the cash-generating unit (CGU) assets. So, entities need to amend VIU models as soon as possible.

This article explores and explains the impacts of right-of-use (ROU) assets and lease liabilities on VIU models. It does not elaborate fully on all aspects of the requirements of the impairment test in IAS 36 Impairment of Assets, or the mechanics thereof. Please refer to our IFRS in Practice for a more in-depth discussion on the reporting requirements of IAS 36.

ROU assets to be tested for impairment

ROU assets are non-financial assets, and impairment is therefore considered in the context of IAS 36. When using the ‘cost model’ to measure ROU assets subsequent to initial recognition, IFRS 16, paragraph 33, specifically requires lessees to apply IAS 36 in order to determine whether the ROU asset is impaired, and then to account for any resulting impairment loss.

Impairment losses arise where the asset’s carrying amount exceeds its recoverable amount. Recoverable amount is the higher of:

- Value in use (VIU), and

- Fair value less costs of disposal (FVLCD).

When to test ROU assets for impairment

At the end of each reporting period, lessees must assess whether there is any indication that an asset may be impaired, and if so, determine the recoverable amount, and any resulting impairment loss (IAS 36, paragraph 9).

It is important to note that an ‘impairment test’ (i.e. determining recoverable amount) is only necessary for an individual asset where impairment indicators exist at the end of the reporting period.

Recently announced tariffs by the United States of America (USA) may be an impairment indicator for many entities that individual assets are impaired.

At what level are ROU assets tested for impairment?

Individual asset level

If the recoverable amount of the ROU asset can be estimated for the individual asset, then individual ROU assets are tested for impairment on a stand-alone basis. This would only occur if the ROU asset generates cash flows in its own right, i.e. the cash flows generated are largely independent of those generated from other assets.

Cash-generating unit (CGU) level

If it is not possible to estimate the recoverable amount of the individual ROU asset, lessees will need to identify and then determine the recoverable amount of the cash-generating unit (CGU) to which the ROU asset belongs. Typically, ROU assets do not generate their own independent cash flows, except in limited cases, such as ROU assets that comprise investment properties, which generate rental income. ROU assets are usually used as part of the lessee’s main operating activities, and therefore tested for impairment as part of a CGU, for example, leased premises, photocopiers, etc.

IFRS 16 has resulted in the recognition of more corporate ROU assets, e.g. leased corporate head office, which must be allocated appropriately to CGUs for impairment testing purposes.

Timing of impairment tests

Impairment tests (i.e., determining the recoverable amount), are performed within the time frames indicated in the table below.

|

Individual asset |

Part of a CGU with NO goodwill and/or indefinite useful life intangible assets |

Part of a CGU containing goodwill and/or indefinite useful life intangible assets |

|

At the end of each reporting period, but only if there are indicators of impairment IAS 36, paragraph 9 |

At the end of each reporting period, but only if there are indicators of impairment IAS 36, paragraph 9 |

At least annually, at the same time each year IAS 36, paragraph 10(a) & 90 AND Whenever there is an indicator of impairment if outside of the normal annual impairment testing cycle IAS 36, paragraphs 9 & 90 Example: Entity ABC has a CGU containing goodwill and a 30 June 2025 year-end. It performs its annual impairment test in December each year. Due to the overriding requirement in IAS 36, paragraph 9, to assess impairment indicators at the reporting date, and given impairment indicators at 30 June 2025 due to recently announced USA tariffs, Entity ABC will need to perform another impairment test at 30 June 2025. |

VIU applying IAS 17 Leases (method no longer recommended)

Under IAS 17, operating lease expenses, both fixed and variable lease payments were:

- Presented in the cash flow statement as cash outflows from ‘operating activities’ and

- Deducted in determining VIU (i.e. NPV of future cash flows).

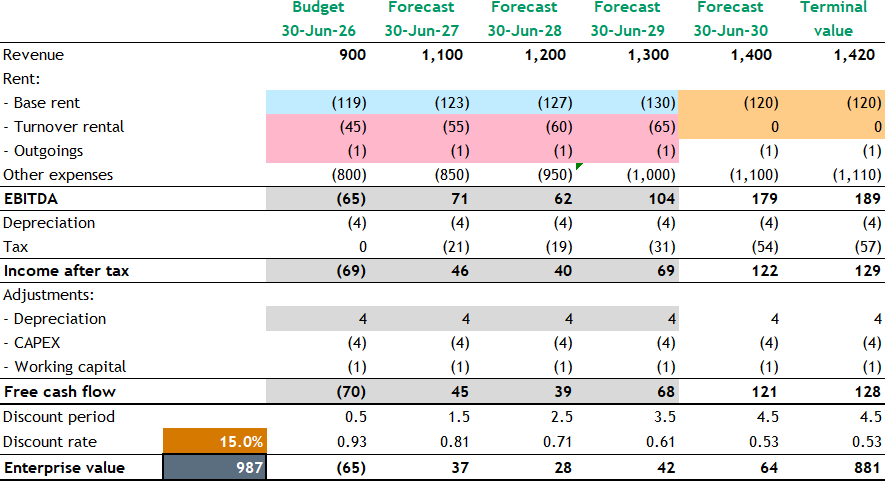

Although no detailed background information has been provided, the example VIU model below is a snapshot of an impairment test to illustrate how all rent charges until the end of the lease in 2029 would have been deducted to determine VIU. That is, base (fixed) rent is shown in blue below, and turnover rent (variable payments) and outgoings are shown in pink below.

Even though the lease finishes in 2029, we had to assume that the existing ROU asset would need to be replaced. Therefore, cash flow assumptions for 2030 and the terminal value include cash outflows for new capital investment required to replace the current lease (shown in orange below).

Assuming the following carrying amounts of CGU assets, no impairment write-down would be required as the recoverable amount of $987 exceeds the carrying amount of the CGU assets of $950 by $37, i.e. there is ‘head room’ of $37:

|

|

$ |

|

500 |

|

350 |

|

100 |

|

|

950 |

VIU applying IFRS 16 (preferred method)

Under IFRS 16, lessees:

- Recognise a ROU asset and lease liability on the balance sheet

- Present the principal amount of the lease payments in the cash flow statement as outflows from financing activities, and

- Present the interest portion of lease payments in the cash flow statement as outflows from either operating, investing or financing activities, depending on the entity’s accounting policy choice as permitted by IAS 7 Statement of Cash Flows.

IAS 36, paragraph 50, requires that estimates of future cash flows do not include cash outflows from financing activities. Because lease liabilities are part of the entity’s recognised borrowings, they are part of the lessee’s financing activities, and all payments associated with these lease liabilities (principal and interest) must be excluded from the cash flows used to determine VIU.

‘Adding back’ lease payments to VIU cash flows will result in an increase in the recoverable amount of a CGU. However, the carrying amount of the CGU will also increase, because ROU assets must be included with the carrying amount of all other assets making up the CGU (such as goodwill, intangibles, PPE, etc.).

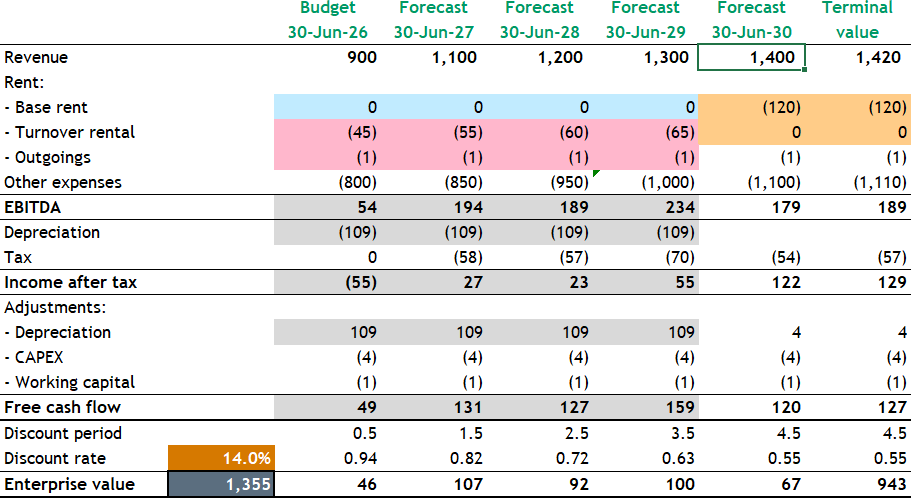

Using a similar VIU model as demonstrated for IAS 17 above (no detailed background information provided), the example VIU model below illustrates how the calculation is adapted under IFRS 16:

- Budget and forecast cash flows for the remainder of the lease no longer include base rent changes as these are now considered outflows for financing activities (refer blue below)

- Cash outflows still include variable lease charges for turnover rent, as well as outgoings (refer pink below), and

- Consistent with VIU calculations under IAS 17, we assume that the existing ROU asset will have to be replaced at the end of the lease (see orange cash outflows for base rent (CAPEX) during 2030 and the terminal value).

Assuming the following carrying amounts of CGU assets, an impairment write-down of $23 is now required ($1,355 less $1,378):

|

|

$ |

|

500 |

|

350 |

|

423 |

|

5 |

|

100 |

|

|

1,378 |

Theoretically, this change in VIU methodology should not result in CGU impairment because economically the entity is leasing the same asset. However, the discounted ‘cost savings’ in fixed lease payments are likely to be less than the additional ROU assets added to the CGU. This discrepancy arises because the incremental borrowing rate used to discount lease liabilities (which is the starting point for the ROU asset – assume 8%) is less than the rate used to discount cash flows for VIU (14%).

The discount rate

Also note that the discount rate used in our IFRS 16 example above is lower at 14% than the 15% used under IAS 17. This is because the weighted average cost of capital should incorporate the capital cost of lease liabilities, which is expected to be lower because lease liabilities are secured borrowings. If you require assistance with determining the discount rate for VIU models applying IFRS 16, please contact BDO’s Corporate Finance team.

Are lease liabilities deducted from the carrying amount of the CGU?

The general rule is that liabilities are not deducted from the carrying amount of the CGU. IAS 36, paragraph 78, only requires liabilities to be deducted where the disposal of the CGU would require the buyer to assume the liability (for example, a buyer would be required to assume lease liabilities).

In such cases, the carrying amount of lease liabilities would be deducted from both the carrying amount of the CGU, and the recoverable amount of the CGU determined as VIU (i.e. comparing ‘apples with apples’).

|

On disposal of CGU… |

Carrying amount of CGU |

VIU recoverable amount |

|

Buyer would not assume lease liabilities |

No reduction for lease liabilities |

No reduction for lease liabilities |

|

Buyer would assume lease liabilities |

Deduct from the carrying amount of CGU |

Deduct from the VIU recoverable amount |

Deducting the lease liabilities from the VIU recoverable amount calculation in these circumstances ensures that the VIU is a comparable measure to FVLCD, where a buyer would offer a lower price because of its assumption of lease liabilities.

It is important to note that the inclusion/exclusion of lease liabilities from the carrying amount of the CGU and VIU has a neutral effect, and therefore no impact on the amount of impairment losses recognised. In practice, even if lease liabilities would be assumed by a buyer, they can be ignored where there is a reasonable amount of ‘headroom’ in the VIU calculation (i.e. VIU exceeds the carrying amount of the CGU by a reasonable amount). However, if there is insufficient ‘headroom’ in VIU, then FVLCD must be determined because recoverable amount is the ‘higher of’ FVLCD and VIU. FVLCD assumes deduction of lease liabilities, therefore, in order to compare FVLCD and VIU, lease liabilities must also be deducted from VIU.

More information

You can find more information about impairment testing generally and the impact of leases on VIU models in the following webinars:

- Understanding the what, how and when of conducting impairment testing

- Practical tips on impairment testing

- Impairment testing after the implementation of IFRS 16.

Need assistance?

As demonstrated above, developing assumptions and inputs for VIU models under IAS 36 is complex, particularly given the adjustments required to incorporate ROU assets into impairment models, and the added uncertainties around tariff impacts. Please contact our IFRS& Corporate Reporting team if you require assistance.