Accounting impacts from recent Federal Budget announcements

Accounting impacts from recent Federal Budget announcements

As part of the Federal Government’s October 2022 and May 2023 Budgets, there were some announcements, which in addition to taxation impacts, could also affect the preparation of your financial statements when legislation for these initiatives passes through Parliament. These include:

- Changes to the thin capitalisation rules and limits on interest deductibility

- Limits on intangibles deductions for significant global entities

- Extension of the small business instant asset write-off

- Small business energy incentive.

Changes to the thin capitalisation rules and limits on interest deductibility

The October 2022 Budget announced changes to the thin capitalisation rules and limits on interest deductibility, although draft legislation fleshing out the proposals was only made available in March 2023 and at time of writing, have not been finalised. Three tests for interest deductibility are being proposed:

- Fixed ratio test (replaces the safe harbour test, where interest deductions are currently limited to 60% of the average value of the entity’s assets, with various adjustments)

- Group ratio test (replaces the worldwide gearing test)

- External third-party debt test (replaces the arm’s length debt test).

The fixed ratio test is the default test whereby interest deductions are limited to 30% of tax-EBITDA. In certain circumstances, entities can choose to apply the group ratio test or the external third-party test to determine the quantum of interest deductibility.

Deferred tax impacts

Based on current rules, non-deductible interest in one period cannot be carried forward to be deducted in a later period, and undeducted amounts would appear as ‘expenses not deductible for tax purposes’ in the entity’s tax reconciliation note.

The draft legislation proposes that undeducted interest amounts using the fixed ratio test be carried forward for up to 15 years and deducted in subsequent periods, provided the entity’s net debt deductions in that later period are less than 30% of tax-EBITDA, and the entity passes the continuity of ownership test.

Entities will therefore need to assess whether a deferred tax asset is recognised for the deductible temporary difference (undeducted interest carried forward), i.e. whether it is probable that sufficient tax-EBITDA will be available against which the deductible temporary difference can be recognised.

Accounting impacts of modifying financial liabilities

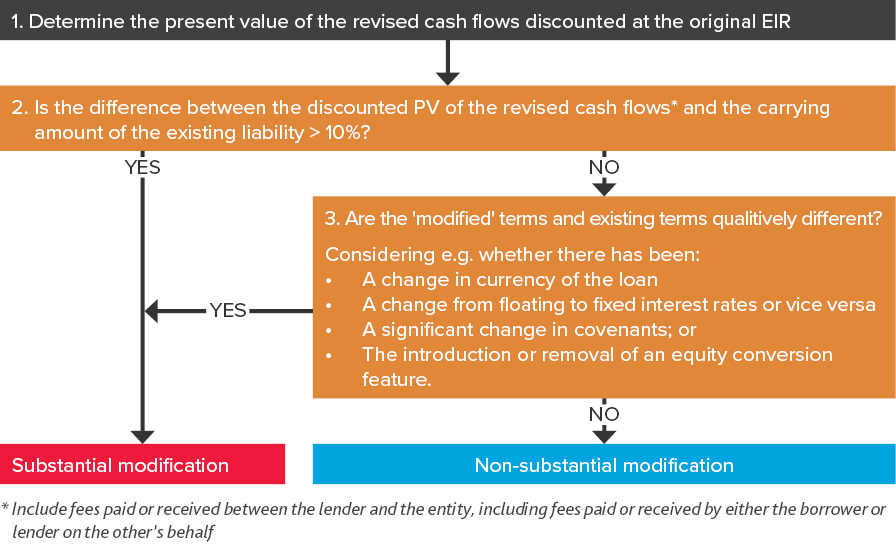

As a result of these changes, some entities may choose to restructure loan agreements. If your entity chooses this path, you will need to assess whether the modification to your loan agreement is considered to be ‘substantial’ or ‘non-substantial’ as shown below.

It is important to make this distinction because the accounting differs as follows:

- ‘Substantial’ modifications - Derecognise the existing liability and recognise a new liability using an updated discount rate. Costs or fees incurred are recognised as part of the gain/loss on extinguishment.

- ‘Non-substantial’ modifications - Adjust the carrying amount of the existing liability to reflect the present value of the revised cash flow payments (in profit or loss), discounted using the original effective interest rate. Costs or fees are included in the new carrying amount of the modified liability.

Working through the details of the substantial vs non-substantial modification requirements is complex. Please contact our IFRS and Corporate Reporting team if you require assistance.

In addition to the accounting implications described above, restructuring a loan agreement may also have transfer pricing implications if it results in non-arm's length interest expenses/payments and/or the General anti-avoidance provisions (Part IVA) may apply if the dominant purpose of the restructure is to obtain a tax benefit. Please contact our Corporate & International Tax Management team if you need assistance.

Limits on intangibles deductions for significant global entities

The October 2022 Budget also announced an anti-avoidance provision to prevent significant global entities (SGEs) from claiming tax deductions for payments made directly or indirectly to related parties in relation to intangibles held in low or no-tax jurisdictions (i.e. where the tax rate is less than 15%, or there is a tax preferential patent box regime without sufficient economic substance).

These payments include royalties and using other intangibles, such as customers' databases and advertising algorithms, regardless of whether they are labelled as such or ‘management fees’. The measure is not yet law. It will apply to payments made on or after 1 July 2023.

No deferred tax will arise as a result of this proposal. The amounts will be non-deductible and reflected as ‘expenses not deductible for tax purposes’ in the tax reconciliation note in the financial statements.

Extension of the small business instant asset write-off

During the COVID-19 pandemic, the Government provided a 100% instant asset write-off for the purchase price of a new asset, or improvements to older assets (with no upper spending limit) for businesses whose aggregate turnover was less than $5 billion. This initiative expires 30 June 2023.

The May 2023 Budget, although not yet law, extends the instant asset write-off for small businesses with aggregated turnover of less than $10 million (there is no extension for larger businesses). It will apply to assets costing less than $20,000 per asset, if first used or installed ready for use between 1 July 2023 and 30 June 2024. Assets costing $20,000 or more can continue to be placed into the small business simplified depreciation pool, and depreciated at 15% in the first income year, and 30% each income year after that.

The above accelerated depreciation measures mean that the carrying amount of assets will exceed their tax base. Deferred tax liabilities must therefore be recognised if preparing financial statements in accordance with Australian Accounting Standards.

Small business energy incentive

The May 2023 Budget also announced a small business energy incentive, which will be available to businesses with aggregate turnover less than $50 million. These entities will be able to claim an additional 20% deduction for spending up to $100,000 that supports electrification and more efficient use of energy. An entity that spends $100,000 would therefore be able to claim ordinary tax depreciation of $100,000, plus an additional 20% special deduction. It applies to eligible assets or upgrades first used or installed ready for use between 1 July 2023 and 30 June 2024.

As this initiative is not yet law, it is unclear whether the additional 20% deduction for electrification assets will be deductible upfront or spread over the asset’s life. Regardless of the timing of the tax deduction, this special deduction does not result in any deferred tax being recognised because of the ‘initial recognition exception’. At initial recognition, the difference between the accounting carrying amount ($100,000 in this example) and the tax base ($120,000) affects neither accounting or taxable profit. Therefore, the additional 20% allowance is disclosed as ‘expenses not deductible for tax purposes’ in the entity’s tax reconciliation note.

More impacts

Please refer to our article, Four accounting issues to consider from the 2023/2024 Federal Budget for additional areas where the Government’s Budget announcements could impact your accounting.

Need help?

Preparers should not underestimate the potential accounting implications associated with the measures in this Budget. As always, if you need support, please contact our IFRS and Corporate Reporting team.