Payment times reporting obligations for trusts

Payment times reporting obligations for trusts

Large Australian businesses and some government enterprises must report their details of payment times to, and terms with, small business suppliers under the Payment Times Reporting Scheme. This occurs every six months if they meet certain criteria set out in the Payment Times Reporting Act 2020, as amended by the Payment Times Reporting Amendment Act 2024 (the Act).

1. Do trusts have payment times reporting obligations?

Payment times reporting obligations are not limited to companies, other body corporates and government enterprises. There may also be payment times reporting obligations if a trust is considered a ‘constitutionally covered entity’ (under section 6 of the Act) and meets four other criteria for a ‘reporting entity’ under section 7.

However, the trustees must report payment times on behalf of the trust, not the trust itself. This is because the trust does not have a legal personality.

2. Criteria for reporting

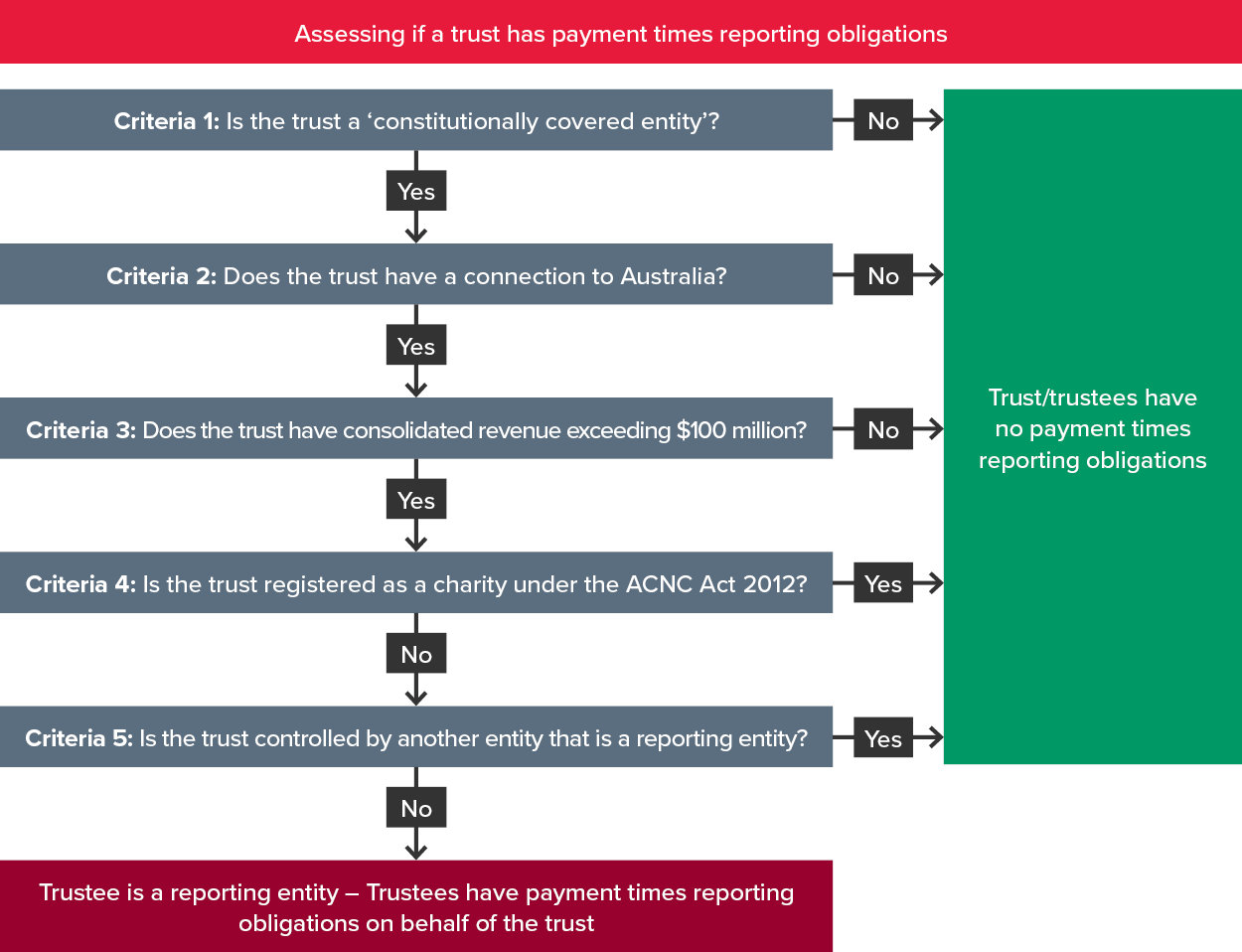

The diagram below summarises the five criteria in the Act for a trust to be considered a ‘reporting entity’.

Each of these tests are discussed in more detail below.

3. Criteria 1: Is the trust a constitutionally covered entity (CCE)?

Firstly, the trust must assess whether it is a CCE. The meaning of a CCE in the Act is broad, and all of the following would be CCEs under section 6 of the Act:

- A constitutional corporation

- A foreign entity

- An entity, other than a body politic, that carries on an enterprise in a Territory

- A body corporate that is incorporated in a Territory

- A body corporate that is taken to be registered in a Territory under section 119A of the Corporations Act 2001

- A corporate Commonwealth entity, or a Commonwealth company, within the meaning of the Public Governance, Performance and Accountability Act 2013.

Whether a trust is a CCE depends on its operations and structure. A trust is a CCE if it is not a body politic and it carries on an enterprise in an Australian Territory, including the Northern Territory and the Australian Capital Territory. When assessing whether a non-corporate entity, such as a trust, is a CCE, the Regulator may consider:

- Whether it was formed, registered, or operates in an Australian Territory

- Whether it has an Australian Business Number (ABN)

- Its activities and whether it is ‘carrying on an enterprise’ for tax purposes.

4. Criteria 2: Connections to Australia

Next, the trust must assess its connections to Australia. A trust has a connection to Australia if one or more of the following applies:

- It is incorporated in Australia

- It carries on a business in Australia

- It has its central management and control in Australia, or

- It has its voting power controlled by Australian resident shareholders.

5. Criteria 3: $100 million revenue threshold

Revenue is then assessed to determine if the trust meets the $100 million revenue threshold. A trust meets the threshold if its consolidated revenue is over $100 million. Consolidated revenue includes the total revenue of the trust and any entities it controls, as per the Accounting Standards published by the Australian Accounting Standards Board (AASB), i.e. AASB 10 Consolidated Financial Statements.

A trust meets this threshold if it earns over $100 million in revenue individually, or in combination with other trusts or enterprises that it controls.

6. Criteria 4: ACNC registration

If a trust is registered under the Australian Charities and Not-for-profits Commission Act 2012 (ACNC Act), it is automatically excluded from reporting. Therefore, trusts operating as not-for-profit entities and registered with the ACNC are not required to prepare payment times reports.

7. Criteria 5: Trust is controlled by another reporting entity

Lastly, a trust is not considered a ‘reporting entity’ if it is controlled by another entity that is a reporting entity. In these cases, the trust would provide information about its payment times reporting to its parent entity, but would have no obligations for payment times reporting as an individual entity.

Need help?

The cost of failing to comply with payment times reporting obligations is high. Penalties for failing to report range from $19,800 for individuals to $99,000 for body corporates (in both cases, these can be applied for each day overdue), and $115,500 for providing false or misleading reports.

Our IFRS & Corporate Reporting and CFO Advisory experts can assist with your payment times reporting. Contact us now.