Reminder: A third balance sheet is required where liability classification changes

Reminder: A third balance sheet is required where liability classification changes

New rules for classifying liabilities, contained in amendments to IAS 1 Presentation of Financial Statements, may result in entities having to change the way they classify liabilities in the balance sheet. The amendments, effective for annual periods beginning on or after 1 January 2024, require entities to restate comparatives.

If the new rules impact the classification of liabilities at the beginning of the comparative period, entities should remember that a third balance sheet must be presented in the first year of these amendments. For entities with 30 June year-ends, this would be on 1 July 2023 and for those with 30 September year-ends, on 1 October 2023.

It should be noted that the third balance sheet is only required if the retrospective application of the amendments has a material effect on the information in the statement of financial position at the beginning of the comparative period.

Example 1 – Loans with covenants

Entity ABC entered into a 5-year loan on 1 April 2022, which required compliance with a covenant on 1 March each year.

If Entity ABC failed to meet the covenant, the loan would become repayable on demand.

Classification at 30 June 2024

Entity ABC classified the loan as a CURRENT LIABILITY in its 30 June 2024 and 30 June 2023 financial statements because it did not have an unconditional right to defer settlement for 12 months after the end of the reporting period. Entity ABC reached this conclusion on the basis that the loan covenant would be tested within 12 months, and it predicted on 30 June of those years that the future covenant test may not be met.

Classification at 30 June 2025

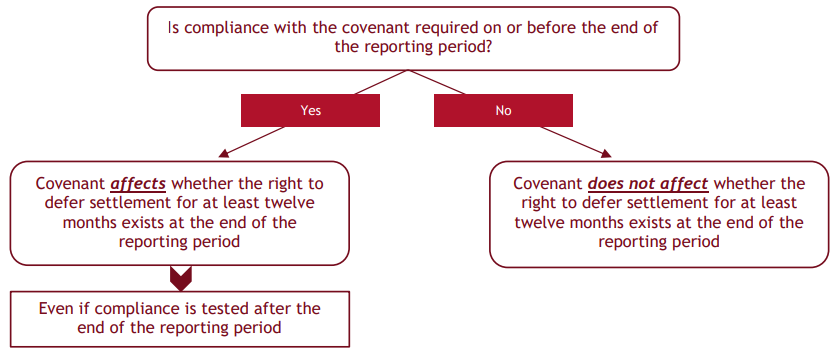

Applying paragraph 72B of the amendments to IAS 1 (illustrated in the diagram below), Entity ABC must classify the loan as a NON-CURRENT LIABILITY at 30 June 2025 because compliance with the loan covenant is not required on or before the end of the reporting period (30 June 2025).

In addition, Entity ABC also:

- Reclassifies the loan as a NON-CURRENT LIABILITY for the comparative period, i.e. 30 June 2024

- Presents a third statement of financial position (balance sheet) at the beginning of the comparative period (1 July 2023) in accordance with IAS 1, paragraph 40A, reclassifying the loan as a NON-CURRENT LIABILITY.

Example 2 – Settlement of liabilities by transferring an entity’s own equity instruments

Entity XYZ issued a convertible note of $1 million (US dollars) on 31 March 2023 with an ‘American style’ conversion option, exercisable at the option of the holder at any time over the life of the note.

Interest is payable in cash at 10% annually, in arrears. If exercised, the conversion feature will result in the principal amount of the note being converted into 1 million ordinary shares of Entity XYZ.

Otherwise, the note payable is repayable in five years. Entity XYZ’s functional currency is Australian dollars.

Classification at 30 June 2024

Entity XYZ’s convertible note is a hybrid financial instrument containing a FINANCIAL LIABILITY (the host convertible note) and a DERIVATIVE FINANCIAL LIABILITY (the conversion feature).

Despite there being no obligation to pay cash, the conversion feature is a DERIVATIVE FINANCIAL LIABILITY because it does not meet the ‘fixed for fixed’ criteria in IAS 32 Financial Instruments: Presentation for equity presentation. That is:

- The convertible note is denominated in a currency other than Entity XYZ’s functional currency

- The amount of cash that will be required to settle the liability on conversion is not represented by a fixed amount of cash expressed in Entity XYZ’s functional currency (Australian dollars). That is, the convertible note that may be settled by exercising the conversion feature is fixed in terms of US dollars, but not Australian dollars, the functional currency of Entity XYZ.

Prior to the amendments to IAS 1, an exception in paragraph 69(d) meant that issuers of convertible notes could effectively classify the host and any associated derivative liabilities according to the maturity date for cash settlement of the note, rather than by considering the time period during which the host liability could be converted into equity instruments of the issuer.

Entity XYZ therefore classified the host financial liability and the derivative financial liability as a NON-CURRENT LIABILITY in its 30 June 2024 and 30 June 2023 financial statements.

Classification at 30 June 2025

The amendments to IAS 1 change this. Basically, if the conversion feature is classified as:

- Equity - the host liability is classified according to the maturity date for cash settlement of the note

- Derivative financial liability – the host liability and the derivative financial liability are classified according to the time period during which the holder can require conversion of the debt.

Our bulletin contains more information on this.

Applying paragraph 76B of the amendments to IAS 1 (extracted below), Entity XYZ must classify both the host financial liability and the derivative financial liability as CURRENT LIABILITIES at 30 June 2025 because the conversion feature of the convertible note is classified as a derivative financial liability rather than as equity.

Terms of a liability that could, at the option of the counterparty, result in its settlement by the transfer of the entity’s own equity instruments do not affect its classification as current or non-current if, applying AASB 132 Financial Instruments: Presentation, the entity classifies the option as an equity instrument, recognising it separately from the liability as an equity component of a compound financial instrument.

IAS 1, paragraph 76B (emphasis added)

In addition, Entity XYZ also:

- Reclassifies the host financial liability and the derivative financial liability as CURRENT LIABILITIES for the comparative period, i.e. 30 June 2024

- Presents a third statement of financial position (balance sheet) at the beginning of the comparative period (1 July 2023) in accordance with IAS 1, paragraph 40A, showing the host financial liability and derivative financial liability as CURRENT LIABILITIES.

More information

Please refer to our publication and bulletin for more information on the amendments to IAS 1.

Need help?

Classifying loan arrangements and other liabilities as current or non-current may be complex. Please contact our IFRS & Corporate Reporting team for help.