For-profit entities - What’s new for 31 December 2019 financial reports?

Mini ‘big bang’

Although somewhat quieter than 2018, 2019 will still be a busy year for preparers of financial statements, with the new leases standard, AASB 16 Leases, and new Interpretation 23 Uncertainty over Income Tax Treatments, applying for the first time to annual periods beginning on or after 1 January 2019 (i.e. 31 December 2019 year-ends).

There are also five amending standards to consider, but except for AASB 2017-7 (impairment of long-term loans to associates and joint ventures) these are not expected to have wide spread application.

| New standards | |

| AASB 16 Leases | |

| New interpretations | |

| Interpretation 23 Uncertainty over Income Tax Treatments | |

| Amending standards | |

| AASB 2017-6 | Amendments to Australian Accounting Standards - Prepayment Features with Negative Compensation |

| AASB 2017-7 | Amendments to Australian Accounting Standards - Long-Term Interests in Associates and Joint Ventures |

| AASB 2018-1 | Amendments to Australian Accounting Standards – Annual Improvements 2015-2017 Cycle |

| AASB 2018-2 | Amendments to Australian Accounting Standards – Plan Amendment, Curtailment or Settlement |

| AASB 2018-3 | Amendments to Australian Accounting Standards – Reduced Disclosure Requirements |

AASB 16 Leases

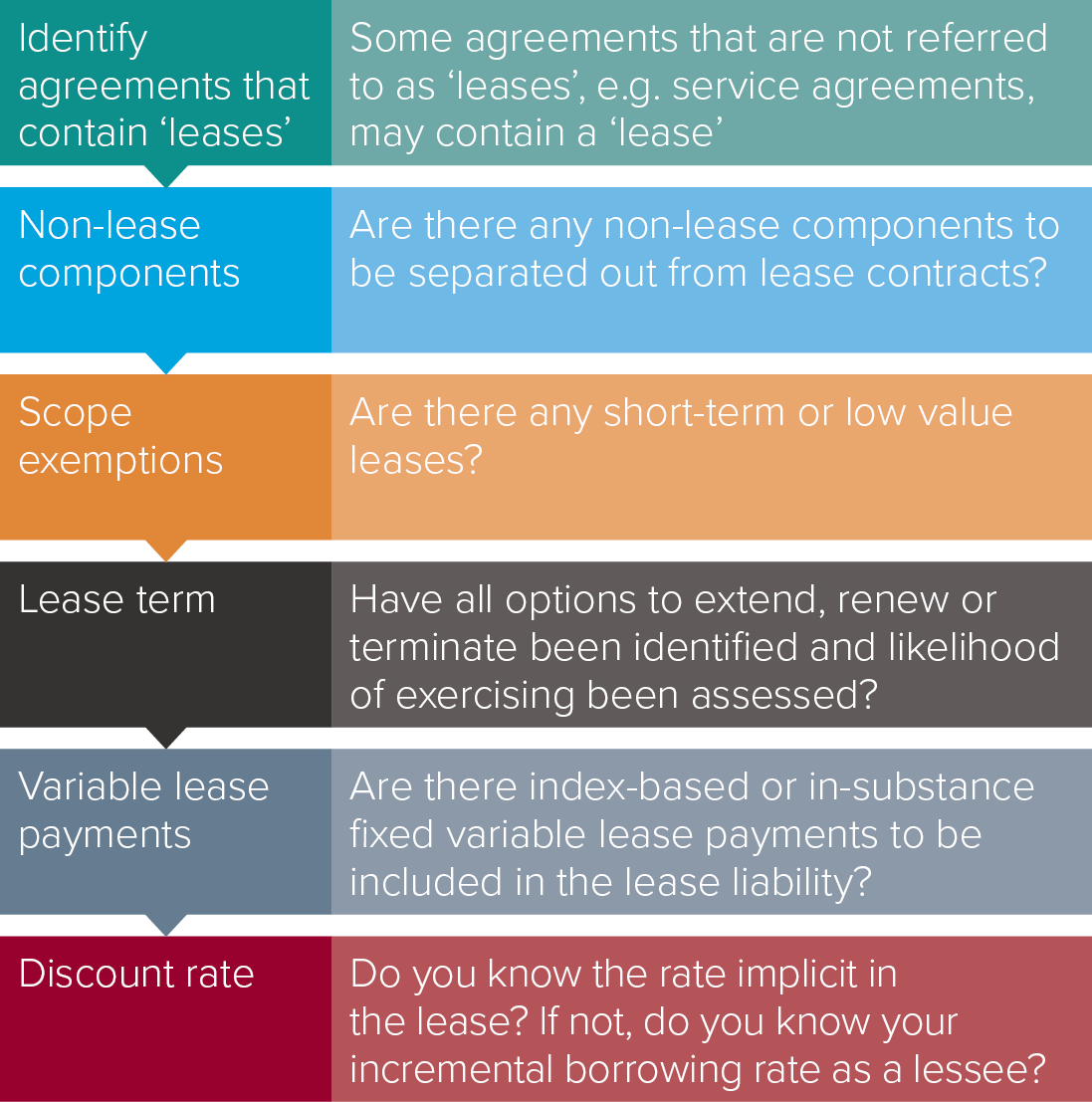

This standard is expected to impact a large number of entities because many businesses lease operating assets and premises, and except for certain low value and short-term leases, these right-of-use (ROU) assets must be capitalised on the balance sheet, together with the related lease liability. When applying AASB 16 for the first time, preparers need to pay attention to the following issues:

Ongoing changes to leases

Calculations for finance leases in accordance AASB 117 Leases did not tend to change very often. However, under AASB 16, lease liabilities could change from period to period because of various reassessments, or where leases have been modified.

|

|

This will involve a considerable amount of work for preparers of financial statements on an ongoing basis because lease liability calculations are likely to change frequently, which also lead to adjustments to the corresponding ROU asset and potentially profit or loss. An added complexity is that the incremental borrowing rate needs to be adjusted in certain of the reassessments and modifications.

Transition – Which method is best to apply?

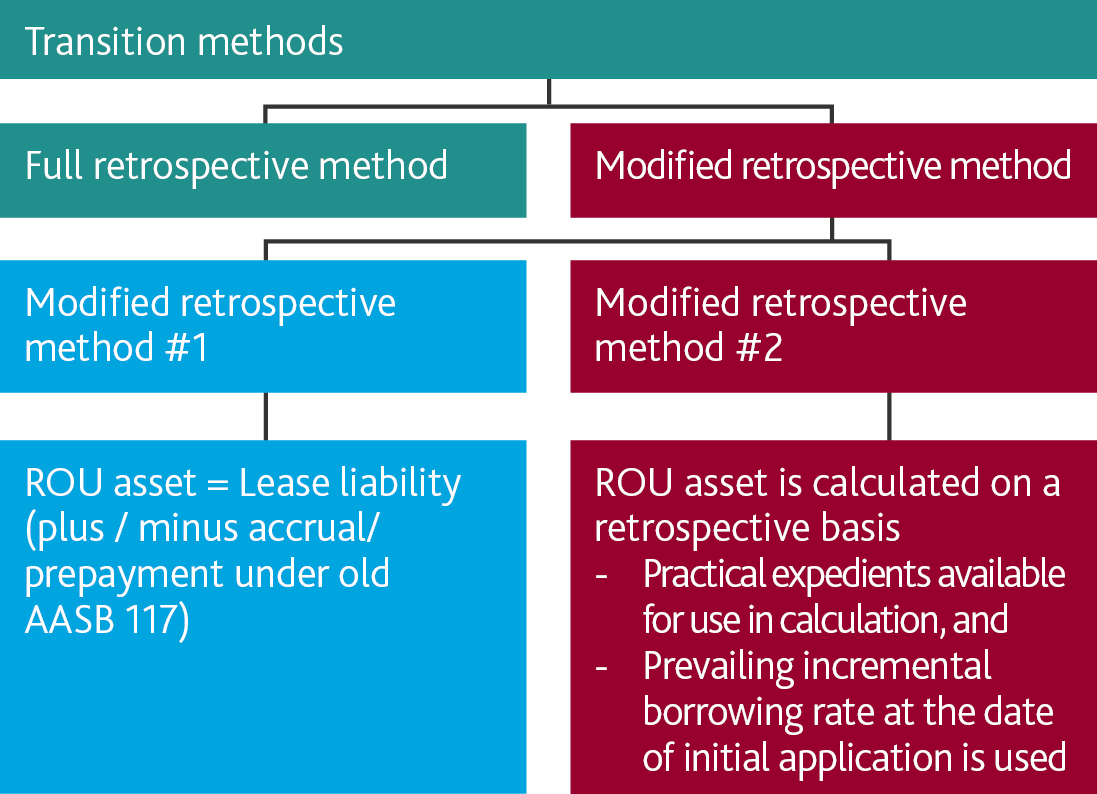

Decisions about which of the various transition methods is best for your business can be tricky, because different methods can have a different impact on assets, liabilities and retained earnings, which in turn can have a significant impact on an entity’s ability to pay dividends and meet bank covenants. It is important to note that the appropriate transitional method for an entity depends of the specific circumstances and pressure points of the entity. The three transition methods are illustrated in the diagram below.

Comparatives will only be restated where the full retrospective method is used.

Applying the full retrospective method can be complex because practical expedients for first-time adoption relate mainly to the modified retrospective methods. Using the modified retrospective method #1 is likely to be the simplest method to apply in practice, however, it also results in the biggest negative impact on future profits.

Disclosing the impacts of transition

Transition adjustments need to be clearly explained so that users can easily understand what has changed. Details of old and new accounting policies should be contrasted, together with details of each adjustment (ideally in a tabular format with narrative footnotes). AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, paragraph 28 outlines the disclosure requirements when entities change accounting policies on initial adoption of a new accounting standard.

New AASB 16 disclosures

AASB 16 requires more disclosure by lessees than AASB 117, including where future cash outflows could vary because of factors that have not been included in measuring the lease liability, e.g. variable lease payments, extension and termination options, residual value guarantees and leases not yet commenced (i.e. not using the leased asset yet) to which the lessee is committed.

Other than for ‘low value’ or short-term leases, the presentation of cash outflows for ‘operating lease’ payments is likely to change. Previously disclosed as cash outflows from operating activities, these will in future be presented as:

- Financing outflows for repayments of principal, and

- Either operating, investing or financing outflows for repayment of interest (as appropriate).

AASB 16 terminology is different to that used in AASB 117, particularly for lessees. Accounting policies of lessees will also need to be rewritten to remove reference to ‘finance’ and ‘operating’ leases.

Additional disclosures take a significant amount of time to prepare, so we recommend that you commence redrafting financial statement reporting templates or packages in advance of 31 December 2019.

Interpretation 23 Uncertainty Over Income Tax Treatments

Interpretation 23 requires entities to calculate their current and deferred tax assets and liabilities as if the tax authorities were going to perform a tax audit, and the tax authorities knew all the facts and circumstances about the entity’s tax position.

We are unlikely to see changes to financial statements in the way entities recognise tax assets and liabilities if it is probable (more than a 50 percent chance) that the tax authority will accept the uncertain tax position.

However, if it is not probable that the tax authority will accept the uncertain tax position, the effect of the uncertain tax position will need to be included when measuring the income tax expense and related current and deferred tax assets and liabilities, using either a ‘most likely amount’ or ‘expected value’ measurement method.

This is likely to have a significant impact on the quantum of income tax liabilities for entities subject to judgmental tax areas such as transfer pricing. Boards and audit committees who have not already done so, need to ensure that an extensive tax review is conducted, firstly to identify all uncertain tax positions (and the probabilities of it being accepted); and then to assess the impact on the financial statements.

Please contact a member of BDO’s Tax team if you require assistance.

AASB 2017-6 Amendments to Australian Accounting Standards – Prepayment Features With Negative Compensation

Early prepayment of a financial asset before maturity can sometimes jeopardise the instrument being measured at amortised cost (if business model is ‘hold to collect’) or fair value through other comprehensive income (FVTOCI) (if business model is ‘hold to collect and sell’) because the settlement amount may include compensation other than solely payments of principal and interest (SPPI test), including negative compensation.

Under AASB 9 Financial Instruments, financial assets with early prepayment options still meet the SPPI test, and therefore qualify for amortised cost or FVTOCI measurement, if the contractual terms permit early repayment by either party before maturity, at an amount that represents substantially all of the unpaid amounts of principal and interest. The early repayment may include a reasonable amount for additional compensation for the early termination of the contract.

This narrow-scope amendment to AASB 9 extends the exemption for early repayment to cases where, regardless of the event or circumstance that caused the early repayment, reasonable compensation could be a variable amount (more or less than unpaid amounts of principal and interest), such as:

- The instrument’s current fair value, or

- An amount that reflects the remaining contractual cash flows discounted at the current market interest rate.

AASB 2017-7 Amendments to Australian Accounting Standards – Long-Term Interests In Associates And Joint Ventures

These changes are likely to have a major impact on entities with investments in overseas exploration projects that are funded primarily through loans advanced to associates and joint ventures, rather than via equity funding. Previously, many such entities relied on projects not yet being at a stage to be tested for impairment under AASB 6 Exploration for and Evaluation of Mineral Resources to conclude that there is no objective evidence of impairment under AASB 128 Investments in Associates and Joint Ventures.

AASB 2017-7 clarifies that loans are first tested for impairment under AASB 9 using the expected credit loss model, and then under AASB 128 for the investment as a whole.

AASB 2018-1 Amendments to Australian Accounting Standards – Annual Improvements 2015-2017 Cycle

In February 2018, the Australian Accounting Standards Board approved the International Accounting Standards Board 2015-2017 annual improvements to the following standards:

- AASB 3 Business Combinations - When a party to a joint arrangement obtains control of a joint operation that is a business, the amendments clarify that this is a business combination achieved in stages. The acquirer remeasures its previously held interests at acquisition date fair values (as if the entity had disposed of its interests and reacquired them at fair value).Applies to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period which starts on or after 1 January 2019.

- AASB 11 Joint Arrangements - When a party to a joint arrangement that is a joint operation does not have control of the joint operation, but subsequently obtains joint control, the amendments clarify that it does not remeasure its previously held interest in the joint operation.This applies to transactions where joint control is obtained on or after the beginning of the first annual reporting period which starts on or after 1 January 2019.

- AASB 112 Income Taxes - Clarifies how to account for adjustments to income tax payable where income taxes are payable at a higher / lower rate if net profits or retained earnings are paid out as a dividend to shareholders. There is an adjustment to tax payable when the liability to pay the dividend is recognised.This applies to annual reporting periods beginning on or after 1 January 2019 and the income tax consequences of dividends recognised on or after the beginning of the earliest comparative period presented.For example, ABC Limited has a 31 December 2019 year-end. It recognised a dividend liability to shareholders on 1 April 2018. ABC Limited presents only one year of comparative information for the year ended 31 December 2018. Although this amendment applies to the annual period commencing from 1 January 2019, any adjustment to the income tax payable as a result of the dividend would be retrospectively adjusted and recognised on 1 April 2018 (date of dividend liability).

- AASB 123 Borrowing Costs – Clarifies that once a qualifying asset funded through specific borrowings becomes ready for its intended use or sale, capitalisation of borrowing costs on that particular qualifying asset ceases, but any remaining borrowings form part of the pool of general borrowings when determining the capitalisation rate applied to general borrowings.

AASB 2018-2 Amendments to Australian Accounting Standards – Plan Amendment, Curtailment Or Settlement

These amendments to AASB 119 Employee Benefits clarify how to measure the net defined benefit liability (asset) and related amounts when a modification (plan event) occurs during the reporting period.

When there has been a plan amendment, curtailment or settlement during the reporting period, AASB 2018-2 requires an entity:

- To use the assumptions used when remeasuring the net defined benefit liability or asset to determine the current service cost and the net interest for the remainder of the reporting period after a plan event occurs, and

- Recognise the past service cost or a gain or loss on settlement separately from its assessment of the asset ceiling.

AASB 2018-3 Amendments to Australian Accounting Standards – Reduced Disclosure Requirements

AASB 2018-3 sets out the reduced disclosure requirements for AASB 16 Leases. The amendments clarify that disclosures do not necessarily need to be provided in a tabular format. In addition, the following disclosures from the leases standard are not required for entities applying RDR:

- Lease liability maturity analysis presented separately from the maturity analysis for other financial liabilities (paragraph 58)

- Lessee’s extension and termination options (paragraph B50), except that details of the prevalence of options being exercised that were not included in the measurement of lease liabilities must still be disclosed

- Lessee’s residual value guarantees (paragraph B51), except that details of the nature of underlying assets for which guarantees have been provided must also still be disclosed, and

- Lessee’s sale and leaseback transactions (paragraph B52).

Implications for Half-Years Ending 31 December 2019

Listed and disclosing entities reporting for the half-year ending 31 December 2019 are effectively reporting for the first-half of the annual reporting period ending 30 June 2020. Such entities will apply the same standards for the first time as noted above for entities reporting on annual periods ending 31 December 2019 because all new and amending standards, and new interpretations, apply to annual periods beginning on or after 1 January 2019.

On the horizon

Reporting thresholds doubled for ‘large’ proprietary companies

The good news for large proprietary companies is that the thresholds for reporting to the Australian Securities and Investments Commission (ASIC) for annual periods beginning on or after 1 July 2019 have doubled, resulting in many such entities no longer having to prepare, have audited, and lodge financial statements for 30 June 2020, 31 December 2020 and beyond.

Proprietary companies are ‘large’ if two of the three thresholds in s45A of the Corporations Act 2001 are met. The Corporations Amendment (Proprietary Company Thresholds) Regulations 2019 introduces new Regulation 1.0.02B which increases these size thresholds for the purposes of s45A(3) as follows:

| Current thresholds | Thresholds applying from 1 July 2019 | |

| Consolidated revenue for the financial year | $25 million | $50 million |

| Consolidated gross assets | $12.5 million | $25 million |

| Employees of the consolidated group | 501 | 1001 |

| 1 Part-time employees as an appropriate fraction of a full-time equivalent | ||

Please refer to our May 2019 Accounting News article for more information.

Scrapping special purpose financial statements for certain for-profit private sector entities

Bad news for entities currently lodging special purpose financial statements with ASIC is that the Australian Accounting Standards Board (AASB) has a project underway to remove special purpose financial statements for entities required to prepare financial statements:

- By legislation in accordance with Australian Accounting Standards or ‘accounting standards’, or

- By constitutions or other documents (e.g. lending agreements) created or amended on or after 1 July 2020, in accordance with Australian Accounting Standards.

The changes proposed are included in AASB Exposure Draft ED 297 Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities. If the AASB’s project is successful, entities reporting under Part 2M of the Corporations Act 2001 will no longer be able to prepare special purpose financial statements from 30 June 2021 onwards. However, as a concession to entities having to upgrade special purpose financial statements to ‘Tier 2’ general purpose financial statements (Reduced Disclosure Requirements or RDR), the AASB is also proposing that Tier 2 RDR general purpose financial statements be cut back to a Simplified Disclosure Regime, developed based on disclosures required in IFRS for SMEs.

For more information, refer to our Accounting News articles:

- Scrapping special purpose financial statements (September 2019)

- Simplified disclosure regime (August 2019)

More information – Free BDO resources

More information on the above amendments is available in our:

- November 2019 webinar, Getting Ready for 31 December 2019.

Need help?

If you require any assistance implementing any changes to your December 2019 financial statements, please contact your engagement partner or a member of our BDO IFRS Advisory team.