Convertible notes - Are you accounting for these correctly (Part 1)?

In the current economic climate, we continue to see different types of convertible note arrangements, typically entered into by companies needing to offer attractive returns in order to obtain funds from lenders and investors.

What is a convertible note?

As the name implies, ‘convertible notes’ usually result in debt funding being converted into equity, providing the investor with upside returns. However, some convertible notes also have a cash settlement feature which protects the investor from any downside losses where the option conversion feature is ‘out of the money’.

We also see issuers adding enhancements to conversion features in order to attract investors. These enhancements still result in terms that are advantageous to the issuer, because in comparison with a straightforward interest-bearing loan, the convertible note can result in lower cash outflows, with the lender accepting a lower interest rate on the funds advanced because the conversion feature will, potentially, provide a significant enhancement to the overall return for the investor.

Is a convertible note always a ‘compound’ financial instrument of the issuer?

A common misunderstanding in the accounting for convertible notes is that these instruments are always classified as ‘compound’ financial instruments on the balance sheet of the issuer.

A compound financial instrument contains both a liability and equitycomponent:

|

Some conversion features in these notes fail the ‘fixed for fixed’ requirement in order for the option component to be classified as equity, and instead should be classified as either straight debt (financial liability), or as a derivative liability.

Why is classification of convertible notes so critical?

Firstly, the classification as equity or debt may have a significant impact on the quantum of the entity’s net equity, which could impact compliance with bank covenants and key ratios.

Also, if conversion features are classified as derivative liabilities, these are subsequently remeasured at each reporting date at fair value through profit or loss, which could impact employee remuneration arrangements, including bonus schemes linked to reported profits and share-based payments, as well as overall investor communications if there are negative impacts on earnings.

In this new series of articles, we explore some common mistakes when classifying convertible notes by the issuer. In this first article, we recap the requirements for classifying these notes as debt v equity, and will follow in subsequent months with examples demonstrating the classification based on a variety of fact patterns.

Debt or equity?

As noted above, convertible notes can be classified as all debt, all equity, or a mixture of both. To determine the appropriate classification, we need to consider the relevant definitions in IAS 32 Financial Instruments: Presentation.

FINANCIAL LIABILITY | EQUITY | |||

| ↙ | ↘ | ↓ | ||

|

| Any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities | ||

The above diagram only includes an extract of the relevant definitions, which are far more detailed. However, for the purposes of determining the appropriate classifications by an issuer, they can be summarised into two key principles:

- Does the issuer have a contractual obligation to deliver cash or another financial asset that it cannot avoid?

If the issuer does not have an unconditional right to avoid delivering cash or another financial asset to settle the convertible note, this obligation meets the definition of a financial liability

- A financial instrument can only be classified as equity if the ‘fixed-for-fixed’ criterion is met.

This means that the note will be settled by the issuer delivering a fixed number of its own equity instruments in exchange for a fixed amount of cash.

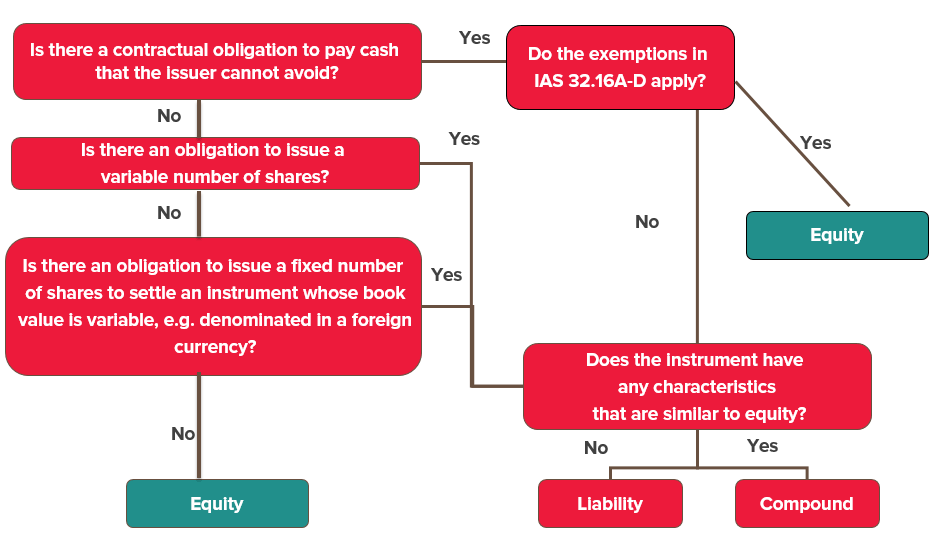

The following flow chart summarises the accounting requirements in IAS 32 in relation to the evaluation of liability and equity classification of financial instruments.

Let’s look at some simple examples to demonstrate how the process works.

Example 1: Entire note is classified as equity

Entity A issues 1,000 convertible notes for $1,000 each (total proceeds of $1,000,000).

Each note is mandatorily convertible into 1,000 ordinary shares anytime between issue date and closing date (which is three years after issue date).

Applying the guidance in the flow chart above, Entity A classifies the convertible notes as ‘equity’ because:

- It has no contractual obligation to deliver cash to the holders (the notes are mandatorily convertible)

- The ‘fixed for fixed’ test is met, i.e. it will convert the notes into a fixed number of shares, predetermined on issue date of the notes, and

- There is no obligation to issue a fixed number of shares to settle a variable obligation.

Example 2: Entire note is classified as debt

Entity B issues 1,000 convertible notes for $1,000 each (total proceeds of $1,000,000), paying an annual coupon of 5% p.a.

The notes are convertible at the option of the holder for a three-year period, with the number of shares to be issued on conversion being determined by dividing the face value of each note ($1,000) by the market value of the Entity B’s share price on conversion date.

Note holders can also elect to have their debt repaid in cash if they do not wish to convert at the end of the three-year conversion period.

Applying the guidance in the flow chart above, Entity B classifies the convertible notes as debt because:

- It has a contractual obligation to deliver cash to the holders if the holders so elect

- The conversion terms fail the ‘fixed for fixed’ test because a variable number of shares will be issued on conversion, based on the market value of the shares on conversion date, and

- There is no embedded derivative.

Example 3: Note is classified as a compound instrument

Entity C issues 1,000 convertible notes for $1,000 each (total proceeds of $1,000,000), paying an annual coupon of 5% p.a.

Each note is convertible into 1,000 ordinary shares anytime between issue date and closing date (which is three years after issue date).

Note holders can also elect to have their debt repaid in cash if they do not wish to convert at the end of the three-year conversion period.

Applying the guidance in the flow chart above, Entity C classifies the convertible notes as a compound instrument because:

- It has a contractual obligation to deliver cash to the holders if the holders so elect (debt portion)

- The conversion feature meets the ‘fixed for fixed’ test, i.e. option to convert the notes into a fixed number of shares, which is predetermined on issue date of the note (equity portion).

Measurement of debt and equity components of a compound financial instrument

IAS 39 Financial Instruments: Recognition and Measurement (and IFRS 9 Financial Instruments from 1 January 2018) make it clear that except where a financial instrument is quoted in an active market (such as a listed share), the transaction price for the instrument is its fair value. This means that where a whole instrument is either entirely debt, or entirely equity, the instrument will initially be measured at its transaction price.

For compound instruments, i.e. notes comprising a host liability and embedded equity conversion feature, the diagram below shows how the different components are measured on initial recognition:

- The fair value of the liability component is determined first, i.e. the contractual stream of future cash flows is discounted at the rate of interest that would apply to an identical financial instrument without the conversion option (that is, a stand-alone loan or debt instrument), and

- The equity component is then assigned as the residual amount, by deducting the amount calculated for the liability component from the fair value of the instrument as a whole. This is consistent with the definition of equity under which an equity instrument is a residual interest.

Fair value of convertible note | - | Fair value of the liability | = | Equity residual component |

As noted above, unless the convertible note is quoted on an active market, the fair value of the convertible note at initial recognition is assumed to be the transaction price for the instrument as a whole, and no further valuation exercise is required.

Next month

Next month, we continue our convertible note series using a simple example to illustrate the process described in the flowchart above, determining the appropriate classification, as well as measurement issues and the relevant journal entries.