IASB proposes reduced disclosures for subsidiaries without public accountability – what does this mean for Australian entities?

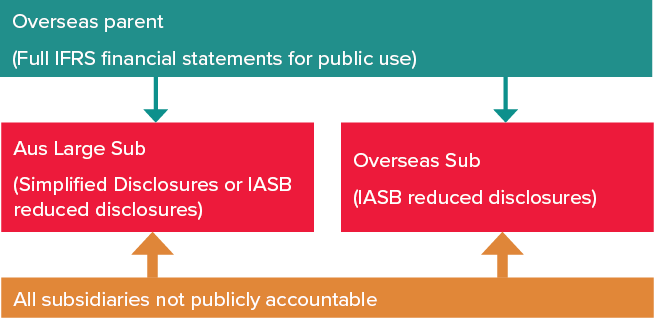

On 26 July 2021, the International Accounting Standards Board (IASB) published Exposure Draft ED/2021/7 Subsidiaries without Public Accountability: Disclosures (Exposure Draft). The Exposure Draft proposes to allow subsidiaries without public accountability to prepare financial statements with reduced disclosures if at the end of the reporting period, it has an ultimate or intermediate parent entity that produces consolidated financial statements for public use that comply with full IFRS. The proposals for reduced disclosures are not mandatory. If eligible, subsidiaries can choose to apply reduced disclosures, or they could choose to do full IFRS disclosures.

Public accountability

Consistent with IFRS for SMEs, and AASB 1053 Application of Tiers of Australian Accounting Standards, publicly accountable entities are those that have issued, or are in the process of issuing, debt or equity instruments for trading in a public market, or those that hold assets in a fiduciary capacity for a broad range of outsiders as one of its primary businesses.

An entity has public accountability if:

- its debt or equity instruments are traded in a public market or it is in the process of issuing such instruments for trading in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local and regional markets); or

- it holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (most banks, credit unions, insurance companies, securities brokers/dealers, mutual funds and investment banks would meet this criterion).

Exposure Draft, paragraph 7

An entity may hold assets in a fiduciary capacity for a broad group of outsiders because the entity holds and manages financial resources entrusted to it by clients, customers or members not involved in the management of the entity. However, doing so for reasons incidental to a primary business does not make the entity publicly accountable. Such a situation may arise for travel or real estate agents, schools, charitable organisations, co-operative enterprises requiring a nominal membership deposit, and sellers (such as utility companies) that receive payment before the delivery of goods or services.

Exposure Draft, paragraph 8

The proposed reduced disclosures are only available to entities that are not publicly accountable.

Recognition and measurement

Unlike IFRS for SMEs, which is a ‘one stop shop’ for recognition, measurement and fewer disclosures than full IFRS, these proposals would require eligible subsidiaries to apply all the recognition and measurement requirements of IFRS, but provide the reduced disclosures included in this stand-alone standard (i.e. entities will be relieved from all the detailed disclosures included in full IFRS).

Additional disclosures for segment reporting, insurance contracts and EPS

Appendix A to the Exposure Draft includes a list of IFRS disclosures that are not required if these reduced disclosures are applied. Basically, all IFRS disclosures are excluded except IFRS 8 Operating Segments, IFRS 17 Insurance Contracts and IAS 33 Earnings per Share. As eligible subsidiaries must not be ‘publicly accountable’, it is unlikely that disclosures regarding segment reporting, insurance contracts and earnings per share would apply. However, if they did, preparers would have to refer to the complete list of disclosures in these three standards.

Similarities and differences between the Exposure Draft and the new Australian Simplified Disclosures contained in AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities

The reduced disclosures in the Exposure Draft and the Simplified Disclosures are similar in that they both:

- Only apply to entities that are not publicly accountable

- Include considerably fewer disclosures than full IFRS, and

- Include the whole suite of reduced disclosures in one, separate, standard.

However, the Exposure Draft reduced disclosures and the new Australian Simplified Disclosures per AASB 1060 differ in the following respects:

- The Exposure Draft only applies to certain subsidiaries (refer discussion above) whereas Simplified Disclosures in Australia applies to all Tier 2 entities. This means that Simplified Disclosures can apply to the ultimate parent entity in a consolidated group whereas the Exposure Draft reduced disclosures cannot apply in this instance.

- In order to prepare Simplified Disclosures financial statements for a subsidiary, it is not a prerequisite that the ultimate or intermediate parent entity prepare a consolidated set of full IFRS financial statements for public use.

- The Exposure Draft contains a considerable amount of additional disclosures as compared to AASB 1060, for example in areas such as business combinations, non-current assets held for sale, E&E assets, financial instruments, unconsolidated subsidiaries and share-based payments.

What does this mean for Australian entities?

You may well be wondering what these proposals will mean for financial reporting by Tier 2 Australian entities in future, particularly given that Simplified Disclosures were only recently introduced. We are too.

The Australian Accounting Standards Board (AASB) has published these proposals as Exposure Draft 314 Subsidiaries without Public Accountability: Disclosures and noted some context as part of their request for comments:

- When preparing AASB 1060, the AASB considered the IASB’s project on subsidiaries that are SMEs but noted that it would not be completed in time for the removal of special purpose financial statements in Australia from 1 July 2021.

- The AASB therefore proceeded with developing its own standard for Simplified Disclosures, but noted at the time that AASB 1060 might ultimately be replaced with the reduced disclosure standard developed by the IASB.

Amongst other questions, the AASB are therefore seeking comments (due by 1 November 2021) as to whether, when finalised, these proposals should be:

- Issued as an additional reduced disclosure standard for eligible subsidiaries

- Issued as an additional reduced disclosure standard for all Tier 2 entities

- Issued as a replacement to AASB 1060 for all Tier 2 entities, or

- Not issued at all in Australia,

Given the significant costs many early adopters have already incurred to adopt and implement Simplified Disclosures, we encourage you to respond to the AASB if you are not in favour of having to transition again should AASB 1060 be replaced by these proposals.

BDO comments

Proposals allowed as an additional reduced disclosure standard

If these proposals are approved for use as an additional reduced disclosure standard in Australia, this would be beneficial because:

- Eligible Australian subsidiaries of foreign entities that currently prepare Tier 2 financial statements (Simplified Disclosures) would be able to use a global reduced disclosure template, providing significant cost and time savings by not having to create bespoke templates to comply with Simplified Disclosures.

- All Australian Tier 2 entities, regardless of whether their ultimate parent entity prepares full IFRS consolidated financial statements for public use, would be able to continue to apply reduced disclosures in the form of Simplified Disclosures.

Proposals replace Simplified Disclosures

However, if Simplified Disclosures is replaced completely by this international reduced disclosure standard, many Australian large private groups may no longer be able to apply reduced disclosures, and may instead have to prepare full IFRS (Tier 1) financial statements. This could occur as shown in the following examples:

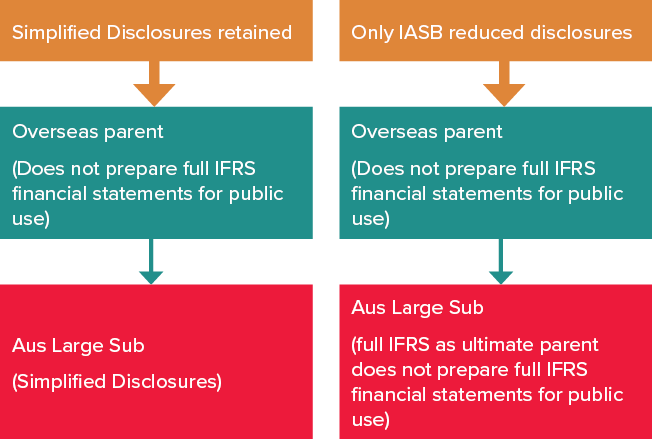

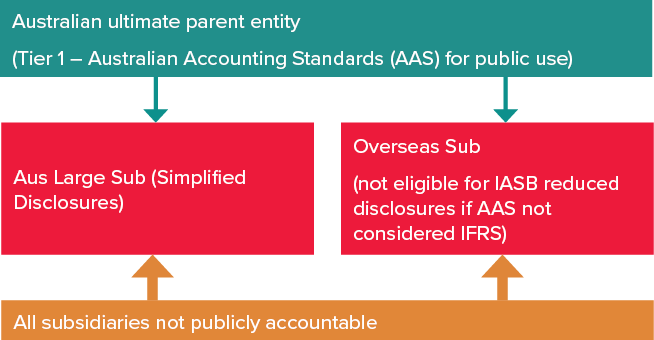

Example 1: Overseas parent does not produce full IFRS financial statements for public use

If Simplified Disclosures were completely replaced by the IASB proposals, the Australian consolidated financial statements (and separate financial statements for large subsidiaries) would not be eligible for any form of reduced disclosure because they do not have an ultimate parent entity that lodges full IFRS consolidated financial statements. This would result in Aus Large Sub having to prepare Tier 1 full IFRS financial statements.

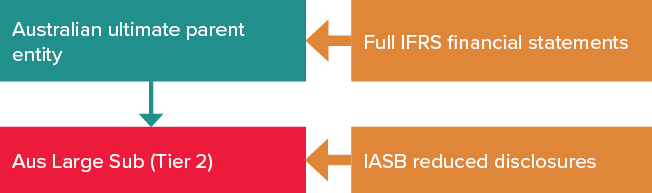

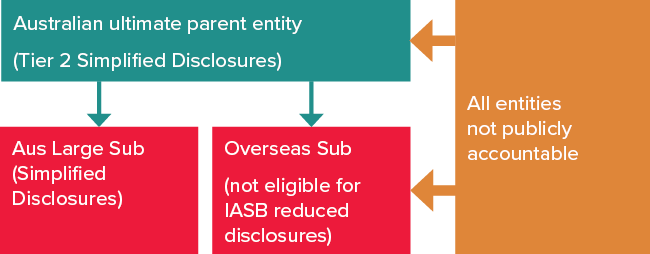

Example 2: Ultimate parent entity is an Australian Tier 2 entity

In addition, the ultimate parent entity in an Australian group would no longer qualify for reduced disclosures because it is not a subsidiary of an entity that produces full IFRS financial statements for public use (i.e. there is no parent entity on top of it). Consolidated group financial statements would therefore need to be Tier 1 so that Aus Large Sub could qualify for reduced disclosures.

What does this mean for overseas subsidiaries of Australian entities if Simplified Disclosures are retained?

A subsidiary is only eligible to apply the proposed international reduced disclosures if an intermediate or ultimate parent entity produces consolidated full IFRS financial statements for public use. If the intermediate or ultimate parent is an Australian entity permitted to apply Tier 2 Simplified Disclosures, it appears that none of the overseas subsidiaries could adopt these proposals because the Australian parent would not be preparing full IFRS consolidated financial statements.

Even if the Australian parent prepares Tier 1 consolidated financial statements for public use by applying Australian Accounting Standards (AAS), which are compliant with IFRS, we are uncertain whether such AAS financial statements would be considered to be IFRS financial statements such that the overseas subsidiaries would be eligible for the reduced disclosures.

In summary

ED 314 does not outline the advantages and disadvantages of the AASB scrapping Simplified Disclosures, or keeping it as an option alongside an international reduced disclosure standard. As noted above, it appears that scrapping Simplified Disclosures could leave many Australian entities worse off, in some cases having to comply with the global reduced disclosures, which is more onerous than Simplified Disclosures, and in other cases, having to revert to Tier 1 full IFRS financial statements because they are not an eligible subsidiary. We encourage you to respond to the AASB by 1 November 2021 if you have any views on these proposals.

More information

Please refer to our International Financial Reporting Bulletin IASB published Exposure Draft – Subsidiaries without Public Accountability for more information.