Payment Times Reporting Scheme - Is your organisation ready for 1 January 2021?

Payment Times Reporting Scheme - Is your organisation ready for 1 January 2021?

This article was originally published on 16 December 2020.

After one of the toughest years many Australian organisations have faced, there is one constant that has remained – the need for transparency and a spirit of collaboration and partnership. With a view to delivering this, and providing greater commercial certainty for small businesses, the Australian Government has introduced the Payment Times Reporting Scheme (PTRS).

Starting on 1 January 2021, the scheme will require large organisations and certain Government enterprises (referred to as Payment Times Reporting Entities) to report on their small business payment terms and times. This information will be published by the Federal Government twice a year on a public register. A Small Business Identification Tool will also be available in due course (scheduled for release in December 2020), which will assist organisations with finding out who their small business suppliers are. Small businesses can choose to opt out of being identified by this tool.

With increased transparency surrounding large organisations' payment times, Australia’s small businesses will be able to make informed decisions about which large organisations they supply and proactively manage their cash flow. In addition, large organisations will be further incentivised to pay their small business suppliers on time and improve payment practices, so as to avoid unfavourable public reporting and the reputational risk that could follow.

Who must report

The PTRS applies to constitutionally covered entities (CCEs) that carry on an enterprise in Australia and have a total income that exceeds a certain threshold (as detailed below). A CCE includes:

- A constitutional corporation (a trading or financial corporation formed within the limits of the Commonwealth)

- A foreign entity

- A corporate Commonwealth entity or a Commonwealth company, within the meaning of the Public Governance, Performance and Accountability Act 2013

- An entity, other than a body politic, that carries on an enterprise in a Territory

- A body corporate incorporated in a Territory taken to be registered in a Territory under section 119A of the Corporations Act 2001.

It should be noted that CCEs can include private/public companies, trusts, partnerships, joint ventures, or sole traders. Not-for-profit entities registered under the Australian Charities and Not‑for‑profits Commission Act 2012 are not required to report under the scheme.

Income threshold

An organisation’s total annual income in its most recent income year must meet one of the following thresholds to be deemed a Payment Times Reporting Entity:

- More than $100 million

- If the entity is a controlling corporation, the combined total income of the controlling corporations group exceeded $100 million

- If the entity is a member of a controlling corporation’s group that has a combined income of more than $100 million, the total income for the entity must have been at least $10 million.

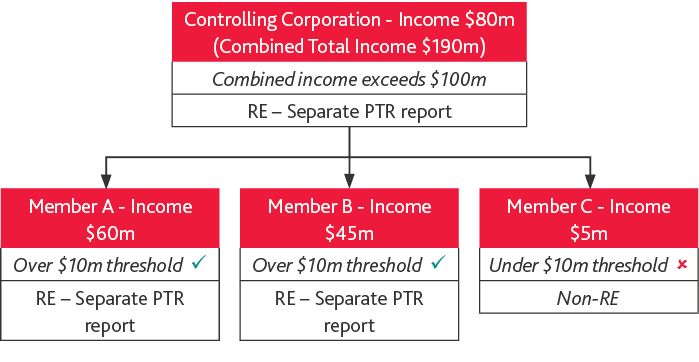

The following diagram demonstrates how the income thresholds are treated for an example corporate group structure.

Reporting period

The first reporting period for entities with standard and calendar income years will begin on 1 January 2021 and run to 30 June 2021 (detailed in the below table). All reporting entities will have a three month period after the end of the reporting period to submit their Payment Times Report for the reporting period – referred to as the reporting window.

Below are the upcoming reporting requirements for a number of common financial years.

|

Financial year beginning |

Reporting period |

Reporting window to be published on or before |

|

1 July 2020 |

1 January 2021 to 30 June 2021 |

30 September 2021 |

|

1 January 2021 |

1 January 2021 to 30 June 2021 |

30 September 2021 |

|

1 April 2021 |

1 April 2021 to 30 September 2021 |

31 December 2021 |

Reporting requirements

Payment Times Reporting Entities will be required to disclose both qualitative and quantitative information relating to their small business payment terms and practices, including metrics such as standard payment terms, payment dispute resolution processes, time taken to make payments in the reporting period, and statements about supplier arrangements.

Learn more about the specific information to be reported here.

What organisations should do now

Organisations who will need to report should prepare by:

- Ensuring company accounting software can extract the required reporting information

- Identifying small business suppliers within their customer listing/ledger (the government tool due for release in December 2020 will enable this)

- Reviewing current policies and procedures relating to payments and, in particular, payments to small businesses

- Familiarising finance teams with potential penalties for non-compliance with reporting requirements.

Small businesses who supply Payment Times Reporting Entities should be ready to leverage the information reported publicly in their respective industry, so they can make informed decisions about the large businesses they do business with.

How BDO can help

Our cross-functional team of accounting and business advisory experts can support Payment Times Reporting Entities and small businesses manage the impact and benefits of this new scheme.

Working with Payment Times Reporting Entities we can help them prepare for the new requirements and ensure their reporting processes capture the information necessary for efficient compliance. BDO can help:

- Assess reporting arrangements and capabilities

- Deliver guidance for managing the demands and requirements of the new regulations

- Provide assurance over the accuracy of submissions

- Extract reporting information from accounting systems, then assess and design reports to extract the data for reporting

- Validate data to confirm what is reported is valid, accurate, and based on sound assumptions, prior to submission

- Apply data analytics to enhance assurance over the data held in systems and identify anomalies.

- Implement reporting automation and dashboards to improve the efficiency of ongoing reporting requirements

- Benchmark against best practice policies and procedures

- Assist with registration in the Reporting Portal and provide guidance on using it.

We can also support small businesses to interpret the publicly available information once reporting commences and provide guidance on how they can use it to proactively manage their cash flow. Small business may wish to opt out of being identified by the Small Business Identification Tool and we can assist with this review to determine which option is best in the circumstances.

If you would like to discuss how the PTRS could impact your organisation and how you can best prepare, contact us and a member of our team will be in touch.

Prepare for the Payment Times Reporting Scheme

Please fill out the following form to access the download.

Download our guide