In 1881, astronomer Simon Newcomb noticed the page numbers in a book of logarithm tables were more worn out at the front when compared to the back of the book. The phenomenon was again noted in 1938 by the physicist Frank Benford. In 1996, Theodore Hill researched this phenomenon and found there was a mathematical law that could explain it.

Coined as Benford's Law, the expected distribution of leading numbers in real-life data sets is more ordered than one would assume. The Law states that the number one appears as the leading digit about 30% of the time, reducing systematically to less than 5% for the number nine.

In our practice, this Law is still quite useful today.

Let us consider a case study

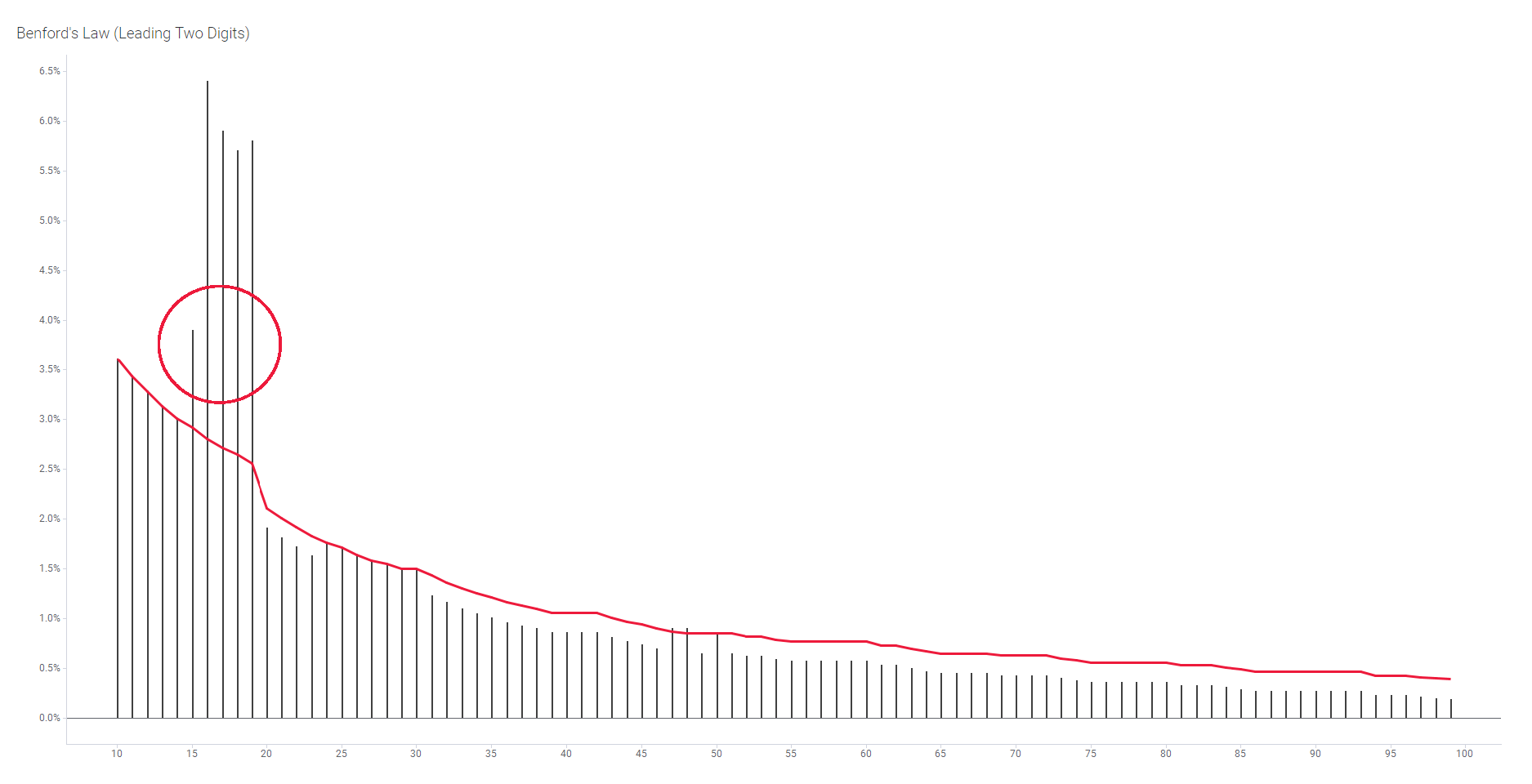

BDO’s Forensic Services team were recently engaged to review several years of purchase order data, for a large company. Various testing was completed including Benford's Law Two-Digit Testing. Significant spikes were identified where the leading digits ranged between 15 and 19. This prompted us to look into why this spike of purchase orders with these leading digits was raised, since it was not in line with the expected population of leading digits.

Source: BDO Analysis (Red: Expect Value / Blue: Actual Value)

The outcome

Our fraud data analytics specialists subsequently identified Person X responsible for processing most of the leading digit purchase orders between 15 and 19. Initially, the results could seem plausible, given Person X's authority limit was $20,000.

However, further investigations by our specialist team, including the review of non-financial data, identified that Person X had deliberately circumvented their authority limit over several years, ensuring orders were placed with certain vendors (which breached conflict of interest policies).

For example, Person X would place a $45,000 order and split it over three $15,000 purchase orders. The breach of Person X’s authority limits resulted in disciplinary action.

BDO recommends

Forensic accountants have been using Benford's Law for decades to identify outliers for further analysis. Non-conformance with Benford's Law does not mean fraud has occurred, and it should not be used on its own as a final decision-making tool. However, Benford's Law can be a useful screening tool to identify financial data that requires further investigation.

The case study highlights that while data analytics can be leveraged to help identify outliers, the best outcomes are achieved when paired with an expert forensic accountant. In other words, there is still no substitute for the human element when tackling financial investigations.

Should you want to discuss how BDO’s Fraud Data Analytics can benefit your organisation, please reach out to our forensic services professionals for a confidential discussion.