In December 2020, Reserve Bank of Australia (RBA) Governor, Philip Lowe, issued a statement that the official cash rate is likely to remain at 0.1% until 2024, the lowest cash rate in Australian history. This sentiment is also shared in more recent statements. With a cash rate of almost zero for the next few years to come, individuals, families and organisations with large cash holdings should consider the hidden force eating away at the real value of their wealth.

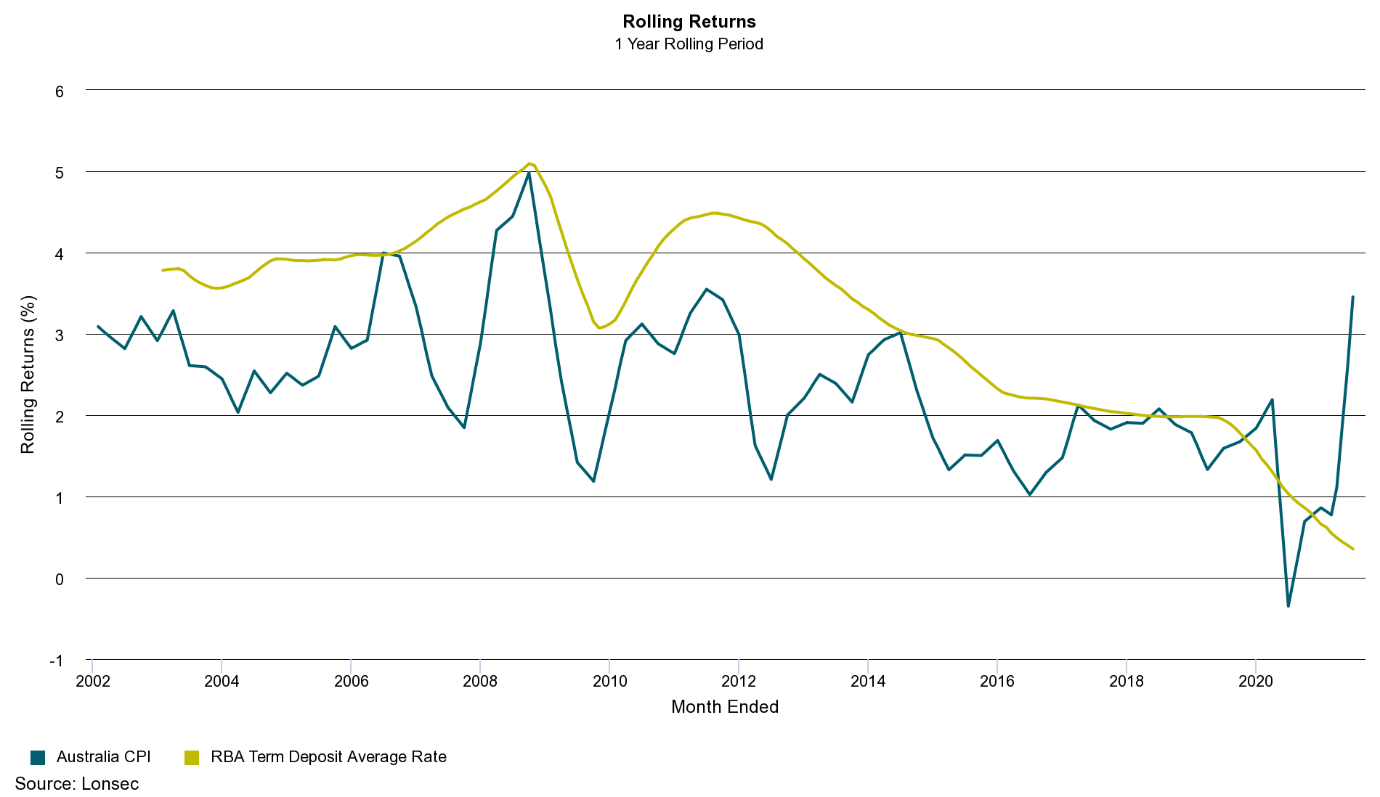

The chart below shows one-year returns from a basket of term deposits (light green line) compared to Australian inflation (dark green line). When the term deposit line sits above the inflation line, the purchasing power of money held in cash is maintained. However, when the term deposit line is below the inflation line, the cost of living increases more than the return on cash (e.g. you can now buy less with the same amount of money compared to a year ago). While this has historically been a rare occurrence, central bank policy to lower interest rates over recent years has forced this scenario. The situation is worse if you pay tax, as tax paid further reduces your return on cash.

Some commentators are extrapolating current supply issues (e.g. microchips, building materials, used cars), suggesting the RBA will be forced to hike the cash rate to curb inflation. Whilst inflation has spiked temporarily due to the reversal of some COVID-19-related price reductions, we believe low cash rates are likely to stay for the foreseeable future due to high levels of debt (both government and household), ageing demographics, low wage growth and technological advances, all of which will keep a lid on inflation over the long-term.

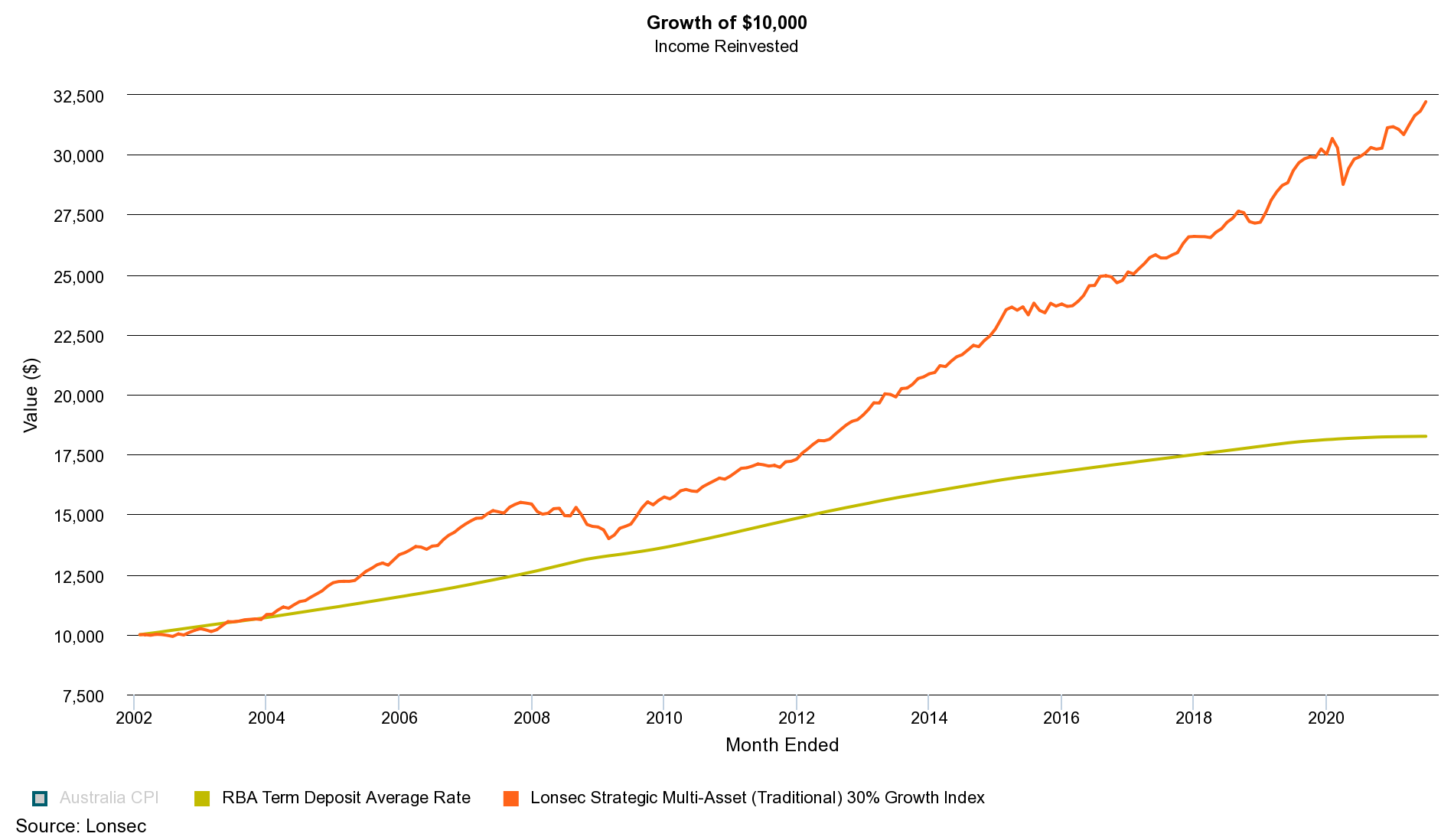

The chart below shows the journey of a low-risk investment portfolio. Only 30% is currently invested in growth assets (such as shares, listed property and listed infrastructure) while the remaining 70% is invested in defensive assets (a variety of bonds – corporate, government, floating and fixed-rate) when compared to a term deposit strategy over the same period of time. While some volatility was introduced, the longer-term outcome of the low-risk investment portfolio was much greater due to higher compounding returns.

BDO can assist with your investment needs

Cash may no longer be a ‘risk free’ asset, as inflation eats into the real value of your money. While we stress the importance of maintaining a healthy cash buffer to provide flexibility, there are higher returning alternatives that don’t involve taking a significant amount of additional risk for funds not immediately required. We work with our clients to tailor investment portfolios to match their desired wants and needs.

If you have any questions, or would like to discuss your personal financial situation, please contact your local BDO adviser.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in Australia to discuss these matters in the context of your particular circumstances. BDO Australia Ltd and each BDO member firm in Australia, their partners and/or directors, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

BDO Private Wealth Advisers Pty Ltd ABN 62 805 149 677 AFS Licence No. 238280 is a member of a national association of separate member firms which are all members of BDO Australia Ltd ABN 77 050 110 275, an Australian company limited by guarantee. BDO Private Wealth Advisers Pty Ltd and BDO Australia Ltd are members of BDO International Ltd, a UK company limited by guarantee, and form part of the international BDO network of separate member firms. Liability limited by a scheme approved under Professional Standards Legislation.

BDO is the brand name for the BDO network and for each of the BDO member firms.

© 2021 BDO Private Wealth Advisers Pty Ltd. All rights reserved.