This article was originally published on 17 August 2020.

On 12 August 2020, the ATO finalised a long awaited taxation ruling and provided administrative guidance that deals with the application of the arm's length debt test (ALDT) contained in the thin capitalisation rules.

Taxation Ruling TR 2020/4 – Income tax: thin capitalisation – the arm's-length debt test

On 12 August 2020, the ATO released final Taxation Ruling TR 2020/4, which provides interpretative guidance on key technical issues that may arise in determining an entity's arm's length debt amount (ALDA) for the purposes of the thin capitalisation rules.

The final version remains largely unchanged from the earlier draft version. It therefore confirms the ATO’s position on a number of key technical issues and seeks to establish the matters that should be considered for the purposes of establishing the ALDA by using ALDT. It further highlights how the application of the ALDT differs to the requirements under the transfer pricing rules.

Key points include the following:

- Debt giving rise to deductions must be a reasonably likely or expected amount (i.e. how much debt a taxpayer ‘would’ take on, not just ‘could’ take on). In other words, the ALDT is not seeking to identify the highest debt amount possible as more than a mere possibility is required, rather the amount must be probable (paragraph 35);

- An entity's position as a member of a global group, including capital structure and leverage preferences of shareholders, should be disregarded for the purpose of applying the ALDT, rather the “focus is on the entity's activities alone” (paragraph 58);

- A failure to comply with record keeping requirements may result in a penalty but will not preclude reliance on the ALDT (paragraph 91); and

- An ALDA may be different to the arm’s length capital structure for transfer pricing purposes (paragraph 97).

The Ruling applies to years of income commencing both before and after the date of issue. Therefore, taxpayers are advised to revisit existing ALDT calculations to ensure they have addressed the key technical issues highlighted within TR 2020/4.

Practical Compliance Guideline PCG 2020/7 – ATO compliance approach to the ALDT

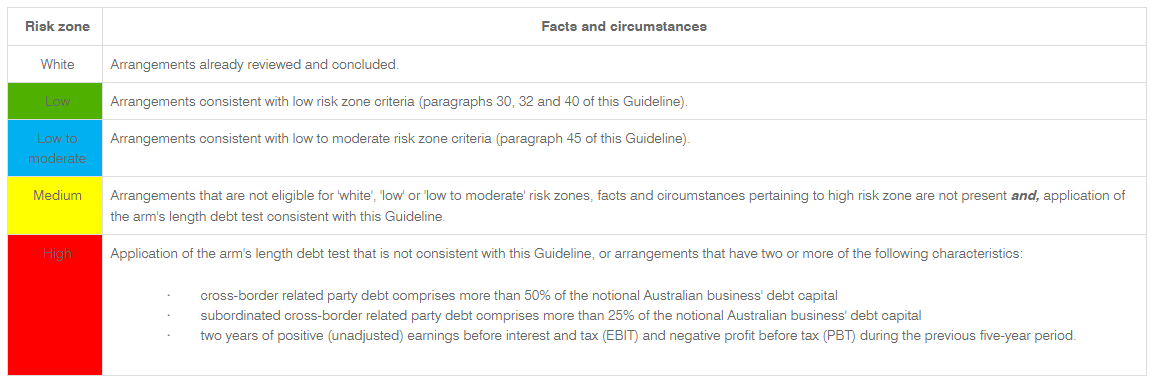

The ATO also released Practical Compliance Guideline PCG 2020/7, which provides administrative guidance in applying the ALDT and should be read in conjunction with TR 2020/4. The most significant change from its draft, PCG 2019/D3, is that whilst taxpayers are still required to ‘self-assess’ using risk zones, which determine the level of compliance resources the ATO will devote to reviewing the taxpayer’s position, a broader range of the color-coded risk zones have been added so the spectrum of risk zones.

In addition to the three previous zones - White (no risk), Green (low risk) (Green), Yellow (medium-high risk), two new zones have been added – Blue (Low to moderate risk) and red (high risk). These will provide taxpayers greater scope to distinguish their risk using specified fact patterns and are consistent with consistent with those in PCG 2017/4.

Under PCG 2017/4, the ATO will accept an ALDA as falling within the low to moderate risk zone in the following circumstances (paragraph 45):

- Where the global group is publicly rated on third-party debt that is on arm's length terms and conditions and the notional Australian business would achieve the same credit rating on the basis of its arm's length debt amount; or

- An inward investing entity is owned by a consortium of foreign investors (each with no more than a 20% direct or indirect interest) and the public credit rating of the entity based on the entity's third-party debt (at arm's length terms) is equivalent to the credit rating of the notional Australian business on the basis of its arm's length debt amount, and

- No other facts or circumstances pertaining to the high risk zone are present.

PCG 2020/7 also contains examples demonstrating low and low to moderate risk zone scenarios.

Click the image to view in full size.

BDO Comment

The current COVID-19 pandemic is likely to result in more taxpayers seeking to rely on the ALDT for thin capitalisation purposes. Earlier this year the ATO provided a concession (last updated on 29 July 2020), that effectively allows taxpayers that would otherwise rely on the safe harbour debt amount to apply a simplified approach to the ALDT provided certain assumptions can be met.

The ATO’s latest guidance in conjunction with recent indications from the ATO that its audits and general work streams that were suspended owing to COVID-19 will likely recommence between September and October 2020, signal that the ATO is returning its focus to compliance monitoring and commencing high risk reviews as a matter of priority. This is likely to result in an additional compliance burden for many taxpayers who will need to assess current and historic positions with potentially related additional documentation requirements.

Following the release of TR 2020/4 and PCG 2020/7, taxpayers should assess their current approach to the application of the ALDT and consider their position under the new risk assessment framework, including determining whether a higher maximum allowable debt level can be sustained.

Please contact your local Tax specialist for assistance.