Transition to IFRS 16

To make complying with AASB 16 easier on busy finance teams, the AASB set out a series of ‘transition methods’ in their guidelines. One of these methods - ‘modified retrospective method #1’ - seems much quicker than its counterparts, but it may not be right for every organisation. And that’s where we encounter problems.

There is no one-size-fits-all transition method, and the quickest path could have serious ramifications on future profitability if it isn’t right for your business. It’s important that you examine all of the transition methods and determine whether the future cost is worth the short-term convenience, or whether more planning now could save you over time.

Example: For one client, the modified retrospective method #2 would have removed all of their accumulated retained earnings, which had a negative impact on their ability to declare dividends. We advised they select another method (i.e. modified retrospective method #1), which kept their retained earnings intact. While this would create some other problems with future profitability, the business now has time to consider, manage and plan for it.

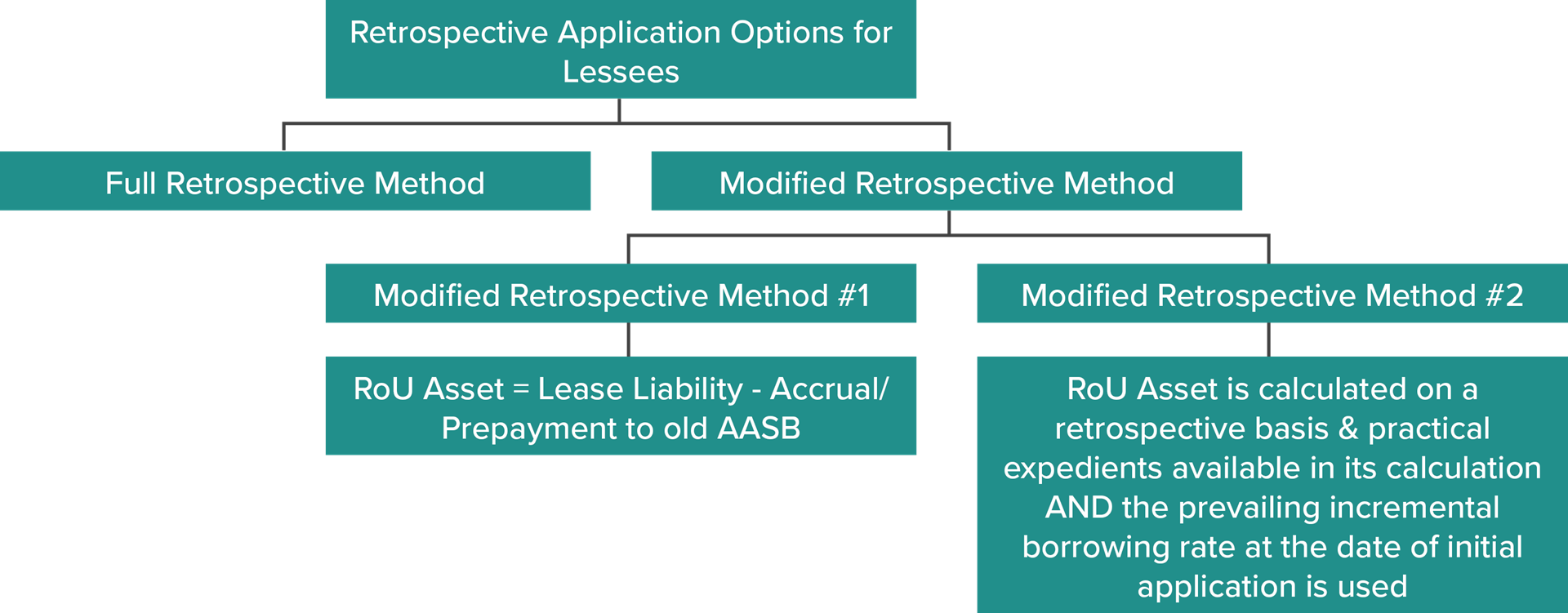

The following is an overview of the three available transition options:

For more information on the most appropriate transitional method watch our webinar: Transition to IFRS 16.

The three transitional methods are also discussed on pages 60-77 of our BDO IFRS in Practice re IFRS 16.