Accounting for portable long service leave in the community services sector

This article has been updated to reflect that long service leave provisions should be recognised ‘gross’, and not net of any anticipated recoveries from the scheme. This is because it is unlikely that the criteria in AASB 101 Presentation of Financial Statements, paragraphs 33 and 34, will be met to offset an asset and a liability for the long service provision and related reimbursement.

Traditionally, employees have only been entitled to long service leave (LSL) benefits if they work for the same employer for a minimum time-period (usually 10-15 years of service). Benefits vary from State to State (and Territories) but result in the loyal employee being able to take an additional two to three months leave once they pass the minimum service period. As such employees who moved around from one job to another, often because the nature of their work was not long-term or permanent, missed out on these additional LSL benefits. Some States and Territories have ‘portable LSL’ laws for industries such as construction, coal mining and contract cleaning to address this issue. Victoria, Queensland and the ACT have recently introduced portable LSL laws for the community services sector to address a similar issue in this sector and to help retain employees in the sector.

Employers are required to recognise a provision for LSL leave in accordance with AASB 119 Employee Benefits. This involves estimating the:

- Number of employees for which LSL is expected to vest

- Expected future cash outflows when employees take their LSL

- Timing of the cash outflows

- Appropriate discount rates.

With the new portable LSL schemes for community service employees, many community service organisations think that they no longer have to recognise these LSL provisions. This is not always true. In most cases, the portable LSL schemes have not removed the employer’s primary responsibility to pay LSL to its employees. What has changed is that the employer may now be able to recover some of these costs from the relevant portable LSL authority.

Ignoring LSL provisions is not an option

Legislation relating to portable LSL in the community services sector varies from State to State (and Territories), as does legislation for other types of portable LSL outside the community services sector. The manner in which LSL entitlements are administered by portable LSL authorities can also vary. Accordingly, community service organisations should pay careful attention to the applicable legislation and their portable LSL authority’s policies, and establish whether the organisation and/or the portable LSL authority has the responsibility for making LSL payments to an employee when the employee becomes entitled and applies for LSL.

If a community service organisation does have a legal responsibility for making some or all LSL payments to employees when they become entitled and claim their LSL entitlements, the organisation must continue to recognise LSL provision in their financial statements. However, depending on the rules of the scheme, a community service organisation may have a legal right to recover the whole, or a portion of, the LSL paid to employees. In such cases it may be able to recognise a reimbursement asset if, as anticipated by AASB 119, paragraph 116, the reimbursement of some or all of the LSL expenditure from the portable LSL authority is virtually certain. If an asset is recognised, it shall be measured at fair value.

In estimating the carrying amount of any reimbursement asset, employers need to understand how much they are able to recover from the relevant portable LSL authority when the employee is expected to take leave. This may be difficult for some employers to accurately assess at this stage given that the portable LSL schemes in the community services sector are relatively new, and some of the finer details regarding how much the employers are able to claim are still being resolved.

Some of the instances that could result in the amount claimed by the employer being less than the actual amount paid to the employee are:

- In most circumstances, the period of service by an employee prior to the commencement of the portable LSL scheme will not be covered by the scheme

- Where superannuation is paid on LSL entitlements, this may not be recovered from the scheme

- Some employees may receive LSL entitlements that are more generous than that provided by the portable LSL scheme, e.g. some employees may receive 13 weeks LSL for 10 years of service, whereas under the scheme, the employee is only allowed to accrue 13 weeks for 15 years of service

- LSL entitlements for employees that spend a period of time working for the same employer in a State or Territory that does not have a portable LSL scheme in place.

Accounting

When the portable LSL levy is due for payment to the portable LSL authority, the employer processes the following journal entry:

DR Portable LSL levy expense

CR Cash

For payment of levy to LSL authority

In circumstances where an employer continues to have primary responsibility for providing LSL benefits to its employees, the employer will need to continue to maintain detailed calculations for LSL leave provisions and recognise the full provision for LSL as follows:

DR LSL provision expense *

CR LSL provision

Provision for LSL

The employer then estimates any amounts expected to be recovered from the portable LSL authority when the employer pays the employee their LSL entitlements:

DR Reimbursement asset for LSL

CR LSL provision expense *

For reimbursement of LSL payment from portable LSL authority

*The employer may choose to recognise in profit or loss the LSL expense net of the amounts relating to changes in the carrying amount of the right to reimbursement

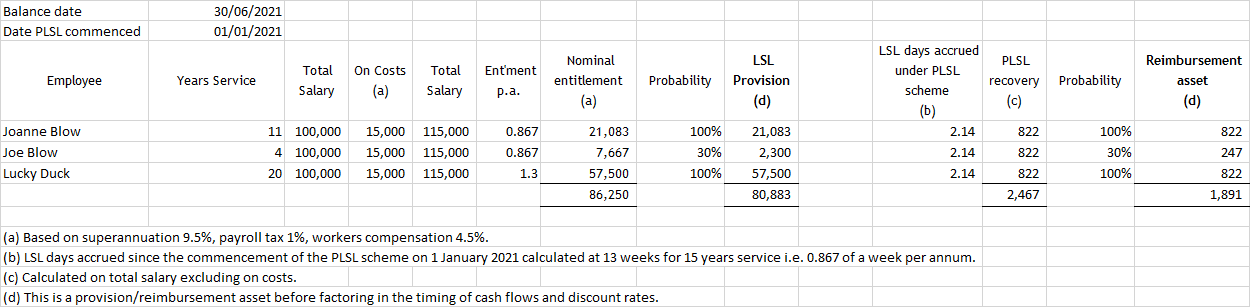

Following is an example calculation where the employer maintains primary responsibility for LSL benefits to employees. The balance date is 30 June 2021 and the date the portable LSL scheme commenced is 1 January 2021.

For the year ended 30 June 2021, the employer therefore recognises a ‘gross’ LSL provision of $80,883, and assuming recovery is virtually certain, a reimbursement asset for $1,891 (ignoring the effect of discounting).

In circumstances where the employee is required to claim portable LSL directly from the portable LSL authority, the amount of the employer’s LSL provision may be reduced to reflect ‘net’ payments required by employer to settle the LSL liability.

More information

For more information about portable LSL, please contact your local BDO NFP team or watch our recent webinar, Understanding Portable Long Service Leave.