Step five – Recognising revenue where the customer controls the partially completed asset

In the April 2018 edition of Accounting News, we discussed the five-step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers:

| Step 1 | Identify the contract(s) with the customer | |

| Step 2 | Identify the performance obligations in the contract | |

| Step 3 | Determine the transaction price | |

| Step 4 | Allocate the transaction price to the performance obligations | |

| Step 5 | Recognise revenue when a performance obligation is satisfied |

Since then we have included a number of articles on IFRS 15 in Accounting News that cover various issues from the five-step process in greater depth:

| Step | Accounting News edition… | |

| Step 1 | Identify the contract(s) with the customer | May and June 2018 |

| Step 2 | Identify the performance obligations in the contract | July and September 2018 |

| Step 3 | Determine the transaction price | November 2018, February 2019, March 2019 and May 2019 |

| Step 4 | Allocate the transaction price to the performance obligations | June and July 2019 |

| Step 5 | Recognise revenue when a performance obligation is satisfied | August and September 2019 |

In this edition, we continue our examination of the final step in the five-step process – recognising revenue when a performance obligation is satisfied.

Recognising revenue

In the August 2019 edition of Accounting News we outlined how, under IFRS 15, revenue is recognised when (or as) a performance obligation is satisfied by transferring a promised good or service (i.e. an asset) to a customer (with transfer occurring when, or as, the customer obtains control of the good or service). A performance obligation may be satisfied:

- At a point in time, or

- Over time.

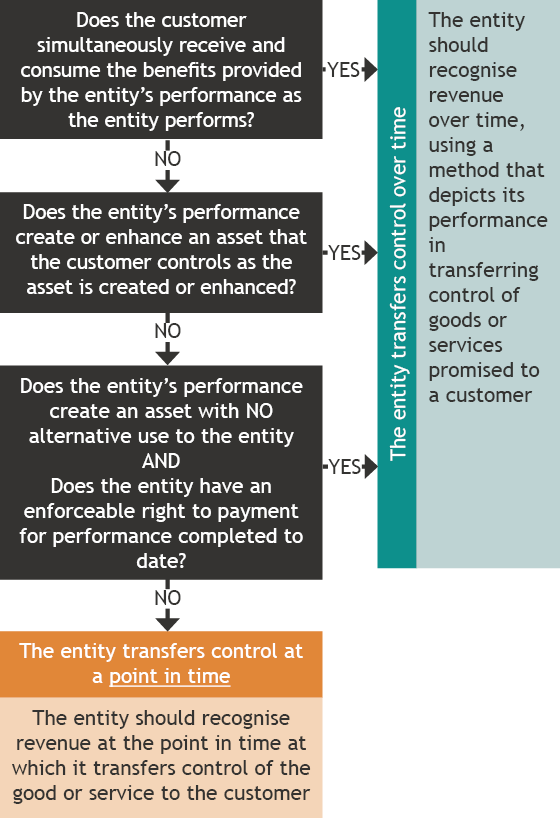

We also noted that an entity transfers control of a good or service over time and, therefore, satisfies a performance obligation and recognises revenue over time, provided that at least one of the following criteria is met:

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (this would occur, for example, in relation to the provision of nightly office cleaning services) – discussed further in September 2019 Accounting News,

- The entity’s performance creates or enhances an asset (for example, work-in-progress) that the customer controls as the asset is created or enhanced, or

- The entity’s performance does not create an asset with an alternative use to the entity (due to a contractual restriction, or practical limitation, on directing the asset to another use) and the entity has an enforceable right to payment for performance completed to date – discussed further in August 2019 Accounting News.

The requirements for the recognition of revenue are illustrated in the decision tree below:

In this edition we examine the second instance where revenue is recognised over time, i.e. where the entity’s performance creates or enhances an asset that the customer controls as the asset is created or enhanced.

Customer controls the asset as it is created or enhanced (IFRS 15, paragraph 35(b))

This criterion applies to work-in-progress which is controlled by the customer.

The asset being created or enhanced could be tangible (e.g. a building constructed on land owned by the customer) or intangible (e.g. customised software written into a customer’s existing IT infrastructure).

In determining whether a customer controls the asset as it is being created or enhanced, we apply the ‘control’ requirements from IFRS 15.

A customer would have ‘control’ of the work-in-progress asset if it has the ability to direct the use of, and obtain substantially all the economic benefits from the asset. ‘Control’ includes being able to prevent others from directing the use of the asset, and from obtaining the benefits from the asset.

…Control of an asset refers to the ability to direct the use of, and obtain substantially all of the remaining benefits from, the asset. Control includes the ability to prevent other entities from directing the use of, and obtaining the benefits from, an asset. The benefits of an asset are the potential cash flows (inflows or savings in outflows) that can be obtained directly or indirectly in many ways, such as by:

- using the asset to produce goods or provide services (including public services);

- using the asset to enhance the value of other assets;

- using the asset to settle liabilities or reduce expenses;

- selling or exchanging the asset;

- pledging the asset to secure a loan; and

- holding the asset.

Example - Work-in-progress enhanced on customer’s premises

On 1 July 2019, Builder Co won the tender to build a house on land owned by the customer.

Construction commenced 1 October 2019 and is estimated to take 18 months to complete the house.

At 30 June 2020, the house is 50% complete.

Year end is 30 June.

Analysis

Builder Co recognises revenue ‘over time’ because the second criterion in IFRS 15, paragraph 35(b) is met. That is, Builder Co’s performance constructs an asset (house) on land that the customer controls as the house is being built. Builder Co has no control of the partially built house because it sits on land owned by the customer.

Concluding thoughts

Under IAS 18 Revenue, revenue recognition was comparatively straightforward – when services were being sold, revenue was recognised on a percentage of completion basis.

Under IFRS 15, revenue can only be recognised over time if strict criteria are met. A determination of whether those criteria have been met will often involve an in-depth examination of the terms of contracts that have been entered into with customers. As we have seen with all of the five steps in the IFRS 15 revenue recognition model, this will require finance teams to work with sales (and in some instances legal) teams to ensure that they have a sufficiently in-depth understanding of contractual terms and the legally enforceable rights to correctly identify when revenue should be recognised.