Australian Carbon Credit Units: An accounting overview

Australian Carbon Credit Units: An accounting overview

Accounting for ACCUs is a complex area, especially since there are no specific requirements in the IFRS® Accounting Standards or Australian Accounting Standards that directly address carbon credits. The approach also differs depending on whether the acquirer of the carbon credits:

- Is a for-profit or not-for-profit entity for financial reporting purposes, and

- Whether the ACCUs are purchased or produced.

This article provides an overview of how to account for ACCUs in all of these scenarios.

What is an ACCU?

An Australian Carbon Credit Unit (ACCU) is a tradable financial product representing one tonne of carbon dioxide (CO2) equivalent that has been removed from the atmosphere or avoided. ACCUs are issued by the Australian Government through the Clean Energy Regulator and are recorded, with ownership tracked on the Australian National Registry of Emissions Units.

ACCUs provide incentives to landholders, communities and businesses that run approved Australian-based projects that avoid releasing GHG emissions, or remove carbon from the atmosphere. Project developers may hold onto ACCUs or sell them to other individuals or entities that wish to voluntarily offset their GHG emissions, or to businesses required to surrender carbon credits for excess emissions under the Safeguard Mechanism.

No guidance in Accounting Standards

Currently, neither IFRS Accounting Standards nor Australian Accounting Standards contain specific guidance on how to account for ACCUs. This includes entities producing ACCUs (project developers) as well as entities purchasing them for surrender as part of their carbon emissions reduction strategies. Entities must, therefore, consider the hierarchy in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors to develop an appropriate accounting policy. They should consider:

- Firstly, the requirements of IFRS Accounting Standards dealing with similar and related issues

- Secondly, the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Conceptual Framework for Financial Reporting (Conceptual Framework)

- Thirdly, the most recent pronouncements of other standard setters that use a similar conceptual framework to develop accounting standards and other accounting literature (if these do not conflict with the above sources).

Judgement is required in determining the appropriate accounting policy, and if it is material to the entity, the entity should consider disclosing the accounting policy in its financial statements.

ACCUs generated (produced) as a result of carbon abatement activities

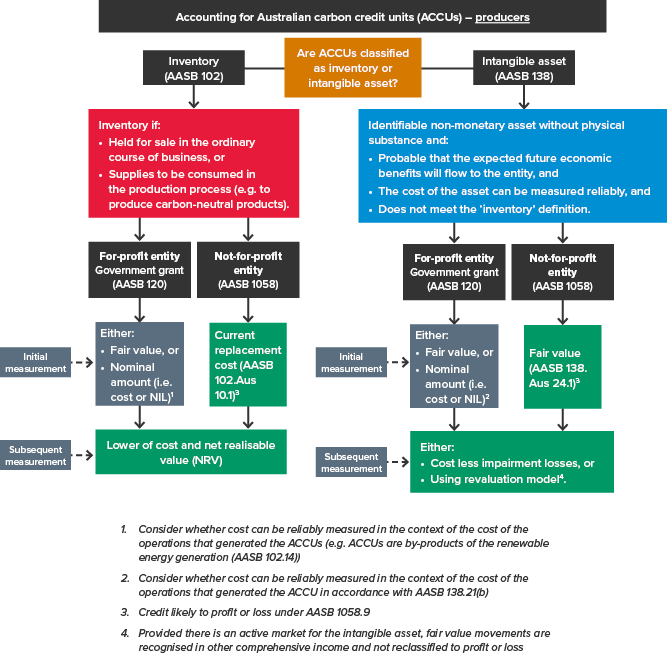

ACCUs meets the definition of an ‘asset’ in the Conceptual Framework. Therefore, applying the hierarchy noted above, and considering IFRS Standards dealing with similar and related issues, producers recognise ACCUs issued following carbon abatement activities as either inventory or intangible assets.

The appropriate classification depends on whether the producer is holding ACCUs for sale or consumption in the ordinary course of business, or for investment purposes. This is shown in the diagram below:

As noted above, there is a difference in accounting by producers depending on whether they are for-profit or not-for-profit entities.

For-profit producer entities

An ACCU is essentially received for free from the government; therefore, a for-profit producer entity accounts for ACCUs under AASB 120 Accounting for Government Grants and Disclosure of Government Assistance. The for-profit producer can choose to initially account for the inventory or intangible ACCU on the balance sheet at either fair value or a nominal amount (either NIL or ‘cost’). However, entities should carefully consider whether ‘cost’ can be reliably measured in the context of the cost of the operations that generated the ACCU.

The use of fair value to initially measure ACCUs is typically preferred because it best reflects the opportunity cost of the producer using the ACCUs to offset their GHG emissions compared to selling the ACCUs.

Not-for-profit (NFP) producer entities

AASB 120 applies only to for-profit entities. NFP producers initially account for ACCUs received from carbon abatement activities applying AASB 1058 Income of Not-for-Profit Entities with:

- Inventories measured using current replacement cost (a fair value measure), and

- Intangible assets measured using fair value.

Subsequent measurement

Both for-profit and NFP entities subsequently measure ACCU inventories at the lower of cost and net realisable value, whereas there is a choice, subject to certain criteria being met, to measure intangible assets using a cost or revaluation model.

Net realisable value and impairment write-downs are recognised in profit or loss, but fair value movements for the intangible asset revaluation model are recognised in other comprehensive income, with no reclassification to profit or loss upon disposal.

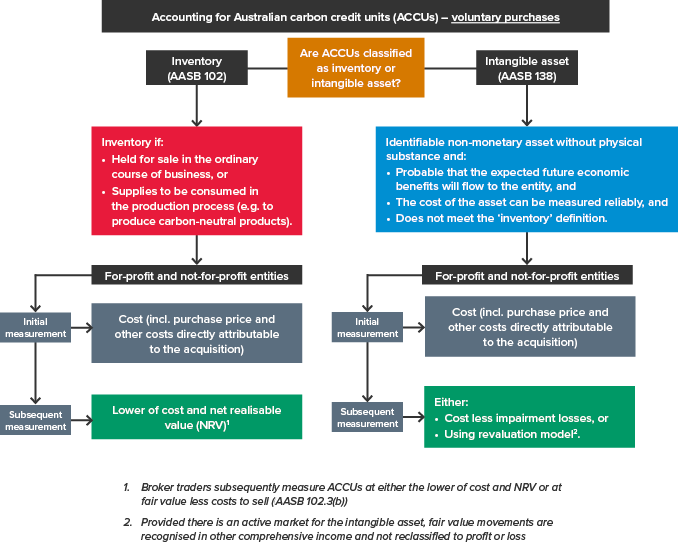

Voluntary ACCU purchases

Consistent with the approach outlined above for producers, entities classify ACCUs voluntarily purchased as either inventory or intangible assets. The following diagram explains how voluntary purchasers initially and subsequently account for ACCUs.

As noted in the diagram above, the accounting applies to voluntary purchasers, regardless of their for-profit or NFP status.

Initial measurement

Purchased ACCUs are initially recognised at cost (i.e. the purchase price plus any other costs directly attributable to the acquisition). This applies equally to ACCUs held as inventory (accounted for under AASB 102 Inventories) and those classified as intangible assets (AASB 138 Intangible Assets).

Subsequent measurement

ACCU inventories are subsequently measured at the lower of cost and net realisable value, whereas there is a choice (subject to certain criteria being met) to measure ACCU intangible assets using a cost or revaluation model. Net realisable value and impairment write-downs are recognised in profit or loss, but fair value movements for the intangible asset revaluation model are recognised in other comprehensive income, with no reclassification to profit or loss upon disposal.

More information

Learn more about ACCUs in our webinar and article, which answers your questions about accounting for ACCUs.

Need help?

Accounting for carbon credits is a new and evolving area and can be complex, with judgement required to establish an appropriate accounting policy. Please contact our IFRS & Corporate Reporting team if you need assistance.