Changes in the pipeline for business combinations, goodwill and impairment

Changes in the pipeline for business combinations, goodwill and impairment

In March 2024, the International Accounting Standards Board (IASB) issued Exposure Draft Business Combinations – Disclosures, Goodwill and Impairment (ED 329 in Australia) to address concerns raised by stakeholders as part of the post-implementation review of IFRS 3 Business Combinations.

ED 329 proposes more disclosure about the strategic rationale for business combinations during the reporting period and the expected synergies. For ‘strategic business combinations’, it proposes new disclosures about the actual performance of business combinations undertaken in the year of acquisition and thereafter.

There are also targeted amendments to the impairment test in IAS 36 Impairment of Assets to reduce shielding of goodwill from impairment write-downs, and to simplify the impairment test. Depending on how goodwill is allocated to cash-generating units (CGUs) under existing requirements, the proposed changes may result in earlier recognition of goodwill impairment for some entities.

Why change IFRS 3?

The additional disclosures will enable users of financial statements to evaluate:

- The benefits an entity expects from a business combination when agreeing the price to acquire a business, and

- For ‘strategic business combinations’, the extent to which the benefits an entity expects from business combination are being obtained.

What is a strategic business combination?

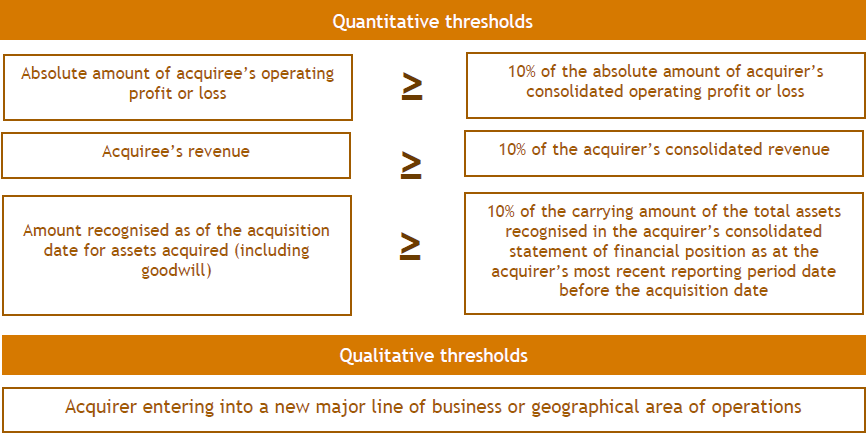

There are more disclosures required for ‘strategic business combinations’ than other business combinations, so identifying them correctly is very important. The Exposure Draft proposes that a business combination will be a ‘strategic business combination’ if it meets any of quantitative or qualitative thresholds shown below:

The acquiree’s operating profit or loss and the acquiree’s revenue is based on the most recent annual reporting period before the acquisition date.

New disclosures for strategic business combinations

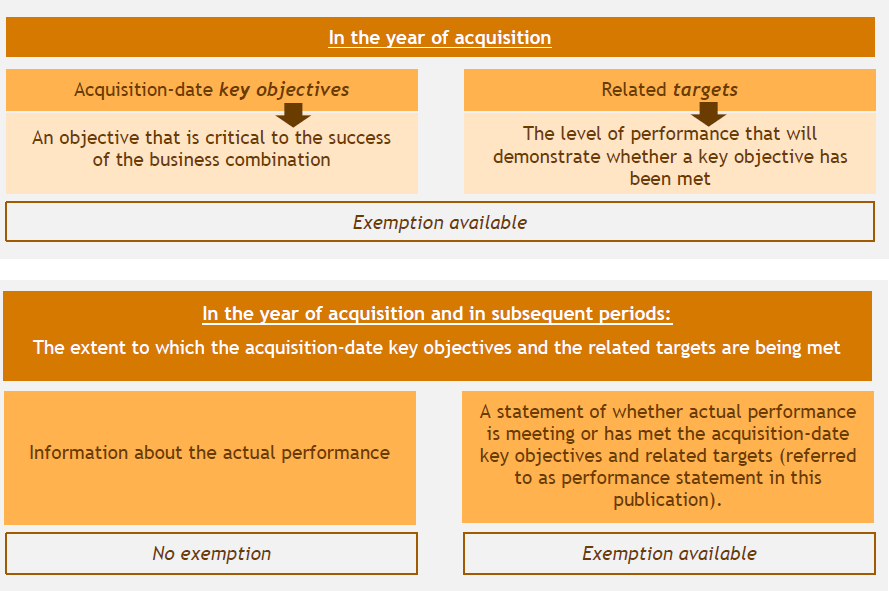

The Exposure Draft proposes the following new disclosures for strategic business combinations, noting exemptions available in certain cases:

The above disclosures about the actual performance and the performance statement will be required as long as the acquirer’s key management personnel (KMP) review the actual performance of the strategic business combination against its acquisition-date key objectives and the related targets. If these criteria cease to be met within two years of the acquisition date, alternative disclosures are required, including the fact that the performance of the strategic business combination is not being reviewed and the KMP’s reasons for not doing so.

Exemptions

In addition to the exemptions noted above, an acquirer may also be able to apply the exemption concerning the proposal to disclose additional information about expected synergies arising from the acquisition, including a description of the expected synergies. These exemptions, however, will only be available (and will only continue to be available) if providing the disclosures can be expected to seriously prejudice the achievement of any of the acquirer’s acquisition-date key objectives of the business combination. We do not expect the exemptions to be used often because entities would first have to show that the prejudice still exists after disclosing information differently, for example, in aggregate, for all synergy types.

For each disclosure where the exemption is used, the acquirer will disclose that fact and reasons for applying the exemption. They must also reassess whether they are still eligible for the exemption at the end of each reporting period.

Changes to the impairment test in IAS 36

Changes are proposed to IAS 36 because stakeholders had raised concerns that for impaired losses on goodwill, it is sometimes a case of ‘too little, too late’. ‘Too little’ occurs because of management overoptimism, and ‘too late’ due to goodwill shielding. Goodwill shielding can occur when an acquisition is integrated with an existing business that has ample headroom in its recoverable amount test. There were also concerns that conducting the impairment test can be costly and time consuming.

Allocating goodwill to CGUs

To reduce the possibility of goodwill shielding, ED 329 proposes amending the requirements for allocating goodwill to CGUs that are expected to benefit from the synergies of the business combination (paragraph 80) by clarifying that:

- Allocated goodwill must represent the lowest level within the entity at which the business associated with the goodwill (rather than goodwill itself) is monitored for internal management purposes

- The operating segment test sets the highest level for allocating goodwill and is only applied after goodwill has been allocated, as noted in (a) above.

Changes to the value in use (VIU) calculation

Proposed change to the VIU calculation include removing the:

- Restriction on including future cash outflows necessary to maintain the level of economic benefits expected to arise from an asset in its current condition. Accordingly, when an asset or CGU consists of components or assets with different estimated useful lives, all of which are essential to the ongoing operation of the asset or unit, the replacement of these components or assets with shorter lives is considered to be part of the day-to-day servicing of the components or assets when estimating future cash flows generated by the asset or CGU

- Restriction on including cash flows from uncommitted future restructuring, improvements or enhancements to an asset or CGU. However, estimated future cash flows must still be for the asset or CGU in its current condition. Accordingly, if the asset or CGU has the current potential to be restructured, improved or enhanced, future cash flows expected to arise from these anticipated future events may qualify to be incorporated in the VIU calculation

- Requirement to calculate VIU on a pre-tax basis.

More information

You can find more information about these changes in our latest publication.

Comments close

Exposure Draft ED 329 is open for comment to the Australian Accounting Standards Board until 3 May 2024. Comments can also be provided directly to the IASB by 15 July 2024. Please contact Aletta Boshoff if you have any concerns with changes to the impairment test or the new disclosures.