Differences in IFRS 18 profit or loss investing category for entities with specified main business activities

IFRS 18 Presentation and Disclosure in Financial Statements is a new financial statements presentation standard that replaces IAS 1 Presentation of Financial Statements. Under IFRS 18, all entities will have to change the way they classify expenses in the statement of profit or loss, allocating them to one of five categories: investing, financing, income taxes, discontinued operations and operating.

This article explores how income and expense classification in the investing category differs for entities with specified main business activities.

Why are special rules needed for classifying income and expenses in the statement of profit or loss?

Income and expenses are generally classified into one of the five categories based on the characteristic of the expense (i.e. the type of asset or liability to which the income or expense relates). Without special rules for classifying the income and expenses of entities with specified main business activities, operating profit would not include all items of income and expenses related to the entity’s main business activities, e.g. for banks and financial institutions. IFRS 18, therefore, contains exceptions so that entities with specified main business activities will classify some income and expense items in the operating category that would otherwise have been classified in the investing and/or financing categories.

Investing category – entities without specified main business activities

Income and expenses are classified in the investing category when they relate to certain assets (i.e. specified assets). The table below shows which specified assets generate income and expenses that will be classified in the investing category for entities without specified main business activities.

|

Assets that result in income and expenses are classified in the investing category |

Income and expense items included in the investing category |

|

|

Investing category – entities with specified main business activities that invest in assets as a main business activity

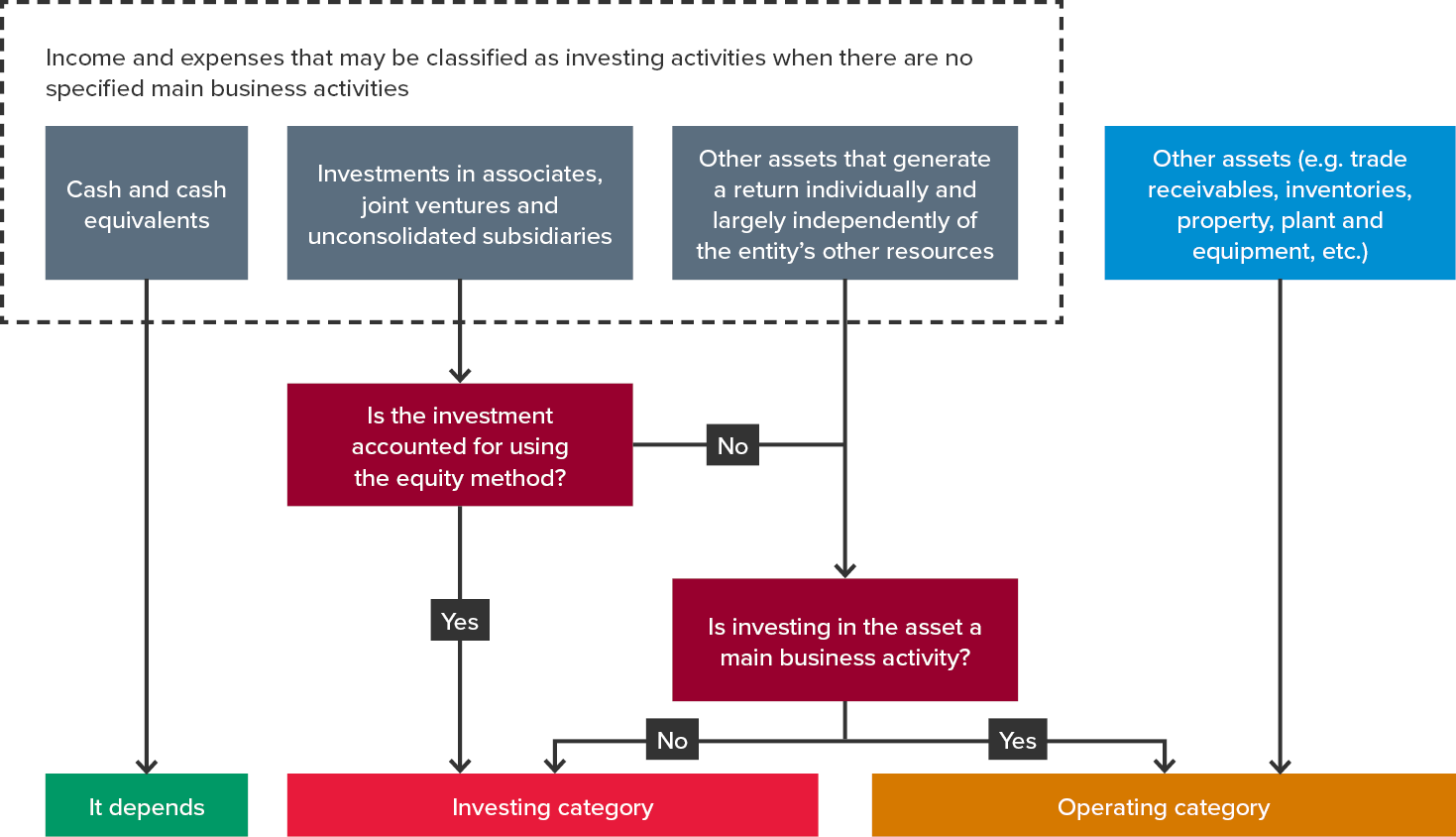

If an entity invests in assets as a main business activity, it has specified main business activities and some income and expenses relating to the three types of specified assets shown in the table above and the diagram below may be classified in the operating category instead of the investing category.

Key points to note:

- There are special rules for allocating income and expenses from cash and cash equivalents (discussed in more detail below).

- Income and expenses relating to investments in associates, joint ventures and unconsolidated subsidiaries accounted for using the equity method are always shown in the investing category.

- Different rules apply for income and expenses relating to investments in associates, joint ventures and unconsolidated subsidiaries that are not equity accounted. If investing in that asset is a main business activity, they belong in the operating category. Otherwise, they are allocated to the investing category.

- Income and expenses from other assets that generate a return individually and largely independently of the entity’s other resources (e.g. debt or equity instruments, investment properties and receivables for rent generated by investment properties) are classified in the operating category rather than the investing category if investing in such assets is a main business activity.

- Income from other assets such as trade receivables, inventories and property, plant and equipment will always be classified in the operating category.

Cash and cash equivalents

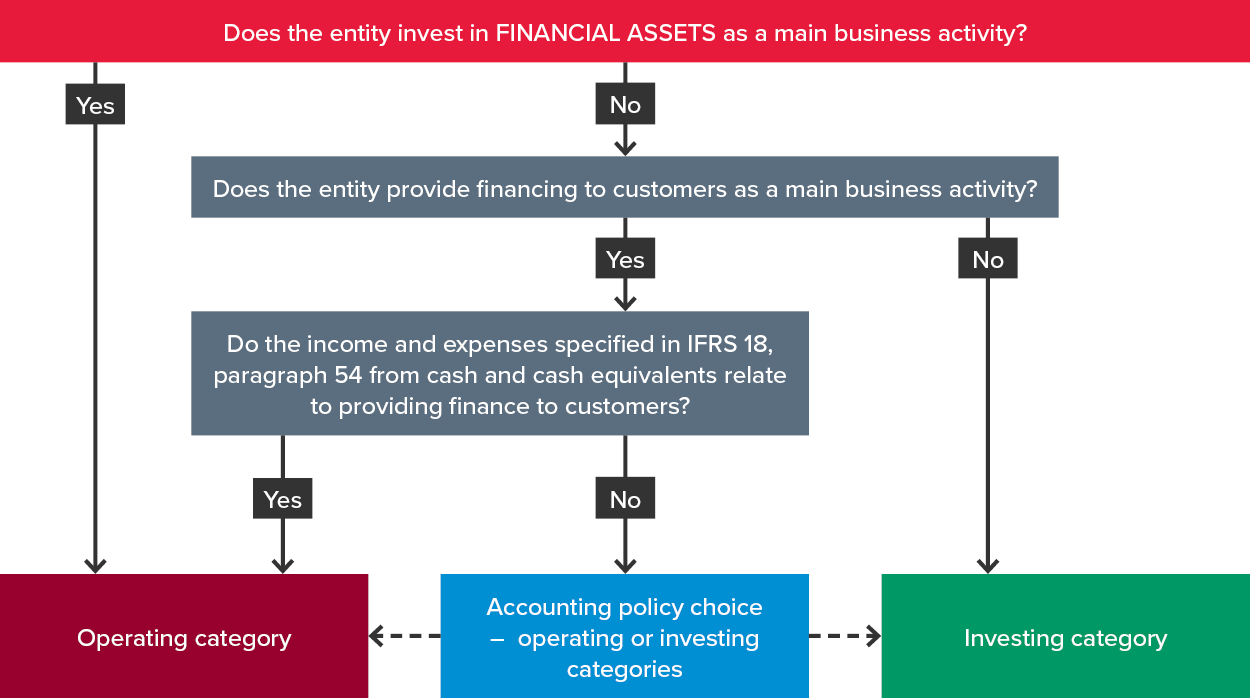

For entities with specified main business activities, the classification requirements for income and expenses relating to cash and cash equivalents (e.g. interest income) are summarised in the decision tree below:

Key points to note:

- Where an entity invests in FINANCIAL ASSETS as a main business activity, it will classify ALL income and expenses related to cash and cash equivalents in the operating category. This applies even if it invests in FINANCIAL ASSETS as a main business activity and it provides financing to customers as a main business activity (i.e. it has more than one specified main business activity).

- If an entity does not invest in financial assets as a main business activity and does not provide financing to customers as a main business activity, income and expenses related to cash and cash equivalents will always be classified in the investing category.

- Where an entity does not invest in financial assets as a main business activity, but does provide financing to customers as a main business activity, it must determine if the income and expenses related to cash and cash equivalents relate to providing financing to customers (IFRS 18.56(b)):

- If they do, income and expenses are classified in the operating category

- If they don’t, there is an accounting policy choice to classify income and expenses either in the operating or the investing category, subject to two restrictions (see below).

Restrictions on accounting policy choice

The accounting policy choice noted above is subject to two restrictions:

- It must be consistent with the accounting policy choice selected for ‘pure financing’ liabilities that do not relate to providing financing to customers (discussed in this article in more detail), and

- If an entity cannot distinguish between cash and cash equivalents that relate to providing finance to customers and those that do not, it must classify income and expenses from all cash and cash equivalents in the operating category.

More information

Stay tuned for future Corporate Reporting Insights during 2025 as we continue our deep dive into IFRS 18 to demystify some of its complexities. Next month, we will look at how the classification of income and expenses to the financing category changes for entities with specified main business activities.

Need help

Entities should start preparing now for IFRS 18 Presentation and Disclosure in Financial Statements because it is a complicated standard. Charts of accounts will need to change to appropriately tag income and expenses to the five categories, and transition dates start from 1 January 2026.

Implementing new accounting standards can be challenging. Reach out to our team for help with understanding the latest requirements in IFRS 18.