Ten things to remember for 30 June 2023 annual and half-year financial statements

Ten things to remember for 30 June 2023 annual and half-year financial statements

This article highlights ten things to remember when preparing 30 June 2023 financial statements. Entities should also consider ASIC’s recently announced focus areas for its surveillance of 30 June 2023 financial reports to address any areas of concern that are not addressed below.

- Accounting in times of uncertainty

- Climate-related matters

- New standards

- IFRIC agenda decisions

- Hyperinflationary economies

- Listed entities

- No more lodgement relief for large grandfathered proprietary companies

- Relief for AFS licensees transitioning to general purpose financial statements

- Changes to classification requirements for liabilities under IAS 1

- Not-for-profit entities

Accounting in times of uncertainty

Preparers must, most importantly, consider the overarching economic and political uncertainty that exists as the world emerges from the COVID-19 pandemic, and the conflict continues between Russia and the Ukraine. Rising energy prices, interest rates, inflation, exchange rate volatility and supply shortages can affect the measurement of your transactions and balances. Our publication on accounting in times of uncertainty contains more information about areas to watch out for when preparing your 30 June 2023 financial statements. These include:

- Going concern

- Judgements, estimates and estimation uncertainty

- Impairment of non-financial assets

- Discount rates

- Events after the reporting period

- Assessment of control, joint control and significant influence

- Effects of inflation

- Financial instruments

- Disclosures.

Impact of recent interest rate increases

Recent interest rate increases are likely to have a significant impact on the measurement of your assets and liabilities, particularly if you are an annual reporter and have not revised your impairment and fair value calculations since June 2022. As interest rates rise, this will directly impact the measurement of many financial statement items because when interest rates increase, so do the discount rates used in present value calculations. The following financial statement items may be affected:

- Impairment of assets (IAS 36 Impairment of Assets)

- Fair value of financial assets and financial liabilities (IFRS 7 Financial Instruments: Disclosures and IFRS 9 Financial Instruments)

- Fair value of investment property (IAS 40 Investment Property)

- Fair value of biological assets (IAS 41 Agriculture)

- Leases (IFRS 16 Leases)

- Long service leave liability (IAS 19 Employee Benefits)

- Defined benefit superannuation obligations (IAS 19 Employee Benefits)

- Fair value of options issued (IFRS 2 Share-based Payment)

- Appropriate measurement of provisions, including restoration provisions (IAS 16 Property, Plant and Equipment and IAS 37 Provisions, Contingent Liabilities and Contingent Assets).

Please refer to our article for more information.

Climate-related matters

The move to a more sustainable world is gaining momentum. The Australian Government has committed to reduce Australia’s greenhouse gas emissions by 43% below 2005 levels by 2030, and to achieve net zero emissions by 2050.

Please refer to IFRB 2020/14 for a summary of these educational materials. More resources on sustainability matters are available on our sustainability reporting web page.

New standards

The main new standards applying for the first time to 30 June 2023 annual and half-year periods are outlined in the table below. Please refer to resources listed for more information or contact our IFRS & Corporate Reporting team for assistance.

| Standard number |

Standard name |

Applies to periods |

Annual periods |

Half-year periods |

Resources |

|

AASB 2020-3 |

Amendments to Australian Accounting Standards – Annual Improvements 2018-2020 and Other Amendments |

Beginning on or after 1 January 2022 |

✔ |

N/A |

Supply chain disruptions, higher prices, and accounting standard changes |

|

AASB 17 |

Insurance Contracts |

Beginning on or after 1 January 2023 |

X |

✔ |

|

|

AASB 2021-2 |

Amendments to Australian Accounting Standards – Disclosure of Accounting Policies and Definition of Accounting Estimates |

Beginning on or after 1 January 2023 |

X |

✔ |

Expect to see a reduction in the amount of accounting policy disclosures |

|

AASB 2021-5 |

Amendments to Australian Accounting Standards – Deferred Tax related to Assets and Liabilities arising from a Single Transaction |

Beginning on or after 1 January 2023 |

X |

✔ |

|

|

N/A: Either because there are no half-year reporting obligations, or they applied for first time in the 30 June 2022 half-year reporting period. |

|||||

Please ensure you have considered the impact of these in your 30 June 2023 annual and half-year financial statements.

IFRIC agenda decisions

You will also need to consider whether IFRIC agenda decisions outlined in the table below, which were approved close to, or since your last reporting date, could affect your 30 June 2023 annual or half-year financial statements.

| Month |

Decision |

Resources |

|

April 2023 |

Substitution rights in a lease |

|

|

October 2022 |

Multi-currency groups of insurance contracts |

|

|

October 2022 |

Special purpose acquisition companies: accounting for warrants at acquisition |

|

|

October 2022 |

Loan forgiveness of lease payments |

|

|

July 2022 |

Negative low-emission vehicle credits |

|

|

July 2022 |

Classification of public shares as debt or equity in special purpose acquisition companies |

|

|

July 2022 |

Transfer of insurance coverage under a group of annuity contracts |

|

|

May 2022 |

Principal vs agent (software resellers) |

Hyperinflationary economies

Australia has experienced low inflation levels for decades, and many entities may need to be aware of special accounting requirements when an entity operates in countries whose economy and functional currency are considered hyperinflationary.

Why does hyperinflation matter for your financial statements?

When an entity’s functional currency is ‘hyperinflationary’, IAS 29 Financial reporting in hyperinflationary economies requires the financial statements (including any comparative periods) to be stated regarding the measuring unit current at the end of the applicable reporting period. This is because the currency of a hyperinflationary economy loses a significant amount of purchasing power from period to period, such that presenting financial information based on historical amounts, even if only a few months old, does not provide relevant information to users of financial statements.

| Economies which were hyperinflationary at 31 December 2022 |

Economies which have become hyperinflationary in 2023 |

Watchlist for the future |

|

|

|

Listed entities

Listed entities need to be mindful of the ASX’s strict approach for enforcing lodgement deadlines. From 1 January 2023, listed entities will automatically be suspended from trading if they fail to lodge their reports on time. This includes entities that lodge reports after the market announcement office closes on the day when the report is due, but before trading commences the next day. The market announcements office hours are 8:30am to 7:30pm Sydney time (8:30pm during daylight saving) on ASX trading days. Please read our previous article for more information.

We also remind oil and gas entities that revised Listing Rule 5 Additional reporting on mining and oil and gas production applies to your 30 June 2023 annual report. Disclosures about new and updated reserves made after 1 July 2022 must comply with the revised Listing Rule 5 and Guidance Note 32 Reporting on Oil & Gas Activities.

No more lodgement relief for large grandfathered proprietary companies

Large grandfathered proprietary companies with financial years ending on or after 10 August 2022 are no longer exempt from lodging their audited financial statements with ASIC.

The financial statements must be general-purpose financial statements prepared using, as a minimum, Tier 2 Simplified Disclosures. The financial statements must be audited and lodged with ASIC within four months of year-end (i.e. by 31 October 2023).

Please refer to our previous article for more information.

Relief for AFS licensees transitioning to general purpose financial statements (GPFS)

For years ending 30 June 2022 onwards, AFS licensees must prepare and lodge GPFS with ASIC in order to meet their reporting obligations under both Chapter 2M and Chapter 7 of the Corporations Act 2001.

Chapter 2M reporting

For Chapter 2M reporting purposes, AFS licensees must either lodge:

- Tier 1 GPFS if the entity has ‘public accountability ’ according to the definition in AASB 1053 Application of Tiers of Accounting Standards, or

- Tier 2 (Simplified Disclosures).

Chapter 7 reporting

For Chapter 7 reporting, in June 2022, ASIC deemed certain AFS licensees to have ‘public accountability’ under the certification section of Form FS 70. These entities must prepare Tier 1 GPFS, even though they do not have ‘public accountability’ under AASB 1053 and would ordinarily have prepared Tier 2 (Simplified Disclosures) GPFS.

Form FS 70 provides transitional relief for this additional reporting burden over a two-year period, provided the licensee:

- Was not a reporting entity and prepared special purpose financial statements (SPFS) for 30 June 2021

- Does not have ‘publicly accountability’ according to the definition in AASB 1053.

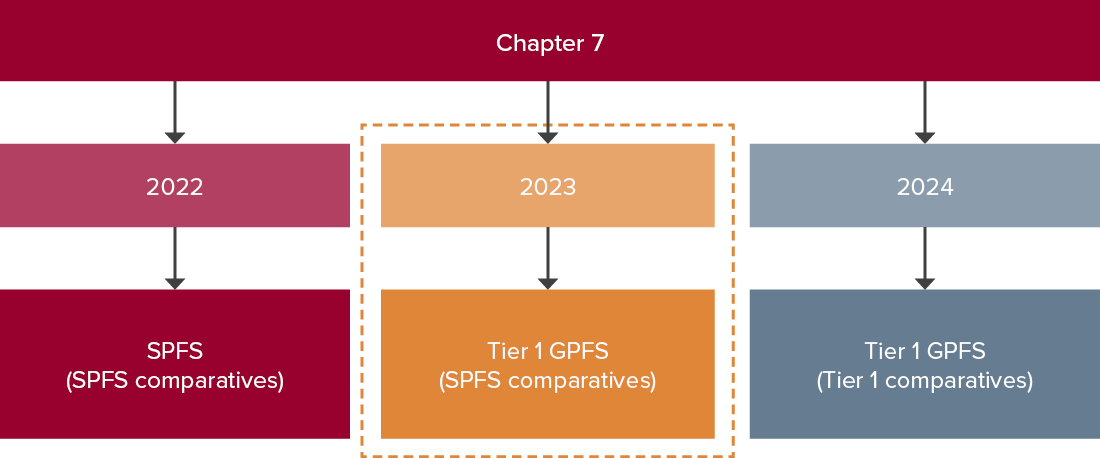

The diagram below shows how entities applying the transitional relief, and reporting only under Chapter 7, will prepare Tier 1 GPFS for 30 June 2023, but will present SPFS comparatives for the year ended 30 June 2022.

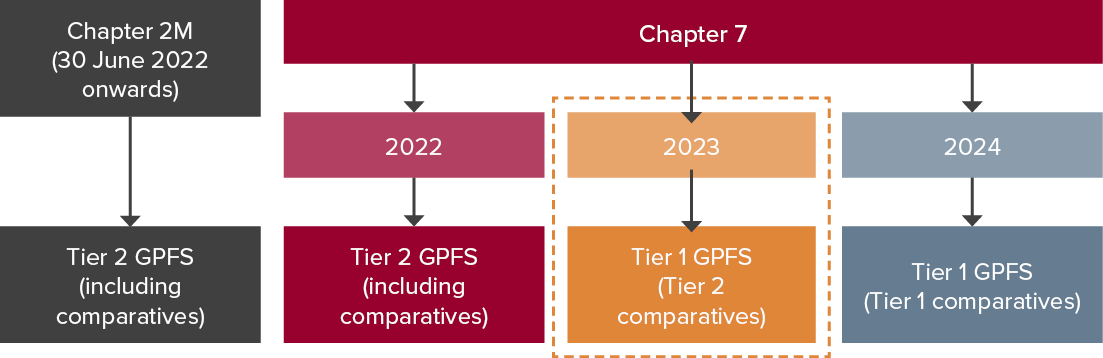

Entities applying the transitional relief but reporting under both Chapter 7 and Chapter 2M will prepare Tier 1 GPFS for 30 June 2023, but will present Tier 2 comparatives for the year ended 30 June 2022. This is illustrated below.

You can find a more in-depth discussion on AFS licensee reporting requirements in our previous article.

Changes to classification requirements for liabilities under IAS 1

Although these changes only become effective for the 30 June 2025 financial year, you must restate your opening balance sheet on 1 July 2023. IAS 8, paragraph 30 requires disclosure of the effect of accounting standards issued but not yet effective.

Classification of your liabilities may be impacted by one or more of the changes to IAS 1, namely:

- The right to defer settlement need not be unconditional and must exist at the end of the reporting period

- Classification is based on rights to defer, not intention

- Early conversion options for convertible notes that can be settled before maturity by issuing the entity’s own equity instruments will result in the underlying liability being classified as CURRENT if the conversion feature is classified as a liability/derivative liability rather than as equity.

Regarding (a) above, if your entity has loan arrangements which are subject to covenants, the amendments clarify when the covenants affect classification at reporting date. This is illustrated in the diagram below.

More information

Our November 2022 article contains an in-depth discussion of the changes, including illustrative examples.

Not-for-profit entities (NFPs)

NFPs should consider the following matters when preparing 30 June 2023 annual financial statements.

Related party disclosures

ACNC Regulation 60.30(2) includes AASB 124 Related Party Disclosures in the list of mandatory standards required for special purpose financial statements (SPFS). Charities preparing SPFS for years ending 30 June 2023 or later must therefore comply the disclosure requirements contained in AASB 124. Comparative information is not required. This is because the ACNC Commissioner has exercised discretion to all such charities applying AASB 124 for the first time in their 30 June 2023 financial statements.

You can find more information about NFP related party disclosure in our articles:

- ACNC guidance – Who is a related party? (June 2022)

- ACNC publishes guidance for disclosing key management personnel remuneration and related party disclosures (April 2022).

Non-refundable upfront fees

AASB 2022-3 Amendments to Australian Accounting Standards – Illustrative Examples for Not-for-Profit Entities accompanying AASB 15 applies for the first time to 30 June 2023 NFP financial statements. The amendments add Illustrative Example 7A to the Australian illustrative examples for NFPs in AASB 15. Example 7A illustrates the application of AASB 15 to transactions where NFPs charge upfront fees to customers or members, for example:

- Joining fees for a club or membership body

- Enrolment fees at schools

- Other establishment or setup fees where a fee is paid at or near the beginning of the contract, and the customer can renew the contract each year without paying an additional fee.

Please read our previous article for more information.

Reminder – Reduced Disclosure Requirements (RDR) has been withdrawn

Tier 2 Simplified Disclosures general purpose financial statements (GPFS) are not mandated for NFPs. Nevertheless, if you previously prepared GPFS using the RDR, you need to redraft these using Tier 2 Simplified Disclosures. We noted a number of entities that continued to prepare Reduced Disclosures Tier 2 GPFS at 30 June 2022 and 31 December 2022. This is no longer permitted because the RDR reporting framework has been withdrawn.

Key Management Person (KMP) compensation

Large charities with more than one KMP were required to disclose aggregate key management personnel compensation for the first time at 30 June 2022. While comparatives were not required at 30 June 2022, they are required going forward. Large charities must therefore include comparative KMP compensation information for the year ended 30 June 2022 alongside the 30 June 2023 compensation.

Non-refundable upfront fees

There is diversity in the way that NFPs account for non-refundable upfront fees. Some recognise it as a contract liability and defer revenue until goods and services have been provided. Others recognise revenue on receipt because the amount is non-refundable. Illustrative Example 7A has been added to AASB 15 to illustrate the appropriate accounting.

Please refer to our previous article for more information.

Need assistance?

Please contact our IFRS Advisory team if you require assistance with any financial reporting matters for your 30 June 2023 annual and half-year financial reports.