Changes to the consolidated entity disclosure statement by Australian public companies

Changes to the consolidated entity disclosure statement by Australian public companies

This article has been updated for current developments. In particular, the example disclosures and example basis of preparation notes shown below have been amended to show the requirements of s295(3A)(vi) and (vii) applying to financial years commencing 1 July 2023 to 30 June 2024, as well as those applying to financial years commencing on or after 1 July 2024 (amended by the Treasury Laws Amendment (Fairer for Families and Farmers and Other Measures) Act 2024).

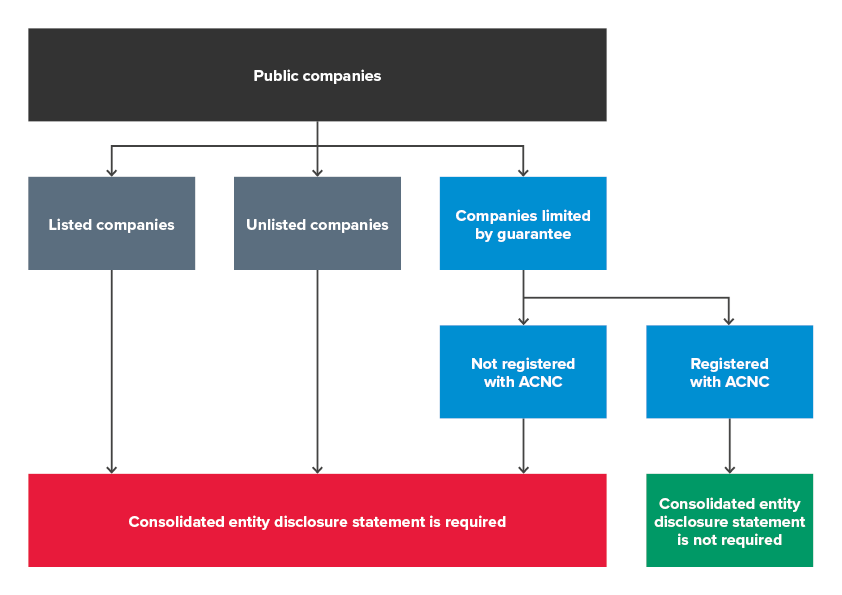

All public companies (both listed and unlisted) reporting under Chapter 2M.3 of the Corporations Act 2001 must include a ‘consolidated entity disclosure statement’ as part of the contents of the annual financial report for financial years commencing on or after 1 July 2023. This will be subject to audit.

Under these requirements, an Australian public company’s annual report must include a ‘consolidated entity disclosure statement’, which either:

- If the accounting standards require the company to prepare consolidated financial statements, disclose details of each entity within the company’s consolidated group, or

- If the accounting standards do not require the company to prepare consolidated financial statements, a statement to that effect.

In addition, directors must state in the directors’ declaration whether, in their opinion, this consolidated entity disclosure statement is ‘true and correct’, and for listed companies, the chief executive officer (CEO) and chief financial officer (CFO) declaration also have to confirm the same.

This article aims to provide practical guidance to preparers preparing their consolidated entity disclosure statement.

Is the consolidated entity disclosure statement required for all public companies?

The consolidated entity disclosure statement is required for public companies reporting under Chapter 2M.3 of the Corporations Act 2001. This includes listed companies and unlisted public companies, as well as companies limited by guarantee that are not registered with the Australian Charities and Not-for-profits Commission (ACNC).

Contents of the consolidated entity disclosure statement

Public companies required by accounting standards to prepare consolidated financial statements must include the following details about each entity that is, at the end of the financial year, part of the consolidated entity:

- The entity’s name

- Whether the entity is a body corporate, partnership, or trust

- Whether the entity is:

- A trustee of a trust within the consolidated entity

- A partner in a partnership within the consolidated entity, or

- A participant in a joint venture within the consolidated entity

- If the entity is a body corporate - the place at which the entity was incorporated or formed

- If the entity is a body corporate with a share capital - the percentage of the entity’s issued share capital (excluding any part that carries no right to participate beyond a specified amount in a distribution of either profits or capital) that was held, directly or indirectly, by the public company.

Additionally, the following details must also be provided for the appropriate period:

|

Financial years beginning 1 July 2023 to 30 June 2024 |

Financial years beginning on or after 1 July 2024 |

|

vi. Whether at that time, the entity was an Australian resident or a foreign resident (within the meaning of the Income Tax Assessment Act 1997 (ITAA 1997)) Note 1, 2 Note 1: From 11 December 2024, the Treasury Laws Amendment (Fairer for Families and Farmers and Other Measures) Act 2024 introduces s295(3B) to clarify that an ‘Australian resident’ includes certain partnerships and trusts (see Note 3). |

vi. Whether the entity was an Australian resident at that time Note 3 Note 3: The following are all Australian residents under s295(3B):

|

|

vii. If the entity is a foreign resident as described in (vi) above – a list of each foreign jurisdiction in which the entity was, at that time, a resident for the purposes of the law of the foreign jurisdiction relating to foreign income tax (within the meaning of that Act). Note 2 Note 2: An entity can be an Australian resident for tax purposes, and simultaneously a foreign tax resident of a foreign country at the same time. |

vii. A list of each foreign jurisdiction (if any) in which the entity was, at that time, a resident for the purposes of the law of the foreign jurisdiction relating to foreign income tax (within the meaning of the ITAA 1997). |

The Treasury Laws Amendment (Fairer for Families and Farmers and Other Measures) Act 2024 amends s295(3A)(vi) and (vii) to correct an anomaly for financial years beginning on or after 1 July 2024. The definitions of ‘Australian resident’ and ‘foreign resident’ in the ITAA 1997 are mutually exclusive, therefore, an Australian entity which is an Australian resident under the ITAA 1997 cannot also be disclosed as a foreign resident in the pre-1 July 2024 disclosures. However it is recommended for pre 1 July 2024 disclosures to include a note that the entity is also a tax resident of the other country as per for Sub 1 Pty Ltd in the example below.

Example

An example of a consolidated entity disclosure statement in consolidated financial statements is shown below:

|

|

|

|

|

|

Pre 1 July 2024 disclosures |

Disclosures for 1 July 2024 onwards |

||

|

Name of entity* |

Type of entity |

Trustee, partner or participant in joint venture** |

% of share capital held |

Country of incorporation |

Australian resident or foreign resident*** |

Foreign tax jurisdiction(s) of foreign residents*** |

Australian resident |

Foreign jurisdiction(s) in which the entity is a resident for tax purposes (according to the law of the foreign jurisdiction) |

|

Public Company Limited |

Body Corporate |

- |

N/A |

Australia |

Australian |

N/A |

Yes |

N/A |

|

Sub 1 Pty Ltd |

Body Corporate |

- |

100 |

Australia |

Australian |

N/A 1 |

Yes |

New Zealand |

|

Sub 2 Unit Trust |

Trust |

- |

N/A |

Australia |

Australian |

N/A |

Yes |

N/A |

|

Sub 3 Pty Ltd |

Body Corporate |

Trustee |

60 |

Switzerland |

Foreign |

United States of America |

No |

United States of America |

|

Sub 4 Pty Ltd |

Body Corporate |

- |

100 |

Bermuda |

Foreign |

N/A |

No |

N/A |

|

Public Company Share Trust |

Trust |

- |

N/A |

Australia |

Australian |

N/A |

Yes |

N/A |

|

XYZ Partnership |

Partnership |

- |

N/A |

N/A |

Australian |

N/A |

Yes |

N/A |

1Sub 1 Pty Ltd is classified as an Australian tax resident under the ITAA 1997, but is a tax resident of Country X under the laws of Country X

* Entities listed here are those that are part of the consolidated entity at the end of the financial year. Entities disposed of during the year, or where the entity has lost control by the reporting date, are not included here. This means that entities listed could be different to the ‘Interests in subsidiaries’ note contained in the notes to the financial statements.

** This means whether, at that time, the entity was a trustee of a trust within the consolidated entity, a partner in a partnership within the consolidated entity, or a participant in a joint venture within the consolidated entity.

*** The definitions of ‘Australian resident’ and ‘foreign resident’ in the ITAA 1997 are mutually exclusive. This means if an entity is an ‘Australian resident’ it cannot be a ‘foreign resident’ for the purposes of the public company disclosures in the consolidated entity disclosure statement (only applicable to financial years beginning 1 July 2023 – 30 June 2024, for financial years beginning on or after 1 July 2024 the disclosure requirements have changed).

Are all subsidiaries required to be included?

Yes. A public company that consolidates subsidiaries has to identify all of its subsidiaries and include them in the consolidated entity disclosure statement, regardless of whether they are dormant or immaterial. However, entities disposed of during the year, or where the entity has lost control by the reporting date, are not included.

A public company that prepares consolidated financial statements is not required to identify those subsidiaries that are not consolidated because of the ‘investment entity exemption’ in AASB 10 Consolidated Financial Statements.

What about investments in associates and joint ventures?

The consolidated entity disclosure statement does not require information for investments in associates and joint ventures as they are not consolidated, and therefore, not part of the consolidated group.

Is comparative information required in the consolidated entity disclosure statement?

Comparative information in the consolidated entity disclosure statement is not required.

What has to be disclosed if consolidated financial statements are not required?

Although it is called a ‘consolidated entity disclosure statement’, the statement must be prepared by all public companies reporting under Part 2M.3 of the Corporations Act 2001, irrespective of whether the company is required to prepare consolidated financial statements. So, when a public company is not required to prepare consolidated financial statements under Australian Accounting Standards, the entity is required to include a statement to that effect in the consolidated entity disclosure statement. Some examples of how this can be presented are shown below:

Public company has no subsidiaries

Public Company Limited has no controlled entities and, therefore, is not required by the Australian Accounting Standards to prepare consolidated financial statements. As a result, section 295(3A)(a) of the Corporations Act 2001 does not apply to the entity.

Public company is an investment entity

Public Company Limited is an investment entity applying the exemption from consolidation described in AASB 10 Consolidated Financial Statements and has no subsidiaries that are not investment entities. As a result, it is not required by Australian Accounting Standards to prepare consolidated financial statements, and, therefore, section 295(3A)(a) of the Corporations Act 2001 does not apply to the entity.

Public company is an intermediate parent entity

Public Company Limited is an intermediate parent applying the exemption from consolidation described in paragraph 4 of AASB 10 Consolidated Financial Statements. As a result, it is not required by Australian Accounting Standards to prepare consolidated financial statements, and, therefore, section 295(3A)(a) of the Corporations Act 2001 does not apply to the entity.

Where does it go?

The consolidated entity disclosure statement is part of the annual financial report, alongside the financial statements, notes and the directors’ declaration. However, it is a separate statement and does not form part of the notes to the financial statements (s295(1)(ba)), so it cannot be combined with the note on controlled entities required by accounting standards or presented as a separate note.

Basis of preparation

The following examples illustrate wording to consider in your basis of preparation note for the consolidated entity disclosure statement for financial years beginning from 1 July 2023 to 30 June 2024, and from 1 July 2024, respectively.

Basis of Preparation (for financial years beginning 1 July 2023 to 30 June 2024)

This Consolidated Entity Disclosure Statement (CEDS) has been prepared in accordance with the Corporations Act 2001 as it applies for financial years beginning 1 July 2023 to 30 June 2024. It includes certain information for each entity that was part of the consolidated entity at the end of the financial year in accordance with AASB 10 Consolidated Financial Statements.

Determination of Tax Residency

Section 295(3A)(vi) of the Corporation Acts 2001 defines Australian resident as having the meaning in the Income Tax Assessment Act 1997. The determination of tax residency involves judgement as there are currently several different interpretations that could be adopted, and which could give rise to a different conclusion on residency. It should be noted that the definitions of ‘Australian resident’ and ‘foreign resident’ in the Income Tax Assessment Act 1997 are mutually exclusive. This means that if an entity is an ‘Australian resident’ it cannot be a ‘foreign resident’ for the purposes of disclosure in the CEDS, even if it is also treated as a resident in a foreign country.

In determining tax residency, the consolidated entity has applied the following interpretations:

- Australian tax residency

The consolidated entity has applied current legislation and judicial precedent, including having regard to the Tax Commissioner's public guidance in Tax Ruling TR 2018/5.

- Foreign tax residency

As the definition of ’foreign resident’ under the Income Tax Assessment Act 1997 is an entity that is not an ‘Australian resident’ as defined under that Act, the definitions of ‘Australian resident’ and ‘foreign resident’ in the Income Tax Assessment Act 1997 are mutually exclusive. Therefore, the entities that are disclosed as foreign tax residents are entities that are not Australian tax residents and, if the entity is a resident of both Australia and another country, it will not be considered to be a foreign resident for the purposes of disclosure in the CEDS. Where necessary, the consolidated entity has used independent tax advisers in foreign jurisdictions to assist in determining tax residency and ensure compliance with applicable foreign tax legislation.

Partnerships and Trusts

Section 295(3B) of the Corporation Acts 2001 has been introduced to clarify that an Australian resident for the purposes of these disclosures includes a partnership with at least one member of which is an Australian resident within the meaning of the Income Tax Assessment Act 1997 and a resident trust estate under the meaning in Division 6 of the Income Tax Assessment Act 1936.

Basis of Preparation (for financial years beginning on or after 1 July 2024)

This Consolidated Entity Disclosure Statement (CEDS) has been prepared in accordance with the Corporations Act 2001, reflecting the amendments to section 295(3A)(vi) and (vii) which clarify the definition of foreign resident as being an entity that is treated as a resident of a foreign country under the tax laws of that foreign country. These amendments apply for financial years beginning on or after 1 July 2024. The CEDS includes certain information for each entity that was part of the consolidated entity at the end of the financial year in accordance with AASB 10 Consolidated Financial Statements.

Determination of Tax Residency

Section 295(3B)(a) of the Corporation Acts 2001 defines Australian resident as having the meaning in the Income Tax Assessment Act 1997. The determination of tax residency involves judgement as there are currently several different interpretations that could be adopted, and which could give rise to a different conclusion on residency. Section 295 (3A)(a)(vii) requires the determination of tax residency in a foreign jurisdiction to be based on the law of the foreign jurisdiction relating to foreign income tax.

In determining tax residency, the consolidated entity has applied the following interpretations:

- Australian tax residency

The consolidated entity has applied current legislation and judicial precedent, including having regard to the Tax Commissioner's public guidance in Tax Ruling TR 2018/5.

- Foreign tax residency

Where necessary, the consolidated entity has used independent tax advisers in foreign jurisdictions to assist in determining tax residency in those foreign jurisdictions and ensure compliance with applicable foreign tax legislation.

- Partnerships and Trusts

Section 295(3B)(b) and (c) of the Corporation Acts 2001 have been introduced to clarify that an Australian resident for the purposes of these disclosures includes a partnership with at least one member of which is an Australian resident within the meaning of the Income Tax Assessment Act 1997 and a resident trust estate under the meaning in Division 6 of the Income Tax Assessment Act 1936. For the purposes of the CEDS, Public Company Share Trust is determined to be an Australian resident trust estate within the meaning of Division 6 of Part III of the Income Tax Assessment Act 1936. XYZ Partnership is also determined to be an Australian resident because one of its partners is an Australian tax resident.

Directors’ Declaration

The directors’ declaration will also have to be amended to refer to the consolidated entity disclosure statement. Regardless of whether the accounting standards require the preparation of consolidated financial statements, a consolidated entity disclosure statement is still required – it is just the amount of disclosure that differs. Therefore, the same ‘true and correct’ declaration is required in all cases. An example of this is as follows:

‘The information disclosed in the attached consolidated entity disclosure statement is true and correct.’

Directors (and the CEO and CFO of listed companies) should note that a ‘true and correct’ certification for the consolidated entity disclosure statement is a higher hurdle than the ‘true and fair’ declaration used in declarations regarding the financial statements. While ‘true and fair’ means that information is not materially misstated, ‘true and correct’ implies that disclosures are more precise, i.e. they are complete and accurate.

Is a consolidated entity disclosure statement required in half-year financial statements?

No. The requirements for a consolidated entity disclosure statement are contained in section 295(3A) of the Corporations Act 2001, which falls within Division 1 of Part 2M.3 – the section that covers the requirements for annual financial reports. Section 303 of Division 2, which covers the requirements for half-year financial reports, has not been amended. Therefore, a consolidated entity disclosure statement is not required in half-year financial reports.

More information

The Australian Securities and Investments Commission’s Information Sheet 284 Public companies to include a consolidated entity disclosure statement in their annual report provides more information on this topic.

Need help?

Navigating new legislation can be challenging. Reach out to our IFRS and corporate reporting team for assistance.