NFPs – More examples of ‘sufficiently specific’ performance obligations under AASB 15

For annual periods beginning on or after 1 January 2019, not-for-profit entities (NFPs) will need to review all donation and grant contracts to determine whether these should be accounted for as revenue under the new revenue standard, AASB 15 Revenue from Contracts with Customers, or as income under the new income standard, AASB 1058 Income of Not-for-Profit Entities.

Practical solution

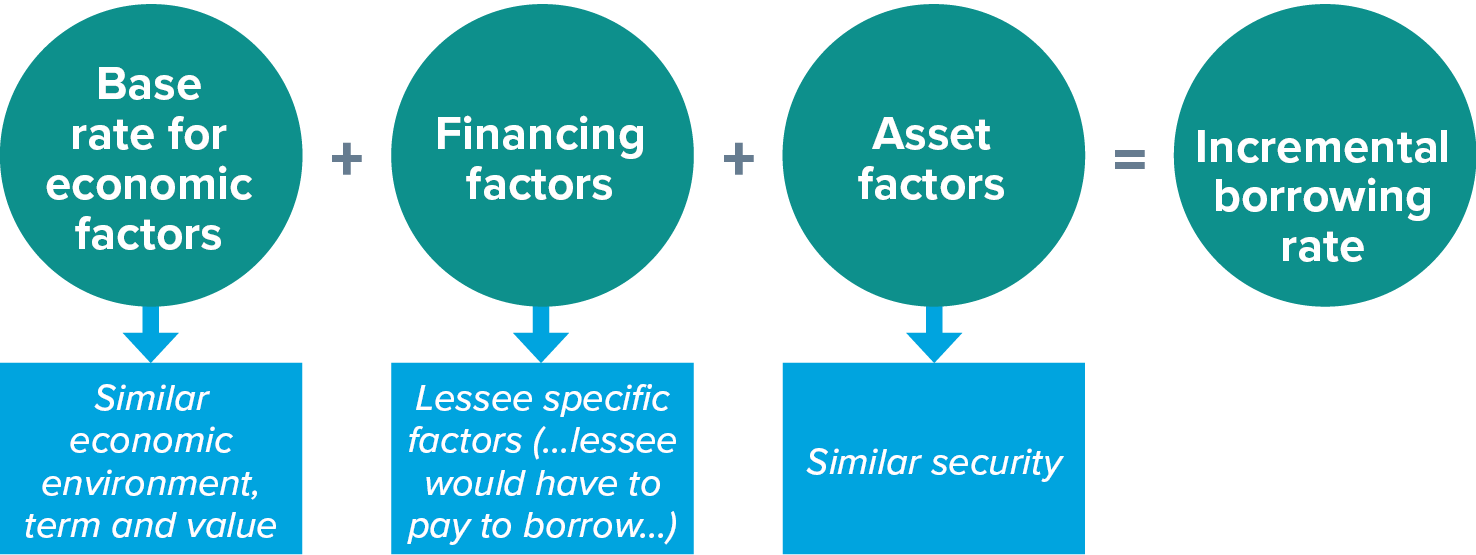

In our October 2019 Accounting News article, we highlighted a practical solution for analysing grant contracts to extract information needed for making these ‘sufficiently specific’ decisions (refer diagram below)

Example 1 – Charitable foundation

Private School has set up a Foundation to enable parents and alumni to make tax-deductible donations. Funds received are then used by the Foundation on various different initiatives to benefit the school, staff and students. The terms of the various donations are outlined in the below.

In Scenarios 2, 3 and 4, all monies unspent at the end of the stated period are to be returned to the donors, Mr and Mrs Smith, i.e. there is an enforceable contract.

Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

Mr and Mrs Smith donate $100,000 to Foundation in 2018. No conditions are attached to the donation. | Mr and Mrs Smith donate $100,000 to Foundation in 2018. Mr and Mrs Smith state that the money should be used to further cricket at the school during 2019. | Mr and Mrs Smith donate $100,000 to Foundation in 2018. The money is to be spent on excess baggage costs for players’ cricket kits on the annual international cricket tours over the next 5 years. | Mr and Mrs Smith donate $100,000 to Foundation in 2018. The money is to be spent on international travel for the annual international cricket tour for the next 5 years. |

NO ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT |

NOT SUFFICIENTLY SPECIFIC | NOT SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC |

No clearly defined outputs (i.e. transfers of goods or services). | No clearly defined outputs (i.e. transfers of goods or services). Only an outcome is defined (i.e. goal is to further cricket at the school during 2019). | Outputs can be identified – payment of excess baggage costs for the next five years is a transfer of goods or services. We can identify WHEN goods or services have been transferred. | Outputs can be identified - spending of money on the international cricket tours for the next five years. We can identify WHEN goods or services have been transferred. |

APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 15 | APPLY AASB 15 |

Example 2 – Disability charity

Wealthy donor donates $500,000 to Public School to improve the educational outcomes of students with disabilities over the next five years.

Assume in all scenarios below that the contract is enforceable because the donation cannot be used for any other purpose and any unspent monies will be returned to the donor.

Scenario 1 | Scenario 2 | Scenario 3 |

Public School must use the funds in the school’s Learning Support Centre for children with disabilities. | Public School must use the funds in the school’s Learning Support Centre for children with disabilities to hire one specialist teacher for 5 years, at a cost of $100,000 per year. | Public School must use the funds in the school’s Learning Support Centre for children with disabilities to hire one specialist teacher for 5 years, at a cost of $100,000 per year. |

ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT |

NOT SUFFICIENTLY SPECIFIC | NOT SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC |

No clearly defined outputs (i.e. transfers of goods or services). | No clearly defined outputs (i.e. transfers of goods or services). The hiring of one specialist teacher for 5 years, at a cost of $100,000 per year is an internal activity and is not the transfer of goods or services to a customer. | Outputs can be identified - teacher must teach in the Learning Support Centre for a minimum 4 days per week during school terms. |

APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 15 |

Example 3 - OOSH

To assist working families in Council’s area, Council grants $180,000 to OOSH (Out of School Hours) Club to run out of school hours’ child minding over a three-year period.

Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

No conditions specified | OOSH Club must use the funds to:

Any unspent funds will not be returned to the Council. | OOSH Club must use the funds to:

The grant cannot be used for any other purpose. Any unspent funds will be returned to the Council. | OOSH Club must use the funds to:

The grant cannot be used for any other purpose. Any unspent funds will be returned to the Council. |

NO ENFORCEABLE CONTRACT | NO ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT |

NOT SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC |

No clearly defined outputs (i.e. transfers of goods or services). | Outputs can be identified - The required operation of the school groups. | Outputs can be identified - The required operation of the school groups. Note: It is not necessary to specify operation times in order to be sufficiently specific. | Outputs can be identified - The required operation of the school groups. Note: It is not necessary to specify operation times or the number of children in order to be sufficiently specific. |

APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 1058, PARAGRAPH 10 (because contract is not enforceable) | APPLY AASB 15 | APPLY AASB 15 |

Note that in both Scenarios 1 and 2 above, there is no enforceable contract because:

- Scenario 1 – There are no conditions attached and no requirement to return any unspent funds to the donor, and

- Scenario 2 - Any unspent funds will not be returned to the Council and can be used for other activities and projects by OOSH.

In Scenarios 3 and 4, the contract is enforceable because the grant cannot be used for any other purpose, and any unspent funds will be returned to the Council.

Example 4 – Rugby Club

Council provides a three-year grant of $300,000 to Local Rugby Club to improve participation of kids in rugby at club level.

In Scenarios 2, 3 and 4, all monies unspent at the end of the stated period are to be returned to the donors (the Council), i.e. there is an enforceable contract.

Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

Local Rugby Club is only permitted by its Constitution to operate as a rugby club. It cannot operate as another sporting club. | Use funds to operate Local Rugby Club for the three-year period for children’s rugby during rugby season. The funds should be used to improve participation of kids in rugby at club level. | Use funds to operate Local Rugby Club for the three-year period for children’s rugby during rugby season. The grant is required to be used to:

| Use funds to operate Local Rugby Club for the three-year period for children’s rugby during rugby season. Local Rugby Club must form a team for all age groups, i.e. under 8s, 9s, 10s, 11s, 12s, 14s, 16s and 18s and participate in the local competition. |

NO ENFORCABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT | ENFORCEABLE CONTRACT |

NOT SUFFICIENTLY SPECIFIC | NOT SUFFICIENTLY SPECIFIC | NOT SUFFICIENTLY SPECIFIC | SUFFICIENTLY SPECIFIC |

No clearly defined outputs (i.e. transfers of goods or services). | No clearly defined outputs (i.e. transfers of goods or services). Only outcomes provided (i.e. improve participation in kids rugby). | No clearly defined outputs (i.e. transfers of goods or services to players). Renting a club-house and arranging volunteer coaches and fixtures are internal activities. | Outputs can be identified - The required forming of teams and participation in the local competition. |

APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 1058, PARAGRAPH 10 | APPLY AASB 1058 PARAGRAPH 10 | APPLY AASB 15 |

Concluding thoughts

From 1 January 2019, NFPs will need to undergo a detailed review of all donation and grant contracts to assess whether recognition under AASB 1058 or AASB 15 is appropriate. The first reporting date, 31 December 2019 has already passed and 30 June 2020 is not far away. Reviewing grant contracts is a difficult and time-consuming process and involves judgement. We encourage NFPs who have not commenced reviewing grant agreements to do so as a matter of urgency.