How businesses responded to the pandemic environment

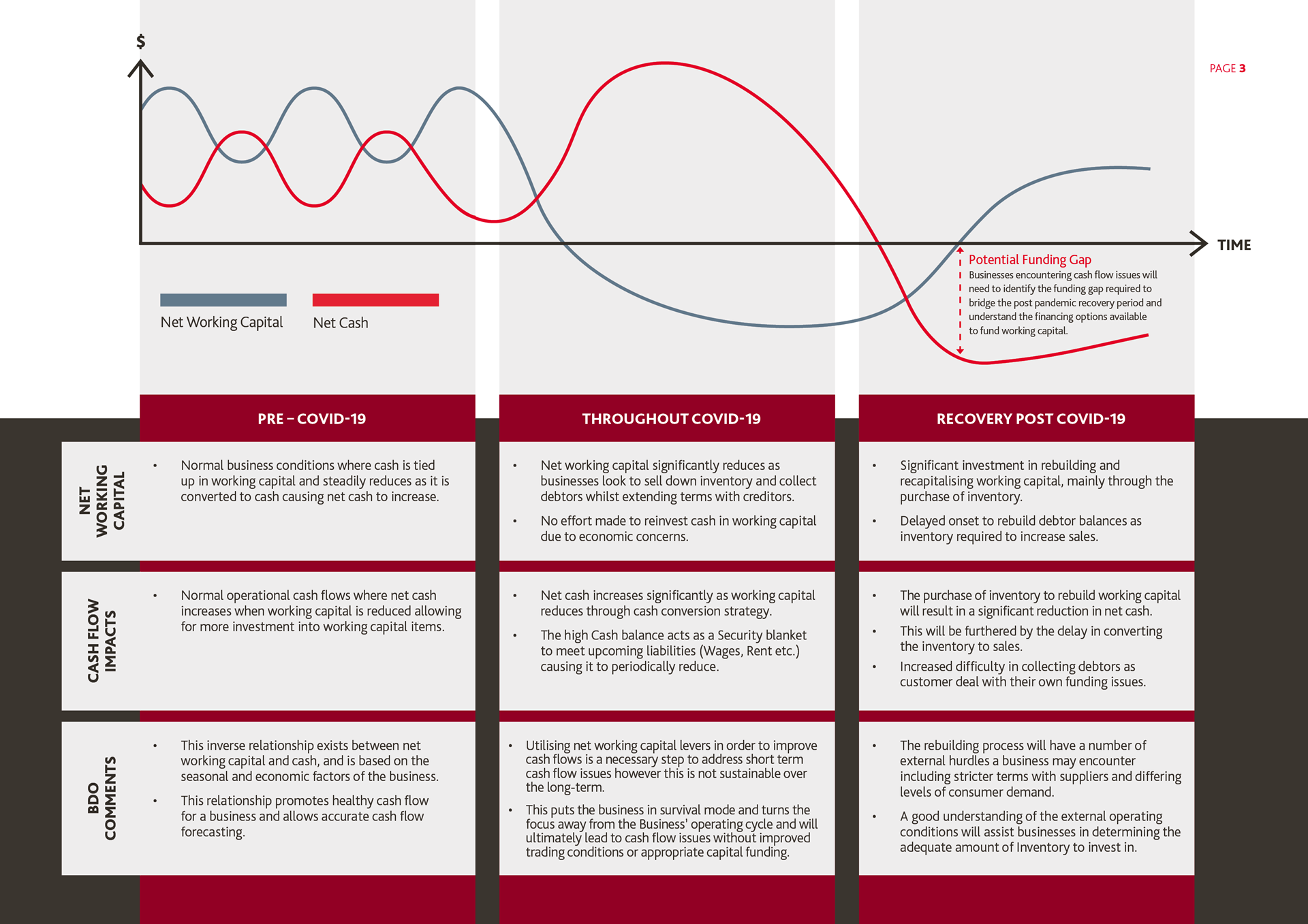

In March 2020, we started to see the effects of the COVID-19 pandemic hit the Australian economy. In response, many businesses looked to rely on preserving and building cash by utilising Government support, selling down inventory, collecting trade debtors and entering into agreements to extend terms with creditors as a way to protect themselves in a time of uncertainty. This desire to increase the amount of cash businesses held or had at their disposal has significantly impacted our mindset towards the importance of working capital. In normal business conditions, healthy businesses should be able to broadly demonstrate an inverse relationship between cash and working capital. This relationship enables the business to rely on working capital and let it form a critical foundation to cash flow forecasting.

The change in mindset caused by the uncertainty of the pandemic resulted in a shift in focus towards cash and the ‘security blanket’ it provides. In times of uncertainty, when survival is paramount, this strategy is understandable and certainly effective in the short term however, as we now move into the post-pandemic environment businesses need to be able to refocus their mindset towards the fundamentals of working capital.

Below we explore the impacts of generating short term liquidity at the expense of maintaining working capital balances and a number of key focus points that will allow businesses to return to a financially sustainable working capital cycle in the long term.

Key Focus Points

1. Understanding your operating environment

Success in the post-pandemic environment will be dependent on the time taken by a business to understand its current situation and how the pandemic has effected its key stakeholders and their relationships. Businesses need to look at this from both a supply perspective by understanding any potential changes to its supply chain as well as how the pandemic has impacted demand and the purchasing habits of their customers. Although changes to key components of a business can cause disruption and will differ based on industry, they can also highlight an array of new opportunities.

The key questions we consider are:

- Is the post-pandemic market a financially viable operating environment for the business?

- Is the business efficiently structured around their Working Capital Cycle? Where can improvements be made?

2. What should your business do? (build a rolling cash flow forecast)

In order to understand working capital requirements, businesses need to have an eyes up approach to upcoming liabilities and expenses. Being able to accurately forecast a businesses cash position is vital in times of stabilisation not only to understand short-term liquidity, but often to ensure covenants from lenders are not being breached. It is imperative that this forecast can be adaptive to numerous scenarios to ensure the business is prepared for changes in the internal or external environment.

Most businesses do not accurately report on working capital and are unable to track its performance over time. This limits their ability to identify potential issues and utilise benchmarking against their competitors. More effective working capital management will allow more cash to pay down debts and fund strategic initiatives.

3. Identify working capital opportunities

Through understanding the current environment in which a business operates, there is potential to identify opportunities that can assist improving a business’ cash conversion cycle. Some of these opportunities can arise from asking questions like:

- Can we utilise early payment incentives for our customers?

- Can we improve our credit assessment process?

- What could be considered reasonable payment terms to suppliers and can these be extended?

- Should we consider working capital financing solutions?

- What is the impact of deferred liabilities (rent, bank loans and GST/PAYG) and what cash do we need to meet these repayments?

Our Special Situations Advisory team are experts in conducting cash flow reviews that highlight the current shortfalls of a business’ working capital position.