There is little doubt that sustainability has become the most talked about ‘issue’ across the globe, particularly in the wake of the UN Climate Change Conference (COP26) held in Glasgow in October.

‘Sustainability’ presents a challenge due to its breadth and complexity. According to the Oxford English dictionary, the definition of Sustainability is ‘the ability for something to be maintained at a certain rate or level’ and /or ‘avoidance of the depletion of natural resources in order to manage ecological balance’. Companies use this blanket term as essentially a catch-all phrase to mean ‘do better’.

The vernacular, terminology and even the meaning of sustainability has changed over time. For business we have seen it evolve from ‘corporate social responsibility’ which generally refers to the practices and policies that a company adopts to promote positive impact, to Environmental, Social, Governance (ESG) which is a metric-based reporting framework that promotes the ongoing process of assessing, monitoring, and improving.

What is a sustainable business?

In short, a sustainable business is one which operates with minimal or no adverse impact, or potentially a positive effect, on the environment, community, society, and/or economy. Sustainable businesses consider the entire ecosystem in which they operate, balancing profit, people, and planet to achieve long-term resilience.

Integrating sustainability into a business is a journey – a transformational journey that will be an ongoing process of monitoring and modification and rethinking ‘how’ the organisation can evolve to embrace new sustainability parameters which are being driven in part by changing societal views.

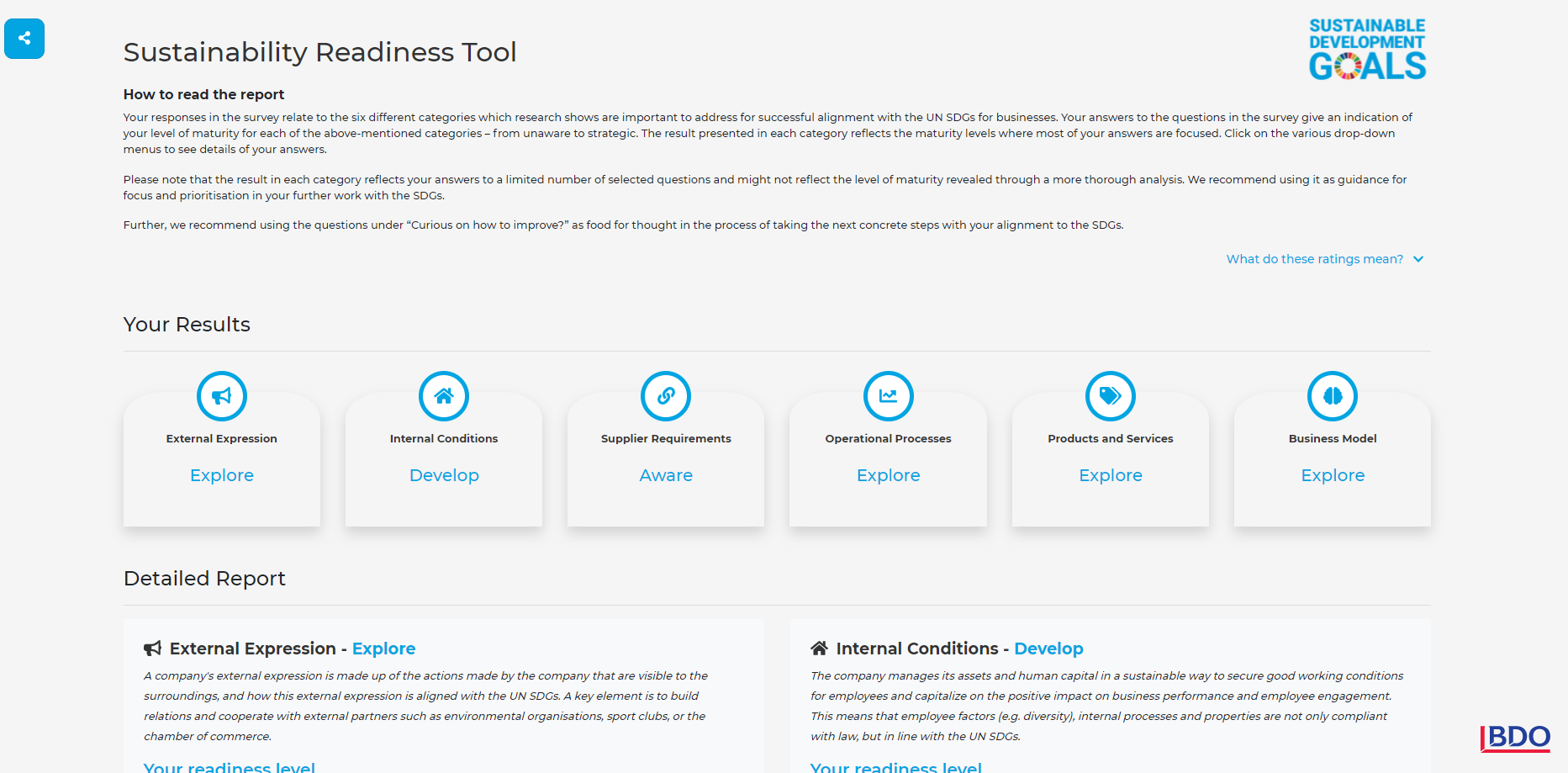

Almost all parts of a business can be viewed through the sustainability lens which is inextricably linked to ESG. Below represents the various aspects of a business that can have an environmental or social impact. It is across these aspects that an organisation can leverage sustainability to create organisational value and resilience.

- External Expression – Leveraging sustainability to strengthen stakeholder relations.

- Internal Conditions – Embedding sustainability into internal processes, policies, and asset management.

- Supplier Requirements – Driving a sustainable procurement strategy.

- Operational Processes – Integrating sustainability into business operations.

- Products & Services – Creating a competitive advantage through sustainable products and services.

- Business Model – Leveraging sustainability to drive customer value.

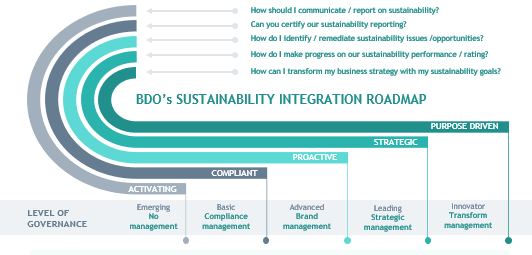

Part of the challenge for many businesses is understanding where to start. BDO’s Sustainability Integration Roadmap (below) helps to illustrate the likely journey of an organisation as it evolves its business to incorporate sustainability as part of its core strategy. Whilst it may seem like a linear journey, in fact no journey is ever that direct. It’s important to understand that the adoption and execution of sustainability will not be the same in any two organisations. In some cases, a company may leapfrog several steps, need to join in at the ‘compliant’ stage, or even have different parts of the business at different stages. But what is important to understand, is that it’s an ongoing journey that can:

- Increase top-line growth via new customers and access to new markets;

- Provide cost reductions via savings realised through understanding your energy footprint;

- Productivity uplift with more engaged and higher-quality talent; and

- Greater returns on assets (higher valuations) by investing in sustainable products, services, and/or equipment.

Changing tone of business

Right now, for most companies, there is a growing business imperative to address sustainability, both locally and globally. The material risks facing companies are broadening and becoming more complex with the realities of climate change, global health pandemics, and rising industrialisation.

These mounting risks are seeing a global movement emerge driven by capital markets, governments, community, and various stakeholders calling for greater transparency and accountability across ESG to better understand the impact of business and industry on the environment and our societies. To date, business has not fully accounted for the true cost of doing business, and as such those costs have at times been unduly passed onto others. A few of the drivers towards sustainability accountability include:

- Investors / stakeholders - Investor appetite is increasingly moving away from short-term gains to longer term purpose, in addition, there is an enormous reallocation of capital towards the ‘green economy’.

- Risk management – As a result of climate change and the green energy transition, there are physical (extreme weather), transition (technology, market shifts), and regulatory (government policy / carbon tax) risks that will see many companies under pressure to operate.

- Regulation – Government, industry, and institutions are waking to the costs of inaction. The European Union Taxonomy comes into force in January 2022 requiring listed companies with more than 500 employees to disclose the proportion of their sales and capital expenditure which comply with the Taxonomy’s definition of sustainability.

- Customers / vendors / employees – As existing markets are disrupted and new markets rapidly emerge, organisations that effectively integrate sustainability into their business will benefit as consumers and stakeholders reward those which demonstrate a strong social licence to operate.

As nature loss and climate risk continue to accelerate at unprecedented rates and the costs of inaction increases, a more rigid and challenging policy environment is expected to develop. Business-as-usual is no longer an option and companies will need to stay informed on industry and government policy, both locally and globally, which may impact their business.

ESG disclosure is facilitating the reallocation of capital

Disclosure plays a key role in the sustainability movement. Investors, financial institutions, and other stakeholders will rely on this data to drive the market towards promoting investment in and support for companies evolving towards a sustainable and green economy.

Mandatory ESG disclosure is a reporting requirement on 26 stock exchanges around the world with 42 providing written guidance – including Australia. At present, ESG reporting is only voluntary in Australia, however, despite this, ESG disclosure is increasingly being demanded by financial institutions as a requirement of project finance and suppliers as part of their ESG-led procurement policies.

In addition, stakeholders are increasingly placing value on ambitious sustainability action which is ensuing the largest reallocation of capital in modern history. Those businesses able to demonstrate their purpose and role in the green economy will attract this finance.

A bright but bumpy transition for Western Australia

With increasing focus on the energy transition, more policy and funding schemes are emerging across Australia. However, it’s the policies and regulations being passed in Europe and other international trading partners that has sparked many Australian businesses to not wait for local or federal guidance, deciding instead to get on the front foot and activate their sustainability journey voluntarily.

With WA’s economy strongly linked to high-emitting sectors such as mining, ESG reporting and disclosure and decarbonisation strategies will become ever more central to WA organisations’ operating strategies as such sectors seek to justify their social licence to operate, both locally and internationally.

With Net Zero commitments by both State and Federal Government, business will have to start demonstrating to stakeholders tangible plans to reduce their emissions profile in line with not just government targets, but more ambitious business and societal expectations. Climate change is and will continue to be a central issue in the coming decade.

Other key issues that organisations in WA will need to address include biodiversity loss, diversity and inclusion, gender equality, and indigenous affairs.

How ready are you?

To understand where your company sits on the sustainability journey – take BDO’s Sustainability Readiness Survey (10 mins). The Tool has been developed based on globally recognised academic research utilising a growth-set maturity model and strength-based readiness milestones. The Tool uses the UN Sustainable Development Goals (SDGs) framework as the roadmap for business transformation. The SDGs provide a unified language and globally recognised goals that business can align to. The SDGs have been officially endorsed by 193 countries, and 12,000+ companies have since signed up to the UN Global Compact - a movement aimed to mobilise companies and stakeholders towards achieving the goals.

What you receive?

The survey framework is built on six pillars covering an organisation’s functional, operational, and strategic workings. Once completed you will receive a personalised ‘maturity benchmark’ report providing an assessment of your answers and useful guidance on how you can further integrate sustainability practices within your business.

Sample report