There definitely needs to be awareness of what risk means for individuals and the business, as well as the upside of operating with a mindset that is aligned to a company’s strategic objectives and values.”

Over the past year, it's become clear that business leaders can no longer wait for stability. They must proactively manage their risk to grow.

Many leaders are dissatisfied with their risk management, particularly the emphasis that is now placed on compliance. With increasing regulations and general economic uncertainty, businesses are taking a more compliance-led approach to risk management which can stunt growth opportunities and overshadow real risk management strategies.

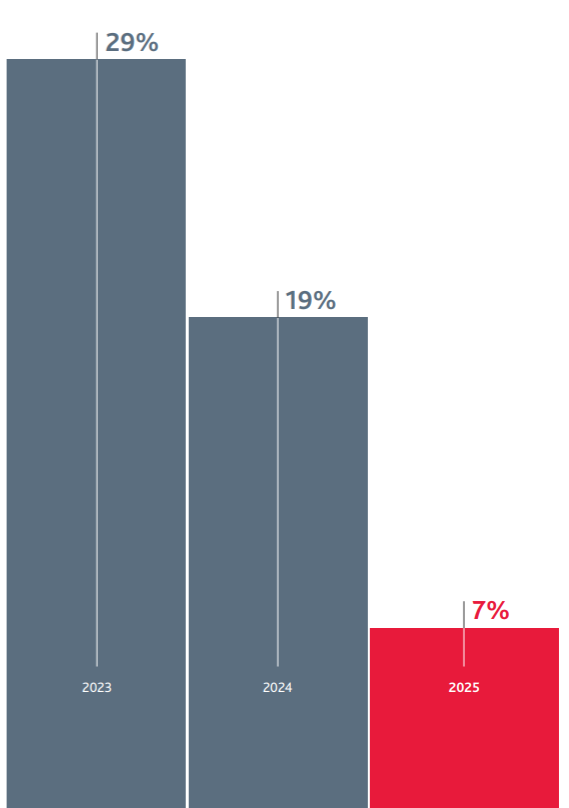

Only 7 per cent of global executives stating a very proactive approach. This is down from 19 per cent in 2024 and 29 per cent in 2023.

Percentage who say their risk management is 'very proactive' (2023 to 2025)

Percentage who say their risk management is 'very proactive' (2023 to 2025)

Yet, encouragingly, 74 per cent of global executives believe embedding real risk thinking into their business culture could shift their risk management from a box-ticking exercise to real strategies that offer value.

In the 10th edition of our global risk landscape report, BDO surveyed 500 C-suite executives across the Asia-Pacific, Europe, Africa and the Middle East. The report highlights current approaches and responses to the global events altering their risk landscape.

Asia-Pacific (APAC) businesses are navigating a risk landscape increasingly defined by crisis and regulatory complexity, yet many are cautiously optimistic - especially in their growing embrace of AI as a strategic opportunity.

Businesses in Australia face numerous threats, from increasing regulatory burdens, to geopolitical tensions, cyber and fraud risks. Alarmingly, 84 per cent think the risk landscape is more defined by crisis than ever before.

Interestingly, the perceived risks to businesses in Australia and the APAC region may be easing, with 41 per cent stating their risk velocity increased compared to 54 per cent in 2024.

This does not mean however, that organisations should become complacent.

The risks that APAC leaders feel unprepared for

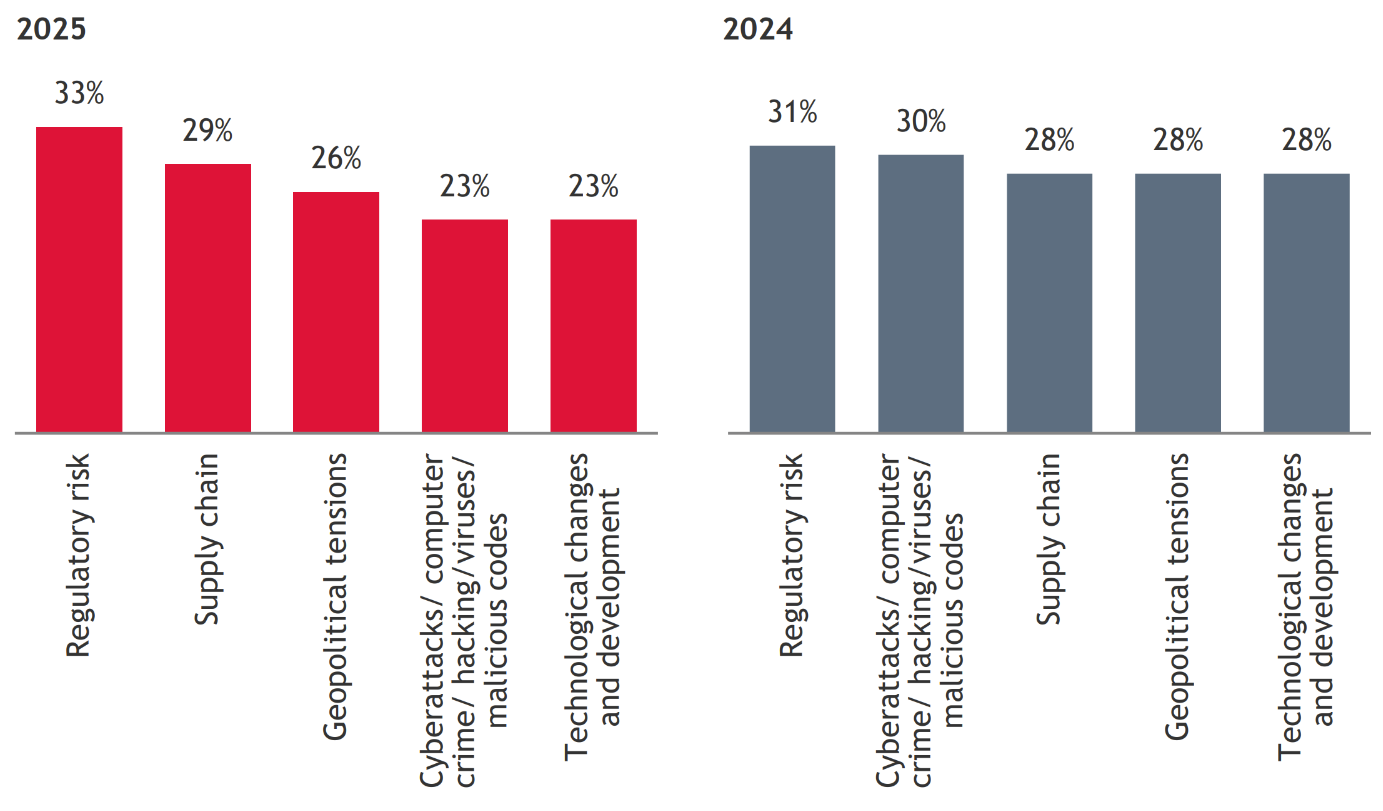

Due to the uneven regulatory environment, regulatory risk remains a top concern for executives in the APAC region.

Shifting from a tick-the-box culture to embedding risk thinking into business strategy will assist in aligning risk priorities in upper levels of management and unlock potential growth opportunities for the business.

While some businesses in our region feel unprepared, respondents said the demand from regulators around risk reporting has in fact helped reduce the real risk, which is quite a different outcome compared with the America’s and Europe.

There definitely needs to be awareness of what risk means for individuals and the business, as well as the upside of operating with a mindset that is aligned to a company’s strategic objectives and values.”

While some businesses in our region feel unprepared, respondents said the demand from regulators around risk reporting has in fact helped reduce the real risk, which is quite a different outcome compared with the America’s and Europe.

In the list of risks that executives feel unprepared for, supply chain risk and geopolitical tensions were ranked second and third respectively. The Sino-US trade war and the relationship between Taiwan, the United States and China mean the situation in the APAC region is tense, with businesses potentially delaying decisions until there is more certainty. Australia’s geographical location and reliance on the global trade market make it vulnerable to geopolitical tensions and disruptions.

Adopting a ‘flexsourcing’ approach, blending nearshoring (with New Zealand and Southeast Asia), and friendshoring can assist in diversifying suppliers and strengthening the digital supply chain.

Fraud risk is underappreciated and sometimes misunderstood with only 15 per cent of global executives citing it as a top three risk. As fraudsters find and exploit new vulnerabilities, it’s time for companies to prioritise this risk.

“These challenges persist as Australia continues to see a steady rise in cyberattacks, scams and fraud – most of them financially motivated.” Matt Williams, National Leader of risk advisory services.

In Australia, this view may be due to past complacency or because many organisational leaders feel there is an overemphasis on compliance. This links back to the tick-the-box mentality, where compliance may come at the expense of real risk management strategies, including fraud prevention.

As organisations gain a deeper understanding of and increased access to AI, many are leveraging it to enhance production efficiencies. However, “in Australia, many businesses still haven’t adopted key AI risk practices like ongoing model checks and testing for manipulation, often due to a lack of expertise, clear responsibility and regulatory direction.” Matt Williams.

When it comes to the evolving AI landscape, cyber risk is a key consideration. Many organisations are still struggling to meet regulatory requirements due to their complexity and lack of resourcing.

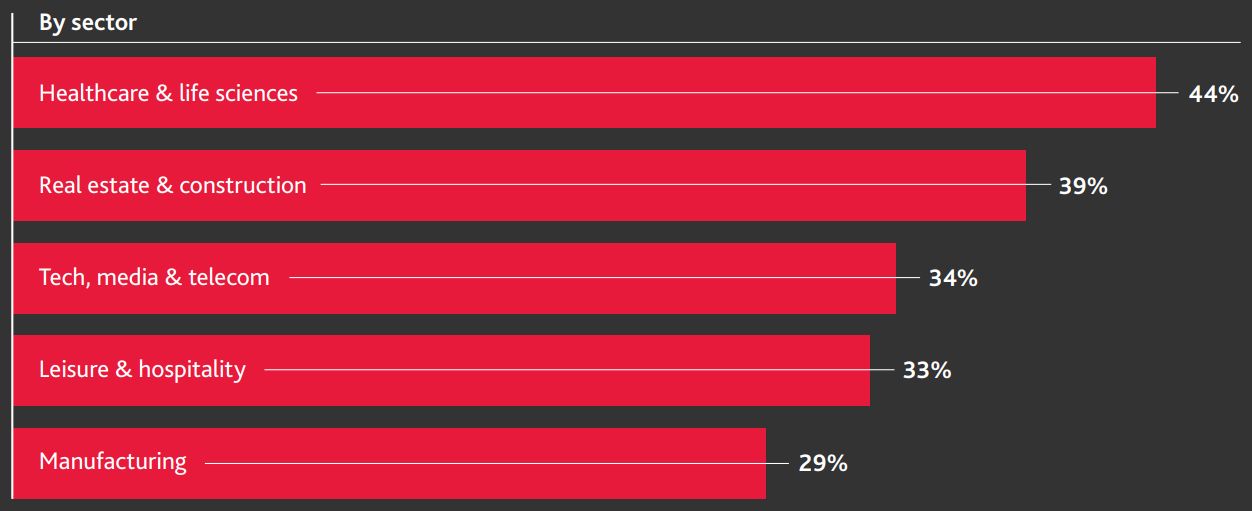

People risk is climbing the agenda once again. The most significant change to the results in the 2025 survey was the increase in concern about people and talent, with more than a quarter of global executives stating this as a top three risk, up from 12 per cent in 2024.

Interestingly, the concerns vary by sector, with healthcare and life sciences most concerned globally at 44 per cent, followed by real estate and construction 39 per cent and technology, media and telecommunication at 34 per cent.

Where is talent/people risk hitting hardest?

Some organisations are risk-averse around not complying, so that’s why they invest resources. If you actually unpack the cost of them not managing compliance, that cost could ultimately be much higher. In the end, compliance for compliance’s sake is not always commercially viable. It may constrain resource allocation for sound business outcomes. So, it’s a balance between managing regulatory risk and enabling organisations to achieve strategic objectives within acceptable risk parameters.

BDO’s global analysis can be explored in our global risk landscape report 2025.

Matt Williams, BDO Australia’s risk advisory services National Leader, has co-authored a whitepaper exploring the risks and attitudes of businesses for the Asia Pacific Region. The whitepaper details how the region is grappling with an evolving threat landscape.

Subscribe to receive the latest insights.