If you’re a business owner who has experienced business disruption due to COVID-19 and have business interruption (BI) insurance, you may be covered to recoup losses. However, with complexities surrounding this Black Swan event, one test case to clarify whether business interruption insurance policies cover losses from the COVID-19 pandemic has been recently decided and another is currently before the court – with outcomes not likely to be known for a couple of months. With this in mind, there are still steps that business owners can take immediately to ensure that they are protected to the fullest extent when outcomes are known. In this article, our specialists guide you on what to expect and their expert-led approaches to making a claim.

Waiting pattern - How did we get here?

Many of our clients have had to deal with business interruption (BI) due to COVID-19. In addition, COVID-19 financial impacts over the past 18 months, and estimating the impact to the future of your business are relevant for reporting your accounts and for stakeholder communications.

One of the ways businesses are mitigating the financial cost of interruptions is to determine whether are able to recover losses under their insurance policy. However, whether insurance policies cover BI caused by COVID-19 continues to be a topic of debate.

On Friday 25th June, the High Court denied the first test case – a request for special leave, around the interpretation of pandemic exclusions in some business interruption policies – which would see the Biosecurity Act treated as an amendment to the Quarantine Act.

This result means that insurers will now need to respond to affected customers who have lodged business interruption claims on a case-by-case basis. However, it’s expected most claims will not be finalised until the second test case provides further clarity. It’s expected this won’t be resolved till the end of August.

The Insurance Council says the second test case will determine the meaning of policy wordings concerning the definition of a disease, proximity of an outbreak to a business, and prevention of access to premises due to a government mandate, as well as policies that contain a hybrid of these type of wordings.

This scenario is being described in numerous updates by law firms and other professional advisors as a ‘waiting pattern’. Generally, the advice across the board has been a statement to the effect that we are in a waiting pattern for certain other pending cases and we could, or should, use that time to prepare ourselves to lodge our COVID-19 BI claims.

But what does this mean? And is it wise to start to prepare in the absence of (more) certainty that claims will be honoured?

In short, the answer is yes. It is essential policyholders protect their interests, and start building substantiation for a potential claim. There are several reasons for this which we elaborate on below. There is never absolute certainty that insurers will accept your claim should other cases play out favourably to insureds. However, without documentation built up at the appropriate time, the chances of insurers granting your claim decline considerably.

Therefore, our main advice to you is twofold:

1. Maintain contemporaneous documentation. To say that current times are ‘unprecedented’ and chaotic is an understatement and cliché by now, yet it is true. This is a trying time for businesses as they try to cycle through lock-downs, rebuild and recover. However, keeping careful records even during this time of disruption is critical.

Documentation around current market conditions, cancellations of sales, or supplier/customer impacts is critical evidence when preparing a business interruption claim once an appropriate precedent has been established. It is hard to (re-)create this information down the track, when a claim needs to be lodged, and such information will be less credible.

This documentation is critical in bolstering a claim, particularly when determining whether potential losses are attributable to the BI incident.

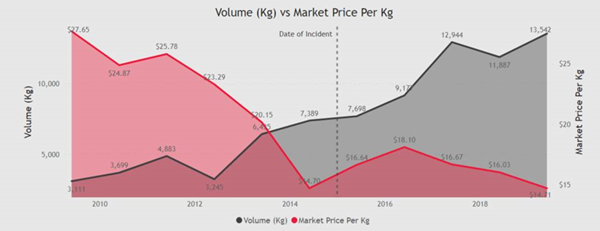

The BDO Forensic Team encountered a recent example of this where the financials evidenced a 20% loss post-incident. However, a deeper analysis of the sales data identified the loss was driven by declining market prices, rather than the actual BI incident.

Accordingly, it is important to maintain contemporaneous documentation in supporting the view that the loss is attributable to COVID-19, rather than other economic or market conditions that are not covered by the insurance policy.

Source: BDO Forensic. Visualisation of development of volume and market price in example substantiation of BI claim

2. Endeavour to mitigate losses. Where possible, you should attempt to mitigate your COVID-19 BI losses. It is a good business practice to mitigate losses, and this should be undertaken to help reduce the losses incurred as a result of any triggering event, at the time of the event.

What this means in practice is that you need to look at alternative ways to mitigate losses triggered by COVID now, rather than analysing this retroactively at the time when you are lodging the claim. If you do this, your claim will stand a better chance to be granted by the insurer.

Of course, it is important to understand if there is a basis for a potential claim in the first place, based on the insurance that you hold. In terms of the policy areas and associated wording that could cover a COVID-19 BI claim, we have compiled the below table to assist you:

Category |

Example Wording |

|

Act |

Quarantine Act – as noted the Act was subject to the first test case. |

|

Disease |

Cover you for the interruption due to an infectious or contagious human disease outbreak within a certain radius of the Premises. |

|

Prevention of Access |

Cover you for loss due to access to or use of the premises being prevented or hindered by any government action due to an emergency that could endanger human life or neighbouring property. |

|

Hybrid |

Cover loss arising from closure or evacuation of the whole or part of the premises by order of a competent government, public or statutory authority resulting from the outbreak of a notifiable human infectious or contagious disease occurring within a certain radius of the premises. |

|

Civil Authorities |

The word "Damage" under the Policy is extended to include loss resulting from or caused by any lawfully constituted authority in connection with or for the purpose of retarding any conflagration or other catastrophe. |

|

Loss of Attraction |

Loss as insured by the Policy resulting from interruption with the Business: by Authorities attempting to avoid or diminish the risk to life or property, which shall prevent or hinder the use thereof or access to the Premises. |

Precedence can also work in your favour when dealing with insurance companies – offering you some additional assistance with identifying the right policies and clauses to consider in your analysis.

Of course, the above information is compiled to be of general assistance and not specifically tailored to your individual circumstance. Do you need advice on or assistance with building your COVID-19 insurance claim? Contact your local BDO Adviser.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in Australia to discuss these matters in the context of your particular circumstances.

BDO Australia Ltd and each BDO member firm in Australia, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this publication nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the

information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded.

BDO Services Pty Ltd ABN 45 134 242 434 is a member of a national association of independent entities which are all members of BDO Australia Ltd ABN 77 050 110 275, an Australian company limited by guarantee. BDO Services Pty Ltd and BDO Australia Ltd are members of BDO International Ltd, a UK company limited by guarantee, and form part of the international BDO network of independent member firms. Liability limited by a scheme approved under Professional

Standards Legislation.

BDO is the brand name for the BDO network and for each of the BDO member firms.

© 2021 BDO Services Pty Ltd. All rights reserved.