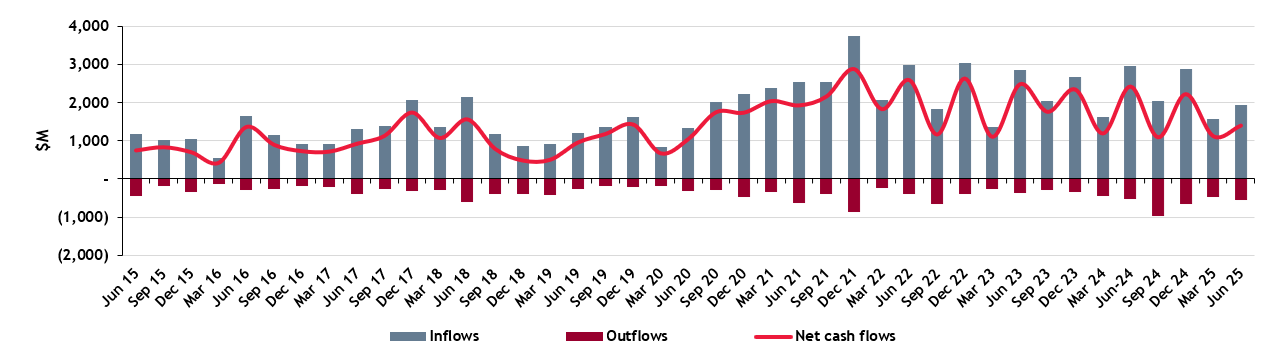

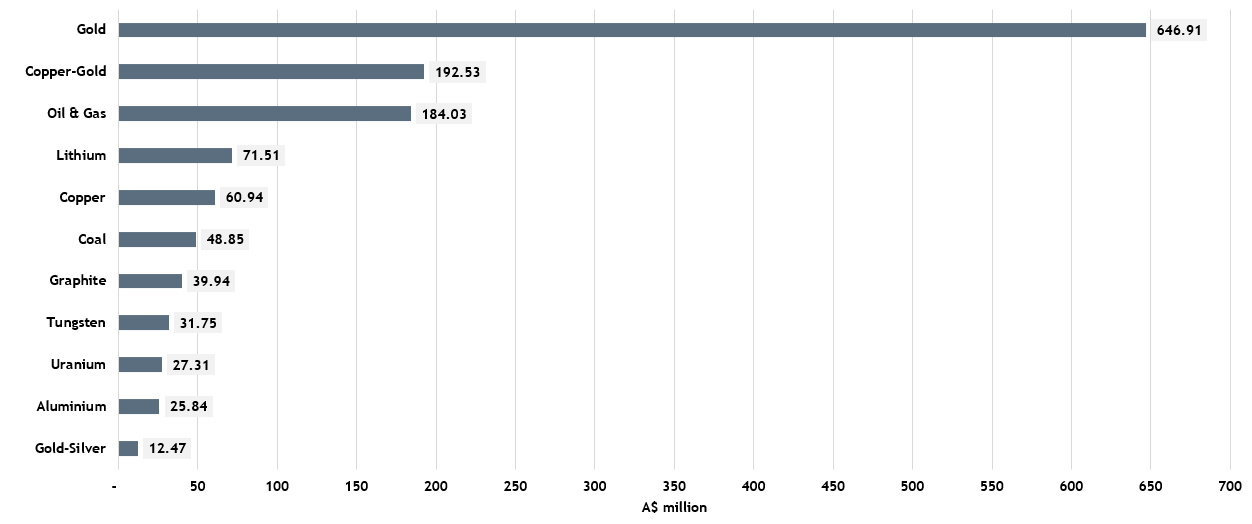

With inflation easing and interest rates potentially peaking, investor confidence is building, especially in gold, copper-gold, and critical minerals. The resurgence in exploration expenditure and the increase in financing inflows suggests that the sector is beginning to turn a corner, albeit gradually.

Gold

Gold