With capital raising and exploration activity in decline, the sector faces mounting pressure, yet gold’s safe-haven appeal and financing strength remain a stabilising force in an otherwise cautious landscape.

Since its inception in 2014, BDO’s Explorer Quarterly Cash Update has become a trusted barometer of Australia’s exploration sector's financial health. Over the past decade, BDO’s natural resources & energy team has tracked the evolving dynamics of capital flows, investor sentiment, and exploration activity across the ASX-listed junior mining landscape.

In the video below, Global Natural Resources & Energy Leader, Sherif Andrawes, provides an overview of the March 2025 quarter. Watch now.

With capital raising and exploration activity in decline, the sector faces mounting pressure, yet gold’s safe-haven appeal and financing strength remain a stabilising force in an otherwise cautious landscape.

Our latest report for the March 2025 quarter reveals a number of trends, including:

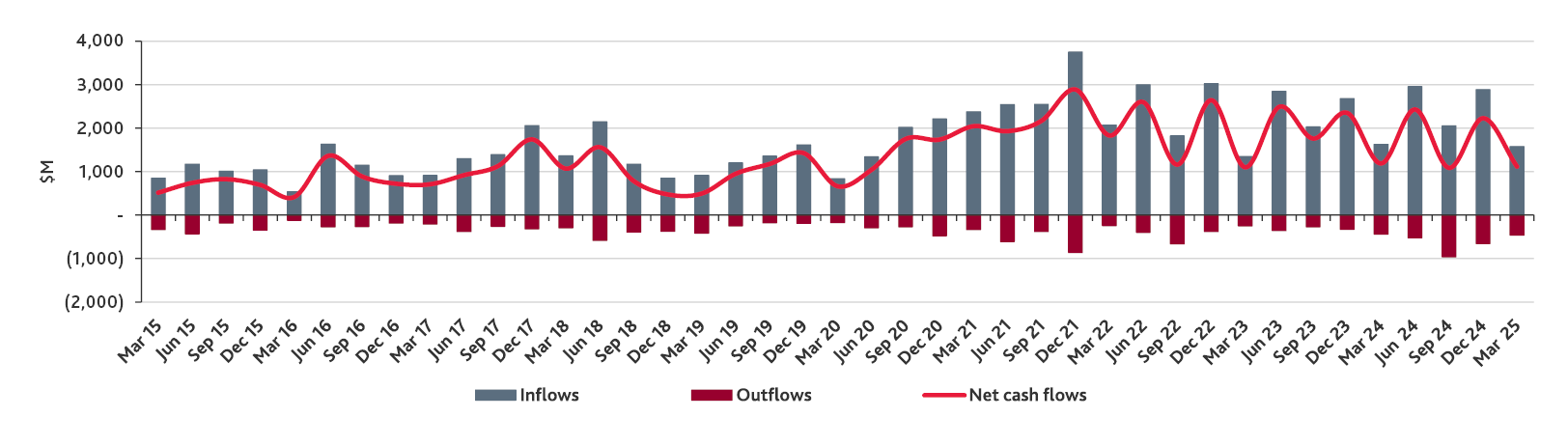

Financing cash inflows dropped to $1.57 billion in the March 2025 quarter, a 45 per cent decline from the previous quarter. Average inflows per company also fell below the two-year trend. Even after adjusting for a one-off reclassification, the quarter recorded the lowest financing inflows since June 2019 and the weakest net inflows since March 2020.

Figure 1: ASX explorers' financing cash flows ($M)

Source: ASX Appendix 5B's of the companies and BDO analysis

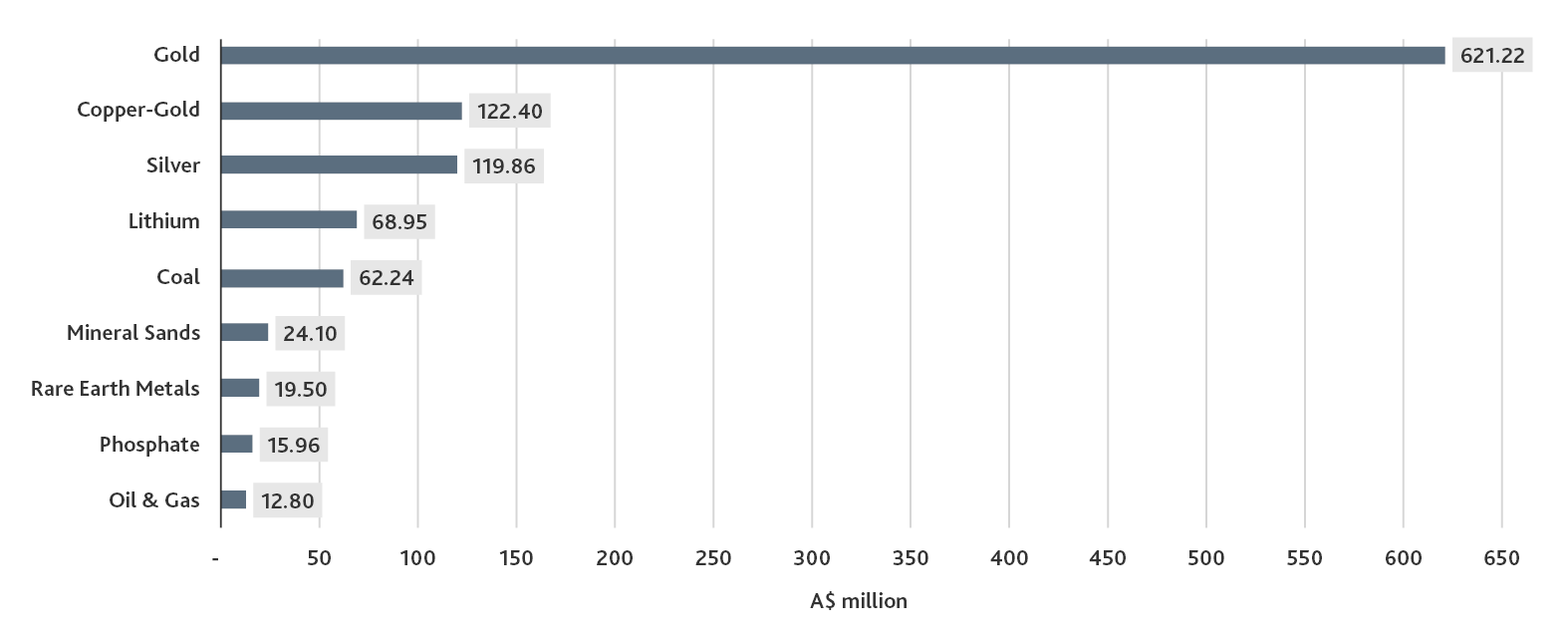

Gold reasserted its dominance in the March 2025 quarter, attracting $621.22 million in financing, more than double the previous year, highlighting its continued appeal as a safe-haven asset amid uncertainty. In contrast, commodities like uranium, lithium, and oil and gas saw sharp declines in funding, reflecting shifting investor sentiment and broader macroeconomic and policy pressures.

Figure 2: Financing inflow by commodity - Top 26 explorers - March quarter 2025

Source: ASX Appendix 5B's of the companies and BDO analysis

Each quarter, BDO reports on the exploration companies that have raised funds of $10 million or more (which we have termed ‘Fund Finders’). The top ten largest fundraisers for the March 2025 quarter are listed below:

Gold

Gold

$279.7 million in proceeds from the maturing of term deposits

$279.7 million in proceeds from the maturing of term deposits

Silver

Silver

$79.91 million in proceeds from issue of equity securities, and

$79.91 million in proceeds from issue of equity securities, and

$39.95 million in proceeds from a concentrate prepayment agreement

$39.95 million in proceeds from a concentrate prepayment agreement

Copper-Gold

Copper-Gold

$95.1 million in proceeds from issues of equity securities

$95.1 million in proceeds from issues of equity securities

Gold

Gold

$69.2 million in proceeds from issues of equity securities

$69.2 million in proceeds from issues of equity securities

Gold

Gold

$53 million in proceeds from issues of equity securities, and

$53 million in proceeds from issues of equity securities, and

$1.53 million in proceeds from the exercise of options

$1.53 million in proceeds from the exercise of options

Gold

Gold

$35.5 million in proceeds from issues of equity securities, and

$35.5 million in proceeds from issues of equity securities, and

$7.94 million in proceeds from borrowings

$7.94 million in proceeds from borrowings

Gold

Gold

$39.9 million in proceeds from issues of equity securities

$39.9 million in proceeds from issues of equity securities

Lithium

Lithium

$39.1 million in proceeds from issues of equity securities

$39.1 million in proceeds from issues of equity securities

Coal

Coal

$31.2 million in proceeds from issues of equity securities

$31.2 million in proceeds from issues of equity securities

Gold

Gold

$28.17 million in proceeds from the exercise of options

$28.17 million in proceeds from the exercise of options

*Foreign-currency denominated inflows converted using the prevailing exchange rate as of 31 March 2025

Since 2014, BDO has proudly published our quarterly Explorer Report, providing insights into the performance and trends shaping Australia’s exploration sector. If you’d like to discuss this quarter’s findings or find out how BDO can support your needs in the natural resources sector, contact us.

Find out more about our Natural Resources & Energy services.

Subscribe to receive the latest insights.