IFRS 16 is not ‘set and forget’

Once you pick an appropriate transition method and get to the initial date of application, IFRS 16 does not end there. You must keep your lease information current throughout the year.

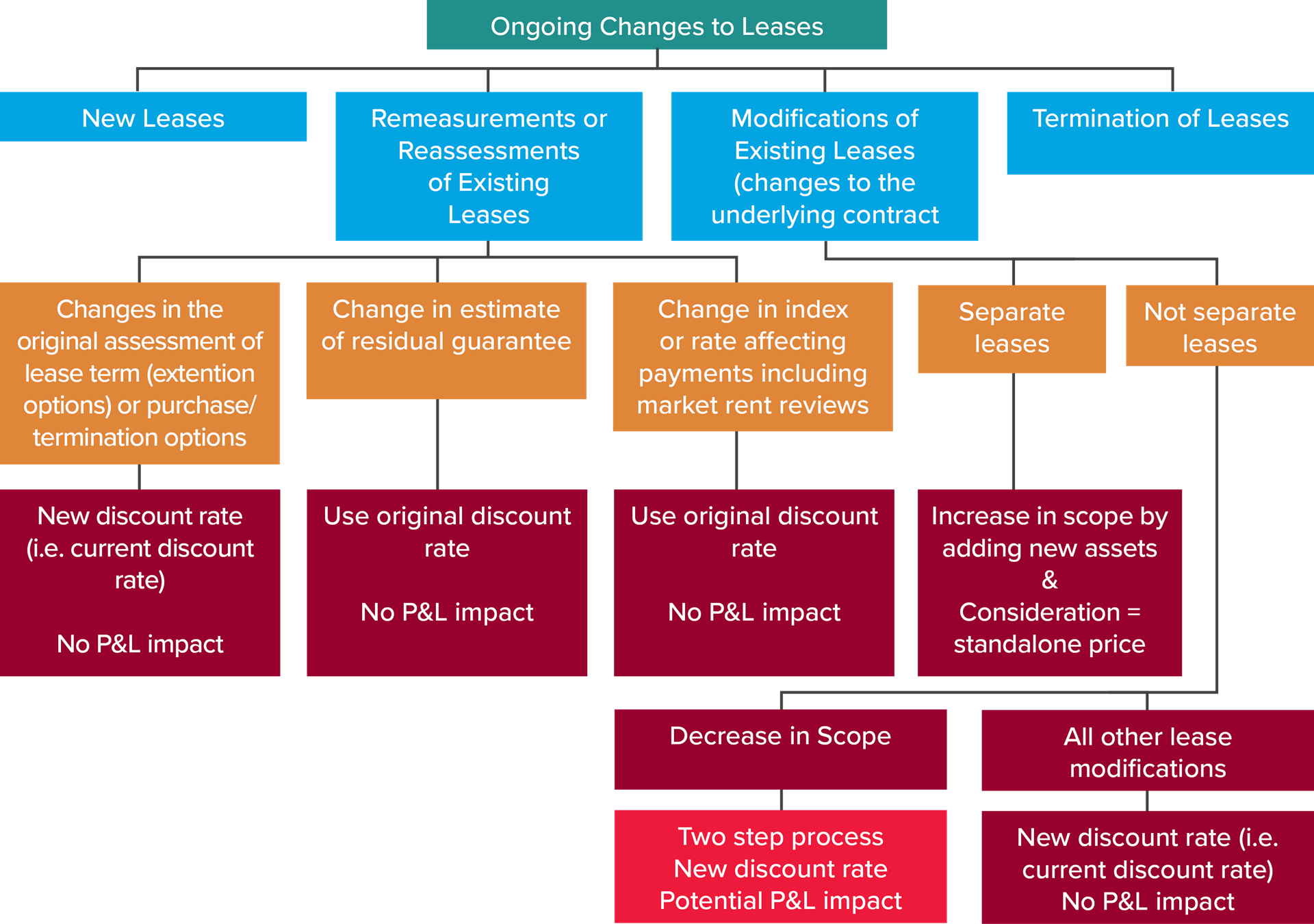

These ongoing changes can be generally grouped into the following four categories and numerous subcategories, which all lead to different accounting outcomes:

It is vital any change in a lease arrangement, whether formally agreed with the lessor or not, is treated with the above categories no matter how complicated, as they lead to different accounting outcomes.

How BDO can help

For more information on the on-going changes of leases, including reassessments and modifications, watch our February 2020 webinar: On-going reassessments and modifications.

The three transitional methods are also discussed on pages 38 to 44 of our BDO IFRS in Practice re IFRS 16.