Accounting for impairment of assets (IAS 36)

With the deadline for moving to general purpose financial reporting approaching fast, entities need to be familiar with all the recognition and measurement requirements of Australian Accounting Standards because general purpose financial statements (GPFS) require the application of all Australian Accounting Standards. With this in mind, Accounting News is tackling one topic at a time.

- Six accounting surprises when buying a business (April 2021)

- Consolidated financial statements – when are they required? (May 2021)

- Accounting for joint arrangements (June 2021)

- Accounting for associates (July 2021)

- Fair value measurement (August 2021)

- When is the acquisition of a business accounted for as a business combination? (September 2021)

- Accounting for business combinations – the acquisition method (October 2021).

Which Accounting Standard applies?

IAS 36 Impairment of Assets is the Accounting Standard that describes the requirements for impairment testing of assets if not covered by other specific Accounting Standards. It can therefore be a little confusing deciding whether IAS 36 applies or not.

IAS 36 does not apply

The following assets are excluded from the scope of IAS 36, with impairment requirements for these assets dealt with in specific Accounting Standards as shown below:

- Inventories (IAS 2)

- Contract assets (IFRS 15)

- Deferred and current tax assets (IAS 12)

- Assets arising from employee benefits (IAS 19)

- Financial assets (IFRS 9)

- Investment property measured at fair value (IAS 40)

- Biological assets at fair value less costs to sell (IAS 41)

- Insurance contracts (IFRS 4 or IFRS 17)

- Non-current assets or disposal groups classified as held for sale (IFRS 5).

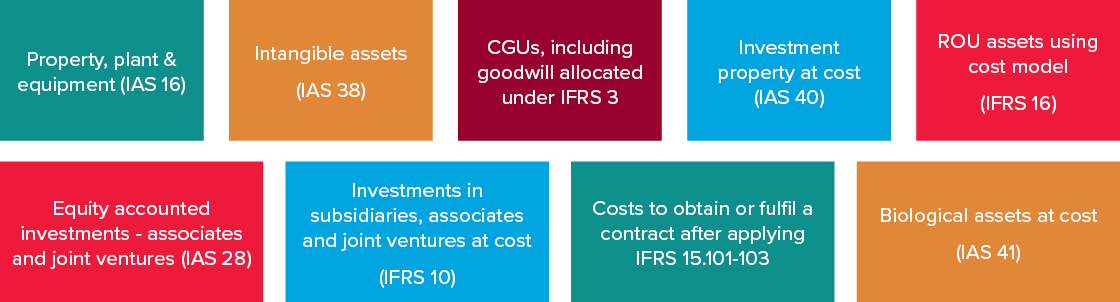

IAS 36 does apply

However, IAS 36 does apply to the following:

When is an asset impaired?

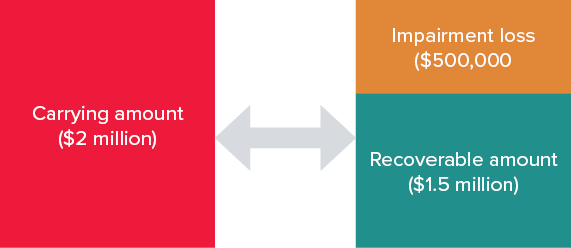

An asset is impaired if its carrying amount exceeds its recoverable amount.

Carrying amount is the amount at which an asset is recognised in the financial statements, after deducting any accumulated depreciation/amortisation and any accumulated impairment losses.

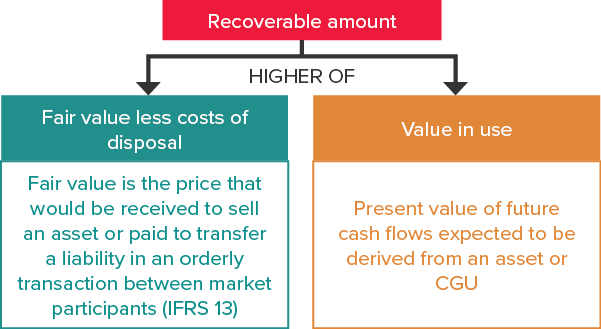

Recoverable amount is the higher of fair value less costs of disposal and value in use.

Identifying an asset that may be impaired

At the end of each reporting period (including half-years for entities reporting twice a year), an entity must assess whether there is any indication that an asset may be impaired. If impairment indicators are identified, the entity must estimate the recoverable amount of the asset, and an impairment loss is recognised for any shortfall between the carrying amount and the recoverable amount.

For many types of assets, recoverable amount need only be determined if there are impairment indicators. However, a mandatory impairment test is required (i.e. recoverable amount must be estimated) annually for the following assets:

- Goodwill acquired in a business combination

- Intangible assets with an indefinite useful life, and

- Intangible assets not yet available for use.

The annual impairment test may be performed at any time during an annual period, but must be performed at the same time every year.

What are impairment indicators?

When determining whether there are any indicators of impairment, entities need to consider, as a minimum, the external and internal sources of information listed in paragraph 12 as shown below.

| External sources | Internal sources |

| Observable indications that the asset’s value has declined significantly more during the period than expected. | Evidence of obsolescence or physical damage to the asset. |

| Significant changes with adverse effects on the entity have taken place during the period, or will take place in the near future, in the technological, market, economic or legal environment. | Significant changes with adverse effects on the entity have taken place during the period, or are expected to take place in the near future, which may affect the extent or how the asset is used (e.g. assets becoming idle, restructuring, plans to dispose of assets early and reassessing useful life as finite rather than indefinite). |

| Increases in market interest rates (i.e. likely to increase the discount rate used to calculate the asset’s value and therefore decrease recoverable amount). | Internal reporting indicates that the economic performance of an asset is, or will be, worse than expected. |

| Carrying amount of net assets of the entity is more than its market capitalisation (e.g. for listed entities). |

Dividends received from subsidiaries, joint ventures or associates

If an entity (investor) receives a dividend from a subsidiary, associate or joint venture (the investee) that it measures at cost in its separate financial statements, it must also consider whether there are impairment indicators. This could occur, for example, where:

- The carrying amount of the investment in the investor’s separate financial statements is greater than the carrying amount of the investee’s net assets (including goodwill) in the investor’s consolidated financial statements, or

- The dividend is greater than the total comprehensive income of the investee in the period the dividend is declared.

That is, impairment indicators could exist where the subsidiary, associate or joint venture effectively pays a pre-acquisition dividend to the investor.

Measuring recoverable amount of an asset or a cash-generating unit

As noted above:

- Recoverable amount is the higher of fair value less costs of disposal and value in use, and

- An impairment loss is recognised if carrying amount exceeds recoverable amount.

The requirements for measuring recoverable amount in IAS 36 refer to ‘an asset’; however, they apply equally to an individual asset or a cash-generating unit (CGU). If an individual asset does not generate cash flows that are largely independent from other assets or groups of assets, the entity must determine recoverable amount for the CGU to which it belongs.

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

Definition of ‘cash-generating unit’ in IAS 36CGUs should not be too large

In practice, care is required to ensure that an entity’s CGUs are not too large (i.e. that they are appropriately disaggregated, and are not larger than the operating segments identified for the purposes of internal reporting). If CGUs are too large, favourable performance of one part of the business may inappropriately mask poor performance of another, resulting is an overstatement of net assets, and an understatement of impairment losses.

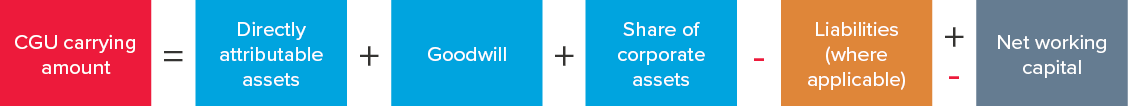

Determining carrying amount of a CGU

Determining the carrying amount for an individual asset is usually quite straightforward but is more complicated for a CGU, which includes a variety of individual assets (including goodwill). The carrying amount of a CGU is calculated as follows:

It is important to remember that corporate assets also contribute to cash flows generated by a CGU and are therefore included as part of the carrying amount of a CGU if their carrying amount can be allocated to the CGU on a reasonable and consistent basis. If not, a complicated process applies (as outlined in paragraph 102(b)).

Liabilities are only deducted from the carrying amount of a CGU, for example, when a potential buyer of the CGU would be required to assume the liability, such as for leases or restoration obligations.

Significant deferred tax liabilities recognised as part of a business combination increases the amount of goodwill recognised which may mathematically result in an immediate impairment of goodwill. In practice, these deferred tax liabilities are often included in the carrying amount of the related CGU, meaning that there is no immediate impairment loss.

Entities have a choice whether to include or exclude working capital balances from the carrying amounts of a CGU, so long as there is a consistent application to the inclusion or exclusion of cash flows from working capital items in determining the CGU’s recoverable amount.

Fair value less costs of disposal

As recoverable amount is the higher of fair value less costs of disposal and value in use, it is important to understand the difference between these two measures.

Fair value for the asset or CGU is determined in accordance with IFRS 13 Fair Value Measurement. Refer to our August 2021 Accounting News article for more information.

Value in use

Value in use differs from fair value because it reflects factors specific to the entity that do not apply to market participants in general, such as synergies and legal rights and restrictions specific only to the owner of the asset.

The discounted cash flow (DCF) model used to calculate an asset/CGU’s value in use includes five elements (assumptions):

- Estimated future cash flows expected to be derived from the asset/CGU

- Expectations about possible variations in amount or timing of future cash flows

- Time value of money (i.e. discount rate)

- Price for bearing uncertainty inherent in asset, and

- Other factors such as illiquidity that market participants would reflect in pricing the future cash flows expected to be derived from the asset.

Developing these assumptions requires a significant degree of estimation and judgement. Elements (b), (c) and (d) above can be reflected either as adjustments to future cash flows or as an adjustment to the discount rate.

For more information on the use of present value techniques to measure value in use, refer to Appendix A in IAS 36, and/or section 4.4 of BDO’s IFRS in Practice – IAS 36.

Estimating future cash flows

Key things to bear in mind when estimating future cash flows include:

- Cash flow projections should be based on pre-tax cash flows

- Cash flow projections must be based on the most recent financial budgets/forecasts approved by management

- Assumptions must be reasonable and supportable (giving greater weight to external evidence)

- Projections should be for a maximum period of five years unless a longer period is justified

- Projections for the period beyond the most recent/budgets or forecasts should use a steady or declining growth rate for subsequent years, and should not exceed the long-term average growth rate

- Cash flows from financing activities must be excluded

- Cash flows are estimated in the currency in which they are generated.

IAS 36 is clear that future cash flows must be estimated for an asset in its current condition, therefore the following cash flows are excluded when estimating future cash flows:

- From a future restructuring to which an entity is not committed, and

- From improving or enhancing an asset’s performance.

Discount rate

The discount rate used to discount the estimated cash flows in a value in use calculation must reflect the current market assessment of the time value of money, and risks specific to the asset for which future cash flow estimates have not been adjusted.

The rate is meant to represent the return that market investors would require when choosing an equally risky investment. The discount rate is usually not observable in the market meaning that a model or formula needs to be used. One of the more common models that is used in practice is the weighted average cost of capital (WACC), which is explained in more detail in section 4.4.2 of BDO’s IFRS in Practice – IAS 36.

CGUs and goodwill

If recoverable amount cannot be estimated for an individual asset, recoverable amount is calculated for the CGU to which the asset belongs. The composition of CGUs should be consistent from period to period unless a change is justified.

If a CGU mainly produces output for internal use, and internal transfer pricing affects cash inflows, it is nevertheless tested for impairment as a separate CGU if an active market exists for the output produced. In such cases, management estimates future prices for cash inflows on an arm’s length basis.

It is vital that the carrying amount of the CGU is determined on a consistent basis with the way the recoverable amount is calculated. Refer above for more information.

Allocating goodwill to CGUs

Goodwill acquired in a business combination must be allocated from acquisition date to each of the acquirer’s CGUs (or groups of CGUs) that are expected to benefit from the synergies of the business combination. Assets and liabilities of the acquiree do not necessarily need to have been allocated to the same CGU(s). If provisional accounting is applied to goodwill, initial allocation of goodwill must be completed before the end of the first annual period, which begins after the acquisition date.

Each CGU (or group of CGUs) to which goodwill is allocated must:

- Be the lowest level within the entity at which goodwill is monitored for internal management purposes, and

- Not be larger than an operating segment under IFRS 8 Operating Segments.

Entities that aggregate operating segments for reporting purposes must ensure that goodwill is allocated to a CGU (or group of CGUs) at the level of the operating segment, and not the higher-level reportable segment.

Disposals of operations within a CGU

If an entity disposes of an operation within a CGU, the goodwill associated with the operation that is sold is included in the carrying amount of the operation when determining the gain/loss on disposal. The allocation of goodwill is usually based on the relative fair values of the operation sold and the portion of the CGU retained.

Reorganisations

If an entity reorganises its reporting structure such that the composition of CGUs changes, goodwill is reallocated using a similar relative fair value approach to that used for disposals of operations within a CGU.

Impairment losses for a CGU

An impairment loss is only recognised for a CGU if its recoverable amount is less than its carrying amount. It is allocated in the following order:

- Firstly, reduce the carrying amount of goodwill allocated to the CGU, and

- Then reduce the carrying amount of other assets in the CGU on a pro rata basis.

It is important to note that the carrying amount of an asset after any impairment write-down cannot be less than the higher of its fair value less costs of disposal and value in use. Nor can it be less than zero. Any excess impairment loss will instead be allocated pro rata to other assets in the CGU.

Reversing impairment losses

At the end of each reporting period, entities must assess whether there is any indication that a previous impairment loss recognised for an asset (other than goodwill) may no longer exist, or may have decreased. If such indication exists, the recoverable amount must be estimated for that asset.

Impairment losses on goodwill can never be reversed, including impairment losses recognised for goodwill during interim reporting periods, which reverse prior to the end of the annual reporting period (refer IFRIC 10 Interim Financial Reporting and Impairment).

Reversals of impairment losses cannot result in the carrying amount of an asset (other than goodwill) being higher than it would have been (net of depreciation/amortisation) had no impairment loss been recognised in prior years.

Reversals of impairment losses are recognised in profit or loss, unless the asset is carried at a revalued amount under IAS 16 Property, Plant and Equipment, and the impairment loss reverses a previous revaluation decrease recognised in other comprehensive income.

More information and assistance

IAS 36 is a long and complex standard, with many intricacies, and this article provides a high-level summary only. Please refer to our IFRS in Practice – IAS 36 for more information or contact a member of BDO’s IFRS & Corporate Reporting team if you require assistance developing your impairment models.