For years ending 30 June 2022 onwards, AFS licensees must prepare and lodge GPFS with ASIC to meet their reporting obligations under both Chapter 2M and Chapter 7 of the Corporations Act 2001.

Chapter 2M reporting

For Chapter 2M reporting purposes, AFS licensees must either lodge:

- Tier 1 GPFS if the entity has ‘public accountability’ according to the definition in AASB 1053 Application of Tiers of Accounting Standards or

- Tier 2 (Simplified Disclosures).

Chapter 7 reporting

For Chapter 7 reporting, in June 2022, ASIC deemed certain AFS licensees to have ‘public accountability’ under the certification section of Form FS 70. These entities must prepare Tier 1 GPFS, even though they do not have ‘public accountability’ under AASB 1053 and would ordinarily have prepared Tier 2 (Simplified Disclosures) GPFS.

Form FS 70 provides transitional relief for this additional reporting burden over two years, provided the licensee:

- Was not a reporting entity and prepared special purpose financial statements (SPFS) for 31 December 2021

- Does not have ‘publicly accountability’ according to the definition in AASB 1053.

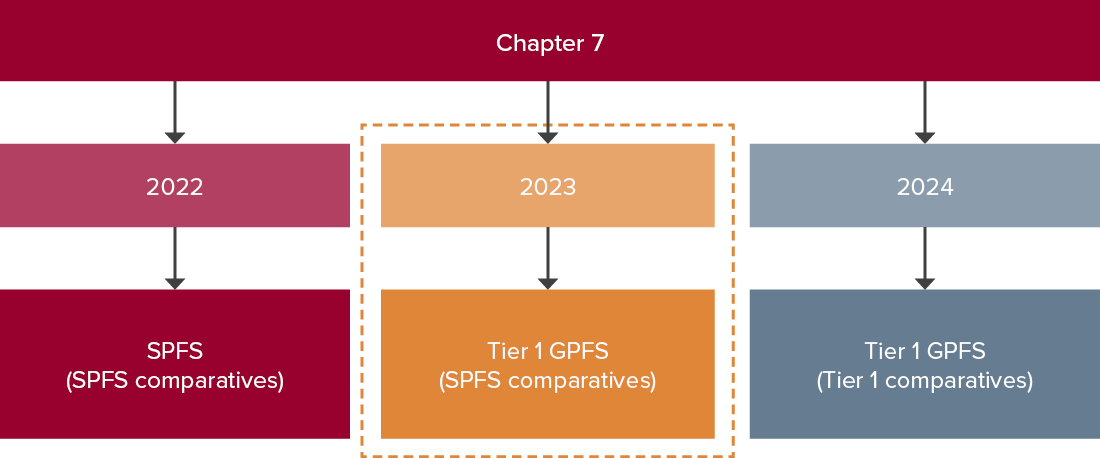

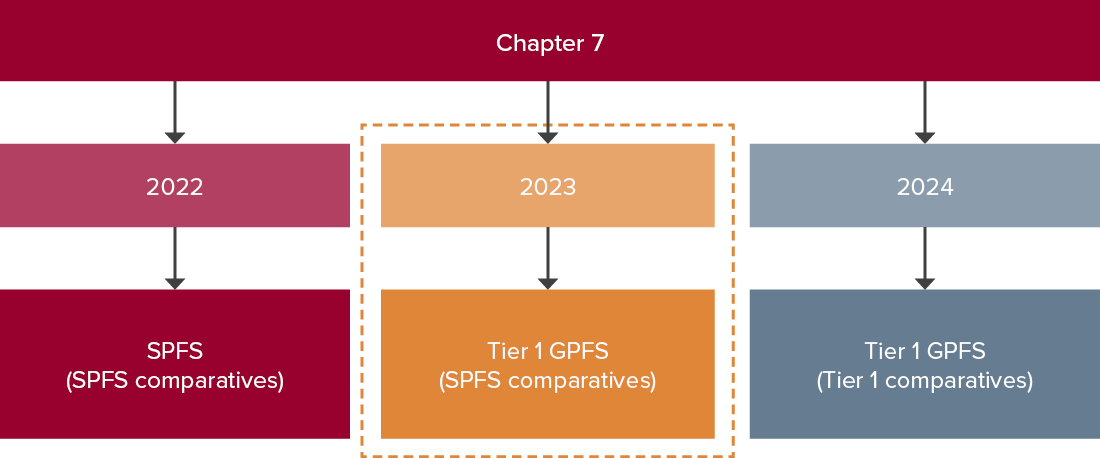

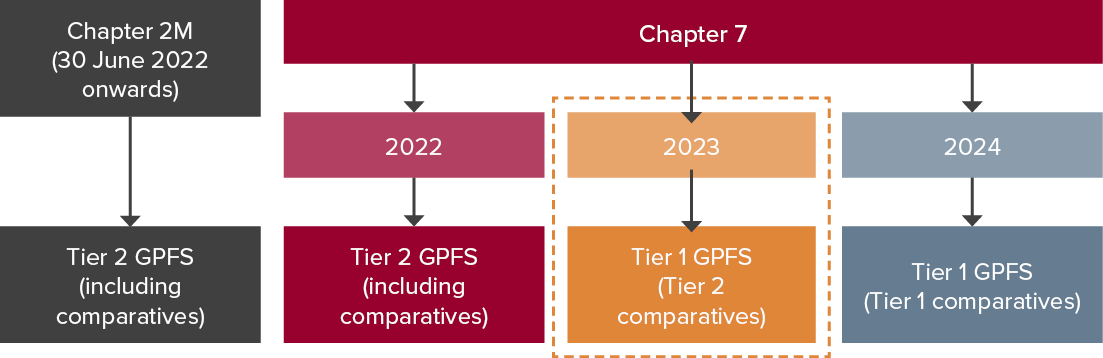

The diagram below shows how entities applying the transitional relief and reporting only under Chapter 7, will prepare Tier 1 GPFS for 31 December 2023, but present SPFS comparatives for the year ended 31 December 2022.

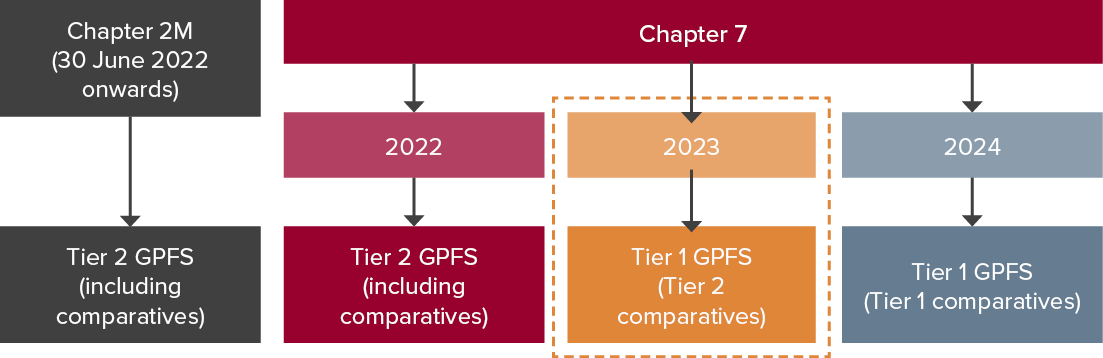

Entities applying the transitional relief but reporting under both Chapter 7 and Chapter 2M will prepare Tier 1 GPFS for 31 December 2023, but present Tier 2 comparatives for the year ended 31 December 2022. This is illustrated below.

You can find a more in-depth discussion on AFS licensee reporting requirements in our previous article.