What impact will business combinations have on your lease accounting and discount rates?

What impact will business combinations have on your lease accounting and discount rates?

Since the new lease standard, IFRS 16 Leases, has been effective for several years, acquirers in a business combination may incorrectly assume that post-combination, the acquiree’s lease accounting continues as usual. While this may be true for the acquiree’s lease accounting in its separate financial statements, the same is not true for the acquirer’s accounting in its consolidated financial statements. In particular, discount rates may change, and the lease term may differ because the likelihood of extension or termination options being exercised may vary .

Acquiree’s leases are new leases

IFRS 3 Business Combinations contains specific requirements for the acquirer to measure the acquiree’s lease liabilities and right-of-use assets at acquisition date.

The acquirer shall measure the lease liability at the present value of the remaining lease payments (as defined in IFRS 16) as if the acquired lease were a new lease at the acquisition date. The acquirer shall measure the right-of-use asset at the same amount as the lease liability, adjusted to reflect favourable or unfavourable terms of the lease when compared with market terms.

IFRS 16, paragraph 28B

The acquirer, in its consolidated financial statements, therefore, treats each of the acquiree’s leases as a new lease and will have to:

- Determine the lease term and whether it is reasonably certain for the acquirer group to exercise any extension or termination options

- Determine the appropriate discount rate, which is the incremental borrowing rate (IBR) if the interest rate implicit in the lease cannot be readily determined

- Remeasure the lease liability using the revised lease term, payments and discount rate as inputs

- Remeasure the right-of-use asset using the revised lease liability as a starting point and adjust it to reflect favourable or unfavourable terms.

What is the appropriate discount rate?

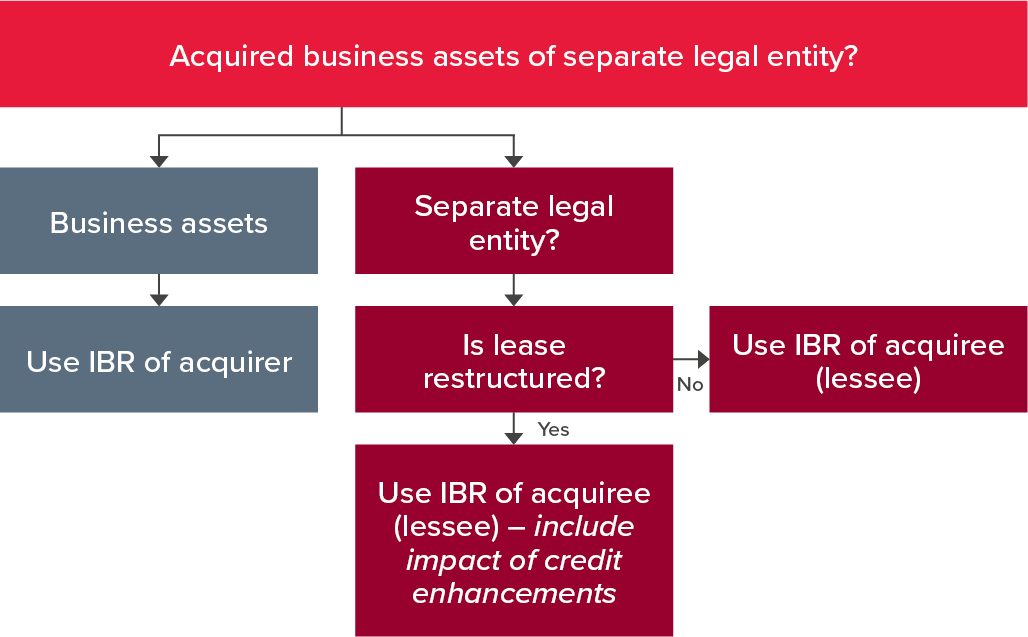

Business combination accounting is from the acquirer’s perspective, so using the acquirer’s IBR to remeasure the lease liability at the acquisition date would seem intuitive. However, this is only sometimes true. The table below illustrates how the acquirer determines the appropriate IBR when discounting the acquiree’s lease liabilities at the acquisition date.

Acquisition of business assets, and not a separate legal entity

If the business combination involves an ‘asset purchase’ rather than the acquisition of a separate legal entity, the lease contract will need to be assigned/novated to the acquirer, who becomes the new lessee.

The acquirer’s IBR at acquisition date will be used because the acquirer is the lessee.

Acquisition of business – purchase of separate legal entity – no restructure (modification) of lease

If the business combination involves acquiring a separate legal entity, the acquiree’s leases generally continue until the lease terminates (assuming the lease is not restructured). This means that the lease remains in the name of the acquiree, and the discount rate to be applied to the revised lease payments is the IBR of the acquiree (lessee).

This is consistent with the Basis for Conclusions to IFRS 16, BC160 which says:

‘The IASB’s objective in specifying the discount rate to apply to a lease is to specify a rate that reflects how the contract is priced.’

Even though this is a new lease from the perspective of the acquirer, initial recognition is still driven by the guidance in IFRS 16.

The acquiree (lessee’s) IBR at acquisition date is used because the acquiree remains the lessee. The acquiree cannot default to using its new parent’s IBR in its separate financial statements. The group cannot use the parent’s IBR in the consolidated financial statements.

Acquisition of business – purchase of separate legal entity – restructure (modification) of lease at acquisition date to include acquirer guarantees

Suppose the lease is simultaneously restructured at the time of the business combination to take account of credit enhancements provided by the acquirer (e.g. guarantees to lessor by the parent). In that case, the acquirer’s IBR may be relevant in determining the lessee’s (acquiree’s) IBR rate at the acquisition date.

Two sets of books

The requirements in IFRS 3, paragraph 28B result in acquired entities having to maintain two sets of books because the same lease will be shown in the acquiree’s and the group’s financial statements at different amounts. This is best illustrated using this basic example below.

Even if the acquiree is not required to prepare and lodge financial statements, it is still required to keep appropriate books and records, so accounting from its perspective, must still be maintained.

Example

Small Co entered a ten-year lease for office premises on 1 January 20X1. Annual rent, payable in arrears is $1,000. The IBR of Small Co on 1 January 20X1 is 6.5%. There are no extension or termination options in this lease. The right-of-use (ROU) asset is amortised on a straight-line basis over ten years.

On 1 January 20X3, Small Co was acquired by the Big Co Group. At the acquisition date, it is determined that the IBR of Small Co reduces to 5%. There is no change to the useful life of the ROU asset (i.e. amortisation continues on a straight-line basis over the remaining eight years of the lease).

Assume that the lease payments are at market rates; therefore, the group requires no adjustment to the ROU asset for the unfavourable or favourable element compared to market rates.

The following table illustrates how amounts recognised in the separate financial statements of Small Co and the consolidated financial statements of the Big Co Group on 1 January 20X3 (acquisition date) and 31 December 20X3 are different. The business combination, therefore, results in ongoing adjustments made in the group accounts until the end of the lease.

|

|

Small Co |

Big Co Group |

|

1 January 20X3 - Balance sheet |

|

|

|

ROU asset |

5,751 |

6,463 |

|

Lease liability |

6,089 |

6,463 |

|

31 December 20X3 – Profit or loss |

|

|

|

Amortisation of ROU asset |

719 |

808 |

|

Interest expense |

396 |

323 |

|

31 December 20X3 - Balance sheet |

|

|

|

ROU asset |

5,032 |

5,655 |

|

Lease liability |

5,485 |

5,786 |

More information

You can find out more about the practical implications of applying IFRS 16 in our recently updated IFRS in Practice publication.

Need help?

Acquirers having to maintain separate books and records for all leases acquired as part of a business combination is a complex and time-consuming process. This is where BDO Lead and BDO Lease Management Services can assist. Please contact a member of BDO’s IFRS & Corporate Reporting team if you require assistance.