Criminalisation of wage underpayment: What employers need to know

Criminalisation of wage underpayment: What employers need to know

The criminalisation of intentional wage underpayment (or wage theft) came into effect on 1 January 2025, making it a federal criminal offence. This includes cases where intentional underpayments form part of a course of conduct that commenced before 1 January 2025.

It is therefore critical that employers are aware of and compliant with paying their employees the correct Instrument entitlements. Employers need to be confident in historical, current, and future payments made to employees and actively implement changes as they arise.

What is wage theft?

Wage theft occurs when employees are not paid their legal entitlements. This is impacted by national employment standards, employment contracts, modern awards, and enterprise agreements. While the phrase wage theft appears harsh, it conveys two important factors:

- Employers must pay their workforce their legal entitlements

- The criminalisation of wage theft involves large fines and potential jail time.

Employers will commit an offence if they intentionally engage in conduct that results in the failure to pay the employees their entitlements.

What are the penalties?

The Fair Work Ombudsman (FWO) can investigate suspected criminal underpayment offences as well as refer suitable identified matters of this nature for criminal prosecution.

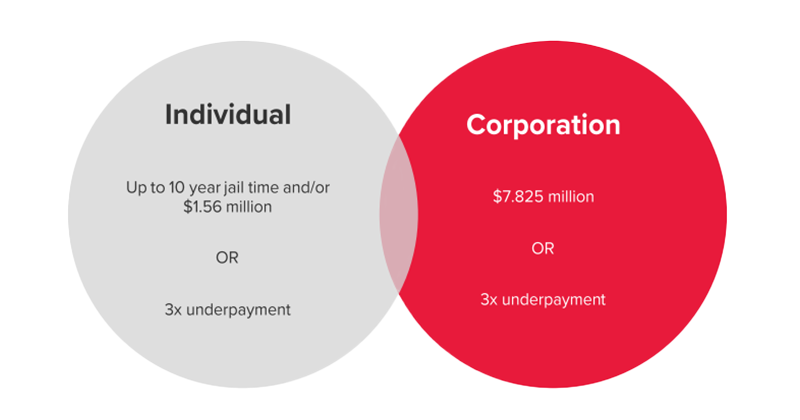

Should an individual or organisation be convicted of a criminal offence, high penalties can apply, including fines, jail time, or both.

- Individuals - Up to 10 years imprisonment and/or $1.65 million, or three times the underpayment amount

- Corporations - Up to $8.25 million or three times the underpayment amount.

While the quoted dollar amounts appear significant, triple the underpayments would easily eclipse these in many of the total underpayment amounts seen in the media.

This represents a real signal of intent to an ongoing crackdown on compliance, which has been evident in recent years.

Employers who make voluntary disclosures regarding conduct that could be deemed as a criminal offence can seek to enter into a written cooperation agreement with the FWO (at their discretion), which can prevent the referral for possible criminal prosecution.

Was there intent?

An employer may commit a criminal offence where they:

- Were required to pay an amount to an employee such as salary/wages or paid leave entitlements or an amount on behalf of the employee, such as superannuation or a salary sacrifice arrangement

- Have intentionally performed actions (or failed to perform an action) which intentionally results in these amounts not being paid on, or before, the date they were due.

Specificity around these actions is understandably vague at this point, however time will tell.

While these penalties relate to intentional underpayments, significant penalties can still apply if the conduct is accidental.

How BDO can help

Pay compliance, particularly Pay Against Award/Enterprise Agreement compliance, is an increasingly important consideration for employers - with errors proving both costly and time-consuming to resolve. Employers are encouraged to remain proactive and conduct regular audits to ensure compliance and address any discrepancies promptly to avoid penalties and reputational damage.

Our payroll advisory team can resolve uncovered issues and help you do the right thing for your employees. We work with employment lawyers to manage the correct interpretation of grey areas and ensure our clients are best protected from penalties and reputational damage. Where remediation is necessary, we will support you through the process and help you project manage and deliver underpayments to former employees. We will also help you manage sensitive communications with your employees to ensure you maintain goodwill.

For further information, including how BDO can assist, refer to our article, 'The risk landscape in employment law: Wage theft, tax and immigration'.

Contact the team at BDO today to learn more about Fair Work compliance.