AASB S2 Pillar 2 in action: Climate resilience, targets and scenario planning

AASB S2 Pillar 2 in action: Climate resilience, targets and scenario planning

Our sustainability webinar series breaks down the complex world of sustainability, making it a little easier for you to understand the basics and begin driving change within your organisation.

In our previous article, Navigating AASB S2 Pillar 2: Embedding climate strategy into your reporting, we explored how organisations can begin integrating climate-related risks and opportunities into their strategic planning. In this webinar follow-up, we shift focus to the practical implications of that strategy, how it affects the business model, value chain, financial statements, and ultimately, your organisation’s climate resilience. This article continues the journey through Pillar 2 of AASB S2 Climate-related Disclosures (AASB S2), with a focus on forward-looking disclosures and scenario analysis.

Your business model and value chain

One key expectation under AASB S2 is for organisations to explain how climate-related risks and opportunities affect their business model and value chain, not just now but also in the future.

Your business model is essentially how your organisation turns inputs into outputs to create value and generate cash flow. The value chain includes all the moving parts that support that model, such as suppliers, logistics, people, financing, and the broader environment in which you operate.

Rather than just describing these elements, AASB S2 asks you to go a step further: identify where climate-related impacts are most likely to show up. That could be in a specific region, facility, or part of your supply chain. For example, if a key supplier is in a flood-prone area or if customer preferences are shifting toward low-emission products, those are material considerations.

By mapping these impacts across your value chain—from sourcing to delivery and even product end-of-life—you’ll gain a clearer picture of where your business is most exposed and where there may be opportunities to adapt or innovate. This kind of insight helps strengthen your climate-related disclosures and strategic planning.

Planning for climate targets: Voluntary and regulatory

AASB S2 expects organisations to explain how they plan to meet both the climate targets they’ve set themselves and those required by law or regulation. This is where a climate-related transition plan comes in. A transition plan is a part of an entity’s overall strategy that outlines its targets, actions (like emissions reductions), and resources for transitioning to a lower-carbon economy.

In Australia, this includes regulatory mechanisms like the safeguard mechanism, which requires certain entities to reduce emissions annually. Even broader national goals—such as the commitment to reach net zero by 2050—may not be self-imposed, but they still shape the strategic and regulatory environment. AASB S2 encourages organisations to show how they plan to align with these expectations.

Even if your organisation hasn’t set its own climate targets, you may still be subject to legally binding or policy-driven obligations. Being transparent about how you plan to meet them is key to building trust and demonstrating the credibility of your climate strategy.

Time horizons and scenario analysis: Looking ahead

Defining appropriate short-term, medium-term, and long-term time horizons is essential for meaningful climate-related scenario analysis. These timeframes help organisations assess how climate risks and opportunities may evolve and impact their strategy, operations, and financial performance.

Organisations are encouraged to move beyond conventional planning cycles, typically limited to 3 to 5 years, which may be too narrow to capture the full scope of climate-related impacts. Relying solely on short-term horizons can lead to simplistic projections that overlook long-term risks and opportunities. Instead, entities should challenge these traditional assumptions and adopt time horizons that reflect both internal factors, such as capital planning, asset life, and investment cycles, and external reference points, including national and international climate targets like 2030 and 2050.

This broader perspective ensures that scenario analysis is not only compliant but also strategically valuable, offering stakeholders a clearer view of the organisation’s resilience under a range of plausible climate futures.

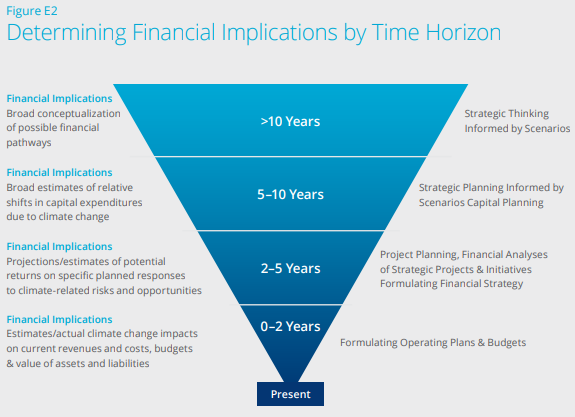

The figure below illustrates how different time horizons can be linked to specific financial planning activities and the nature of climate-related financial implications over time.

Source: Figure E2: Task Force on Climate-related Financial Disclosures Guidance on Scenario Analysis for Non-Financial Companies (page 49)

How resilient is your strategy?

AASB S2 asks organisations to assess and disclose their climate resilience, in other words, how well they can adapt to climate-related changes, risks, and uncertainties. This includes both strategic resilience (how flexible your long-term plans are) and operational resilience (how well your day-to-day operations can respond).

The standard requires the use of climate-related scenario analysis to support this. This helps organisations test how their strategies hold up under different climate futures, whether that’s more frequent extreme weather, tighter regulations, or shifts in market demand.

The level of detail in your scenario analysis should reflect your exposure. If your business faces significant climate-related risks, a more sophisticated, data-driven approach may be needed. If your exposure is lower, a simpler method might be enough.

AASB S2 provides guidance on frameworks like the TCFD and encourages organisations to consider both internal and external factors (like asset life and investment cycles) when designing their approach.

Ultimately, scenario analysis isn’t just a compliance exercise; it’s a tool for assessing the resilience of your strategy.

Key takeaways

- Climate resilience is a core focus of AASB S2 Pillar 2: Requiring organisations to assess how well their strategies and operations can adapt to climate-related risks and opportunities.

- Time horizons matter: Organisations should move beyond traditional 3 to 5 year planning cycles and align scenario analysis with both internal planning and external climate targets e.g. 2030, 2050.

- Business model and value chain disclosures: They must go beyond description. Organisations need to identify where climate impacts are most concentrated and how they affect operations and relationships.

- Transition plans are essential: Whether targets are voluntary or regulatory e.g. safeguard mechanism, entities must explain how they plan to meet them.

- Scenario analysis is not one-size-fits-all: The level of sophistication should reflect the organisation’s exposure to climate-related risks. High exposure may require more quantitative, data-driven approaches.

- Forward-looking disclosures build trust: Transparent planning and credible strategies help stakeholders assess your business's viability and resilience in a changing climate.

How BDO can support your climate resilience journey

In our previous article, we explored how to embed climate strategy into your reporting. This follow-up has taken that a step further, looking at how to assess your business model, value chain, and financial resilience under AASB S2.

Whether you're refining your scenario analysis, aligning with regulatory targets, or mapping climate impacts across your operations, our sustainability specialists can help. We work with organisations at every stage of their climate reporting journey, from strategy development to scenario modelling and disclosure alignment.