Understanding materiality under AASB S2

Understanding materiality under AASB S2

Our sustainability webinar series breaks down the complex world of sustainability, making it a little easier for you to understand the basics and begin driving change within your organisation.

In our July webinar, we initially set out to simplify climate risk management under Pillar 3 of AASB S2. However, as the discussion evolved and in response to recurring questions from participants, a different theme took centre stage: materiality and its critical role in shaping disclosures under the emerging climate reporting standards in Australia.

Having explored Pillar 3’s risk management requirements extensively in our June webinar, this session shifted focus to materiality, offering timely insights into how organisations can determine what information to disclose under AASB S2 Climate-related Disclosures.

What is materiality?

Materiality in the context of financial reporting is a well-understood concept. Drawing from the Australian Accounting Standard Board’s (AASB’s) Practice Statement 2 Making Materiality Judgements, material information is defined as information that, if omitted, misstated, or obscured, could reasonably be expected to influence decisions made by primary users—namely, investors, lenders, and other creditors. These users rely on general purpose financial reports to assess an entity’s prospects, meaning future cash flows, access to finance, and cost of capital.

Material information in the context of AASB S2

Similar to financial reporting, the materiality concept has been included in sustainability reporting standards. In AASB S2, the materiality provisions are included in Appendix D, which contains paragraphs drawn from the voluntary standard AASB S1. (AASB S2 includes key parts of AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information in Appendix D to allow it to function as a standalone standard for climate-related financial disclosures.)

Entities are required to disclose material information about sustainability-related risks and opportunities that could reasonably be expected to affect an entity’s prospects; that means its cashflows, its access to finance or cost of capital over the short, medium or long term. The materiality concept referred to in AASB S2 is also sometimes informally referred to as ‘financial’ materiality; not to be confused with ‘double materiality’, which is discussed in more detail later.

Materiality is an entity-specific characteristic of information. Materiality is used to assess whether information required by AASB S2 would need to be disclosed by a particular entity. In other words, the definition of ‘material information’ is used as a filter to assess what information about the entity’s climate-related risks and opportunities would be of most importance to its primary users (i.e. investors, lenders and other creditors). Looking at it another way, material information would be information that, if left out, incorrect or missed would potentially change the decisions that investors, lenders or other creditors make in respect of providing cash, access to finance or capital to an entity. Important to note is that the term ‘materiality’ is not used in sustainability reporting standards in relation to the significance or importance of a sustainability-related risk or opportunity. Instead, it requires disclosure of (material) information about the climate-related risks and opportunities that could reasonably be expected to affect an entity’s prospects.

Double materiality

Although not specifically discussed in our July webinar, a common question asked by entities is whether the entity will be required to undertake a double materiality assessment to comply with the requirements of AASB S2. This question is specifically relevant to entities that operate in jurisdictions around the world and may be subject to multiple different sustainability reporting frameworks. The answer is ‘no’. Let’s explore why.

The concept of double materiality

The term ‘double materiality’ refers to the combination of impact materiality and financial materiality. The concept emerged to address the need for companies to report not only on how sustainability affects them (financial materiality) but also how it affects the world around them (impact materiality).

Double materiality seeks to provide information to a broader stakeholder group beyond potential investors, lenders, and creditors. It also considers stakeholders who may be affected by an entity’s activities, products, or services, such as employees or customers.

Double materiality doesn’t apply to AASB S2

Materiality under AASB S2 (aligned with IFRS S2 Climate-related Disclosures) focuses solely on information that is material to investors, lenders and other creditors in a climate context with the objective of providing information about the entity’s climate-related risks and opportunities that is useful to primary users of the general-purpose financial reports in making decisions relating to providing resources to the entity. The materiality concept under AASB S2 is most like the financial materiality side of double materiality through an investor lens.

Understanding primary users and their information needs

A key takeaway from the webinar was the importance of identifying who the disclosures are for. Under AASB S2, materiality is assessed based on the information needs of primary users—existing and potential investors, lenders, and other creditors. These users rely on general purpose financial reports to make decisions about providing resources to the entity, such as investing, lending, or voting on governance matters.

When making materiality judgements, entities must consider whether information could reasonably be expected to influence these users’ decisions. This means:

- Information cannot be deemed immaterial simply because it hasn’t been requested

- Even low-likelihood or low-impact risks may be material if primary users are likely to perceive them differently

- Materiality must be assessed from an external perspective, not just management’s internal view.

Primary users typically seek insights into:

- The entity’s resources (assets)

- Claims against those resources (liabilities and equity)

- Changes in those resources and claims (income and expenses)

- How effectively management has used the entity’s resources.

While other stakeholders, such as regulators, management, or the public, may find sustainability disclosures useful, AASB S2 is not designed to meet their information needs. The focus remains squarely on what matters to primary users.

The framework for providing material information

Understanding materiality under AASB S2 doesn’t need to be overwhelming. The International Sustainability Standards Board (ISSB) has developed a guide - Sustainability-related risks and opportunities and the disclosure of material information - to assist entities with assessing whether information required by AASB S2 would need to be disclosed by a particular entity.

This practical framework will help you identify and disclose material information about climate-related risks and opportunities that could reasonably be expected to affect an entity’s prospects.

|

Step |

Action |

|

Part 1: Identify climate-related risks and opportunities |

Identify risks and opportunities that could reasonably be expected to affect the entity’s prospects, i.e., cash flows, access to finance, or cost of capital over the short, medium and long term. |

|

Part 2: Determine the material information to disclose |

Assess which information about those risks and opportunities is material by asking:

|

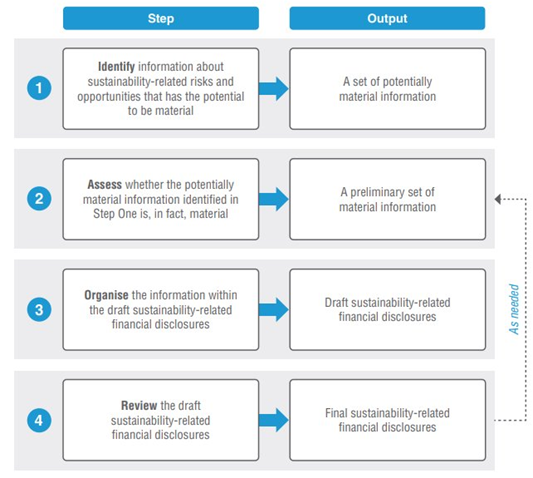

In Part 2, the four-step approach outlined below from the ISSB’s guide applies the materiality filter to the identified climate-related risks and opportunities in Part 1, to ensure disclosures are relevant, decision-useful, and aligned with AASB S2.

Source: Figure 3.1 page 39. IFRS Sustainability-related risks and opportunities and the disclosure of material information

This process mirrors the approach used in financial reporting but is tailored to the unique nature of sustainability disclosures, which often involve more qualitative and forward-looking information.

Why judgement is critical in materiality assessments

Judgement is at the heart of materiality. Entities must consider not only their internal view but also how external stakeholders, particularly primary users, might perceive sustainability-related risks and opportunities. For example, a risk deemed low impact by management might still be material if primary users are likely to see it differently.

Importantly, materiality is not the starting point in the disclosure process. The first step is to identify climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects, such as future cash flows, access to finance, or cost of capital. Only after this step does the materiality overlay come into play, helping determine which pieces of information about those risks and opportunities are material enough to disclose.

To support transparency and audit readiness, entities should document their materiality judgements clearly. This includes being able to clearly explain:

- Why certain information is considered material (or not)

- Why it’s reasonable to believe that primary users would (or wouldn’t) change their decisions based on that information.

This structured approach helps ensure that disclosures are both relevant and defensible, aligning with the expectations of primary users and the principles of AASB S2.

Looking ahead

As organisations prepare to implement AASB S2, understanding the financial materiality concept in AASB S2 and applying judgement to determine material information to disclose in your sustainability report will be essential. It’s not just about identifying climate-related risks and opportunities - it’s about knowing what information about those climate-related risks and opportunities matter most to those who rely on your disclosures.

Stay tuned for our next webinar, where we’ll continue to unpack the complexities of sustainability reporting and help you navigate the path to compliance with confidence.

Navigating materiality with confidence

BDO’s sustainability specialists are here to support you, from identifying climate-related risks and opportunities to navigating materiality judgements and preparing for assurance.

- Explore our sustainability services

- Watch past webinars in our sustainability webinar series

- Get in touch with our expert team to discuss your reporting needs.