Watch video: BDO’s 29th Annual A-REIT Survey | Key takeaways

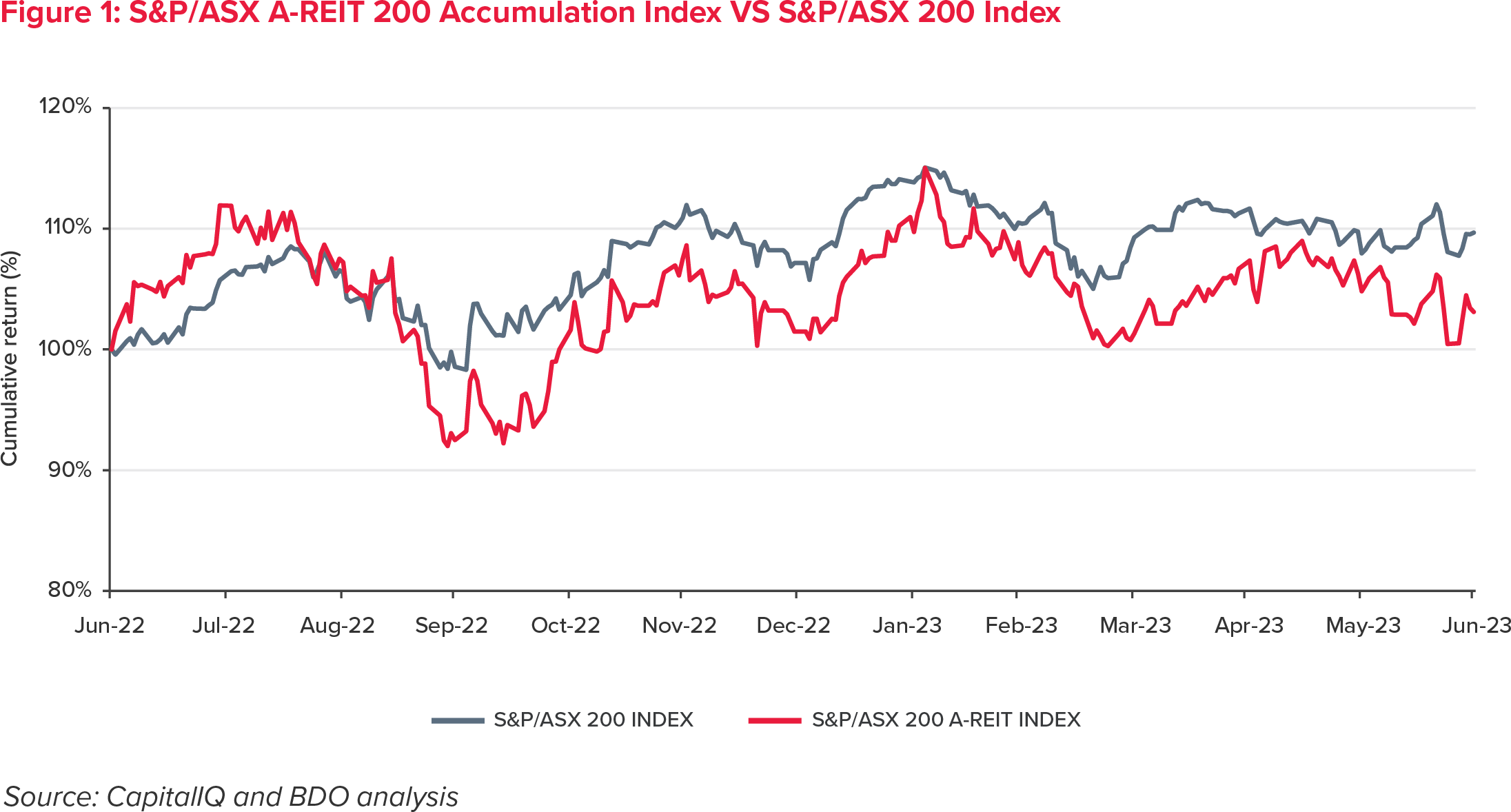

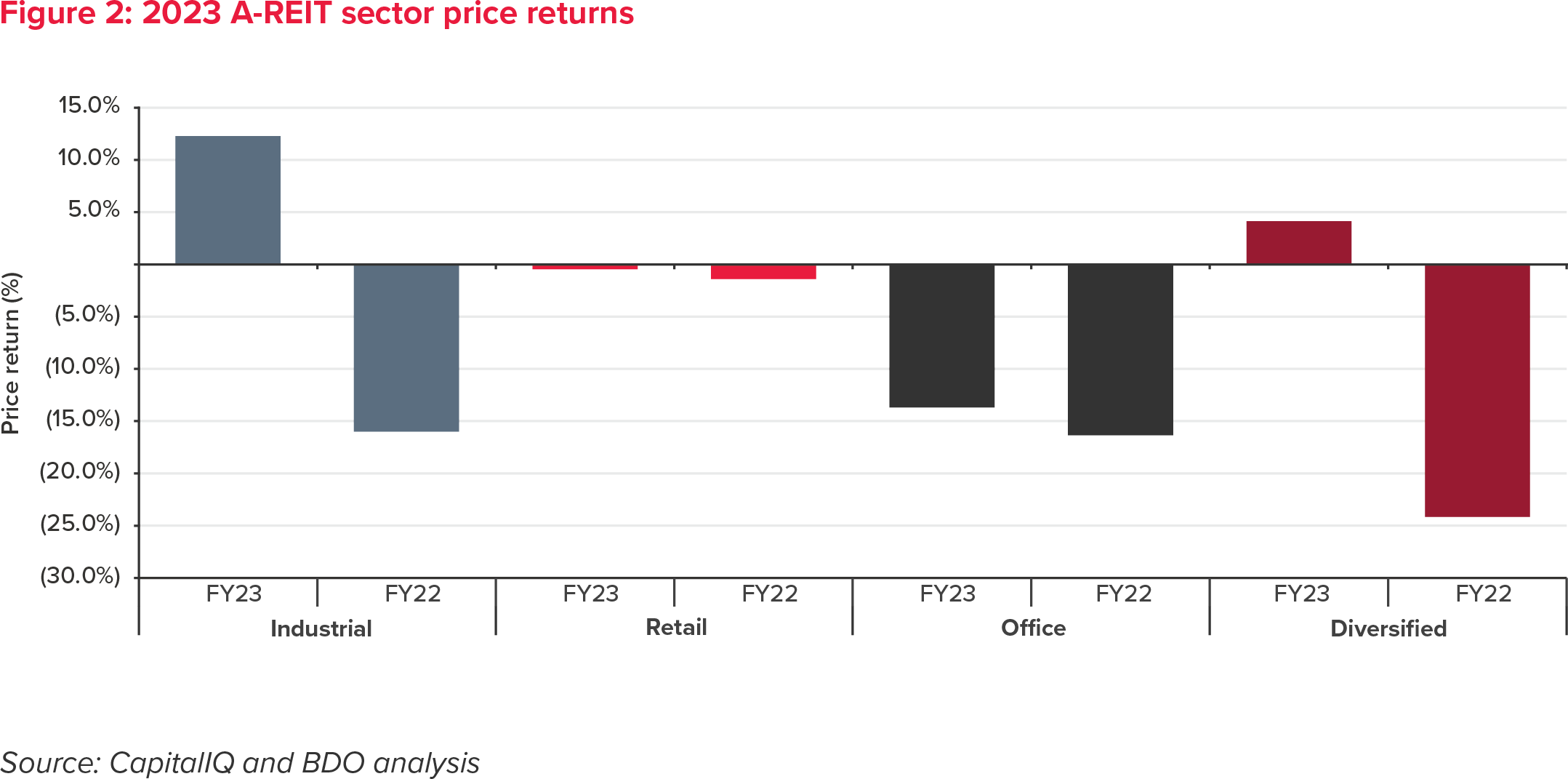

In FY23, the Australian economy grappled with subdued market conditions, high inflation, and significant surges in the cash rate. Australia’s Real Estate Investment Trusts (A-REITs) were susceptible to these challenges and experienced notable fluctuations in their returns throughout FY23.

While A-REITs delivered a positive return of 3.1 per cent, a significant improvement from FY22’s negative return of 15.4 per cent, it remains a stark contrast to FY21’s remarkable positive return of 31 per cent.

7 per cent operating cash yield

7 per cent operating cash yield