After weathering an uncertain 2020, Private Equity (PE) is back with vigour and making up for lost time across the PE funding cycle - with historic highs in fundraising and returns.

Deal activity following the COVID-19 pandemic is remarkably reminiscent of the post-Global Financial Crisis period, with the PE sector capitalising on a myriad of opportunities as the economy rebounded strongly. COVID-19 was a catalyst for PE firms and corporates alike to consider their strategic direction, allowing for continued dry powder accumulation.

Deal activity has been driven by COVID-19, enabling PE firms to take advantage of companies that benefited from the acceleration of consumer focussed and e-commerce trends, and those negatively impacted with depressed valuations. Notably in FY21, Australian PE firm, BGH Capital has taken a growth outlook on distressed industries that had their earnings and valuations depressed, such as travel & leisure with the acquisition of theme park operator, Village Roadshow, online travel agent, Tripadeal, as well as the unsuccessful bid for Virgin Australia Airlines (in FY20).

Overall, PE performed exceptionally well in FY21 – with PE returns outperforming most asset classes. FY21 saw PE harness the macroeconomic environment supported by record low interest rates, and target sectors such as Technology, Media and Telecommunications (TMT), Business Services and Consumer.

As we look forward to the next year, we can expect PE funds to further deploy their dry powder, with the merger and acquisition activity pipeline heightened and technology-enabled ideas continuing to garner support by investors and governments.

Sebastian Stevens

National Leader, Private Equity

In this report

Potentia Commentary

1. There has been a monumental rebound in Private Equity activity since the outbreak of the COVID-19 pandemic what does Potentia attribute this to?

Our sense is that both vendors and PE buyers were cautious during the depths of the COVID-19 crisis given the uncertainty from a macroeconomic perspective. Now that economies are opening up and the direction of the economic recovery is much clearer, it is only natural to see a significant rebound in deal activity (with many deals having been delayed 12-24 months).

2. TMT deals dominated Australian PE activity in FY21, what does Potentia see as the key themes for the TMT sector for the next 12 months?

The TMT sector will continue to be an active part of the economy for capital providers, trade players and strategic M&A. Technology as a sector has grown much faster than GDP over the last three decades and we expect that to continue as the economy continues to digitise. Further, many organisations are looking to acquire strategic assets to either speed up the digitisation of their organisation, add a digital presence as part of their service offering or gain tech experience or products which can be achieved with significant scale and speed with a transaction.

The private equity industry, with its longer time horizons than public markets and ability to incentivise talent through management equity plans, is a natural home for tech businesses. However, what has become really clear is that – in order to succeed in a specialised sector like technology – sponsors really need deep industry expertise.

3. What does Potentia see as potential challenges for Private Equity deal activity over the next 12 months?

Increased competition from international trade players due to the strength of the US dollar and increasing appetite for North American vendors looking into other markets for growth.

A clear example is Microsoft’s acquisition of Clip champ in Brisbane.

4. Are there any other observations on the general Australian Private Equity market that you are able to share?

There is a significant amount of dry powder that is looking for investments in all parts of the economy. For founders and family owned business PE it is a method to de-risk and work with professional investors to grow the business for a potential exit in 3-5years. We are also seeing a greater focus on specialisation in the Australian market, whether it is turnaround funds like Allegro who are raising a new fund or Potentia in technology.

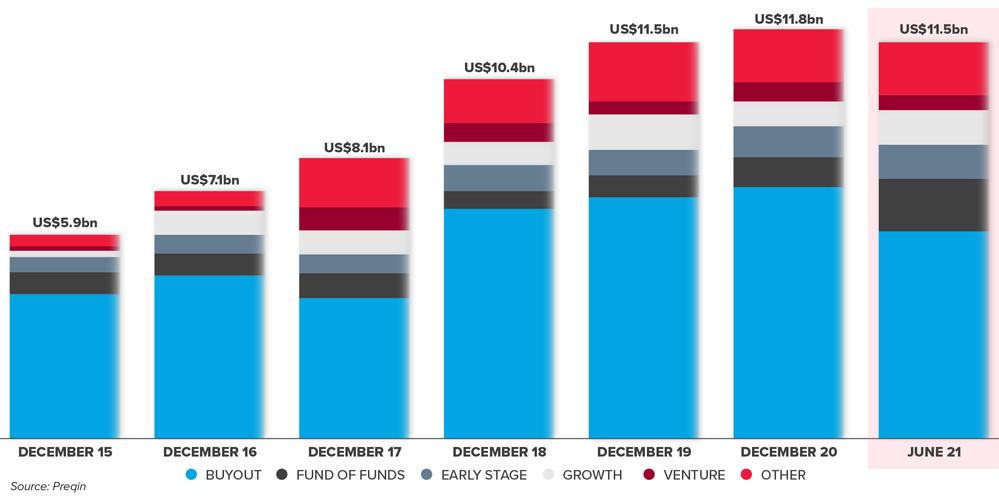

Dry Powder

Dry powder is at historically high levels, at USD $11.5bn as at 30 June 2021 however, down from USD $11.8bn at December 2020. Buyout funds contribute the largest amount of dry powder at USD $6.0bn, however, this is the lowest since December 2018. We note dry powder for growth funds increased 25% since December 2020.

Dry powder committed for investment in Australasia

Since the GFC, there has been a trend towards keeping more in cash reserves awaiting deployment. Several factors drove the increase in dry powder in traditional private capital markets – namely the volatility of 2020 saw many firms accumulate dry powder in wait of greater economic certainty. However, positively, PE's stellar performance over the past few years is being reciprocated with backers investing more money than PE has been able to deploy. Additionally, there is increased market confidence in the Australasian PE market which continues to develop, being viewed favourably to other investment classes across global markets.

“Our sense is that both vendors and PE buyers were cautious during the depths of the COVID-19 crisis given the uncertainty from a macroeconomic perspective. Now that economies are opening up and the direction of the economic recovery is much clearer, it is only natural to see a significant rebound in deal activity (with many deals having been delayed 12-24 months).” - Potentia

We expect to see increased activity in capital deployment over the next year, as investment houses look to deploy their dry powder - or risk suppressing growth and limiting the value of investments over time. At the same time, some PE houses are also looking favourably at debt markets, with distressed debt creating opportunities. While there are concerns that un-deployed capital equals a saturated market, Preqin’s global market evaluation of 186 PE managers highlights that while half believed the market was somewhat over valued and could stand some reduction. Overall, 98% did not see valuations as an issue with confidence in PE’s ability to take on more capital and generate excess returns for their Limited Partners (LPs).

In the Australian market, institutional funds have seen an increase in the value of their assets over the year to March quarter 2021 as local and global markets recovered from the COVID-19 induced downturn. With $3.1 trillion now in superannuation assets, super funds are looking to further diversify their assets through greater allocation to the PE asset class. Further, effective 1 July 2021, the increase in the Superannuation Guarantee rate from 9.5% to 10% and increase in the concessional and non-concessional contribution caps is expected to contribute a flow-on effect to the super fund’s ability to further invest in PE, among other alternative asset classes.

“Super funds are moving back towards tipping money into PE opportunities, on the basis that they need to continue to diversify their investments and there is only so much domestic listed equity that can be held. Hostplus are a particularly strong example of being early backers of PE and Venture Capital (VC), investing heavily in funds such as Square Peg and Blackbird Ventures. Although it’s typically the larger, more liquid funds that have the capacity to do so as the smaller funds don’t necessarily have the regular excess cash flows and as such have to more closely monitor their liquidity.

Regarding internal investment management teams, it is true to say that the vast majority of super funds would have their own investment professionals within a Trustee office. However, it is only the very large ones (e.g. Aussie, Aware, Uni, Hesta, Cbus etc) that are going ‘all-in’ with in-house teams that fully internalise the investment function.” - James Dixon

Funds closed

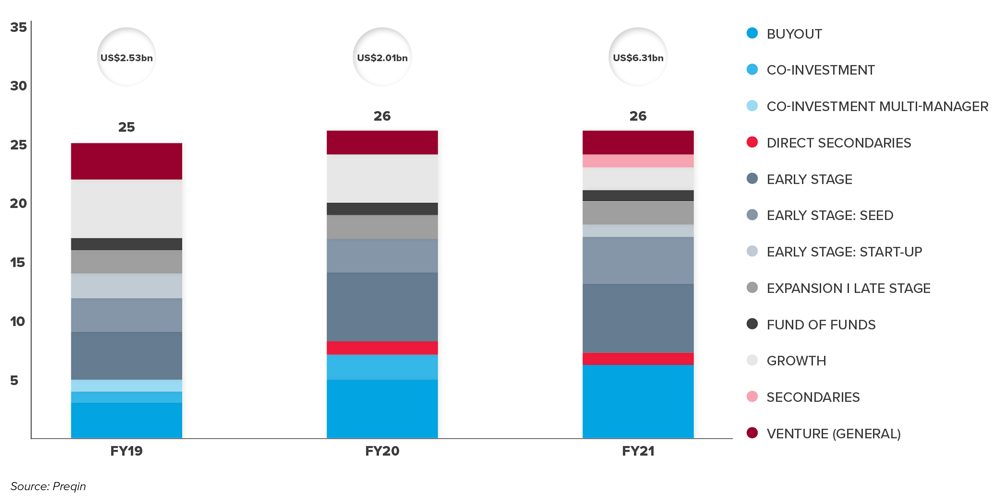

Number of funds closed & total capital raised

The number of funds closed over the last three financial years has remained consistent; however, the average size of funds has increased approximately 2.4x during this period, from USD $101m in FY19 to USD $243m in FY21. This highlights the increased attractiveness of the Australasian PE market, and is a trend we expect to continue as the region’s PE market continues to mature and develop.

Top Deals

Disclosed deals highlight that the top five deals with PE involvement contributed to 66% of total deal value in FY21.

Two of the top five deals highlighted the ongoing demand for communications infrastructure to support a shift towards a digital economy. These include Vocus Group Limited - Australia’s specialist fibre and network solutions provider, and BAI Communications Pty. Ltd. a global communications infrastructure provider.

1. VOCUS Group

Value: USD $3,522m

Date: February 2021

Sector: TMT

Investment type/stage: Private Investment in Public Entity (PIPE)

PE: Voyage Australia Pty Limited’s (a consortium of Macquarie Infrastructure and Real Assets (MIRA) and Aware Super)

Vocus Group, Australia’s specialist fibre and network solutions provider, has entered a Scheme Implementation Deed to be acquired by Voyage Australia Pty Limited’s 100% acquisition of Vocus Group Limited for US$3.5bn, resulting in the delisting of Vocus from the Australia Securities Exchange. (ASX). This deal will provide Voyage the foundation and capacity to build on Vocus’ fibre infrastructure network and take advantage of the growth of the digital economy.

2. BAI Communications

Value: USD $1,952m

Date: June 2021

Sector: TMT

Investment type/stage: Growth Capital

PE: CPP Investment Board, Alberta Investment Management Corporation

Multinational communications infrastructure company, BAI Communications has its sights set on global expansion – namely in the United States - after securing growth capital as part of the second biggest Australasian PE deal in FY21. Since the deal was made BAI Communications has announced the pending acquisition of Mobilitie – a neutral-host infrastructure provider - in August 2021, to further accelerate its growth.

3. Theiss Pty Ltd

Value: USD $1,558m

Date: October 2020

Sector: Energy, Mining and Utilities

Investment type/stage: Buyout

PE: Elliott Management

Thiess Pty Ltd is an Australian global full-scope mining services provider committed to delivering best-for-mine solutions. This buyout will capitalise on the robust outlook of mining – with a plan to continue a growth and diversification strategy.

A sales agreement between CIMIC Group and Elliott Management saw joint control once the deal closed, with Elliot gaining 50% equity interest in Theiss. This transaction will look to strengthen CIMIC’s balance sheet by generating cash proceeds on completion of AUD $1.7-A$1.9 billion as well as reducing CIMIC’s factoring balance by around AUD $700 million and CIMIC’s lease liability balance by some AUD $500 million.

4. Village Roadshow Limited

Value: USD $542m

Date: July 2020

Sector: Leisure

Investment type/stage: Public to Private

PE: BGH Capital

Village Roadshow is Australia’s cinema and theme park operator founded in Melbourne in 1954. After COVID-19 hit both cinematic and theme parks, industry dynamics were turned upside down - presenting an opportunity for a PE takeover. The new structure will enable BGH to expand Gold Coast theme parks.

5. Affinity Education Group Limited

Value: USD $500m

Date: Jun 2021

Sector: Consumer

Investment type/stage: Buyout

PE: Quadrant Private Equity

Affinity Group is Australia’s largest provider of early education and childcare.

The acquisition is expected to sit in Quadrant’s newly raised AUD $1.24 billion QPE7 fund. With an increased appetite for PE firms entering the childcare sector for the first time - heralded as a new era of childcare that is mostly government backed. Quadrant is expected to continue the expansion of Affinity’s 150 childcare centres, kindergartens, preschools and OSCH locations across Australia.

PE deal type

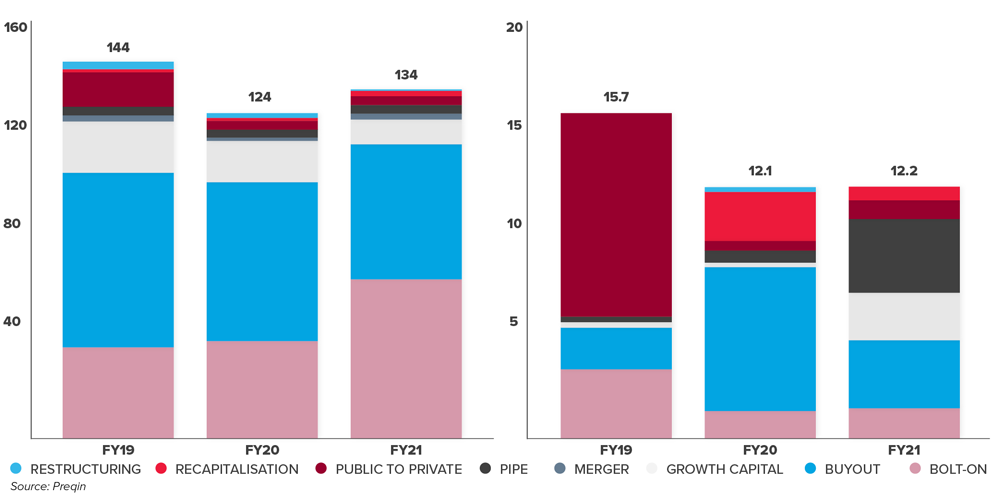

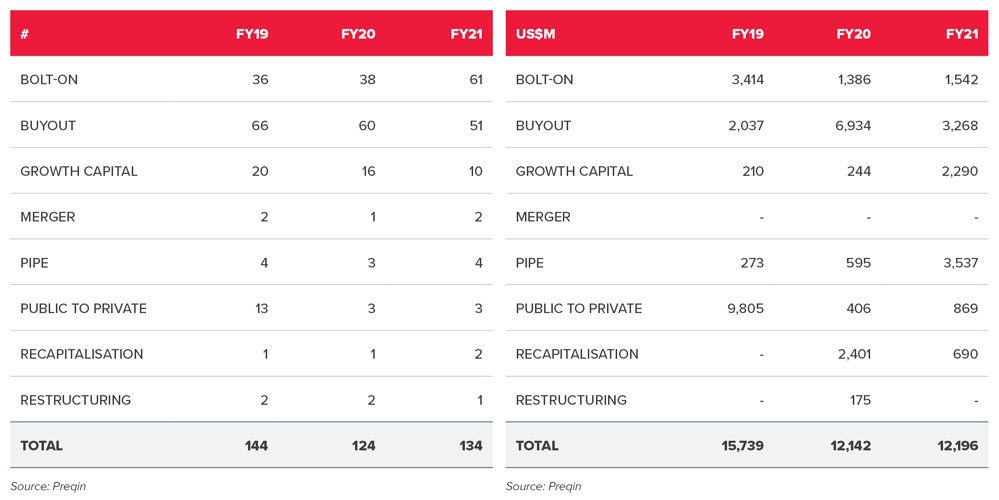

PE deal volume (left) and PE deal value US$bn (right)

PE deal volumes increased from 124 deals in FY20 to 134 deals in FY21. FY21 deal volume remained lower than FY19, which saw 144 PE deals completed.

Bolt-on and buyouts were the most common PE deal type, representing a majority of deal volume over the last three financial years. Whilst FY20 saw noteworthy restructures and recapitalisations in the form of Bain Capital’s acquisition of Virgin Australia Airlines, FY21 saw the majority of deal value being in bolt-ons, buyouts and growth capital. In particular, bolt-ons increased in volume considerably - from 38 disclosed deals in FY20 to 61 deals in FY21, corresponding to an increase in deal value of USD $1.4bn and USD $1.5bn respectively.

Notable bolt-ons in FY21 include the iFiT and Pamplona Capital Management acquisition of popular workout platform, The Bikini Body Training Company, for USD $400m. This business benefited from at-home workout prominence over FY21 during COVID-19 induced restrictions.

PE deal volume (left) and PE deal value US$m (right)

Buyouts deal volume ranked second in FY21 at 51 deals, corresponding to USD $3.2bn (third by deal value compared to other deal types in FY21). This however has decreased from the 60 deals at a USD $6.9bn total deal value in FY20 which was influenced by KKR acquisitions of Arnott’s Biscuits Limited for USD $2.2bn (July 2019) and Colonial First State Investments Limited for USD $1.1bn (May 2020).

Most Active Funds

Quadrant Private Equity was the most active fund for the FY21 with a total of 11 disclosed deals primarily focussing on the business services and consumer sectors.

PE deals by firm

Sector Heat Map

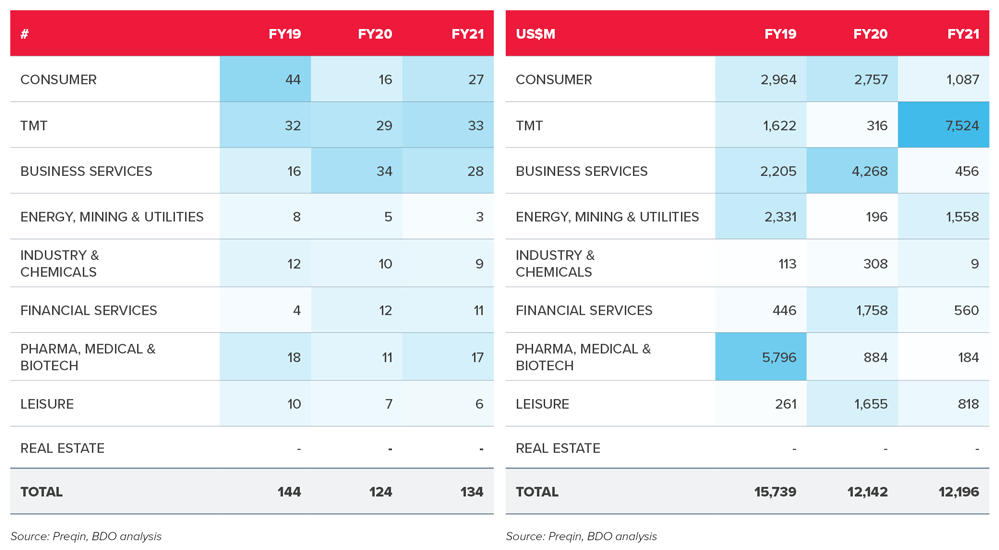

PE deal volume (left) and value (right) by sector

Unsurprisingly, TMT, Consumer, and Business Services continued to be the hottest sectors in FY21 in terms of deal volume.

TMT was supercharged by the pandemic as technology has become embedded into the lives of consumers and business operations. The TMT sector is therefore the front runner, with 33 deals contributing a total disclosed value of USD $7.5bn.

“The TMT sector will continue to be an active part of the economy for capital providers, trade players and strategic M&A. Technology as a sector has grown much faster than GDP over the last three decades and we expect that to continue as the economy continues to digitise.” - Potentia

A notable deal in the Business Services sector in FY21 saw Nomura Research Institute Australia’s (Nomura) acquisition of The Growth Fund’s portfolio company, Planit Test Management Solutions Pty Ltd (Planit) for an undisclosed deal value. Planit is headquartered in Sydney and specialises in providing software testing, quality engineering and automated testing solutions, and related consultancy services. The acquisition of Planit will help build Nomura’s reach in Australia. BDO was engaged by Nomura Research Institute Australia to perform the financial and tax due diligence, and to assist with the SPA completion mechanism drafting.

Pharma, medical and biotech also continue to attract a number of deals, however, in many cases deal value is undisclosed. As the BDO Healthcare Report states, PE remains a major player in the healthcare space, particularly in sub-sectors such as healthcare services and facilities. Additionally, PE healthcare deal values for FY21 have eclipsed those of trade buyers however, despite lower deal volumes relative to trade buyers, PE healthcare deal volumes saw an increase of 300% on FY20. Healthcare will likely remain a key target on the investment radar underpinned by technological advances emerging in the healthcare sector through artificial intelligence, telehealth, robotics and blockchain.

Real estate largely remains untouched by private equity. As highlighted in BDO Horizons, M&A activity within the real estate sector declined due to less reliance on traditional offices and commercial buildings, and increased flexibility amongst most workplaces further accelerated by the COVID-19 pandemic.

Read more about Private Equity in Healthcare: Australian Healthcare Industry: M&A and capital markets update 2021

TMT Sector Spotlight

Global trends highlight that PE’s interest in the TMT sector is a story of two tales – with one being a continued investment in emerging high growth companies with next-generation technologies (with a focus on software), and the other is a newer and increased focus on the regeneration of telcos.

In recent years and as highlighted by our Private Equity in Review, telco investment has been attractive for PE, given that many of their systems – such as copper line networks – require a vast amount of capital to boost them back into relevance. Whilst costly, communications infrastructure sets the foundation for both the digital economy and the development of smart cities – which utilise technologies such as fiberoptics, 5G, IoT – and the result is boundless growth opportunities for digital infrastructure investment.

The pandemic has also highlighted that the digital infrastructure market is stable despite other sectors being affected by geopolitical tensions and volatility – it also operates within a highly regulated environment, and will continue to as protectionism grows.

Technology's ability to keep a world connected both through leisure and work cannot be underestimated – with an assortment of activities that harness it being observed over the past two years - namely the e-commerce boom, as well as data storage, and network security.

This flow-on effect from the Pandemic has also been observed in the media arena, with the previous year seeing a boom in media assets, including pay-tv and broadband operators; digital media and digitally enabled marketing, including content and entertainment and of course software.

‘Listenership’ is also on the rise and will continue to grow. As highlighted in BDO’s latest Media Talk, podcasting is a hot sector and is also likely to be an attractive market for PE investment, given that so many are built on a subscription model and there is potential for licensing and royalty revenue on top of traditional ad sales.

Over the next year, we expect TMT deals will continue to lead PE deal activity, with PE dealmakers going beyond and investing in the advancement of technology as companies and countries continue to adapt to the change in consumer demands to be digital, as well as the inevitable consolidation in the market. Additionally, in harnessing emerging tech trends, we expect PE to invest earlier through either co-investing with or providing exit opportunities to early backer VC funds on TMT deals.

Sebastian Stevens

Technology, Media & Entertainment and Telecommunications

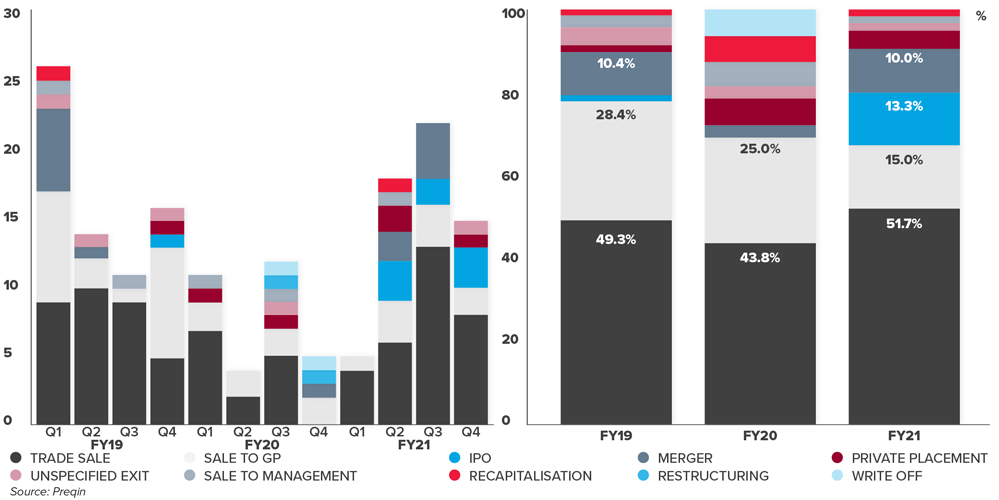

Exits

Trade sales remain the favoured exit-route

Australasian PE funds continue to focus on buyouts, with buyout funds representing 23% of funds closed and 62% of total private capital raised in FY21.

Subsequent exits primarily consist of trade sales (52% of FY21 exits) and sales to a General Partner (GP) (15% of FY21 exits). Notably, there were eight buyout exits via IPO (13% of FY21 exits), up from one in FY19 and nil in FY20.

Quarterly volumes by exit type (left) and annual mix of exit types (right)

Activity from buyout exits rebounded sharply in FY21, as PE firms took advantage of heightened valuations and improved market confidence to drive returns via trade sales, GP sales and IPO exits. In particular, IPO exits were up considerably from one in FY19 and nil in FY20, to eight in FY21, attributed to record low interest rates and overall increased market confidence driving stock market returns providing attractive exit value for PE portfolio companies.

Looking forward, inflation and overconfidence in the market is to be considered as PE seek exits over the next 12 months.

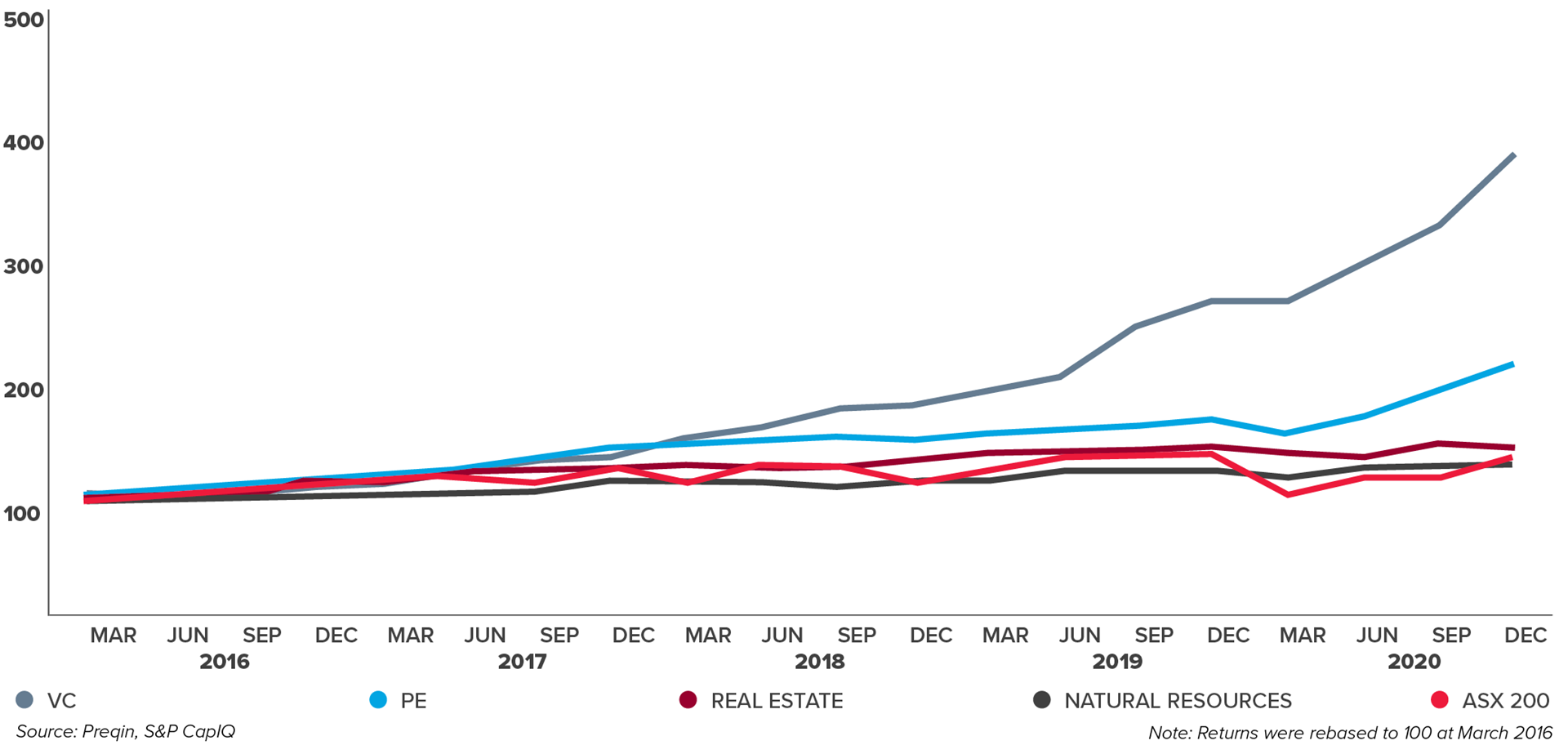

Returns

Private equity has outperformed the majority of asset classes in Australasia, with returns spiking following the initial impact of COVID-19 in the Mar-20 quarter. Since the March 2016 quarter, PE has outperformed the ASX by 75 basis points, achieving 106% returns compared to 30% returns for the ASX 200.

In BDO’s view, the outperformance of PE funds in the past five years relative to the ASX is due to the ASX’s low weighting to the TMT sector (however this is growing), when compared to the higher TMT allocation in PE portfolios. The ASX Tech companies have grown 60% over the last year but they account for a small number of the index and thus the banks and resources impact the ASX returns more.