Australian Scam Culture Report: June 2025 quarter

Australian Scam Culture Report: June 2025 quarter

In this edition of the Australian Scam Culture Report, we compare scam activity across the 2024-2025 financial year, revealing how scammers are adapting to shifting digital behaviours, economic pressures, and emerging technologies. The data highlights new scam delivery channels, rising financial losses, and the demographics most affected, offering a comprehensive view of the current threat landscape.

This report also explores the pricing economy of the dark web, where identity data such as passports, driver’s licences, and full identity profiles are traded at premium rates. Our analysis of dark web pricing trends between June 2023 and June 2025 provides insight into the underground market forces shaping cybercrime in Australia.

Additionally, we examine the growing role of artificial intelligence (AI) in both scam tactics and forensic investigations. As AI becomes more embedded in fraud detection and risk analysis, professionals are challenged to balance innovation with integrity, ensuring that human oversight remains central to every conclusion drawn.

Together, these insights reinforce the need for ongoing vigilance, targeted awareness, and adaptive security strategies to protect Australians from the financial and emotional toll of scams.

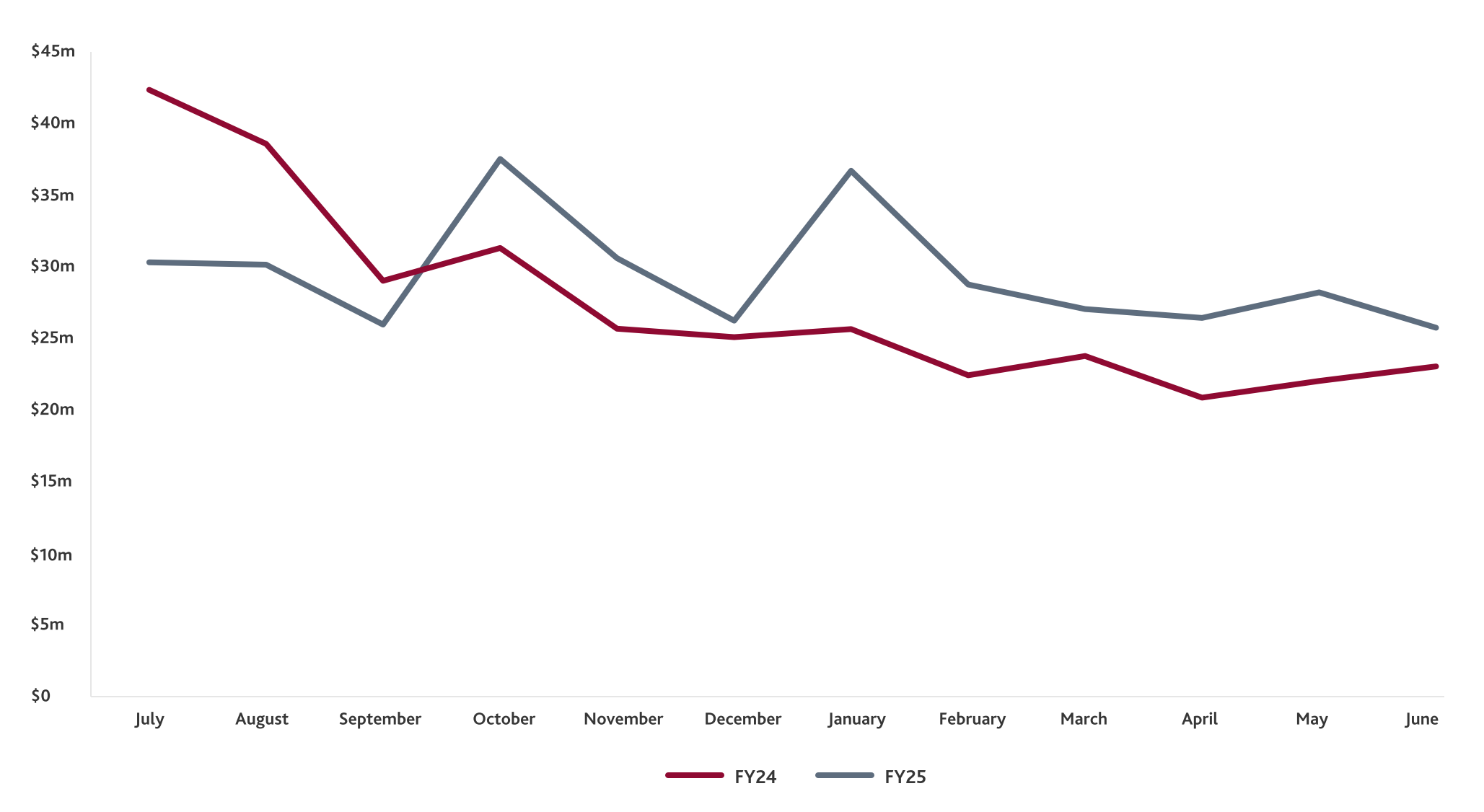

The graph below shows the cumulative Australian dollars lost to scams across FY25.

.png?width=800&height=437)

Source: 2025, All scam types stats - Scamwatch, Australian Competition and Consumer Commission, ©Commonwealth of Australia

Scam behaviour trends

Our latest report provides insights into scam activity across FY24 and FY25, including:

- An increase in total reported losses, reaching $353.9 million across all scam types

- Online and phone scams driving the majority of losses, with $158.8 million lost through online channels and $96.1 million via phone scams

- Investment scams remaining the leading cause of financial loss, accounting for $196 million in total losses

- An uptick in identity-related crime, with scammers increasingly trading passports, driver licences and Fullz IDs on the dark web

- People aged 65 and over continue to experience the highest financial losses (35 per cent of total), while younger adults (18 to 34 year olds) recorded the fastest growth in reported scams.

BDO's forensic services professionals can assist you in mitigating and resolving high-risk matters, helping your organisation create and embed governance frameworks to retain value. Contact our forensic services team to discover how we can help you prevent, detect, and address the risks your organisation faces.