Navigating the future: Trends, challenges and opportunities for Australian dental practices

Navigating the future: Trends, challenges and opportunities for Australian dental practices

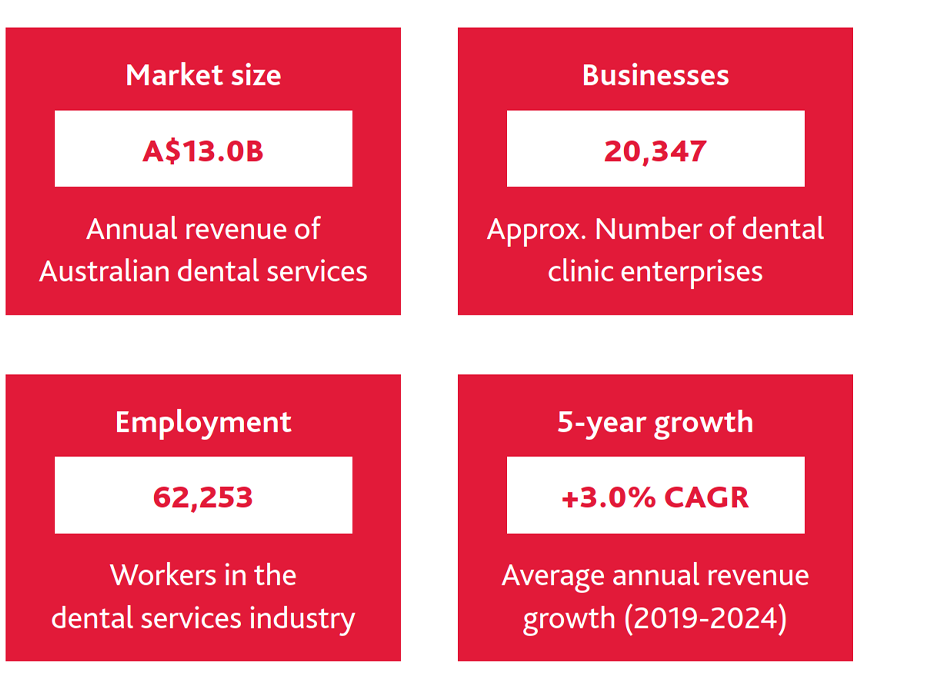

Market overview and macroeconomic impacts

In 2025, the Australian dental industry, valued at $13 billion, is primarily funded by private out-of-pocket spending. While an ageing population maintains steady demand, cost-of-living pressures are causing many Australians to defer non-urgent dental care, leading to increased need for complex treatments later. Despite 78 per cent of dental practices being concerned about economic uncertainty, about 60 per cent remain confident in business conditions as clinics adapt strategies for growth. Modest annual growth of around 3 per cent is expected as the sector navigates inflation and constrained household incomes.

AI trends

Digital innovation is transforming dental practices. While only ~12 per cent of practices currently use AI tools, interest is high, with about 70 per cent of dentists wanting to deploy AI for patient education and nearly two-thirds keen on AI for data analysis, diagnostics, and practice management. Cloud-based software, intraoral scanners, 3D printing, and CAD/CAM fabrication are increasingly common, improving efficiency and patient outcomes. Practices foresee AI-driven diagnostic aids and predictive analytics as key future trends, though widespread implementation faces challenges such as cost, integration, training, and data privacy.

Cost pressures

Running a dental practice in Australia involves various costs, many of which have been rising faster than revenues. The biggest expense challenges are staff wages and fixed overheads, which account for roughly two-thirds of clinics. Rising payroll costs, higher rent, utilities, and materials strain profitability. Concurrently, patient affordability concerns mean clinics must balance fee increases carefully. In response, many practices are prioritising efficiencies by adopting new technologies, streamlining processes, and restructuring expenses to offset cost pressures without compromising care.

Recruitment and remuneration

The dental workforce is strained by shortages and maldistribution, with general dentists in short supply nationwide. Attracting and retaining clinicians and auxiliary staff is particularly difficult in regional areas, limiting many practices' capacity to meet demand. Consequently, recruitment incentives and remuneration are rising, with nearly half of practices boosting pay rates or offering more flexible work arrangements to secure talent. The competition for experienced staff is driving up wage costs, linking back to cost pressures, and forcing practices to invest in enhancing workplace culture and providing career development opportunities to improve retention.

Clinical trends

Key clinical trends in Australia include a shift toward complex restorative and specialist services due to delayed preventive visits and growing demand for cosmetic and orthodontic treatments. Clear aligner orthodontics is booming, with 40,000 Australians using clear aligners annually and the market projected to reach ~$750 million by 2028. Dental implants are now routine for tooth loss in an aging population, and minimally invasive dentistry remains a focus despite cost barriers. Digital dentistry is mainstream, with clinics using 3D imaging, CAD/CAM for crowns, and 3D printing for devices like surgical guides and dentures. These technologies enable more precise, personalised treatments and standardise higher-quality care across practices.

Insights from overseas

Global developments in dentistry offer both cautionary lessons and opportunities for Australia. With 79 per cent of Australian dentists having treated complications from overseas dental work, there is a need for better patient education on the risks of seeking cheaper treatment abroad. This also presents an opportunity for local practices to provide remedial care and capitalise on dental revision cases. Abroad, large corporate dental groups are more prevalent, offering insights into efficient practice management, group purchasing, and innovative care models, while maintaining high clinical standards locally.

Regulatory and compliance requirements

Dental practices in Australia operate under strict regulatory oversight, requiring clinicians to meet the Dental Board’s standards for safety, infection control, and continuous professional development. A recent payroll tax ruling poses a major compliance challenge, as state authorities are classifying contracted dentists as employees for tax purposes. The Australian Dental Association (ADA) warns this could lead to hefty, backdated tax bills, threatening hundreds of clinics. The ADA is lobbying for the same tax amnesty granted to general medical practices (Qld amnesty till 30 June 2025) to prevent potential bankruptcies or dramatic fee hikes. Additionally, privacy and data security compliance are critical, with nearly 29 per cent of practices having experienced a cyber breach, prompting stronger safeguards for patient records. Staying updated on regulatory changes and ensuring compliance is an ongoing necessity that demands management attention and resources.

Recent trends in M&A

Consolidation in the dental industry continues, driven by private equity-backed corporate groups. After a flurry of activity in 2021, rising interest rates slowed deals in 2022, but activity picked up again by late 2023 and into 2024. Corporates remain active, with New Zealand’s Abano Healthcare acquiring Australia’s 1300SMILES chain for A$165 million in 2022, and Crescent Capital proposing a A$303 million takeover of Pacific Smiles Group in 2024. This signals a robust appetite for dental assets. The presence of multiple corporate players means high competition for acquisitions. Analysts expect the pace of dental M&A to resemble 2021 peak levels by late 2024, consolidating a fragmented market. With 90 per cent of clinics still owner-operated, further consolidation opportunities abound, offering scale benefits but raising questions about maintaining personalised patient care in a more corporate environment.

What are our BDO dental practices owners experiencing and saying?

Recent trends with sales and acquisitions with clients

- The Australian dental practice market continues to evolve, with several notable trends shaping the landscape for both buyers and sellers. Private practice sales are currently transacting at around a 4x EBITDA multiple, a level that has remained relatively stable. However, rising start-up costs - now typically ranging between $600,000 and $650,000 - are prompting more buyers to consider acquiring established practices rather than building from the ground up. This shift in buyer behaviour is placing modest upward pressure on valuations, particularly for practices with strong goodwill and operational stability, although we haven’t seen material movement in average multiples just yet.

- We’re also observing increased activity from corporate buyers, including new entrants to the market. This is expected to gradually lift corporate multiples for the right type of practice. Corporates are generally targeting clinics with at least three surgeries, where the principal dentist contributes less than 35 per cent of total billings and there is no key person dependency for clinical delivery. A minimum EBITDA of $200,000 is typically required to attract serious corporate interest.

- Corporate acquisition multiples are currently sitting in the 5.5x to 6.5x range, with most transactions involving an upfront payment of 75-80 per cent, followed by a 3-4 year earn-out period. In recent transactions we've advised on, we’ve seen multiples between 5.9x and 6.4x, reflecting strong interest in well-structured, scalable practices. Notably, Western Australia has seen a slight uptick in valuations, while most other states are holding steady.

- Key negotiation points in recent deals include payroll tax implications, sale structure (particularly around earn-outs and vendor retention), growth targets, and succession planning. These elements are becoming increasingly important as both private and corporate buyers seek to de-risk acquisitions and ensure long-term continuity.

What are the biggest challenges according to our clients

- Staffing continues to be one of the most pressing challenges for dental practice owners across Australia. While the demand for quality auxiliary staff remains high, supply is limited - making experienced dental assistants and front office personnel a rare commodity. Many practices are investing in junior-level training programs to build internal capability, but most acknowledge this is a long-term solution still in its early stages.

- Another significant issue is the widening gap in remuneration between experienced dentists and recent graduates. We’re seeing the largest disparity in hourly rates in over a decade. This has implications not only for practice profitability but also for team dynamics and patient care delivery. Compounding this is a trend among newer clinicians to refer out complex treatment plans rather than seek mentorship or support from the principal dentist. This hesitancy can lead to missed opportunities for both patient outcomes and practice revenue.

- Inexperience in building and managing appointment books is also impacting efficiency. Many younger dentists are still developing the skills needed to attract and retain new patients, and to structure their days for optimal productivity. This learning curve can create inconsistencies in patient flow and revenue generation.

- On the regulatory front, payroll tax remains a major source of uncertainty and frustration. Many practice owners are still navigating the legal and accounting implications, with no clear consensus on best practice. This has become a focal point in strategic planning and deal structuring, particularly in multi-practitioner environments.

- Operationally, the past few months have seen a rise in staff and patient illness, leading to increased appointment rescheduling. While most patients are rebooking rather than cancelling outright, the resulting gaps have placed additional pressure on front desk teams and disrupted practice rhythm.

- Despite these challenges, there is a sense of cautious optimism among practice owners. Many are hopeful about the next 12 months, though concerns remain around the broader economic climate, particularly the impact of cost-of-living pressures on patient spending and potential softening in billings.

What are the benchmarking trends we are observing in the last 6-12 months within our client base

- Over the past year, benchmarking metrics across dental practices have remained relatively steady. However, a noticeable divergence in profitability has emerged between metropolitan and regional practices. While this gap has historically existed, the past 12-18 months have seen it widen further. Metro practices are facing increased cost pressures - particularly around wages and rental expenses - while also being more conservative in implementing fee schedule increases. In contrast, regional practices are benefiting from lower overheads and greater flexibility in pricing, resulting in a reported 20–30 per cent variance to metro practices in profitability.

- Lab fees have risen across the board, but this appears to be more reflective of a shift in clinical focus, with practices undertaking more restorative procedures. Similarly, clinical costs have increased due to higher remuneration for oral health therapists and hygienists, alongside the growing impact of payroll tax obligations. These factors have collectively placed pressure on margins. As a result, inhouse labs are being more common in the current market.

- Across the board, EBITDA as a percentage of billings has declined by approximately 5-10 per cent in many practices. However, proactive owners have responded by expanding their clinical offerings and focusing on new patient acquisition to offset the margin compression. This strategic pivot has helped maintain overall financial stability despite rising costs.

- Interestingly, smaller practices - particularly those with 1 to 1.5 surgeries - are finding it increasingly difficult to compete. Limited economies of scale are making it harder to absorb cost increases, while larger practices are leveraging their operational efficiency and broader service range to capture market share. This trend underscores the importance of scale and diversification in today’s operating environment.

Contact our expert team for more Australian dental insights or to learn how BDO can support your practice.