Auto-I.T. Group

BDO M&A, under Partner Andrew McFarlane, advised Auto IT's shareholders on its sale to Perseus Group, expanding Perseus' dealership software presence in APAC.

The Technology, Media and Telecommunications (TMT) industry is in a state of constant innovation and adaptation. Factors like AI, evolving digital solutions, cyber security risks, sustainability issues, and a complex tax environment influence opportunities within the TMT industry.

Australia's rapid digital transformation has made the technology sector the fastest-growing area for skilled development. A national focus on renewable energy, quality education and research facilities has allowed innovation to thrive.

The Technology, Media, and Telecommunications industries are attractive but competitive and complex, meaning businesses require holistic business advice to succeed.

With a global network of advisers, BDO can assist businesses in the Australian TMT sector and abroad to reach their business goals. BDO assists technology businesses, media companies, telecommunication businesses, and those in the industry to reach their business goals.

Leveraging the experience of a BDO adviser gives your business the competitive edge.

BDO's advisers have the knowledge and experience to help businesses in the TMT sector to grow and thrive with proven business solutions.

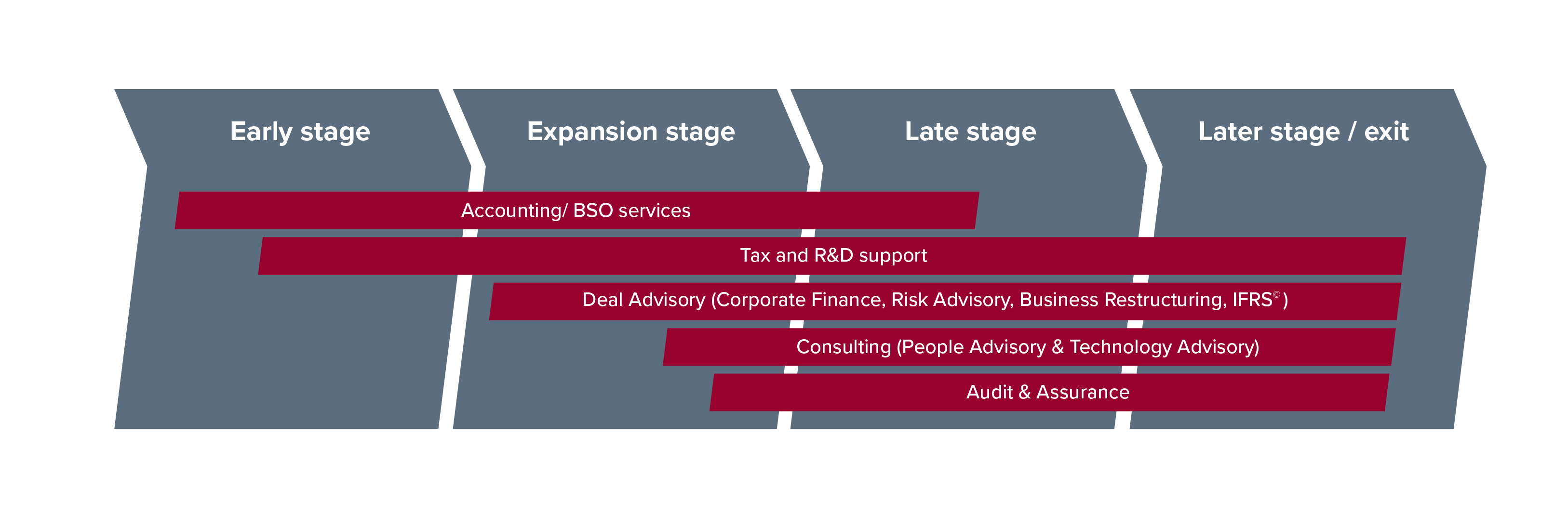

BDO provides the support you need to create, innovate, and solve the problems of the future. Our team works in the TMT sector to assist a broad range of businesses at any stage, including:

In the early stages of starting a business, we provide expert guidance to help you choose a business structure that suits your needs.

A trusted adviser is vital when considering funding options for your business. Our advisers have well-earned industry experience and can assist you in finding the best funding sources.

As a business grows, the logical next step is expansion. BDO offers high-level strategic planning for expansion and adaptation in new markets, helping your business grow.

We can assist your business growth through:

All businesses face challenges, but those businesses that engage a trusted adviser can navigate challenges with confidence. BDO can assist you in working through all the risks and changes to your operation, including:

The final stage of most business ventures is exiting the business. We assist with sales negotiations, succession planning, and exit strategies, helping you to prepare for your exit. Some of the services we assist with are:

![]()

How BDO empowers tech enterprises

![]()

Dedicated services for media innovators

![]()

Assisting telecommunication service providers in a challenging Industry

BDO M&A, under Partner Andrew McFarlane, advised Auto IT's shareholders on its sale to Perseus Group, expanding Perseus' dealership software presence in APAC.

PEXA Group Limited acquired a 70% stake in Slate Analytics, co-developed by UNSW Sydney and FrontierSI, with BDO the lead M&A adviser for FrontierSI.

BDO successfully advised on the sale of Velrada, formerly Australia’s largest privately owned Microsoft solutions and services partner.

Contact our team to discuss your needs using the request for service form. Alternatively, call us on 1300 138 991 to speak with an adviser in your nearest BDO office.

Martin Coyle

Contact us

Contact our team to discuss your needs using the request for service form.

Alternatively, call 1300 138 991 to speak with an adviser in your nearest BDO office.