Aletta Boshoff

National Leader, Sustainability Reporting

Partner, Advisory

Not-for-profit entities (NFPs) registered with the Australian Charities and Not-for-profits Commission (ACNC) are required to prepare financial statements that comply with Australian Accounting Standards. Although the ACNC will, for certain types of charities, continue providing transitional relief and accept financial reports lodged with other relevant state and territory regulators, the ACNC is undertaking a streamlining process so that over time, these charities will need to follow Australian Accounting Standards.

While Australian Accounting Standards are essentially written for application by for-profit entities, there are requirements within standards that are written specifically for NFPs, as well as standards written specifically for NFPs, such as the new income recognition standard, AASB 1058 Income Not-for-Profit Entities.

BDO Australia has a large technical accounting division that is able to assist you with challenges you may face when implementing new standards applicable to your entity (outlined below).

AASB 1058, which applies for the first-time to annual periods beginning on or after 1 January 2019, clarifies and simplifies the income recognition requirements that apply to not-for-profit (NFP) entities, in conjunction with AASB 15 Revenue from Contracts with Customers. These two standards supersede all the income recognition requirements relating to private sector NFP entities, and the majority of income recognition requirements relating to public sector NFP entities, previously in AASB 1004 Contributions.

For lessees, the new standard does away with the current operating/finance lease distinction, requiring lessees to recognise all but the lowest value leases on the balance sheet as a right-of-use asset and a corresponding lease liability. The operating lease rental expense will be replaced by an amortisation charge for the right of use asset and a finance cost.

While there are currently exceptions for recognising ‘peppercorn leases’ on the balance sheet of NFPs, many NFPs do have significant leases, and also need to consider the existence of ‘undocumented leases’.

Effective Date - Mandatory for periods beginning on or after 1 January 2019. For most Australian NFPs, the first reporting period is the year ending 30 June 2020.

The coronavirus poses a serious public health threat and the severity of impacts on global economies is changing daily. Actions taken by the Chinese and many other governments, including Australia, to isolate cities and quarantine people have resulted in significant disruption to business operations in these countries, and particularly in China, which is likely to affect entities which depend on supply chains through China, as well as other businesses that have a high dependency on China, including travel and tourism, manufacturing, construction and the retail sector, and brings significant financial reporting implications.

AASB 1058 clarifies and simplifies the income recognition requirements that apply to not-for-profit (NFP) entities, in conjunction with AASB 15 Revenue from Contracts with Customers. These two standards supersede all the income recognition requirements relating to private sector NFP entities, and the majority of income recognition requirements relating to public sector NFP entities, previously in AASB 1004 Contributions.

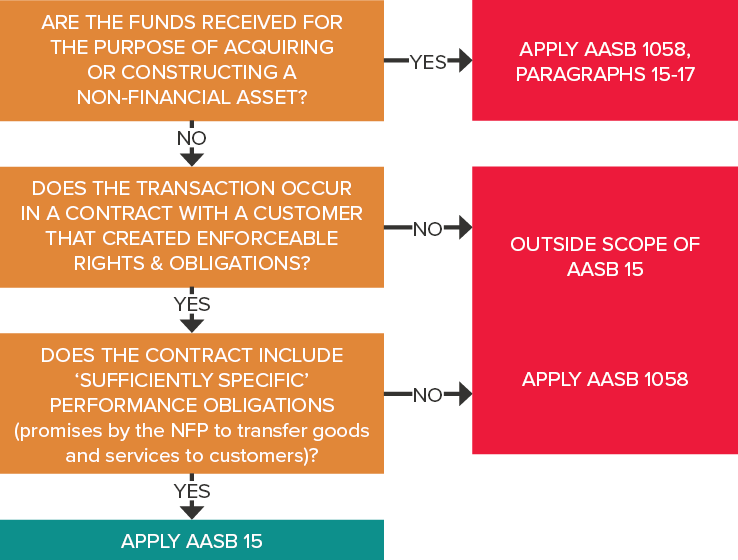

NFP entities should use the following decision tree to determine whether ‘income’ is recognised under the new income recognition standard, AASB 1058 Income of Not-for-Profit Entities, or the new revenue standard, AASB 15 Revenue from Contracts with Customers.

AASB 1058 applies when a NFP entity receives volunteer services or enters into other transactions where the consideration to acquire an asset is significantly less than the fair value of the asset principally to enable the entity to further its objectives. In the latter case, the entity recognises and measures the asset at fair value in accordance with the applicable Australian Accounting Standard (e.g. AASB 116 Property, Plant and Equipment).

The requirements of AASB 1058 more closely reflect the economic reality of NFP entity transactions that are not contracts with customers. The timing of income recognition depends on whether such a transaction gives rise to a liability or other performance obligation (a promise to transfer a good or service), or a contribution by owners, related to an asset (such as cash or another asset) received by an entity.

AASB 1058 applies to annual reporting periods beginning on or after 1 January 2019. Earlier application is permitted, provided entities also apply AASB 15 Revenue from Contracts with Customers to the same period.

Aletta Boshoff

Clark Jarrold

Kevin Frohbus

Contact us

Contact our team to discuss your needs using the request for service form.

Alternatively, call 1300 138 991 to speak with an adviser in your nearest BDO office.