Duplicative and complex GHG emissions reporting likely for Group 1 entities at 31 December 2025

Duplicative and complex GHG emissions reporting likely for Group 1 entities at 31 December 2025

Group 1 entities preparing their first climate-related disclosures for years ending 31 December 2025 should be on notice that changes proposed by the International Sustainability Standards Board (ISSB) to reduce duplication and complexity in climate disclosures may not be approved in time for the Australian Accounting Standards Board (AASB) to publish similar amendments to AASB S2.

Changes to IFRS® Accounting Standards and IFRS® Sustainability Disclosure Standards must be approved by the AASB before they can be adopted, or early adopted, by Australian entities. This can occur after the reporting date but must be prior to the date that the directors authorise the financial statements and sustainability report for issue.

What does this mean for Group 1 entities reporting at 31 December 2025?

At the time of writing, the ISSB’s website shows Exposure Draft feedback due in the fourth quarter of 2025, with no indication of a final publication date for the amendments.

With uncertainty surrounding their final publication, Group 1 entities should assume that the amendments do not pass, and prepare disclosures based on the requirements of AASB S2 as they currently stand.

The implications of this on a group’s reporting of its greenhouse gas (GHG) emissions are as follows:

- GHG emissions calculations must be performed twice where jurisdictional requirements differ from the GHG Protocol

- Entities must use global warming potential (GWP) values from the latest Intergovernmental Panel on Climate Change assessment

- If disclosing Scope 3 in the first year, Category 15 emissions calculations must include those from derivatives, facilitated emissions and insurance-associated emissions

- If disclosing Scope 3 in the first year, the Global Industry Classification Standard (GICS) must be used for disclosing industry information about financed emissions.

These are discussed in more detail below.

1. GHG emissions calculations must be performed twice where jurisdictional requirements differ from the GHG Protocol

Entities reporting climate-related financial information under AASB S2 must disclose their absolute gross GHG emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent. The absolute gross emissions must be disclosed separately for Scope 1, Scope 2 and Scope 3 emissions (noting that entities are not required to disclose Scope 3 emissions in their first year of reporting).

Paragraph 29(a)(ii) requires GHG emissions to be measured in accordance with the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (the GHG Protocol).

However, if a jurisdictional authority or listed exchange requires the use of a different method (alternative method), paragraph B24 permits the entity to use this alternative method rather than the GHG Protocol to measure GHG emissions.

As currently worded, paragraph B24 does not permit a ‘mixed approach’ whereby jurisdictional requirements can be applied to parts of the business and the GHG Protocol to the remainder.

What is the proposed amendment?

If the Exposure Draft proposals are approved, entities will be able to measure GHG emissions using the GHG Protocol for some parts of their business, and an alternative method required by a jurisdictional authority or listed exchange, for other parts.

Applying the amendments, heavy emitters reporting under the National Greenhouse and Energy Reporting Act 2007 (NGER reporters) for a particular facility would report GHG emissions under AASB S2 for the whole group as follows:

- Scope 1 and Scope 2 of the NGER facility using the methodology set out in the National Greenhouse and Energy Reporting (Measurement) Determination 2008, because this measurement approach is required by a jurisdictional authority

- Scope 1 and Scope 2 for the remaining parts of the business (not subject to NGER reporting) using the GHG Protocol

- Scope 3 for all parts of the business using the GHG protocol. This includes the NGER reporting facility because Scope 3 emissions are not covered by the National Greenhouse and Energy Reporting Act 2007. Note that entities are not required to disclose Scope 3 emissions in their first year of reporting.

How will Australian entities be affected if the proposed amendment is not approved in time?

Because AASB S2 does not permit a ‘mixed approach’, in the absence of the proposed amendments being approved by both the ISSB and the AASB by the end of December 2025/early 2026, Australian groups comprising one or more NGER reporting facilities reporting under AASB S2 will have to calculate their Scope 1 and 2 GHG emissions twice for NGER facilities:

- Once for NGER reporting purposes, and

- Again, using the GHG protocol for AASB S2 reporting.

Paragraph B24 of AASB S2 permits an entity to choose either the jurisdictional requirement or the GHG Protocol for reporting GHG emissions for the whole group. However, in practice, it would be easier for groups with NGER reporting facilities to recalculate Scope 1 and 2 calculations using the GHG Protocol than to try to calculate Scope 1 and Scope 2 emissions for the rest of the group using NGER.

2. Entities must use global warming potential (GWP) values from the latest Intergovernmental Panel on Climate Change assessment

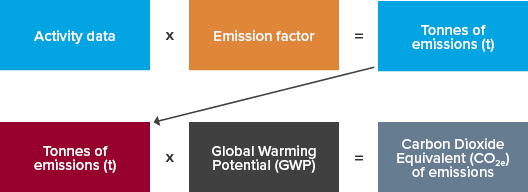

As noted above, entities reporting climate-related financial information under AASB S2 must disclose the absolute gross GHG emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent. This involves converting the six constituent greenhouse gases into CO2 equivalent values, in order to add to the seventh greenhouse gas, CO2.

The seven constituent greenhouse gases are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6), and nitrogen trifluoride (NF3).

Entities using direct measurement methods to calculate their GHG emissions will convert the six constituent greenhouse gases into a CO2 equivalent as follows:

Global warming potential (GWP) values are based on a 100-year time horizon contained in the latest Intergovernmental Panel on Climate Change (IPCC) assessment available at the reporting date. At the time of writing, this would be the IPCC Sixth Assessment Report.

What is the proposed amendment?

Entities required, in whole or in part, by a jurisdictional authority or a listed exchange to use different GWP values for converting the seven constituent gases into CO2 equivalent values will be permitted to do so. In all other instances, entities must use the latest IPCC assessment available (currently the IPCC Sixth Assessment Report).

Legislation governing NGER reporters currently contains GWP values from the IPCC Fifth Assessment Report, which is embedded in Section 2.02 of the National Greenhouse and Energy Reporting Regulations 2008.

How will Australian entities be affected if the proposed amendment is not approved in time?

Without these amendments, groups containing NGER reporting facilities will have to measure GHG emissions twice for each NGER facility:

- Firstly, for NGER reporting using GWP values from the IPCC Fifth Assessment Report, and

- Again, for AASB S2 reporting using GWP values from the IPCC Sixth Assessment Report.

3. If disclosing Scope 3 emissions in the first year, Category 15 emissions calculations must include those from derivatives, facilitated emissions and insurance-associated emissions

Entities must include, at least, all 15 categories referenced in the GHG Protocol when measuring the absolute gross Scope 3 GHG emissions generated during the reporting period.

Category 15 Scope 3 emissions are GHG emissions arising from an entity’s financial investments (including loans) that are not already included in its Scope 1 or Scope 2 emissions. These are also referred to as ‘financed emissions’ in AASB S2. Entities participating in financial activities such as asset management, commercial banking and insurance would be expected to have significant Category 15 Scope 3 emissions.

AASB S2 requires additional disclosures about Scope 3 Category 15 GHG emissions for entities whose activities include asset management, commercial banking and insurance, including splitting them down into the Scope 1, Scope 2 and Scope 3 emissions of related investees and borrowers.

The Basis for Conclusions to IFRS S2, paragraphs BC127-BC129, notes that disclosure of GHG emissions relating to derivatives, facilitated emissions and insurance-associated emissions is not required. However, there is a potential conflict with the requirement in paragraph 29(a)(i)(3) to measure the absolute gross Scope 3 emissions, including Category 15 emissions. Paragraph 29(a)(i)(3) is silent on whether derivatives and facilitated and insurance-associated emissions must be included or excluded when measuring Scope 3 Category 15 GHG emissions.

What is the proposed amendment?

The amendment tidies up the inconsistency described above for entities involved in asset management, commercial banking and insurance activities.

Firstly, they will measure and disclose the gross absolute Scope 3 Category 15 emissions under paragraph 29(a)(i)(3) by:

- Including only financed emissions (facilitated emissions and insurance-associated emissions may be excluded)

- Excluding emissions associated with derivatives.

Additional disclosure will be required about the amount of excluded derivatives and other financial activities excluded (such as investment banking advisory services and insurance and reinsurance underwriting). An explanation will also be required about what the entity treats as excluded derivatives.

Financed emissions are those attributed to the entity’s loans and investments. They include loans, project finance, bonds, equity investments, and undrawn loan commitments.

For entities participating in asset management and insurance activities, financed emissions include GHG emissions from assets under management and insurance assets only. Emissions from any underwriting activities by investment banks (facilitated emissions) and insurance and reinsurance activities by insurance companies (insurance-associated emissions) are not financed emissions.

Secondly, they clarify that the additional disaggregated disclosures about investees’ emissions in Category 15 Scope 3 GHG emissions are limited to only financed emissions.

How will Australian entities be affected if the proposed amendment is not approved in time?

Without this amendment, entities choosing to disclose Scope 3 emissions in the first year will have to include Category 15 GHG emissions for derivatives and facilitated and insurance-associated emissions.

4. If disclosing Scope 3 in the first year, the Global Industry Classification Standard (GICS) must be used for disclosing industry information about financed emissions

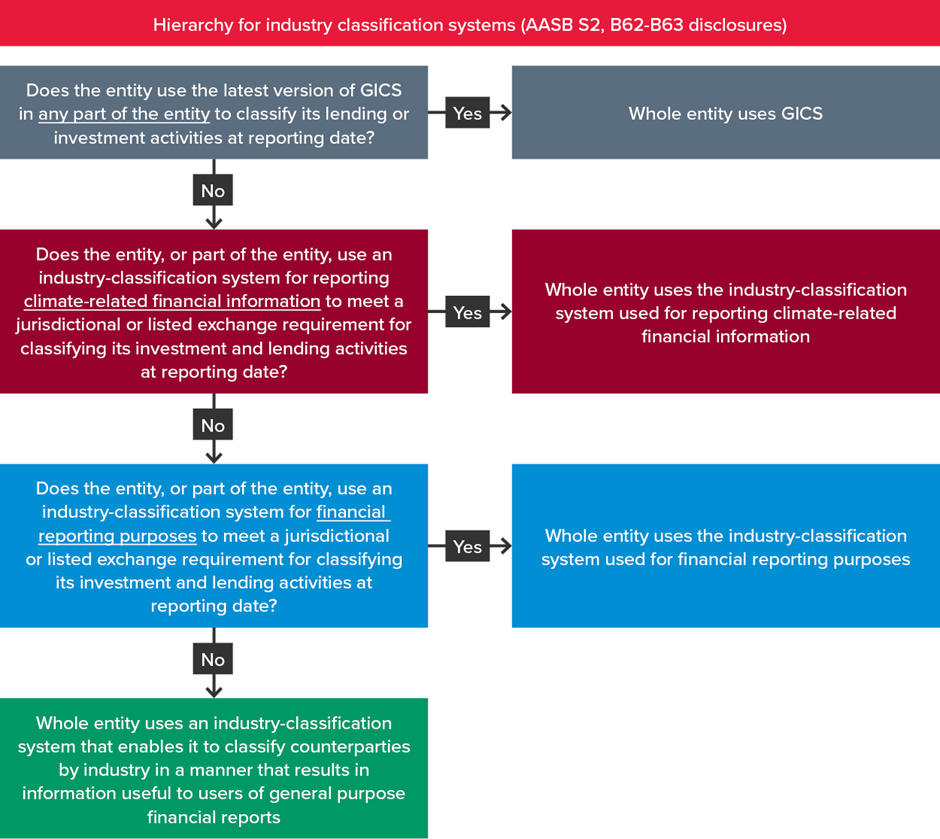

AASB S2 requires entities involved in commercial banking and insurance activities to disclose disaggregated information about the Scope 1, Scope 2 and Scope 3 financed emissions of investees for each industry (paragraphs B62-B63). Industry classification is based on the latest version of the Global Industry Classification Standard (GICS) available at the reporting date. Some of these entities may not currently use GICS as an industry-based classification system, which could result in additional licensing costs and duplicative reporting.

What is the proposed amendment?

Commercial banking and insurance entities will not have to automatically use GICS to determine industry classifications. The amendments propose a four-level hierarchy for determining the appropriate industry classification system as follows:

If the entity is subject to multiple jurisdictional or exchange requirements and uses more than one industry classification system, it is proposed that it select one classification system for the whole entity.

Entities will also have to disclose which industry-classification system they used to disaggregate financed emissions, and if not GICS, the basis for selecting that system.

How will Australian entities be affected if the proposed amendment is not approved in time?

A significant number of entities involved in commercial banking and insurance activities will meet the size criteria for Group 1 entities and are likely to have investments and activities across diverse jurisdictions. As such, they may use different industry classification systems for reporting climate-related financial information and financial information.

For 31 December 2025 reporting, these entities will have to use industry classification based on the latest version of the Global Industry Classification Standard (GICS) available at the reporting date if they choose to provide Scope 3 disclosures (including disaggregated Scope 1, Scope 2 and Scope 3 financed emissions of investees) in the first year.

Lastly, let’s talk about materiality

Many Group 1 entities have already prepared, or are in the process of preparing, their climate-related disclosures for 31 December 2025 on the assumption that the amendments would be approved in time. Although entities must apply the AASB S2 standard in force when the first sustainability report is signed and lodged with ASIC, in practice, there may not be a material difference between GHG emissions measured applying the rules in the current standard as compared to applying the proposed (unapproved) amendments.

We therefore recommend entities prepare a comparison for their auditors, quantifying differences as follows:

|

Measured as required by AASB S2 (currently in force) |

Measured as per the proposed amendments |

|

Scope 1 and Scope 2 GHG emissions for the whole group using the GHG Protocol |

Scope 1 and Scope 2 emissions for NGER reporting facilities using jurisdictional requirements. PLUS Scope 1 and Scope 2 emissions for the remainder of the group using the GHG Protocol. |

|

Scope 1 and Scope 2 GHG emissions for the whole group using GWPs from the IPCC Sixth Assessment Report. |

Scope 1 and Scope 2 GHG emissions for NGER reporting using GWPs from the IPCC Fifth Assessment Report. PLUS Scope 1 and Scope 2 emissions for the remainder of the group using GWPs from the IPCC Sixth Assessment Report. |

|

Scope 3 GHG emissions (if disclosed), measured by including derivatives and facilitated and insurance-associated emissions. |

Scope 3 GHG emissions (if disclosed), measured by excluding derivatives and facilitated and insurance-associated emissions. |

Note: Regardless of whether the entity is measuring emissions using AASB S2 (currently in force), or the proposed amendments, if Scope 1, Scope 2 or Scope 3 emissions have been calculated using emissions factors that have already converted the constituent gases into C02 equivalent values (e.g. from the IPCC Fifth Assessment Report), AASB S2, paragraph B22 notes that the entity is not required to recalculate the emission factors using GWP values based on the IPCC Sixth Assessment Report. However, if the emissions factors have not converted the constituent gases into CO2 equivalent values, the GWP from the IPCC Sixth Assessment Report must be used.

For example, under paragraph B22 an NGER reporter that uses emissions factors incorporating GWP values using the IPCC Fifth Assessment Report won’t have to reperform those Scope 1 and Scope 2 calculations. However, to the extent that the NGER reporter uses emissions factors that have not incorporated GWP values, then for reporting under AASB S2 the entity must use the GWP values from the IPCC Sixth Assessment Report.

For entities involved in banking and insurance activities disclosing Scope 3 emissions and disaggregated Scope 1, Scope 2 and Scope 3 financed emissions of investees in the first year, we also recommend a qualitative comparison of industry disclosure requirements resulting from using only the latest version of the Global Industry Classification Standard (GICS) available at reporting date, as compared to a variety of sources permitted by the amendments.

Entities able to demonstrate immaterial differences may then be able to continue with templates based on the proposed amendments for sustainability disclosures in future years (if and when the amendments are finalised).

More information

Our previous article answers your questions about mandatory sustainability reporting, and our website contains additional resources for sustainability reporting and measuring your carbon footprint.

Need help?

Our sustainability reporting and carbon accounting experts are always available to assist with your sustainability reporting journey. Contact us for help.